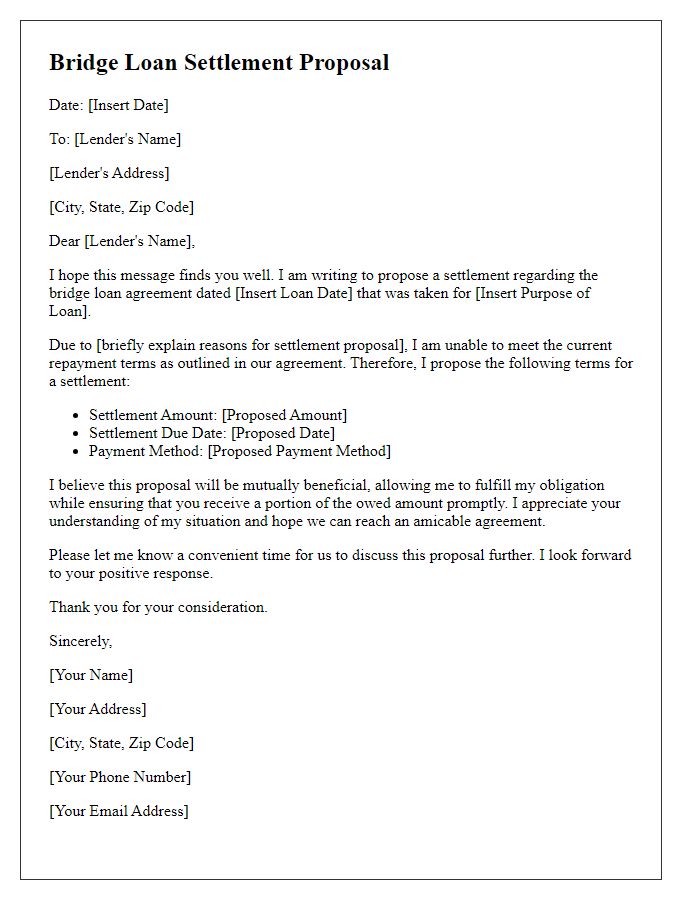

Are you navigating the complexities of a bridge loan settlement? Understanding the terms can feel overwhelming, but it's crucial for making informed decisions about your financial future. In this article, we'll break down the essential components of bridge loan settlement terms, providing clarity and guidance every step of the way. Stick around to dive deeper into this topic and empower yourself with the knowledge you need!

