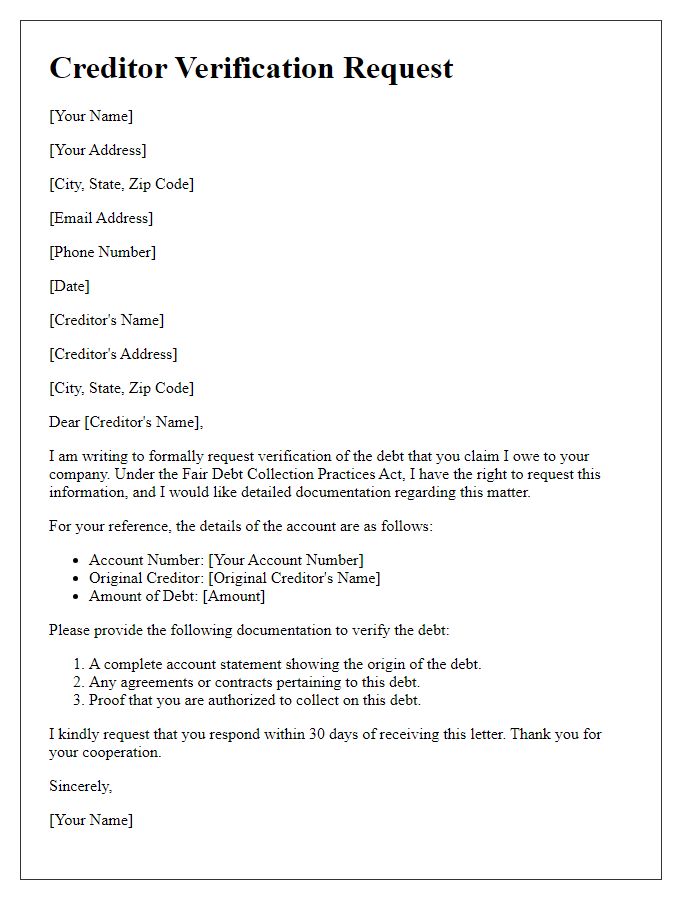

Are you navigating the complexities of managing your debts and seeking clarity on your creditors? A creditor verification request can be an essential step in understanding what you owe and ensuring the accuracy of your financial records. This letter serves as a formal way to confirm the specifics of your debts, protecting your rights and helping you maintain control. Curious to learn how to craft the perfect creditor verification request letter? Let's dive in!

