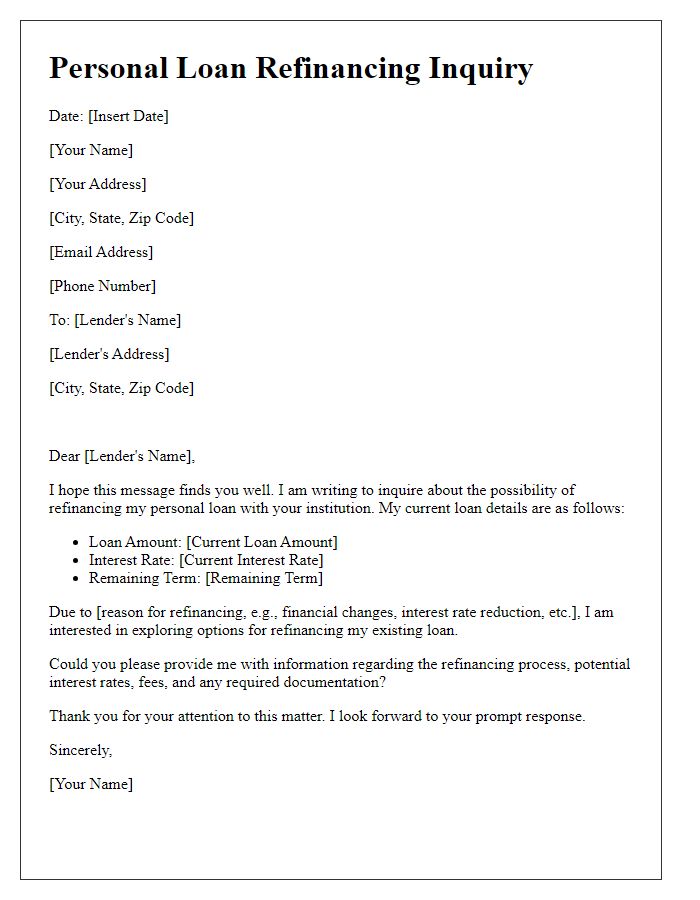

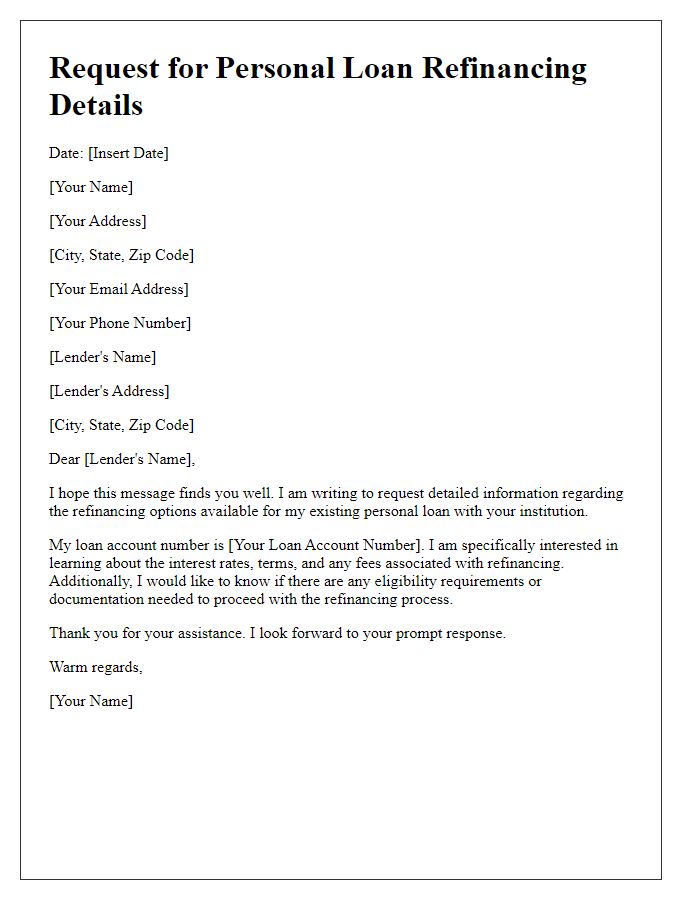

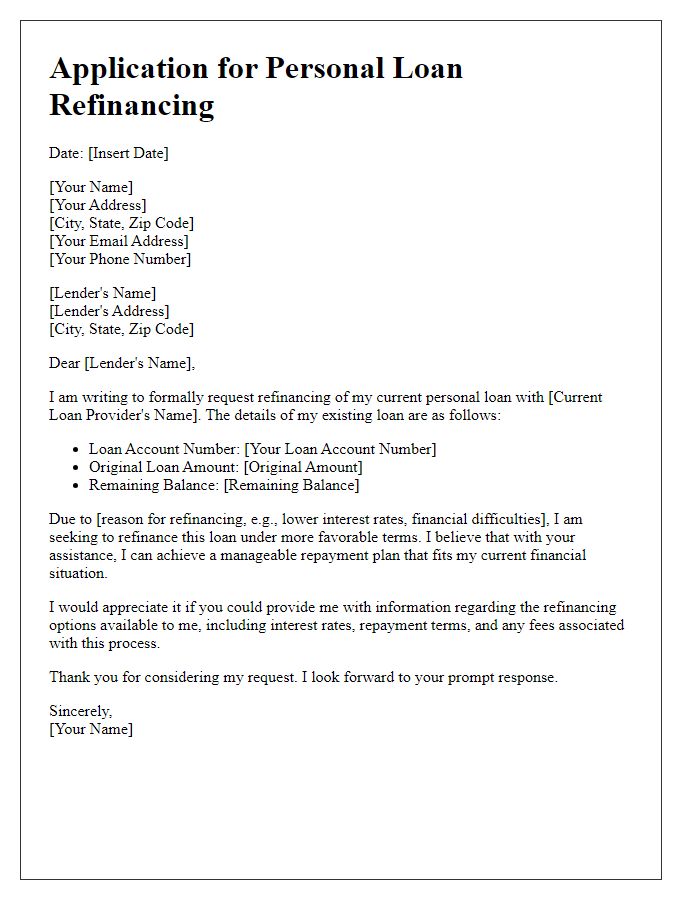

Are you feeling overwhelmed by your current loan terms and looking for a fresh financial start? Refinancing your personal loan could be the key to lower interest rates and improved monthly payments, making your budget much more manageable. With a variety of options available to cater to different financial situations, understanding your choices can empower you to make informed decisions. If you're curious about how refinancing can benefit you, read on to explore the possibilities!

Interest Rate Comparisons

Exploring personal loan refinancing options reveals significant differences in interest rates among various financial institutions. For instance, the average interest rate for personal loans, as reported by the Federal Reserve in March 2023, can range from 6% to 36%, depending on creditworthiness and loan amount. Banks like JPMorgan Chase offer rates starting around 6.99% for borrowers with excellent credit, while online lenders such as SoFi and Marcus by Goldman Sachs may offer competitive rates beginning at 6.00% for similar profiles. Additionally, credit unions typically provide lower rates than traditional banks, often averaging around 6.5% to 15%. Refinancing can lead to considerable savings, especially if a borrower qualifies for a lower rate by improving their credit score or changing financial circumstances since the original loan was secured. Thus, comparing these options is critical for determining potential savings and understanding long-term financial impacts.

Loan Term Adjustments

Personal loan refinancing can provide significant advantages such as lower interest rates and improved loan terms. Many borrowers seek adjustments in their loan term to either reduce monthly payments or pay off debt more quickly. For instance, switching from a 60-month (5 years) loan to a 36-month (3 years) term could save substantial interest over the life of the loan but may increase monthly payments. Refinancing options often consider factors like credit score, which affects interest rates and possible terms. In 2023, average personal loan interest rates ranged from 10% to 36%, depending on the lender and the borrower's creditworthiness. Exploring various lenders, including traditional banks, credit unions, and online platforms, can reveal competitive offers tailored to individual financial situations. Understanding these elements can lead to a more informed decision when considering loan term adjustments.

Fees and Charges Overview

