Navigating financial hardship can be a daunting experience, but you're not alone in this journey. In this article, we'll explore the essentials of crafting a compelling financial hardship declaration that resonates with decision-makers. With the right approach, you can effectively communicate your circumstances and pave the way for potential relief. So, grab a cup of coffee and let's dive into the details that can help you take the next step towards securing your financial future!

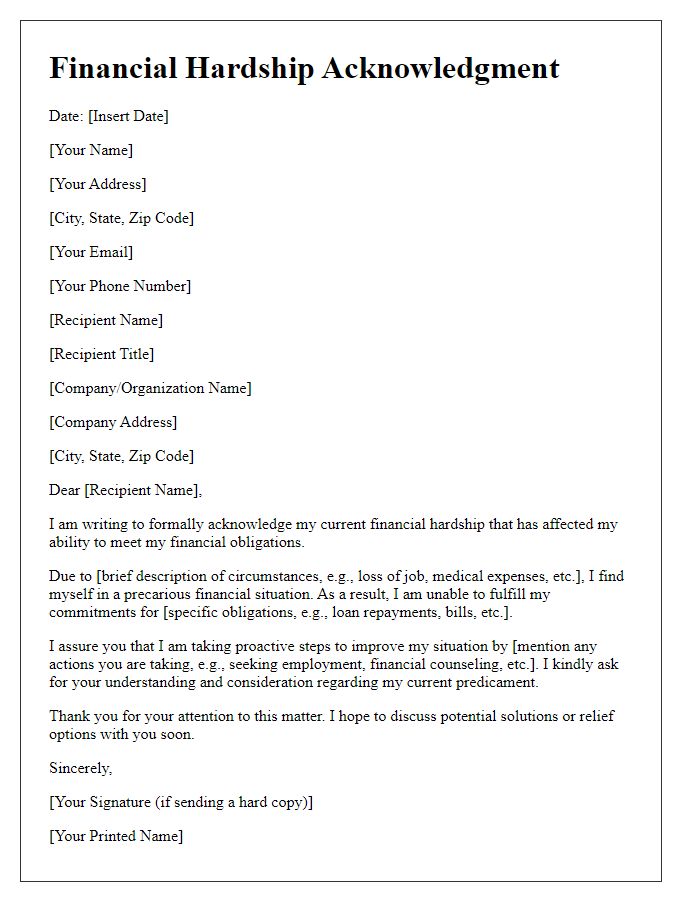

Clear acknowledgment of recipient's situation.

