Are you considering adapting your payment schedule to a bi-weekly plan? Making this switch can simplify your budgeting process and even save you money over time. In this article, we'll explore the benefits of adopting a bi-weekly payment schedule and how it can positively impact your financial health. So, let's dive in and see how this change could work for you!

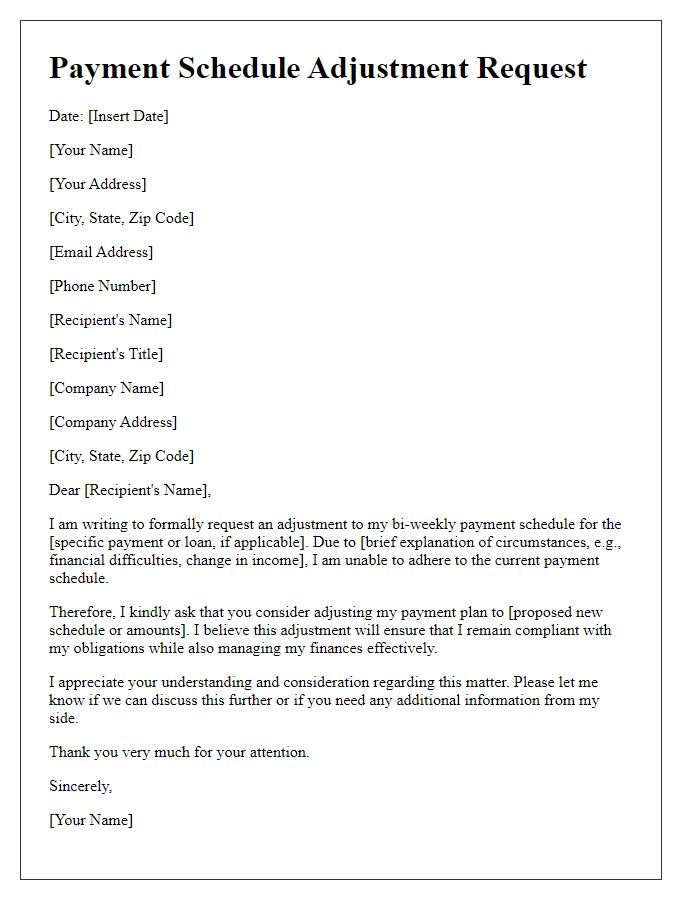

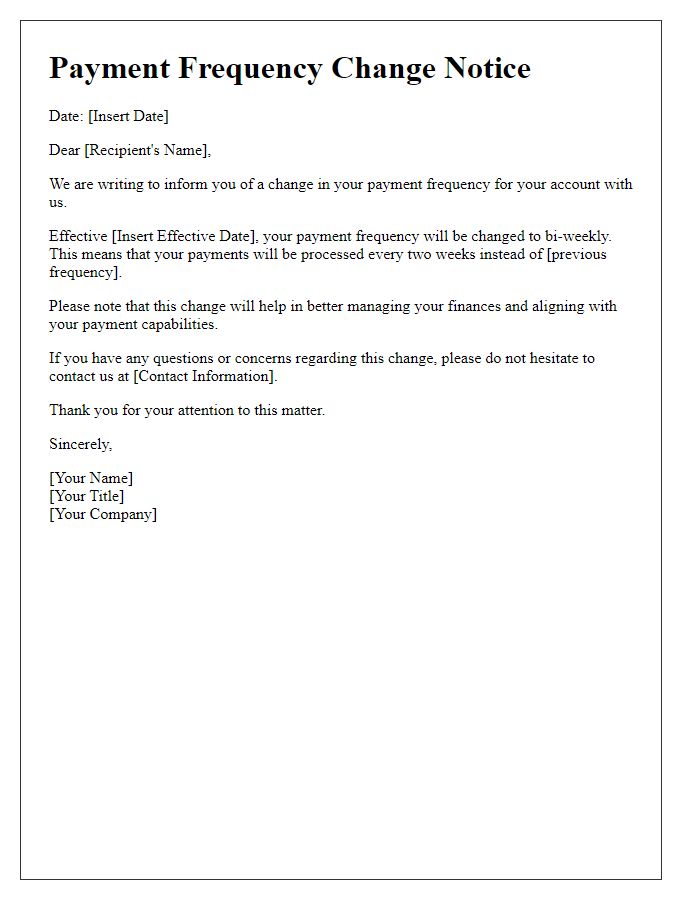

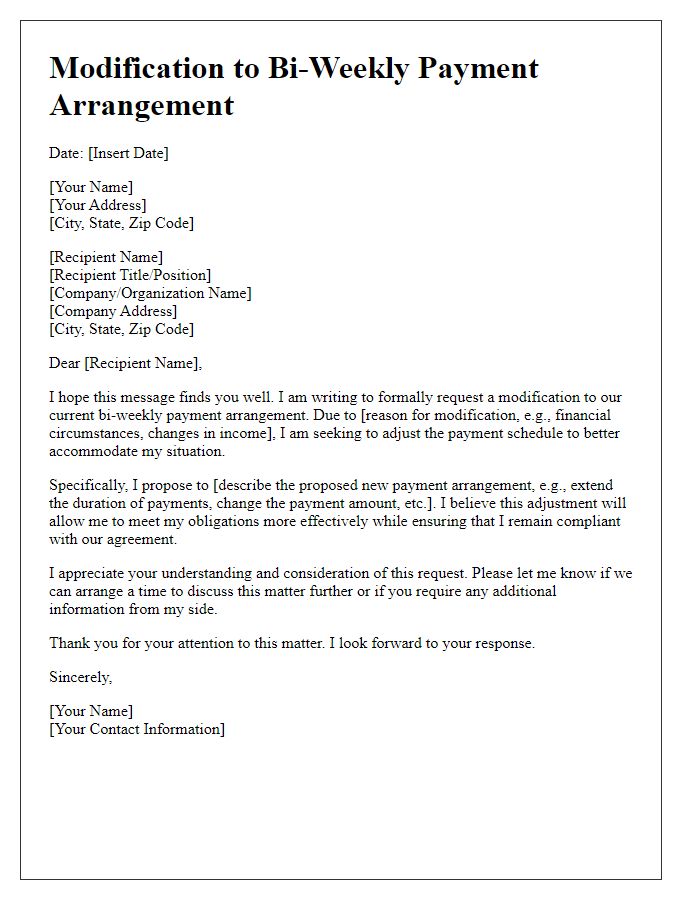

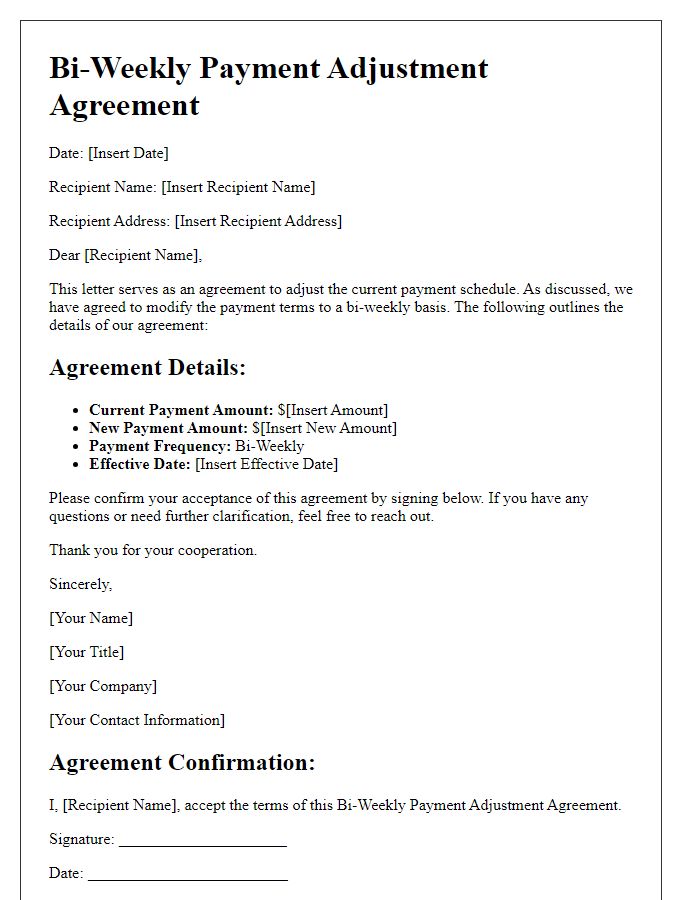

Clearly state the purpose of the change.

In recent changes to our financial policy, a bi-weekly payment schedule adaptation has been implemented to enhance cash flow management for employees. This adjustment allows for a more consistent pay