Are you ready to navigate the world of interim construction loans? Whether you're a seasoned builder or a first-time homeowner, understanding the ins and outs of these financial tools can be a game-changer for your projects. In this article, we'll break down everything you need to know about interim construction loans, from the application process to terms and repayment options. So, grab a cup of coffee and let's dive in â you won't want to miss out on the essential insights ahead!

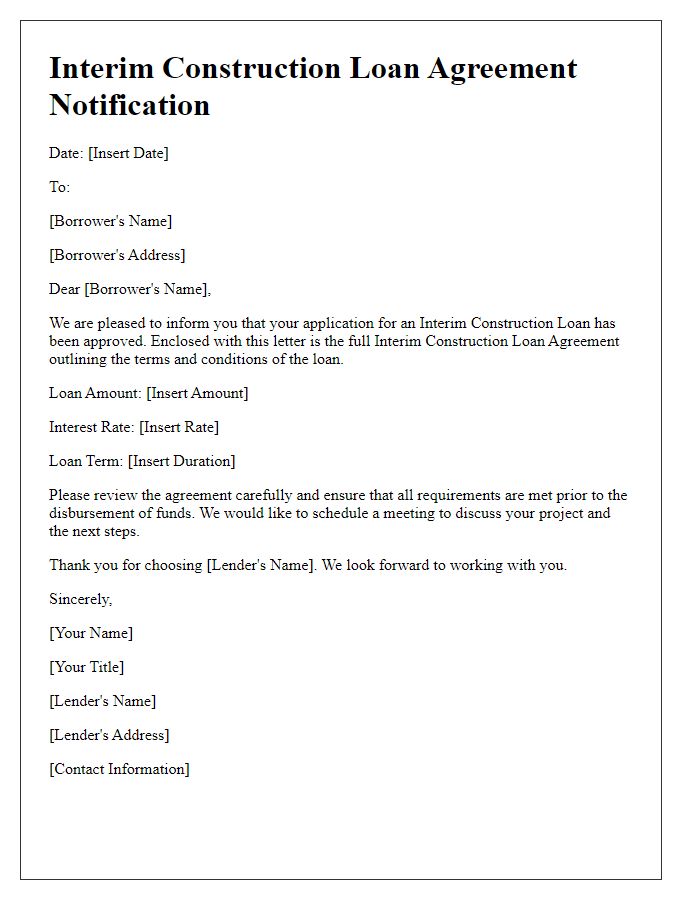

Borrower and Lender Information

Borrowers seeking interim construction loans must provide crucial information to lenders. Borrowers, often homeowners or developers, should present full legal names, social security numbers, and contact details, including addresses and phone numbers. Lenders, typically financial institutions or private investors like banks and credit unions, require their names, addresses, and representative contacts. This information facilitates timely communication regarding loan terms and project progress, ensuring adherence to financing schedules. Accurate documentation ensures streamlined approvals, impacting project timelines significantly. Key elements include loan amount, interest rates, repayment terms, and collateral properties, all essential for comprehensive evaluation in construction financing ventures.

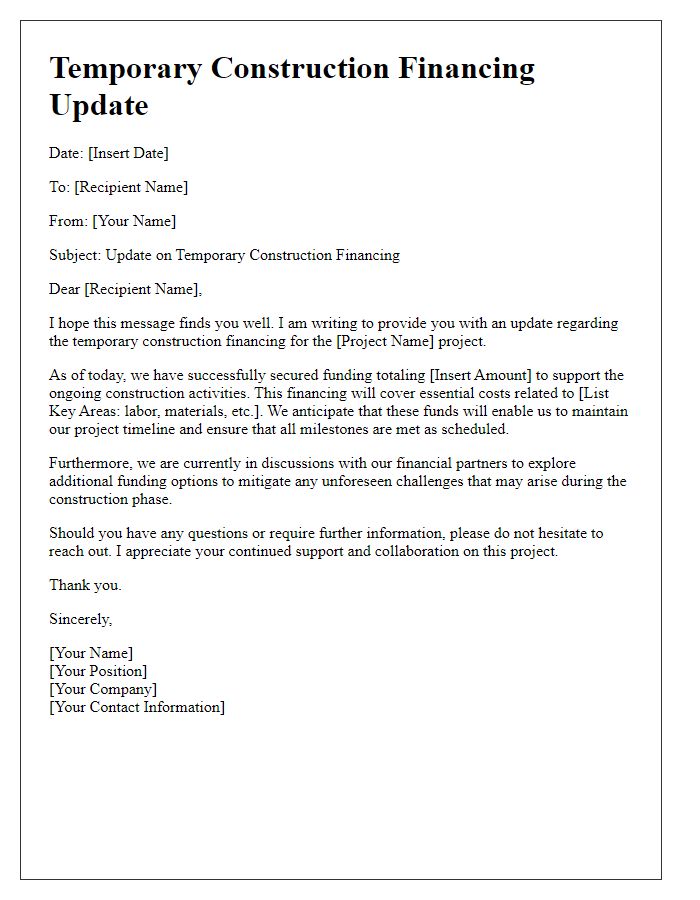

Loan Amount and Terms

An interim construction loan serves as temporary financing during the construction phase of a real estate project. This type of loan typically covers costs such as raw materials, labor, and permits, with amounts generally ranging from $100,000 to several million dollars based on project specifications. Loan terms often span six months to three years, depending on the project timeline. Interest rates may vary, generally between 4% to 8%, with the expectation of interest-only payments during the construction phase. Following project completion, repayment usually transitions to a permanent financing solution or full loan repayment. Understanding these details is vital for project budgeting and timeline management.

Construction Project Details

In construction project management, an interim construction loan is critical for financing projects such as residential buildings, commercial complexes, or infrastructure developments. Key details include the loan amount, which typically ranges from thousands to millions of dollars, depending on project scope; the project timeline, often spanning several months to years; and specific locations, such as urban areas in cities like San Francisco or New York. Construction loan agreements necessitate outlining milestones, including completion percentages for phases like foundation laying or framing, which can affect disbursement schedules. Additionally, budget allocations for materials, labor, and permits play a vital role, often requiring an itemized list detailing costs in thousands of dollars. Regular updates on project progress, compliance with building codes, and inspections by entities like local government agencies are also essential components of maintaining loan agreements.

Disbursement Schedule

Construction loans often involve a detailed disbursement schedule to ensure funds are allocated at the appropriate stages of a building project. A typical schedule outlines key milestones such as initial land acquisition, foundation completion, framing, roofing installation, and interior finishing work. Lenders typically provide funds based on inspections conducted at each stage, ensuring that the project aligns with approved budgets and timelines. Commonly, disbursements occur on a predetermined schedule, such as every 30 days or upon completion of specific phases, to maintain cash flow and monitor progress effectively. Adequate communication between the borrower and lender is essential to comply with loan agreements and timelines.

Compliance and Reporting Requirements

Construction loan notices require adherence to specific compliance and reporting requirements mandated by financial institutions. Parties involved in the construction project must submit detailed progress reports at designated intervals, typically every 30 days, reflecting the percentage of completion, costs incurred, and any deviations from the initial budget. Accurate documentation, including receipts and invoices related to construction expenses, must accompany these reports. Compliance with local building codes, safety regulations, and zoning laws is essential to avoid penalties. Regular site inspections conducted by designated representatives ensure that the work aligns with approved plans and specifications, fostering transparent communication among stakeholders throughout the duration of the loan.

Comments