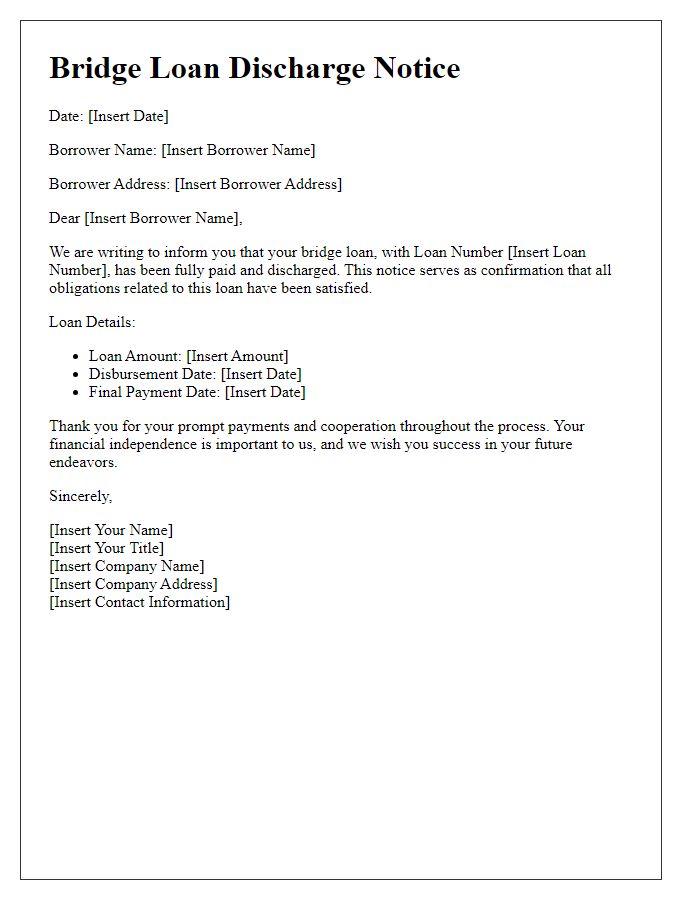

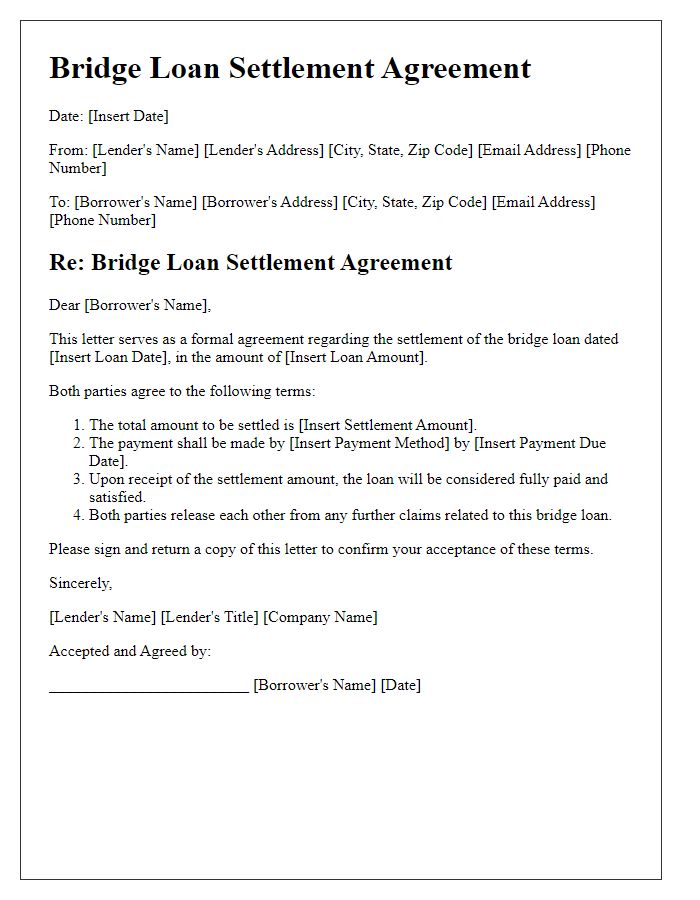

Principal Amount Details

Principal amounts in bridge loan agreements typically refer to the original sum of money borrowed, often between $50,000 to $5 million, depending on the lender's policies and the borrower's financial needs. The repayment term usually ranges from six months to three years, designed to provide temporary financing during transitional periods such as real estate transactions or business expansions. Lenders may charge an interest rate, which can vary widely based on risk factors, typically between 6% to 12%, with origination fees (commonly around 1% to 3% of the principal) applied at the loan's inception. Additionally, detailed documentation is often required, such as proof of income, credit history, and property valuation, to secure favorable terms for both parties involved.

