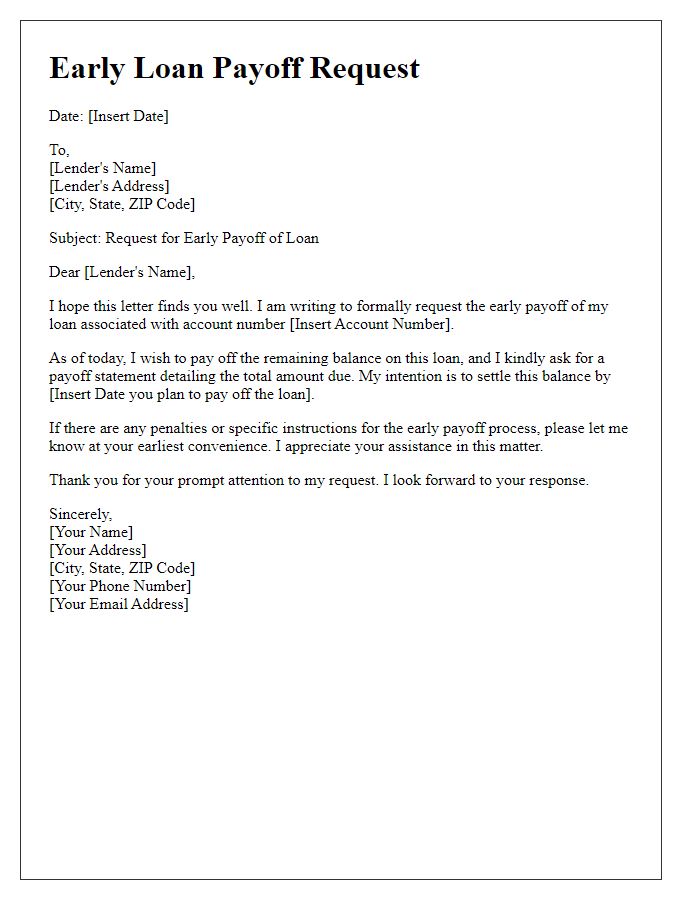

Are you looking for a clear and effective way to communicate your intent to pay off a loan early? Crafting a well-structured letter can make a significant difference in ensuring that your request is processed smoothly. In this article, we'll guide you through the essential elements of an early loan payoff demand letter, helping you articulate your intentions professionally while also safeguarding your rights. So, let's dive in and explore how to create a compelling request that gets results!

Loan Account Details

Early loan payoff requests can arise in various financial contexts, such as personal loans or mortgages. Loan payoff amounts usually need to be calculated accurately to include any remaining principal and interest up to the payoff date. For instance, a personal loan with an outstanding balance of $10,000 may accrue interest at a rate of 5% over time, leading to a potentially varied total depending on the specific terms of repayment. The process typically requires contacting the lender, often a bank or credit union, to request a payoff statement, which itemizes the exact amount needed to totally discharge the loan obligation. Additionally, borrowers must consider any prepayment penalties that may apply according to the loan agreement, which can influence the financial decision to pay the loan off early, ultimately impacting the overall savings on interest payments.