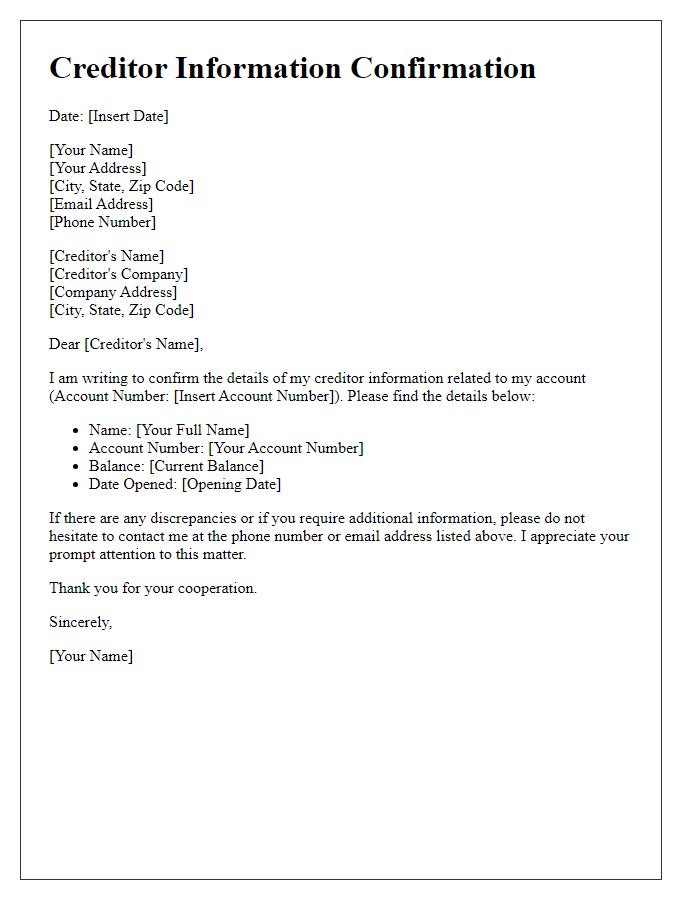

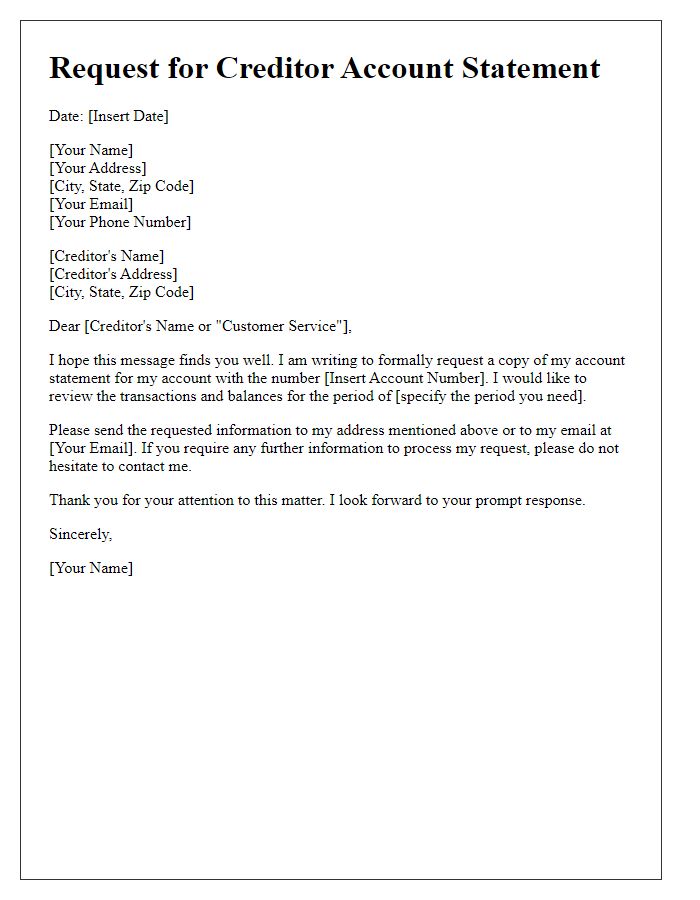

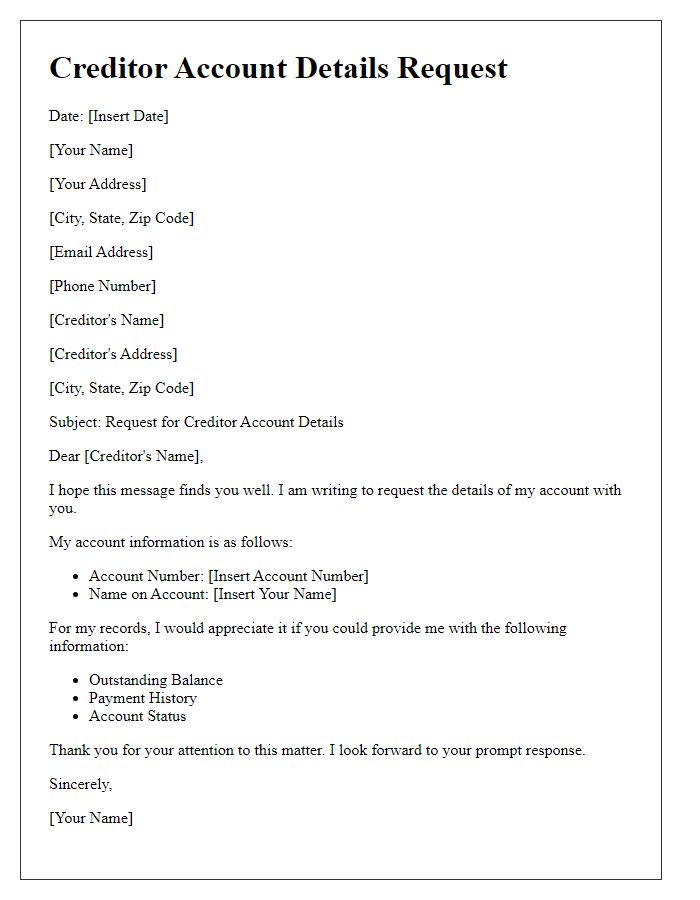

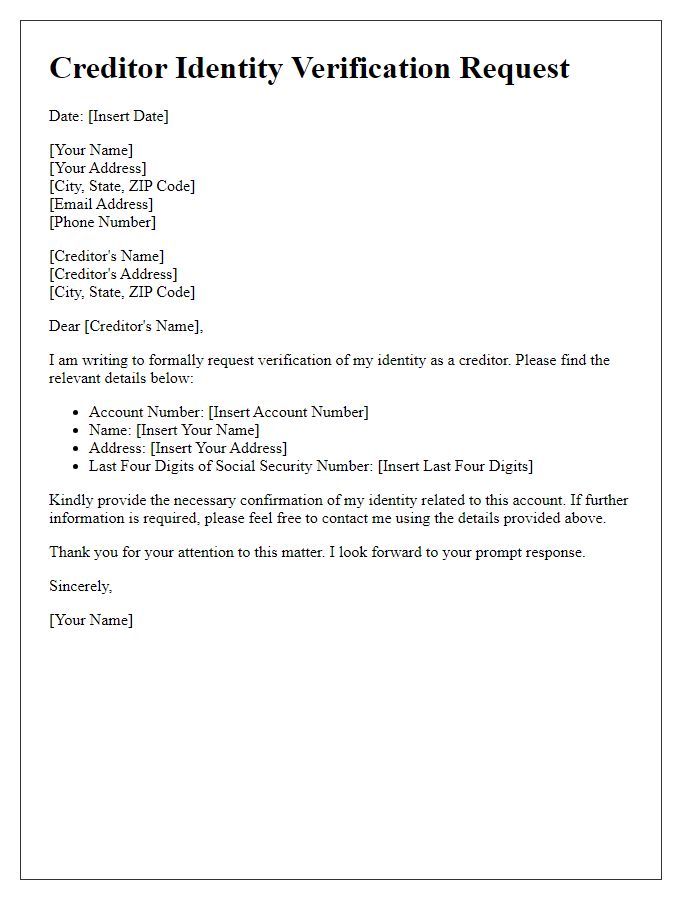

Creditor's Name and Contact Information

When a creditor needs to verify a debtor's information, it is important to provide a clear, concise summary of the necessary details. The creditor's name should include the official business name, while contact information must provide a reliable avenue for communication. Commonly required contact details encompass a mailing address, email address, and phone number, often formatted with area codes for clarity. Accurate information promotes efficient processing. Additionally, including a reference number specific to the account can facilitate quick access to relevant financial records, enhancing the verification process.