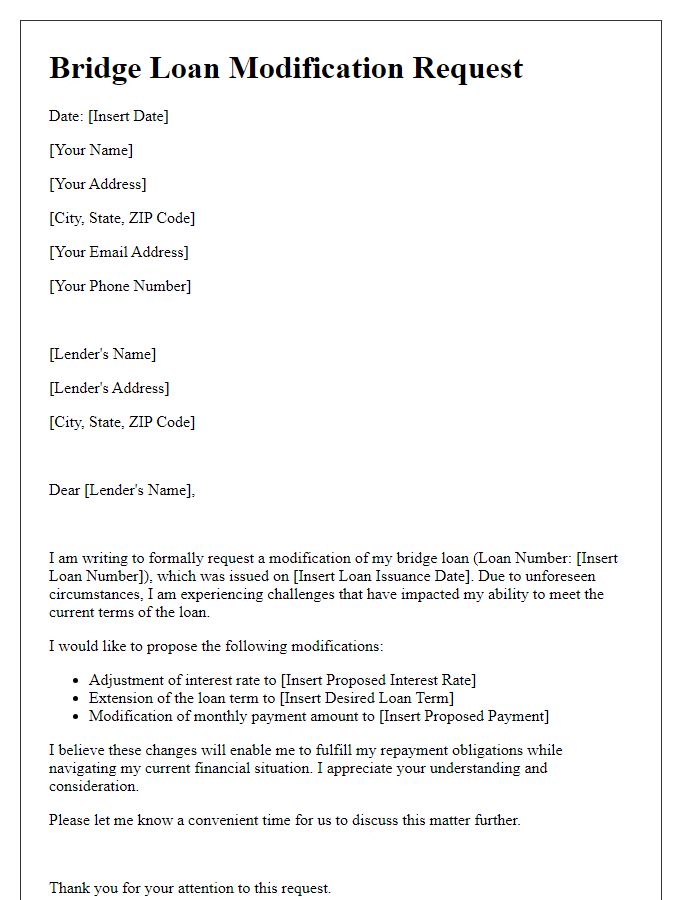

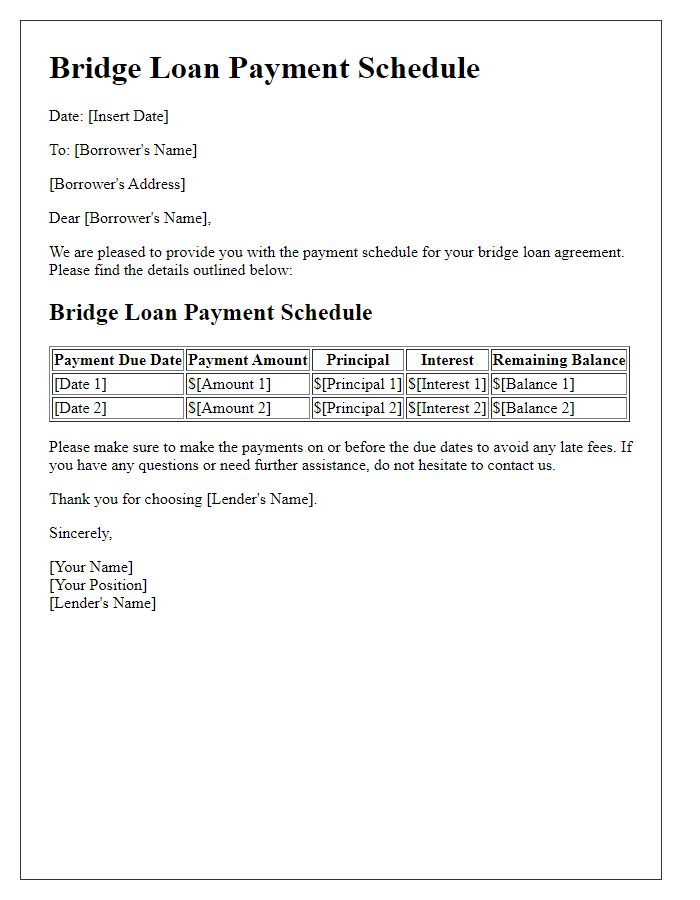

Interest Rates and Payment Schedule

Bridge loans are short-term financing solutions designed to provide immediate liquidity, often during real estate transactions. Interest rates on bridge loans typically range from 6% to 12%, depending on the borrower's creditworthiness and lender's underwriting criteria. The payment schedule often involves interest-only payments for the loan duration, which commonly spans 6 to 24 months. Upon maturity, the borrower must either repay the principal amount or refinance into a more permanent financing solution. In some cases, lenders may require a balloon payment at the end of the loan term, significantly impacting the total repayment amount. Understanding these terms is crucial for borrowers to assess their cash flow and financial strategies effectively.

