Are you struggling with a loan deficiency balance and unsure how to approach settling it? Crafting the right letter can make all the difference in reaching a favorable agreement with your lender. In this article, we'll discuss essential tips and strategies for drafting an effective loan deficiency balance settlement letter that clearly outlines your situation and intentions. So, let's dive in and empower you to take control of your financial journey!

Personal information and contact details.

In the context of settling a loan deficiency balance, personal information such as borrower's full name, address, and contact details play a crucial role in accurately identifying the account in question. These details must include the current living address, email address for correspondence, and a direct phone number for any follow-up discussions. The loan deficiency balance refers to the amount remaining after a foreclosure or repossession process where the sale proceeds did not cover the total owed. It's essential for borrowers to present their case clearly, establishing their current financial situation and proposing a settlement figure that reflects their ability to pay, often supported by documentation like pay stubs, bank statements, or any relevant financial hardship evidence.

Loan deficiency balance details and reference number.

Loan deficiency balances, often resulting from foreclosure proceedings, can create significant financial burden for borrowers. A deficiency balance occurs when the sale of a foreclosed property does not cover the outstanding loan amount, leaving the borrower liable for the difference. For example, if a borrower had a mortgage of $250,000 and the property sold for only $200,000, a deficiency balance of $50,000 arises. Corresponding reference numbers, such as account identifiers or case numbers, are crucial in tracking specific loan details with lending institutions. It is vital for borrowers to clearly document their loan deficiency balance, providing all pertinent figures and cultivating a transparent dialogue with lenders for potential settlement options or forgiveness agreements.