period, ensuring that staff receive their earnings every two weeks instead of the previous method. The new schedule aligns with standard payroll practices in many organizations, facilitating financial planning for employees. Additionally, this shift aims to streamline administrative tasks within the payroll department, improving overall efficiency. Stakeholders should note the transition date and prepare accordingly to mitigate any potential disruptions in their financial activities.

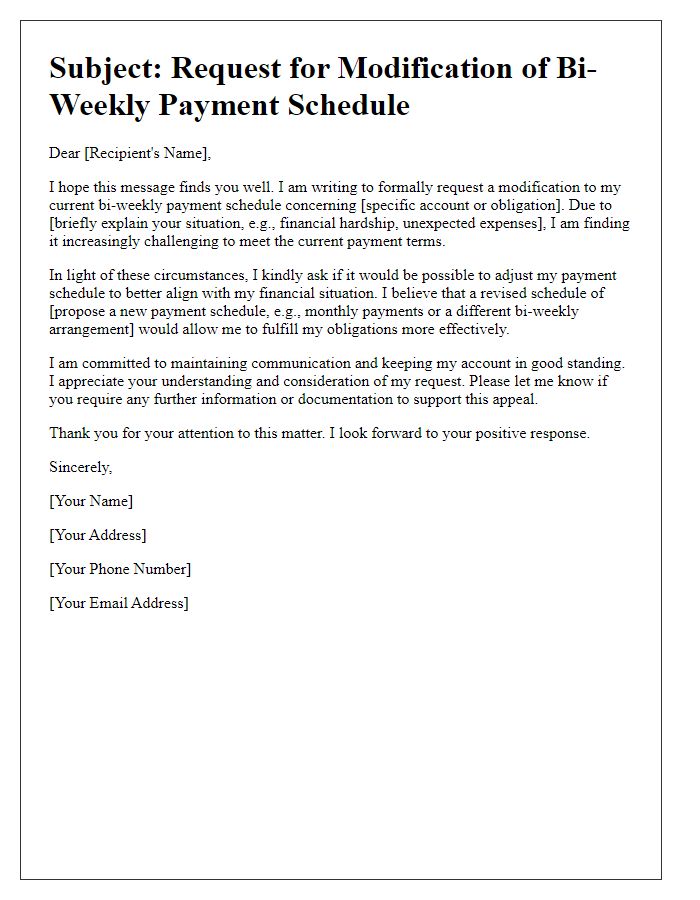

Outline the benefits of the bi-weekly schedule.

Transitioning to a bi-weekly payment schedule offers several key advantages for employees and employers alike. Regular pay periods, occurring every two weeks, can enhance personal budgeting by reducing the gap between paychecks. This frequency can help employees manage expenses more effectively, aligning closely with recurring bills such as rent and utilities. For employers, a bi-weekly schedule can streamline payroll processing, as payments are standardized based on a consistent frame of reference. Additionally, this approach can improve employee satisfaction by providing more immediate access to earnings, thereby potentially increasing motivation and productivity. Financial planning tools like budgeting apps can be utilized alongside bi-weekly payments to promote a healthier financial lifestyle among staff members. This adaptation in payment structure can foster a stronger employer-employee relationship, with open communication regarding financial wellness.

