In today's financial landscape, it's essential for consumers to stay informed about their credit options. If you've recently received a notice regarding a decrease in your credit limit, you're not aloneâmany people face similar situations. Understanding the reasons behind this change can help you navigate your finances more effectively and maintain your credit health. So, let's dive into what this means for you and explore how to best respond to the notice!

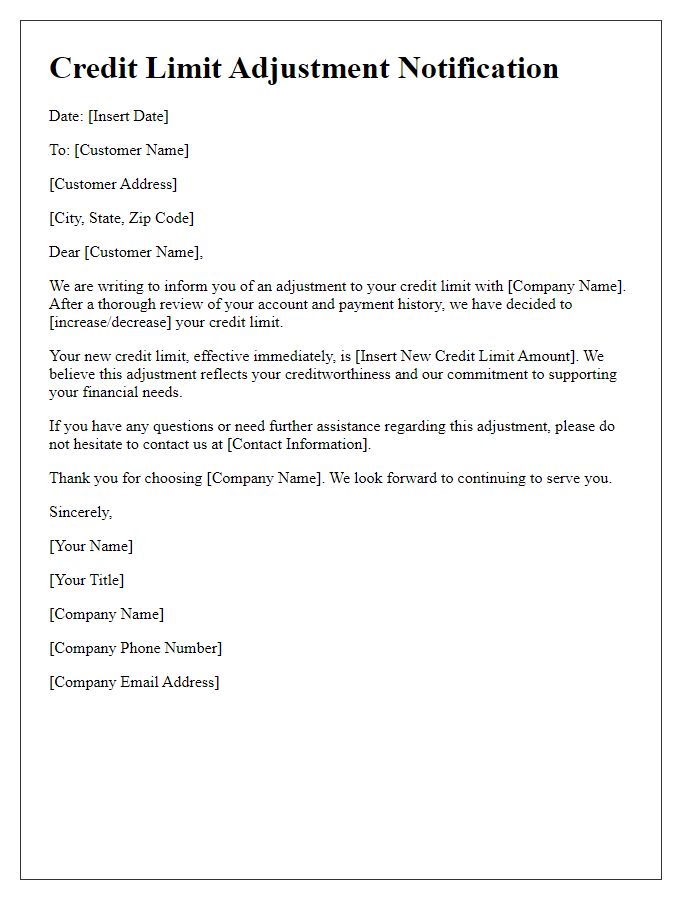

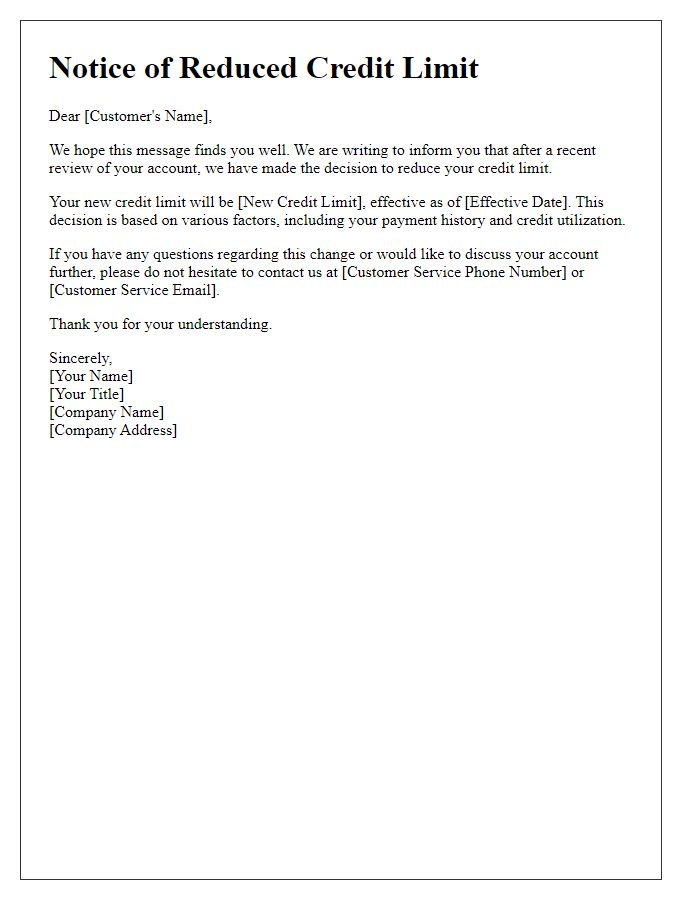

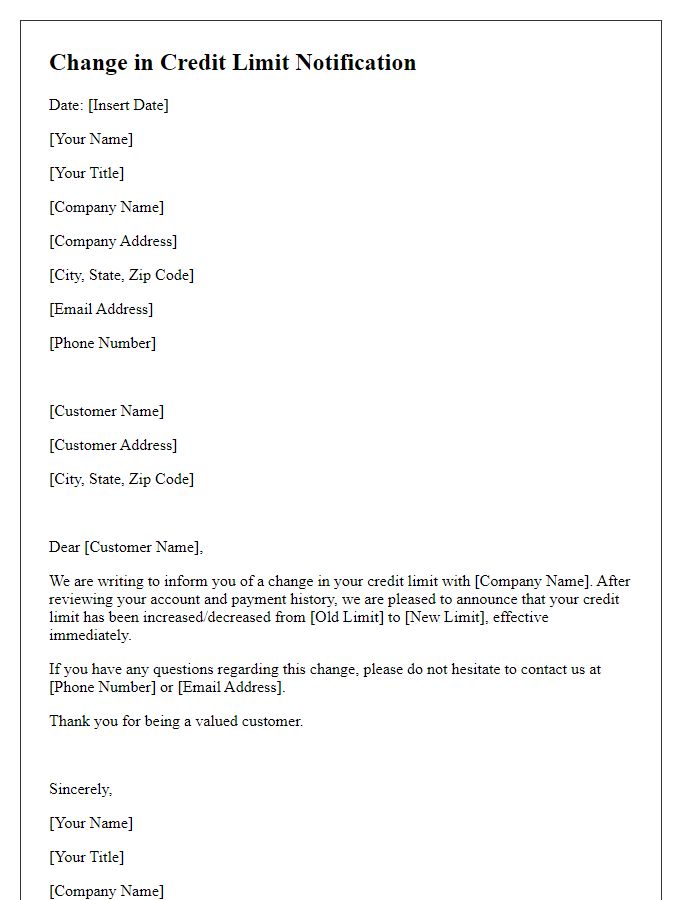

Customer's account information

Credit limit decreases can impact customer spending capabilities, affecting financial flexibility. For instance, if a customer currently has a credit limit of $5,000 on their Visa card, a reduction to $3,000 means they have less available credit for unexpected expenses or large purchases. This change typically arises from factors such as late payments, increased credit utilization ratios (above 30% being considered risky), or changes in credit score, which can fluctuate significantly due to various financial behaviors. It's essential to inform customers about this modification promptly, as it might influence their budgeting decisions and overall financial planning. Notifications should emphasize the rationale behind the decision, giving customers a clearer understanding of their account management practices.

Reason for credit limit decrease

Recent financial assessment indicates a necessary adjustment to your credit limit due to various factors including payment history, credit utilization rate, and overall debt levels. This decision aims to mitigate potential risk and support responsible credit management. Credit scores, derived from data provided by agencies such as Experian or TransUnion, reflect your borrowing behaviors over the past few months, leading to this proactive measure. Regular monitoring and evaluation of your credit activity are essential for maintaining financial health and achieving favorable terms in future credit opportunities.

Effective date of change