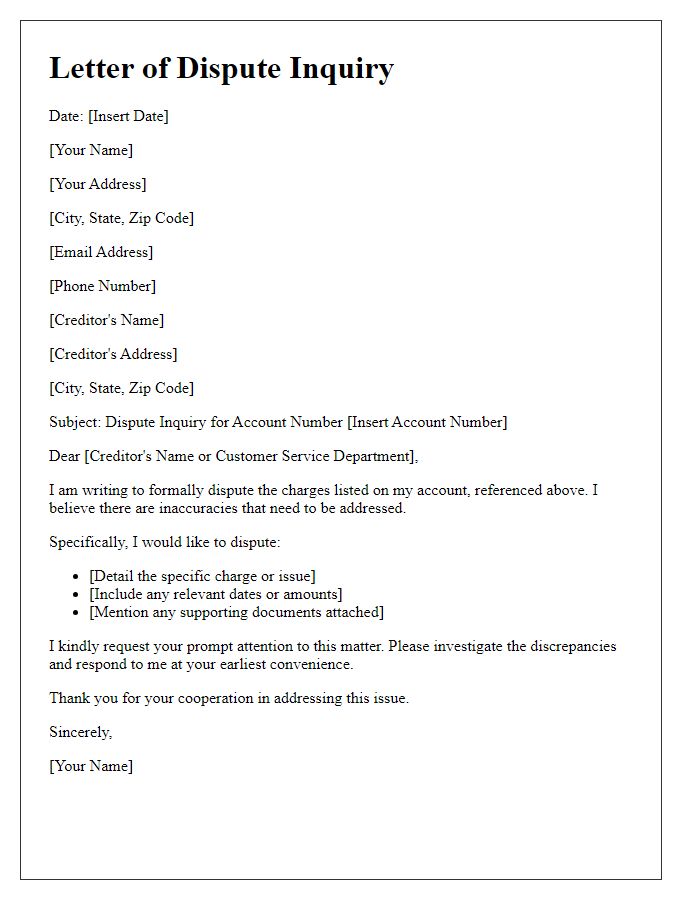

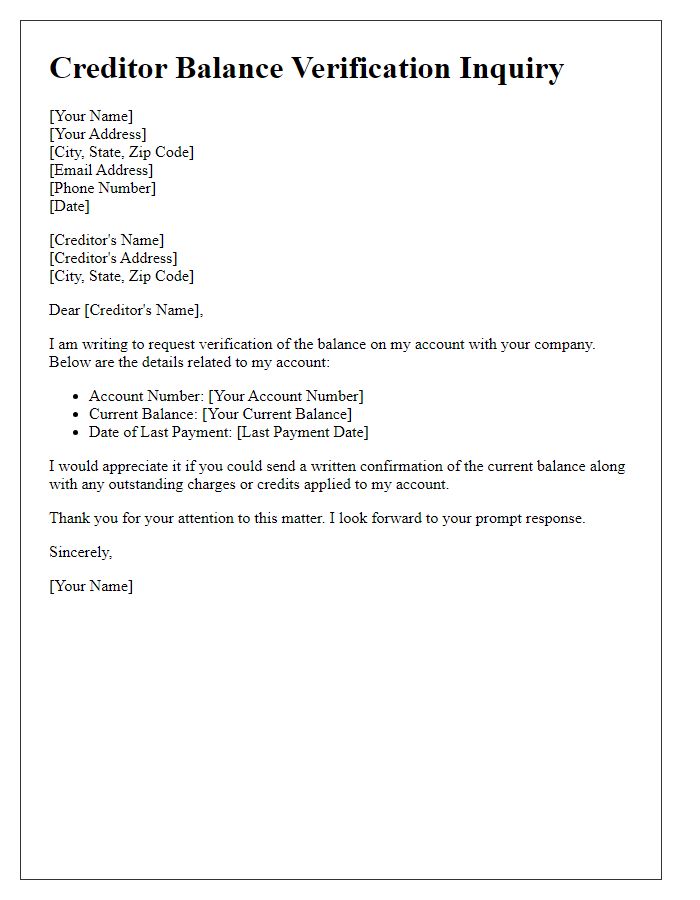

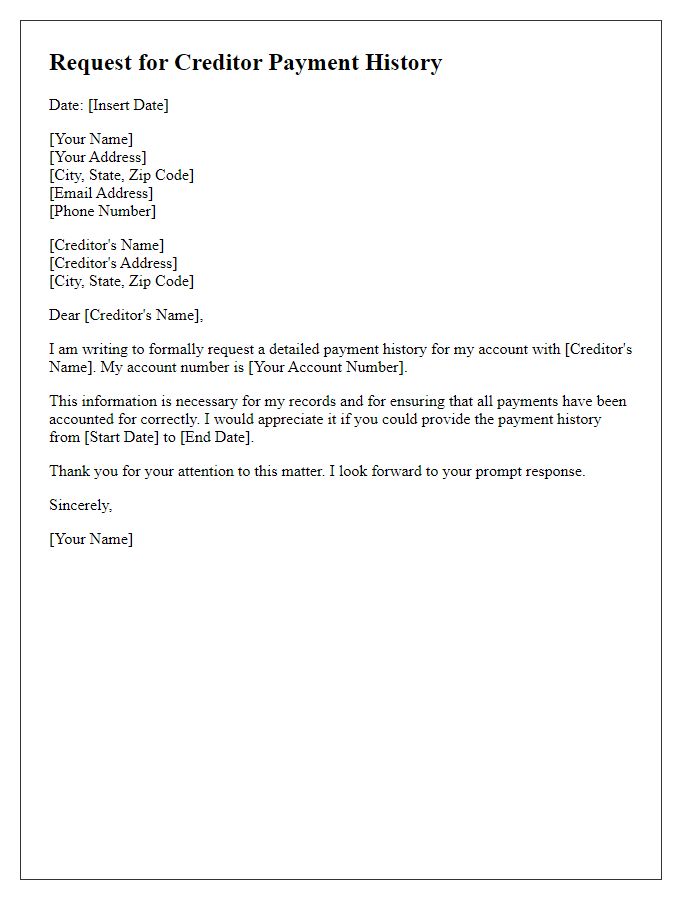

Consumer's Details and Account Information

A creditor verification request is a formal document aimed at confirming the details of a consumer's account for accuracy and authenticity. Consumers, characterized by demographic information such as names, addresses, and Social Security Numbers, provide relevant account information including account numbers, outstanding balances, and payment history. This request typically contains specific sections such as account identification, verification purpose, and inquiry regarding discrepancies. Such verification is crucial for consumer protection under regulations like the Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA). Accurate documentation can significantly impact credit scores, potential disputes, and credit reporting agencies, facilitating a transparent financial dialogue.