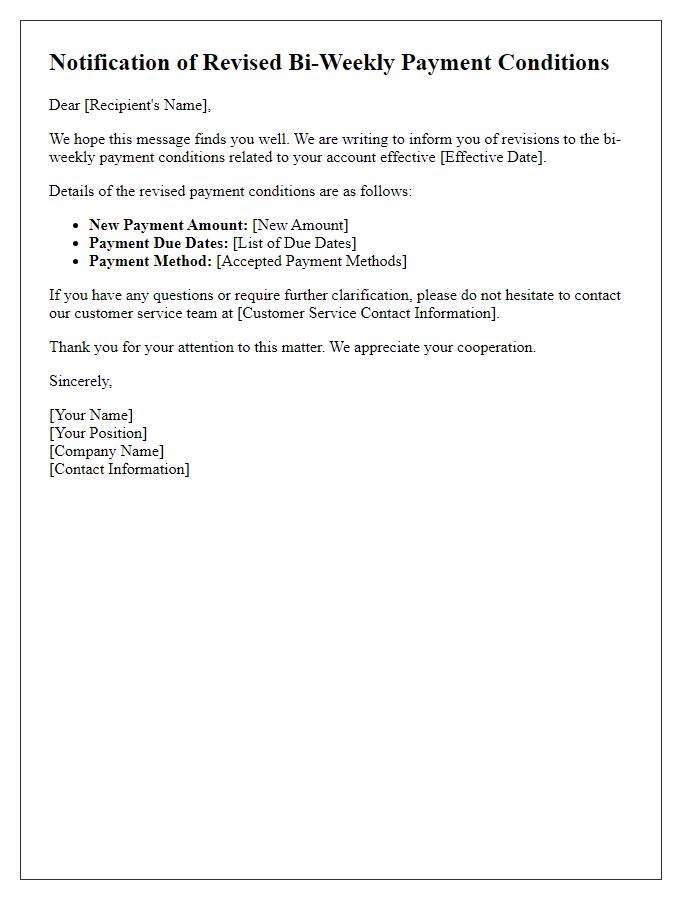

Include the effective date of the change.

Adjustments to a bi-weekly payment schedule can significantly impact budgeting for employees, providing a steady cash flow every two weeks. Effective January 1, 2024, the updated payment schedule will ensure employees receive their paychecks on alternating Fridays, optimizing financial planning. This change aims to enhance employee satisfaction by aligning pay dates with common expense cycles such as rent and utilities, which are often due at the beginning of the month. Employers should communicate these changes clearly, allowing staff ample time to adapt their personal budgets accordingly. An FAQ section may also assist employees in addressing any concerns regarding this new payment structure.

Provide detailed payment breakdown.

In the case of adapting a bi-weekly payment schedule, individuals or businesses can benefit from an organized payment breakdown. For example, if an annual salary of $52,000 needs to be recalculated into a bi-weekly payment schedule, the total number of pay periods amounts to 26 per year. This results in a bi-weekly payment of approximately $2,000 before taxes and deductions. Additional contextual elements can include benefits such as health insurance (averaging $150 per pay period) and retirement contribution plans (typically around 5% of gross pay). Furthermore, adjustments may be necessary for any accrued vacation time or unpaid leave, impacting the overall compensation each pay period. Clear communication regarding these expectations can foster transparency and enhance financial planning for both employers and employees.

Offer contact information for further assistance.

The bi-weekly payment schedule adaptation provides convenience for managing cash flow and budgeting effectively. Companies often prefer to implement this structure, as it aligns with employee work patterns, ensuring timely compensation every two weeks. Such a schedule involves 26 pay periods per year, allowing employees to receive their salaries in a more frequent manner, potentially improving employee satisfaction. For any questions or assistance regarding this payment structure, please reach out to our payroll department at [phone number] or [email address], where dedicated staff can provide support and clarifications.

Comments