Personal loan refinancing options often include various fees and charges that borrowers should be aware of, such as origination fees typically ranging from 1% to 5% of the total loan amount. Prepayment penalties, which may apply if borrowers pay off the loan early, can cost between $0 to several hundred dollars depending on lender policies. Closing costs, including title search and appraisal fees, can add another several hundred to thousands of dollars. Additionally, late payment fees often incur around $15 to $30 for missed due dates, which can affect the overall cost of refinancing. Understanding these potential expenses ensures informed financial decisions when considering refinancing options.

Credit Score Impact

Refinancing a personal loan can have significant implications on credit scores, particularly when considering factors such as credit inquiries and debt-to-income ratios. Each application for refinancing typically results in a hard inquiry, which can temporarily lower the credit score by a few points (usually 5-10%). However, if managed wisely, refinancing can lead to improved credit health by reducing the overall debt burden. Consolidating high-interest loans into a single lower-interest loan can improve the credit utilization ratio, a key component of the credit score, enhancing the borrower's financial stability. Furthermore, timely payments on the new loan can contribute positively to the credit history, ultimately increasing the score over time. Careful consideration of the terms and conditions of refinancing options is essential for achieving optimal credit score outcomes.

Repayment Flexibility Options

Personal loan refinancing options provide borrowers with varied repayment flexibility features, enhancing overall financial management. Numerous financial institutions offer adjustable repayment plans, allowing borrowers to choose between fixed-rate (steady monthly payments) or variable-rate (changing monthly payments based on interest rates) options. Certain lenders extend the opportunity for loan term adjustments, enabling borrowers to opt for longer terms (such as 15 or 30 years) for lower monthly payments or shorter durations for reduced total interest paid. Payment deferral options may also apply, granting borrowers the ability to pause payments without penalty during financial hardship. Additionally, some lenders incorporate biweekly payment schedules, which can lead to substantial savings on interest due to increased payment frequency. Individual borrower profiles, including credit scores and income levels, determine eligibility for these options. Understanding these features can significantly influence the decision-making process when considering refinancing a personal loan.

Comments