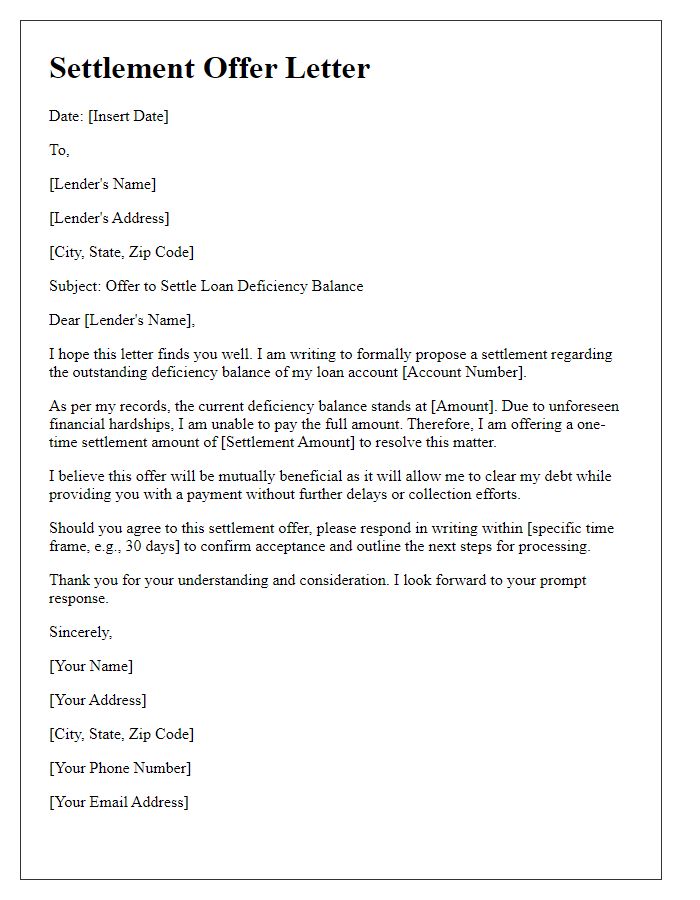

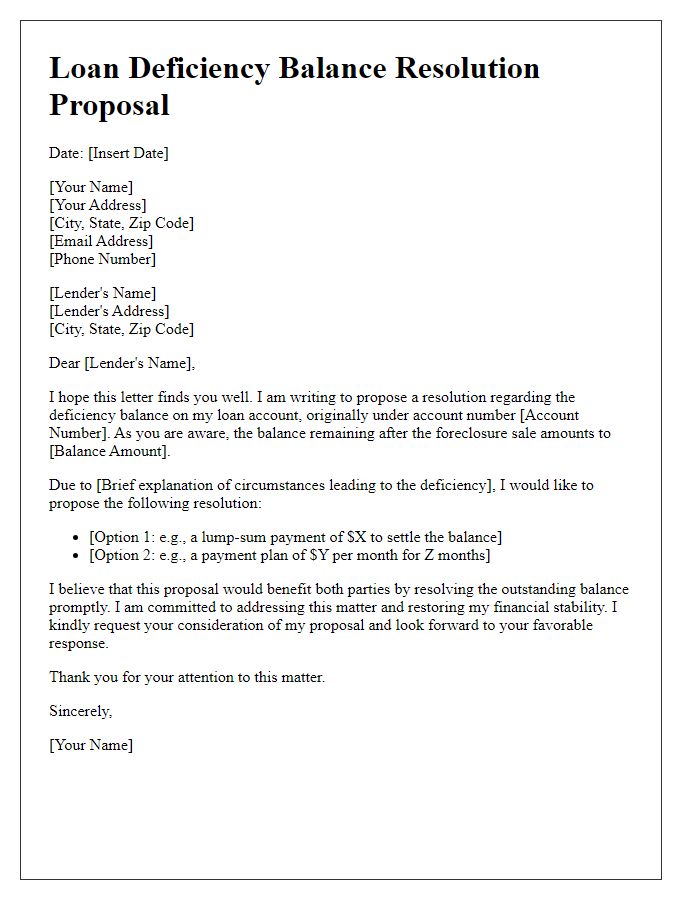

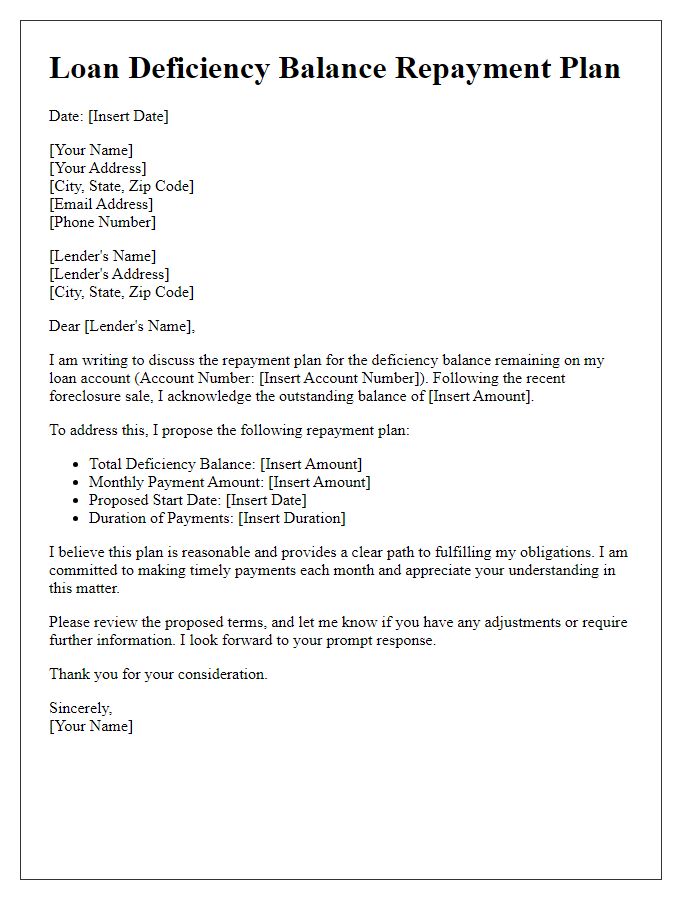

Proposed settlement amount and payment terms.

A loan deficiency balance settlement involves negotiating a reduced amount owed on an unpaid loan, often after a repossession or foreclosure, to resolve the remaining debt. Typically, lenders may require a one-time lump sum payment or a structured payment plan, which outlines the proposed settlement amount, due dates, and payment methods. For instance, a borrower could propose a settlement of $5,000 for a $10,000 deficiency, payable over six months, with a payment of approximately $833.33 per month. Such negotiations require comprehensive documentation, including account statements, repayment history, and financial hardship details, to support the request effectively. Engaging with a qualified debt settlement professional may be advisable to navigate the complexities of the settlement process and ensure favorable terms.