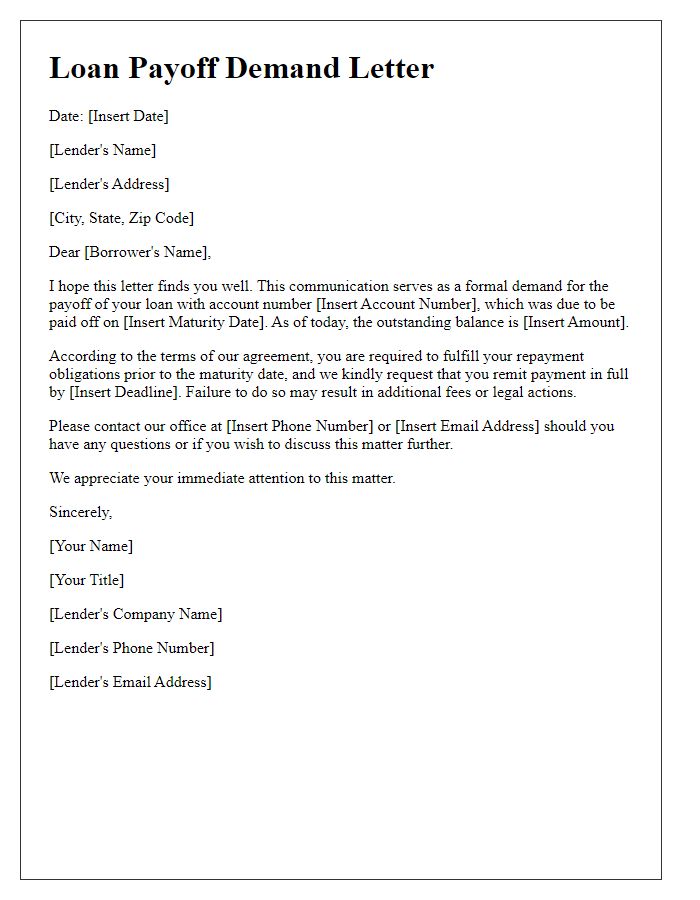

Payoff Amount Calculation

Early loan payoff can significantly impact financial planning. In general, the payoff amount consists of the principal balance, accrued interest, and any applicable fees (such as early termination fees). For example, if a borrower has a remaining principal of $10,000, and the loan term is scheduled to end in 2025, the accrued interest over time (based on an annual percentage rate of 5%) must be considered. Additionally, early payoff penalties can vary by lender; for instance, some lenders impose a fee of 2% of the remaining balance, leading to a potential fee of $200 in this scenario. Overall, a comprehensive understanding of the payoff amount calculation is essential for borrowers to make informed financial decisions.