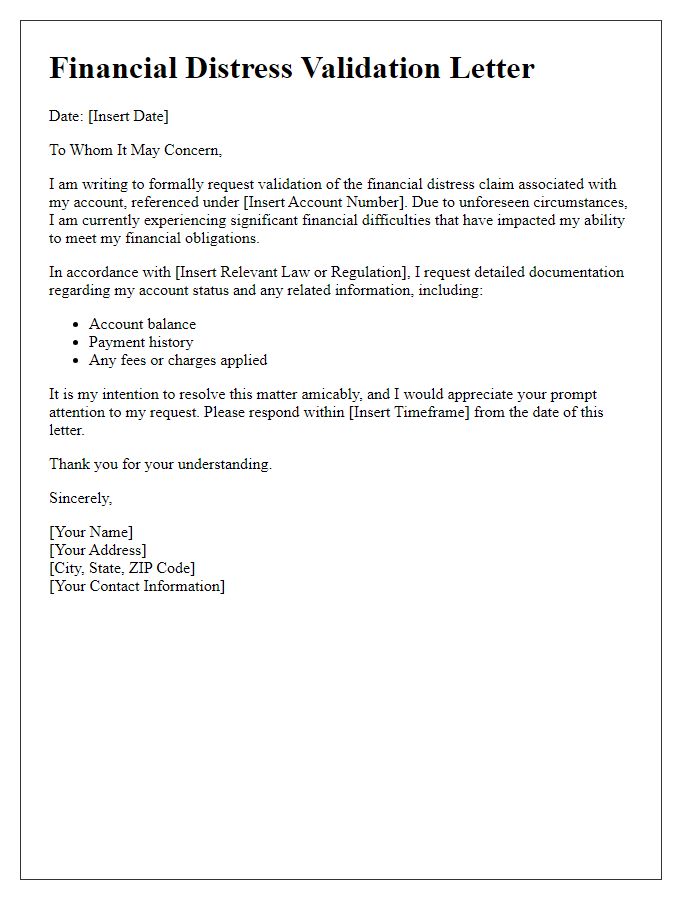

Acknowledgment of financial hardship can significantly impact individuals and families, particularly during economic downturns or personal crises. A situation marked by loss of employment, medical emergencies, or unforeseen expenses can lead to difficulties in meeting financial obligations. Organizations, such as banks or creditors, often receive letters or applications explaining these circumstances. Understanding these situations requires a clear recognition of the affected party's emotional and economic struggles. Essential details include specific events such as job loss in 2023, health issues, or other personal crises. Locations of the affected, such as areas hit by natural disasters or economic decline, play a crucial role in contextualizing their challenges. Acknowledgment letters should contain empathy and support, alongside options available for assistance, like payment deferrals or restructuring of debt.