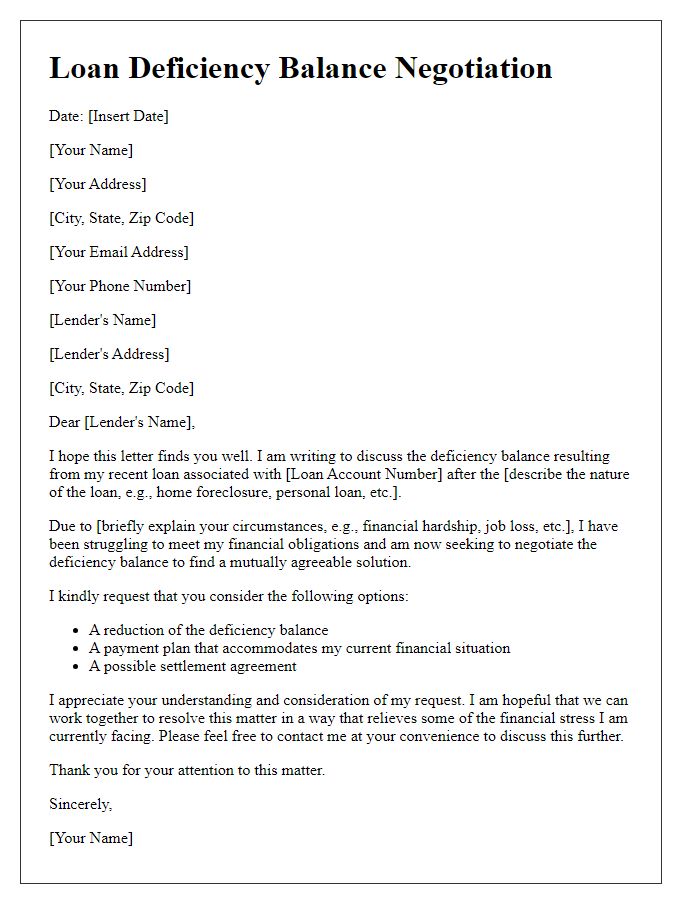

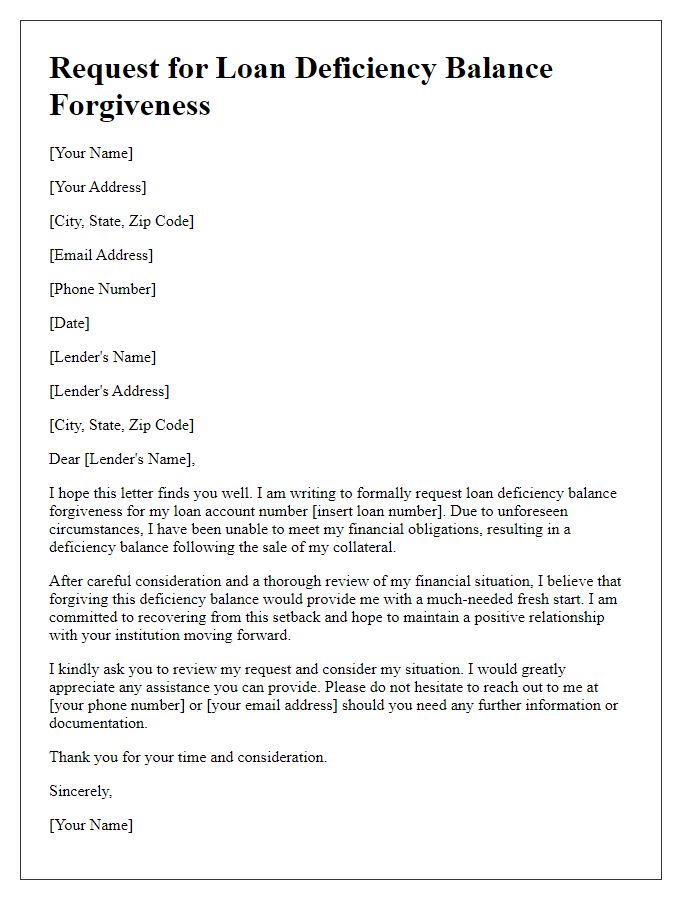

Justification for settlement offer.

A loan deficiency balance refers to the remaining amount owed after the sale of a repossessed asset, such as a vehicle or property, which is often less than the outstanding balance on the original loan. Several financial factors influence the decision for a settlement offer, including an individual's current income level, outstanding debts, or recent life events such as job loss or medical emergencies. Borrowers may present a formal proposal for settlement negotiation based on an inability to pay the remaining balance, providing documentation of fiscal hardships and proposing a lump sum payment at a reduced amount. In such cases, lenders often consider the long-term benefits of settling the debt against the costs and time involved in pursuing collection, potentially leading to a mutually agreeable resolution. Essential data could include the original loan amount, total deficiency balance, value obtained from the asset sale, and proposed settlement figure, all of which provide insight into the borrower's financial position and justification for a settlement offer.