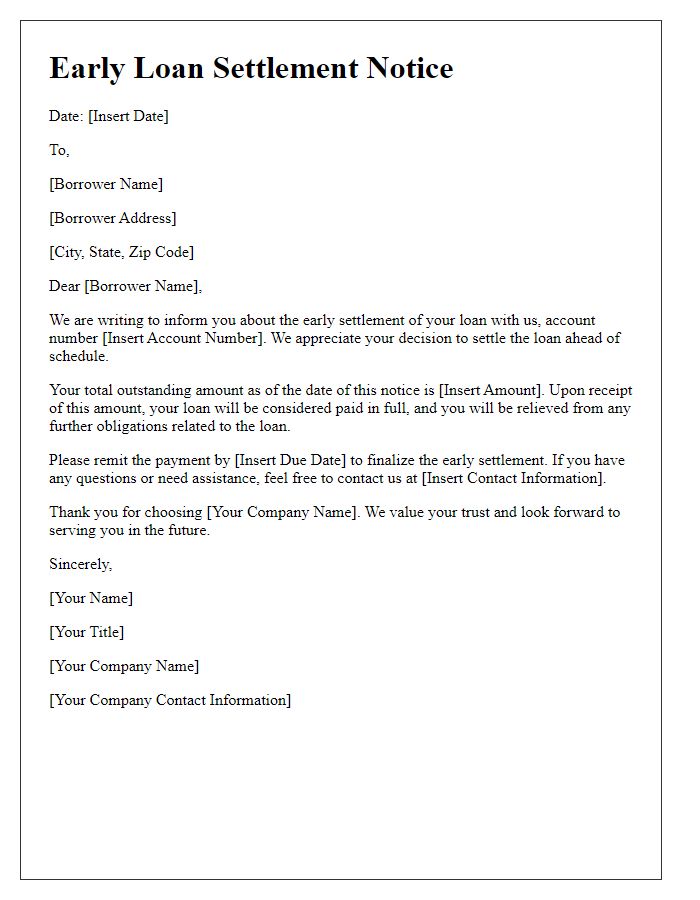

Request for Written Confirmation

Early loan payoff can impact credit standing, particularly for personal loans issued by financial institutions like banks. Borrowers typically seek to confirm early payoff amounts, which may include principal, interest, and any applicable fees. This confirmation is crucial for ensuring correctness in calculations and understanding repayments. Specific instructions from the lender are necessary to finalize payoff dates. Regulations such as the Truth in Lending Act (TILA) may dictate disclosure timelines, typically requiring lenders to respond within a defined period, often 30 days. Borrowers must keep in mind that early payoff can either improve or negatively affect their credit score, depending on individual circumstances and lender reporting practices.

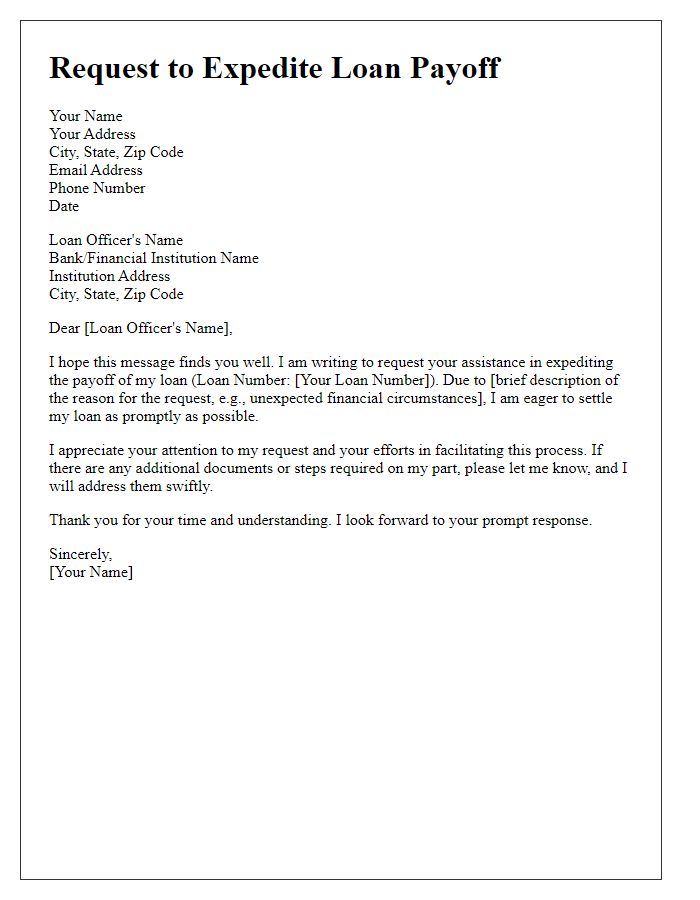

Contact Information for Queries

Early loan payoff demands can significantly impact financial planning and credit management. Loan agreements often stipulate the terms for early repayment, affecting interest calculations and outstanding balance, typically leading to potential prepayment penalties. Borrowers may seek clarity on consequences like changes in credit scores, overall savings, or benefits associated with completing payments ahead of schedule. For assistance, contact the customer service department of the lending institution, located at the corporate headquarters, usually available on weekdays from 9 AM to 5 PM, local time, or check their official website for email inquiries and FAQs regarding early loan payoff specifics.

Deadline for Response

A demand for early loan payoff can arise from specific situations, such as vehicles, mortgages, or personal loans. Loan agreements typically specify a payoff amount influenced by the remaining principal balance and any accrued interest and penalties. Responding within a stipulated timeframe, such as 30 days from the demand date, is critical to avoid additional fees. Timely feedback enables borrowers to adjust their financial strategies or negotiate terms with lenders effectively. The location of the lending institution, often specified in regional legal statutes, may also determine the appropriate actions required for compliance and processing the payoff correctly.

Comments