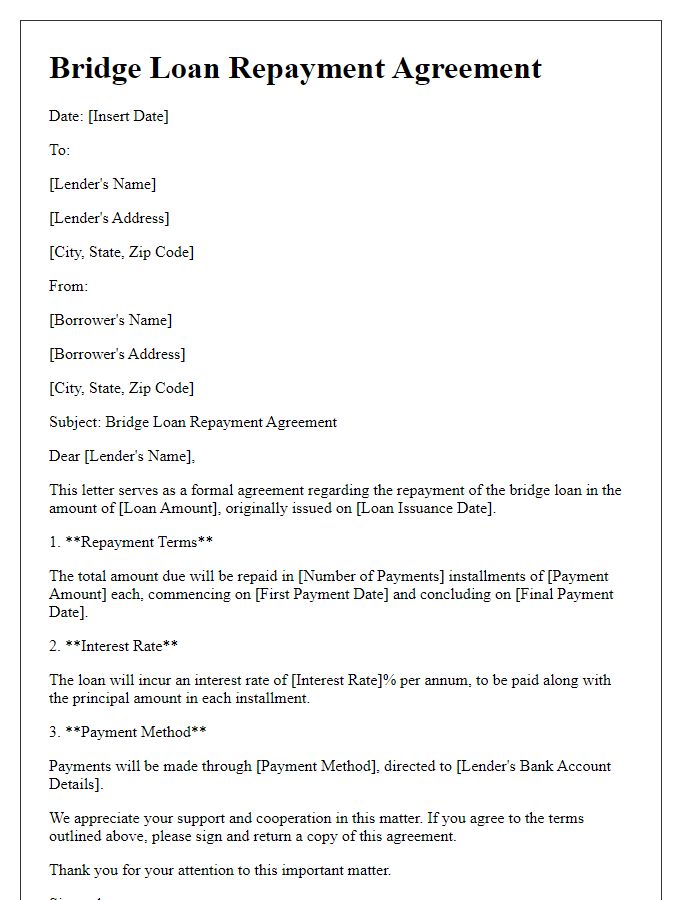

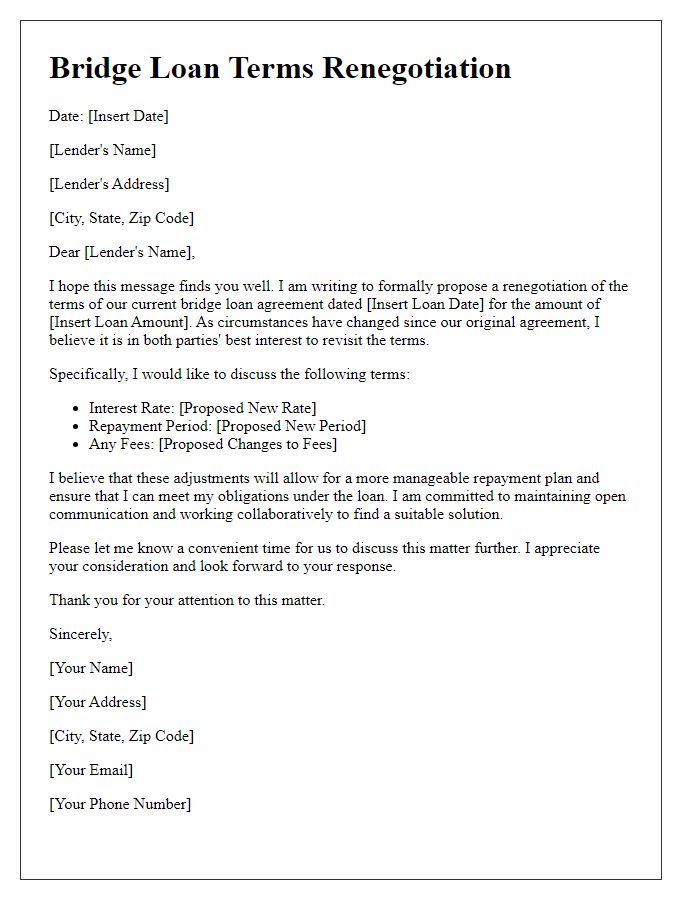

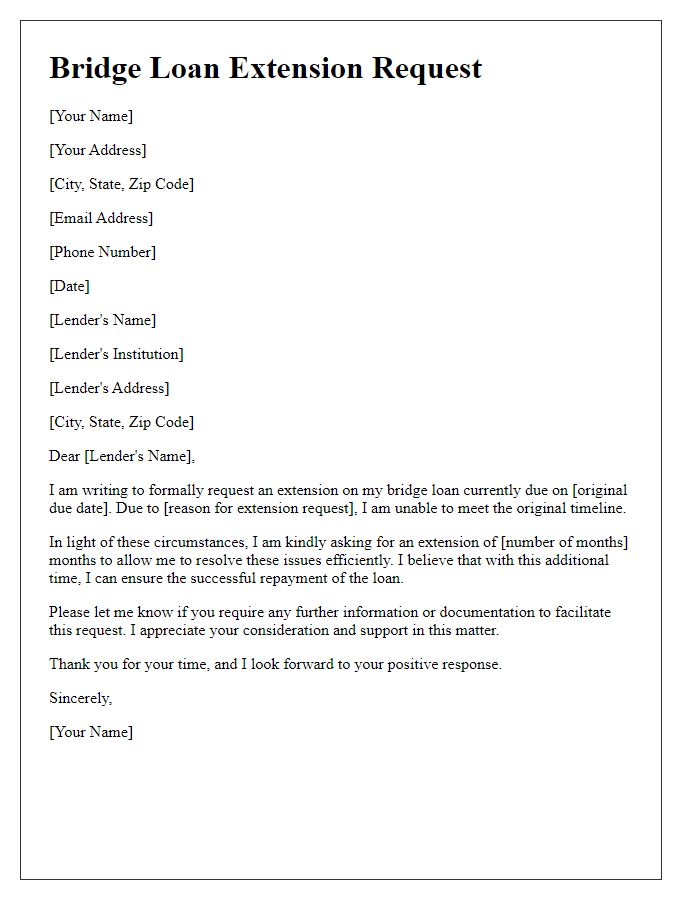

Repayment Terms and Conditions

Bridge loans typically involve specific repayment terms and conditions that dictate the borrower's obligations. The loan duration usually ranges from six months to three years, depending on the lender. Interest rates for bridge loans can vary, often between 6% to 12%, reflecting the short-term nature and higher risk. Monthly payments are commonly structured as interest-only, allowing borrowers to focus on the principal during the loan period. Full repayment is expected at the end of the term, either through the sale of a property or securing a permanent loan. Prepayment penalties may apply if borrowers choose to pay off the loan early, typically outlined in the loan agreement. Late payment fees can accrue if obligations are not met on time, emphasizing the importance of adhering to the established schedule. Additional requirements, such as collateral, may be necessary to secure the loan. Documentation related to the property and the borrower's financial capability must be provided to finalize the settlement terms.

Collateral and Security Provisions

Bridge loans often require specific collateral and security provisions to protect the lender's interests. Commonly accepted collateral includes real estate properties, such as commercial buildings or residential apartments, valued through independent appraisals, often exceeding the loan amount by 20-30%. Personal guarantees from borrowers or key stakeholders provide additional security, ensuring commitment to repayment. Additionally, lenders may place liens on the collateral, offering rights to the property in case of default. Loan-to-value ratios typically do not exceed 70%, ensuring sufficient equity cushion. Regular updates on the property's value and condition are often stipulated, ensuring the collateral remains an adequate security measure throughout the loan period.