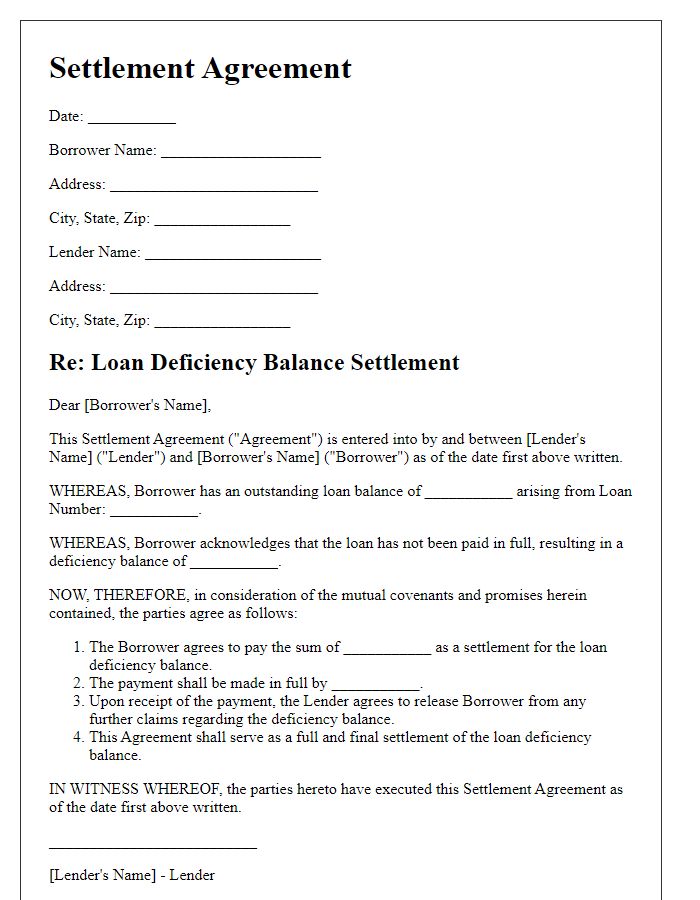

Request for written confirmation and agreement.

A loan deficiency balance settlement request involves negotiating with a financial institution regarding the remaining balance on a defaulted loan, often related to mortgages or personal loans. Borrowers may find themselves in need of a settlement due to various circumstances, such as job loss or unexpected expenses. The request aims for a written confirmation, ensuring both parties agree on the terms of settlement. Key elements include the original loan amount, the deficiency balance, proposed settlement amount, and any relevant account numbers or borrower references, creating a clear record for future reference. It is crucial to document the agreement properly to prevent any misunderstandings or additional charges.

Letter Template For Loan Deficiency Balance Settlement Samples

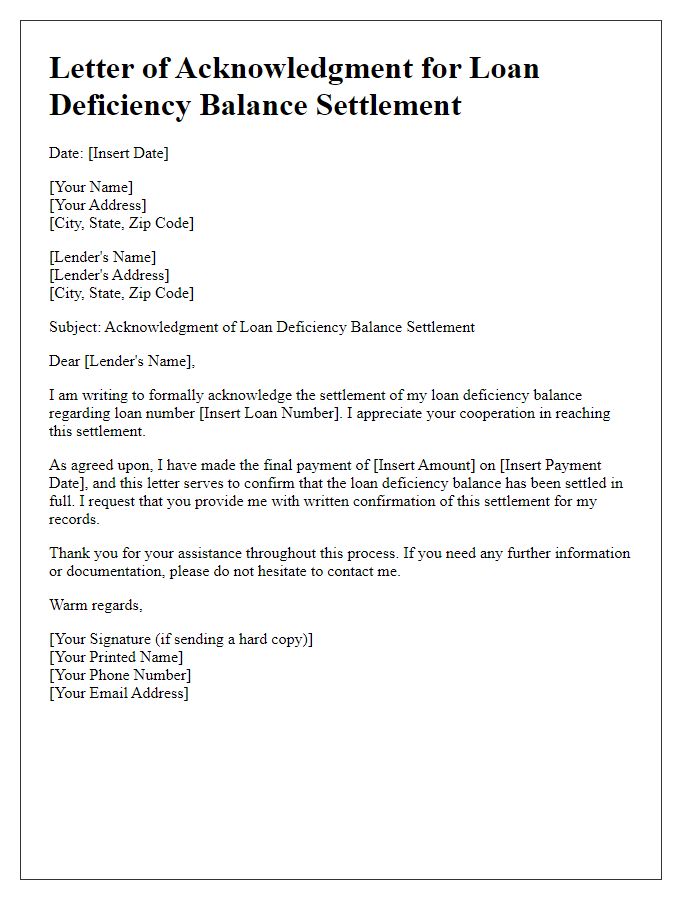

Letter template of acknowledgment for loan deficiency balance settlement.

Comments