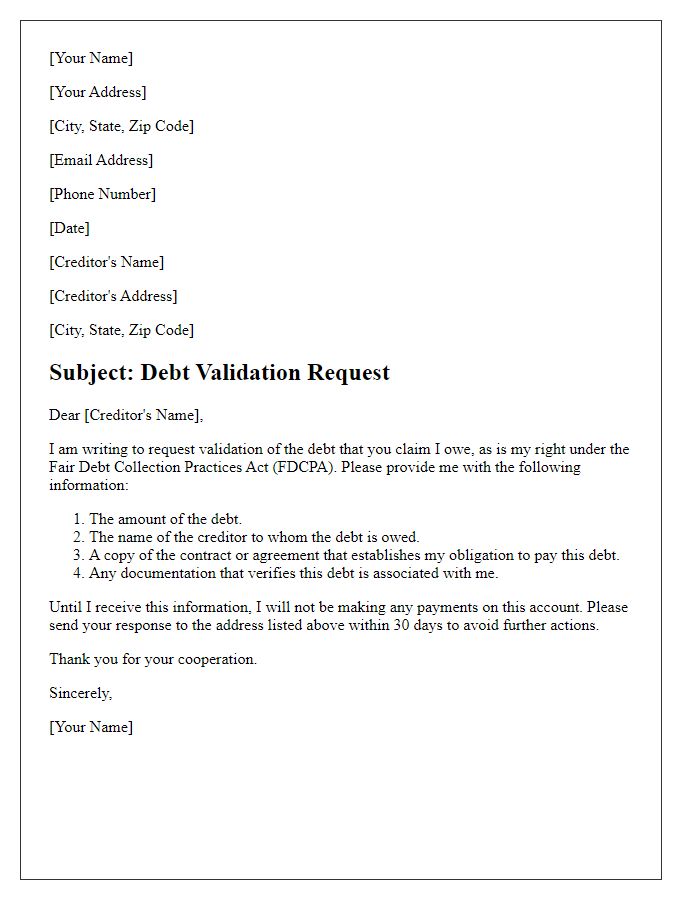

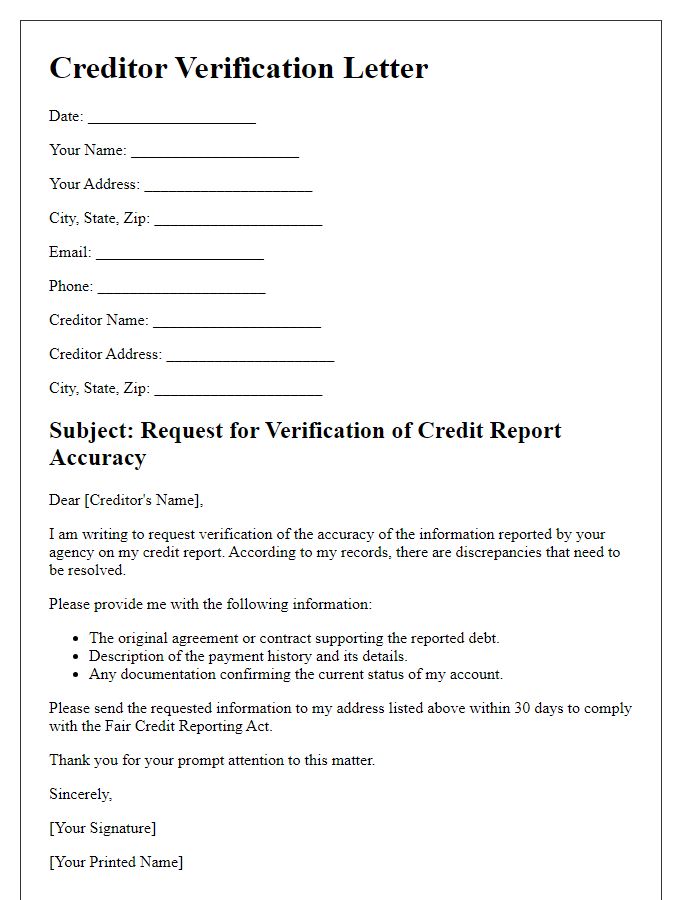

Request for Debt Validation and Documentation

Debt validation requests serve to confirm the legitimacy of outstanding debts. Creditors must provide comprehensive details regarding the debt, including original account numbers, the name of the original creditor, and itemized transaction histories. Documentation should encompass formal agreements, clear proof of account ownership, and detailed payment history to verify the authenticity of the debt. Additionally, regulations under the Fair Debt Collection Practices Act (FDCPA) require creditors to respond promptly, ensuring consumer rights are upheld throughout the verification process. Failure to comply can lead to disputes or legal ramifications for the creditor.

Legal References and Compliance Requirements

Creditors must adhere to various legal references and compliance requirements when processing verification requests. Under the Fair Debt Collection Practices Act (FDCPA), debtors possess the right to request validation of their debts within 30 days of initial communication. This includes accurate details about the amount owed, the original creditor's name, and any relevant account numbers. Additionally, the Fair Credit Reporting Act (FCRA) mandates that creditors must ensure the information they report to credit bureaus is accurate and can be substantiated. Compliance with the Consumer Financial Protection Bureau's guidelines is also crucial to avoid potential penalties. Documentation should be meticulously maintained, as regulatory bodies may require evidence of compliance during audits. Understanding these legal frameworks and ensuring adherence can protect creditors from disputes and legal challenges.

Signature and Contact Information of the Consumer

A creditor verification request requires precise details about the consumer's identity and their contact information. This includes the full name of the consumer, typically formatted as "John Doe" to ensure clarity and avoid confusion with similar names. The consumer's residential address, including city and zip code, should be presented accurately, like "123 Main Street, Springfield, 12345," to facilitate easy communication and verification. Additionally, the request should include the consumer's email address, for instance, "johndoe@email.com," and a contact phone number, formatted as "(123) 456-7890," providing options for direct outreach. Finally, the consumer's handwritten signature or electronic signature confirmation signifies authority and consent, making the request legally binding and authentic, essential for financial correspondence.

Comments