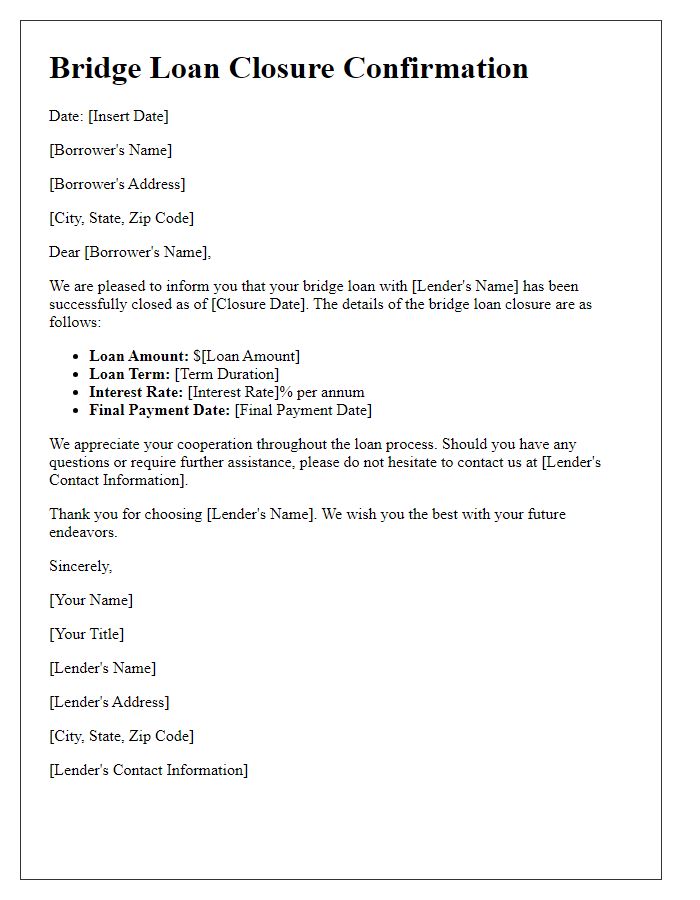

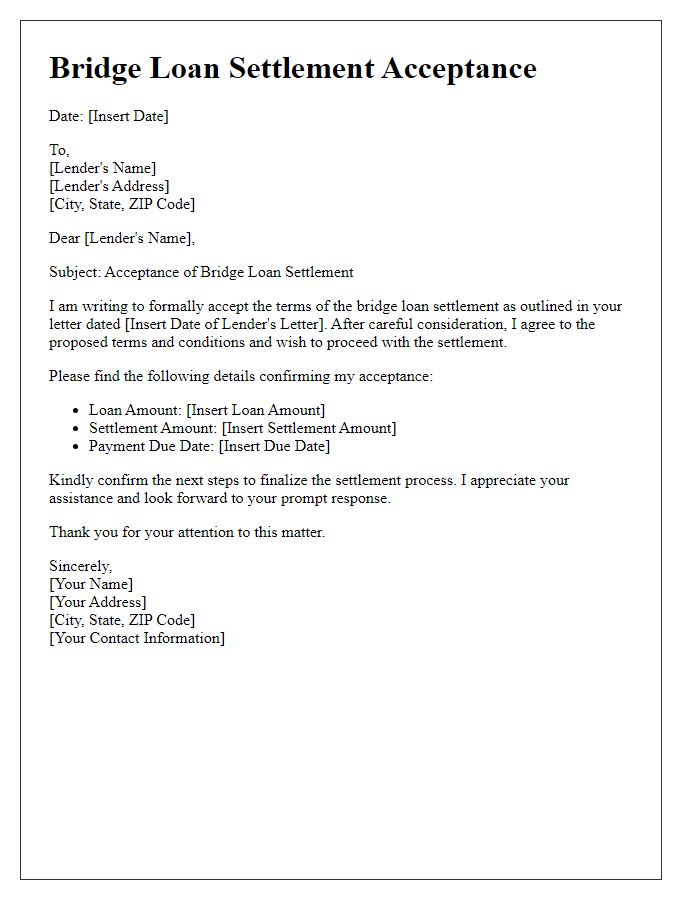

Closing Procedures and Documentation

Bridge loans serve as short-term financing solutions for property purchases or investments. Closing procedures for bridge loans typically require a series of essential documents, including the loan agreement outlining interest rates (often ranging from 6% to 12%), the promissory note stating the borrower's commitment to repay, and the title report verifying ownership and any liens on the property. Additionally, a property appraisal is necessary to assess the current market value, while evidence of insurance coverage protects against potential losses. Closing also involves the disbursement of funds, usually managed by an escrow agent who ensures that all conditions are met before finalizing the transaction. Timelines for these procedures can vary, with closings often occurring within a month, depending on the lender's requirements and the property's status.

Comments