Are you ready to take control of your finances with a hassle-free recurring payment plan? Enrolling in a payment plan not only simplifies budgeting but also ensures that you never miss an important payment deadline again. Imagine the peace of mind knowing that your bills are taken care of automatically each month. If you're curious about how to get started and make the most of this convenient option, keep reading for all the essential details!

Clear and concise introduction

A recurring payment plan enrollment often simplifies financial transactions for both businesses and customers. Setting up automatic payments can streamline monthly billing for services such as subscriptions, utilities, or loan repayments. On average, 70% of consumers prefer automatic payments to avoid late fees and ensure continuity of service. Businesses benefit by reducing administrative workload and improving cash flow predictability through consistent income. Many enrollment forms include essential customer information, payment method details, and authorization signatures to comply with security regulations.

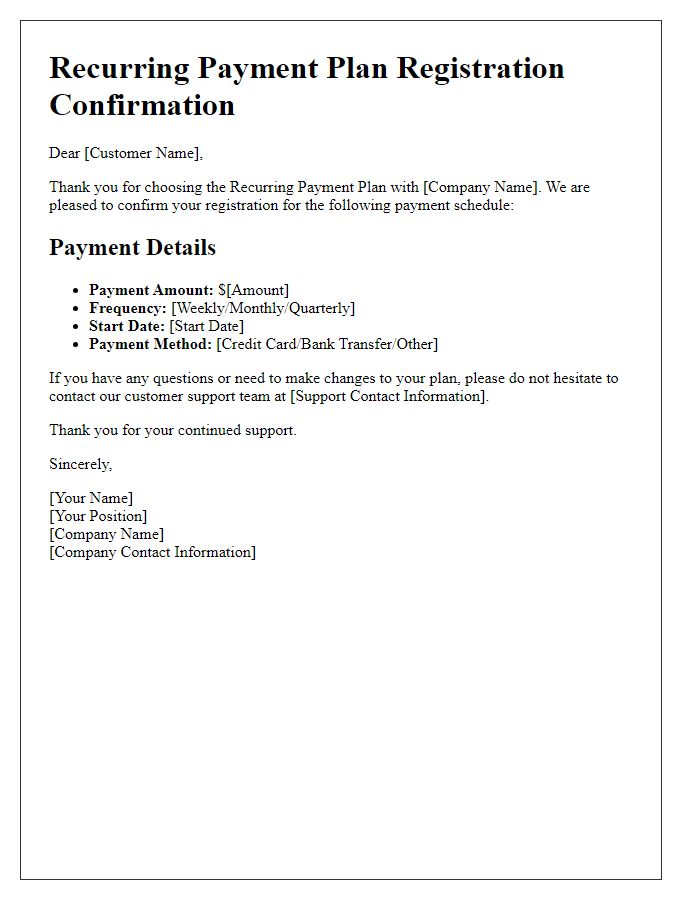

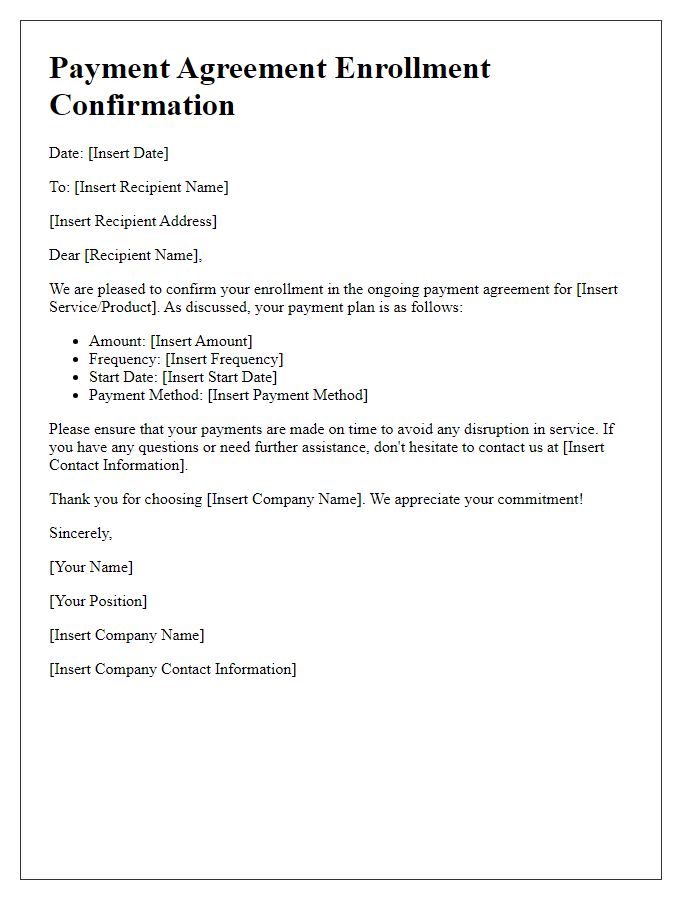

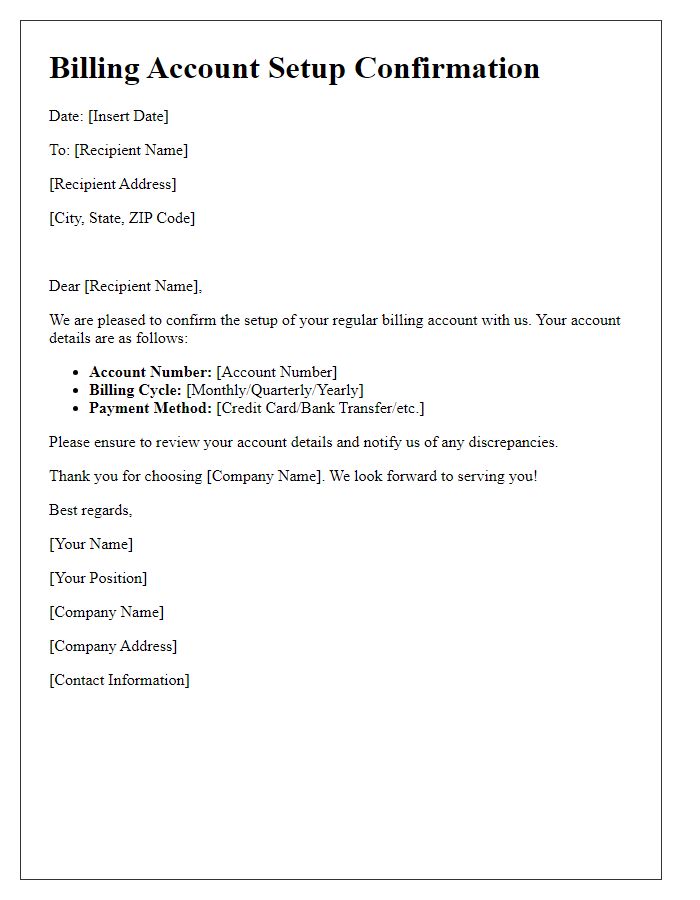