A credit limit decrease can impact consumer spending and financial stability, particularly affecting credit cards issued by major banks like Visa and MasterCard. The effective date of change is significant, often enabling consumers to adjust their budgets accordingly before the new limit comes into effect. Generally, notice periods range from 15 to 30 days, providing sufficient time for customers to address their financial strategies and manage their credit utilization ratio, which is critical for maintaining healthy credit scores. Additionally, understanding the reasons behind the decrease, such as changes in payment history or overall creditworthiness, is essential for consumers to regain confidence and improve their financial profiles moving forward.

Contact information for queries

Credit limit decreases can significantly impact consumer spending behavior and financial management. Financial institutions, like banks and credit unions, often adjust credit limits based on a range of factors, including payment history, credit utilization ratios, and overall economic conditions. In such notices, contact information becomes essential for customer inquiries, typically including a customer service phone number (such as 1-800-123-4567), an email address (support@financialinstitution.com), and a physical address for written correspondence (123 Main St, City, State, Zip Code). Clear communication helps customers understand the reason for the adjustment and explore options for reassessment or appeal.

Appreciation for business and reassurance

A recent policy change at a major financial institution has led to the implementation of tighter credit limit regulations for certain customers. This affects credit holders across various demographics. Customers may witness a decrease in their credit limits after annual reviews. Financial experts emphasize that this adjustment aims to enhance responsible borrowing practices among consumers. The notice will typically acknowledge the customer's loyalty and highlight the importance of maintaining healthy credit habits. Customers are encouraged to reach out to customer service for further clarification on their individual situations.

Comments