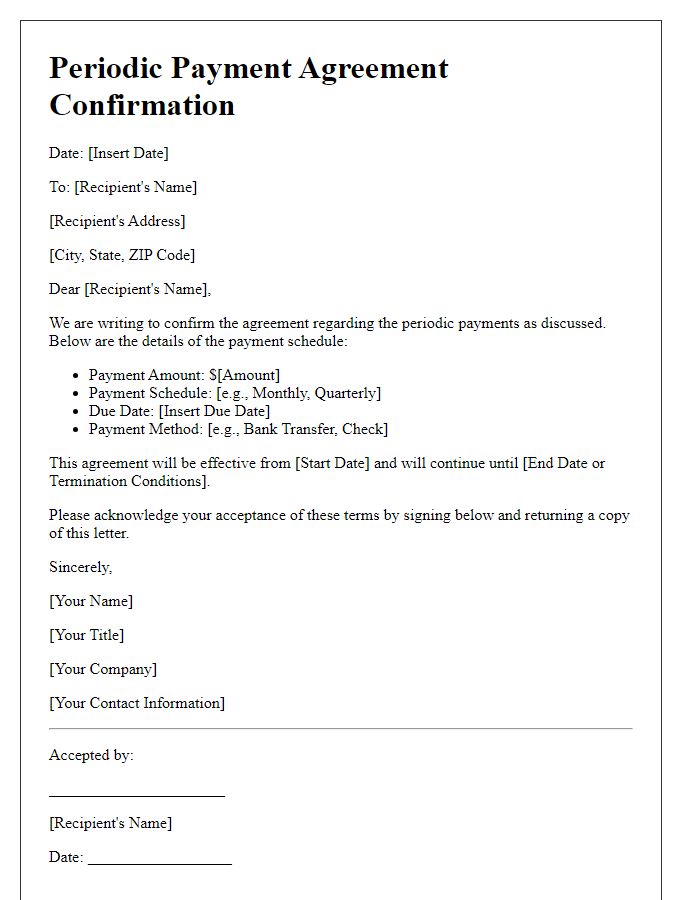

Detailed payment plan terms

Recurring payment plans provide a structured way for customers to manage their finances while ensuring timely payments for services or products. Payment plans typically include essential terms such as frequency of payment, which can range from weekly, bi-weekly, to monthly intervals. Payment amounts vary based on total costs, dividing the total sum into manageable installments; for instance, a $600 service payment could be split into six monthly payments of $100 each. Specific due dates are crucial; payments might be scheduled on the first of each month or another designated date, ensuring clarity in timing. Additionally, terms regarding interest rates (if applicable) may apply, with some plans offering zero-interest financing for promotional periods. Late fees often feature in payment plans, detailing additional charges incurred after the agreed-upon payment deadline. Cancellation policies require careful attention, outlining the process for discontinuing the plan and any financial repercussions for early termination. Clear communication of these detailed terms enhances customer understanding and satisfaction, fostering trust in recurring payment enrollment.

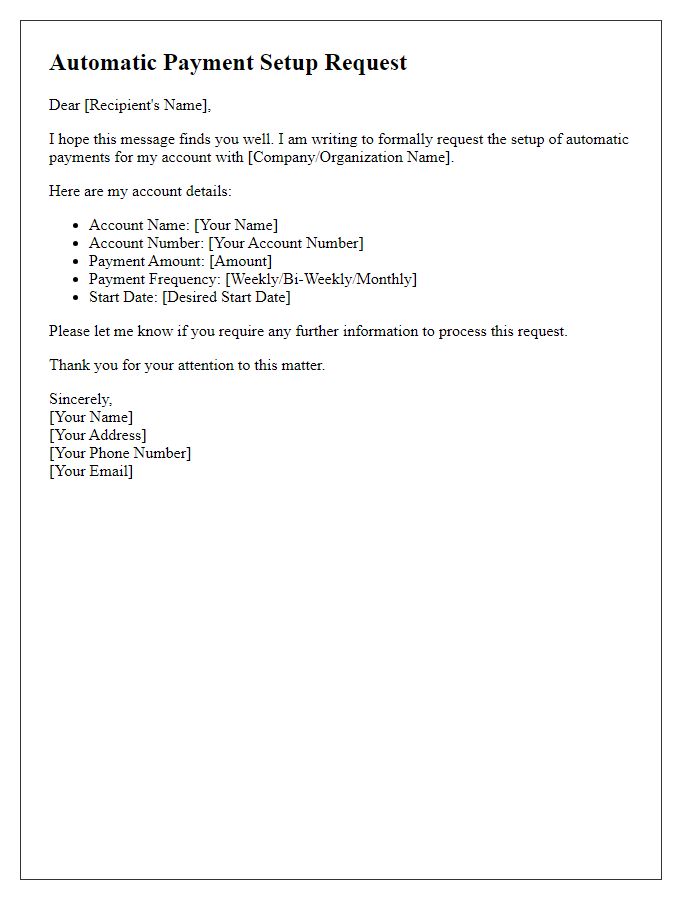

Instructions for enrollment

To enroll in a recurring payment plan, follow these detailed steps: First, visit the official website of the service provider, usually found in the top navigation bar. Locate the "Billing" or "Payment Plans" section, typically positioned in the account settings menu. Next, select the option for "Recurring Payments" to access the enrollment form. Fill in required information, including payment method, such as credit card details or bank account information, adhering to security protocols like SSL encryption. Review the payment schedule options, which may range from monthly to yearly intervals, ensuring alignment with personal budgeting strategies. Confirm the total recurring amount, inclusive of any applicable fees or taxes, commonly noted in the FAQ section for transparency. Finally, submit the enrollment form and monitor for a confirmation email detailing the start date and amount of the first payment, along with instructions for managing or cancelling the plan.

Contact information for support

Recurring payment plans provide customers with convenient financial management options for services or subscriptions. For assistance, individuals can reach out to customer support via email or phone. The support team, operating Monday through Friday, 9 AM to 5 PM Eastern Time (ET), can address inquiries regarding payment schedules, account updates, or troubleshooting issues. Relevant contact details such as the email address support@company.com and the phone number (555) 123-4567 are crucial for quick resolutions. Ensuring timely communication helps maintain a seamless experience for customers enrolled in these automated payment systems.

Compliance and privacy assurance

Recurring payment plans, commonly utilized by various organizations for services and subscriptions, require stringent compliance and privacy assurance measures. Regulatory frameworks such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States emphasize the necessity of obtaining explicit consent from participants before processing their personal financial data. Organizations must also implement secure payment gateways that encrypt sensitive information, reducing the risk of data breaches. Transparency in communication about how personal data will be used, stored, and shared is crucial, instilling confidence in users. Regular audits of payment processing systems ensure adherence to compliance standards, thereby safeguarding consumer trust and maintaining compliance with legal obligations. Furthermore, establishing clear procedures for participants to update or withdraw consent reinforces an organization's commitment to privacy.

Comments