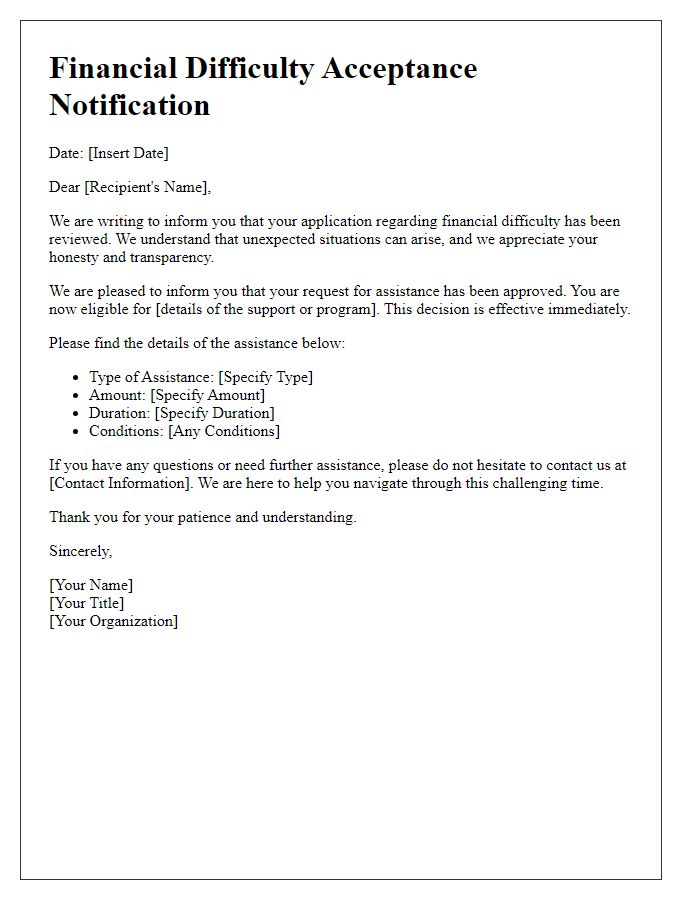

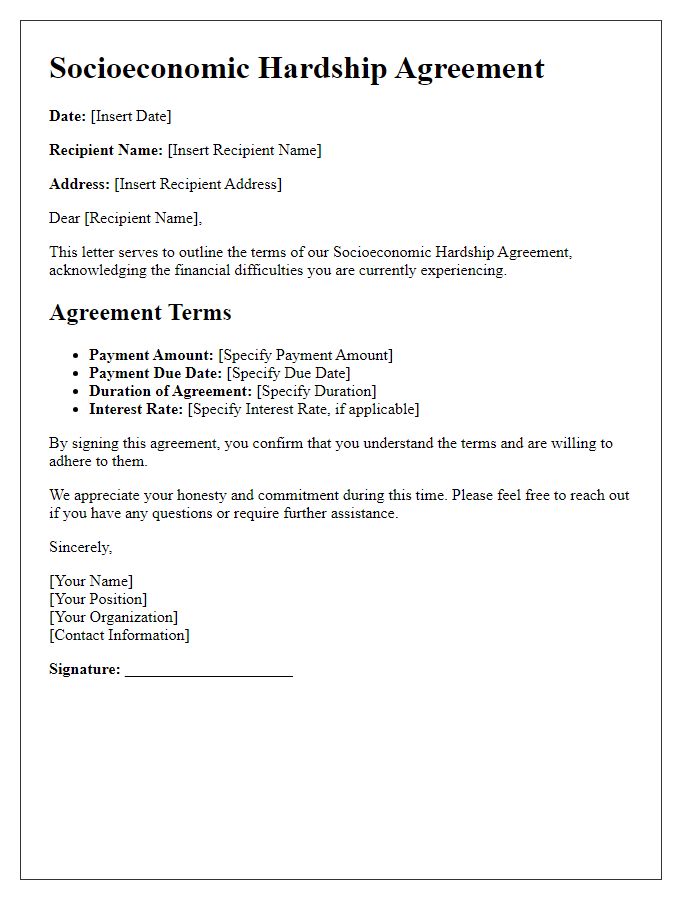

Specific terms of the agreed resolution.

Financial hardship declarations are pivotal in granting relief to individuals facing economic challenges. Accepted resolutions often comprise specific terms, such as reduced monthly payments (often a percentage decrease, like 30% from existing obligations), deferred payment periods (typically ranging from three to six months), and potential debt forgiveness options (which may involve waiving up to 25% of total debt). Additional provisions may include a commitment to annual financial reviews to assess ongoing eligibility and adjustments based on income fluctuations. Compliance with these terms is essential for maintaining benefits and avoiding defaults, with clear guidelines set for communication channels between the creditor and debtor.

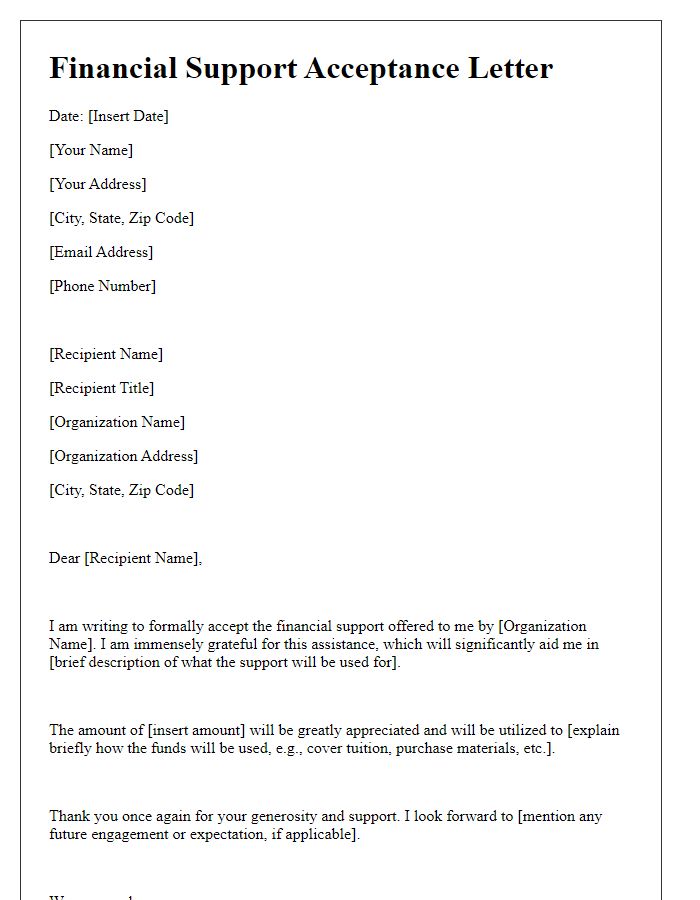

Continuation of support and contact details.

Financial hardship declarations require careful consideration to ensure that individuals receive the support they need. Financial institutions such as banks and credit unions often have processes in place to assist customers facing economic difficulties. Details such as the specific type of financial hardship (e.g., job loss, medical expenses) must be clearly articulated to facilitate a thorough review. Contact details for dedicated support teams should be provided, including phone numbers (e.g., 1-800-555-0199), email addresses (e.g., support@financialinstitution.com), and hours of operation (e.g., Monday to Friday, 9 AM to 5 PM). Comprehensive documentation may also be required, such as proof of income, expense records, or a formal statement outlining the current financial situation.

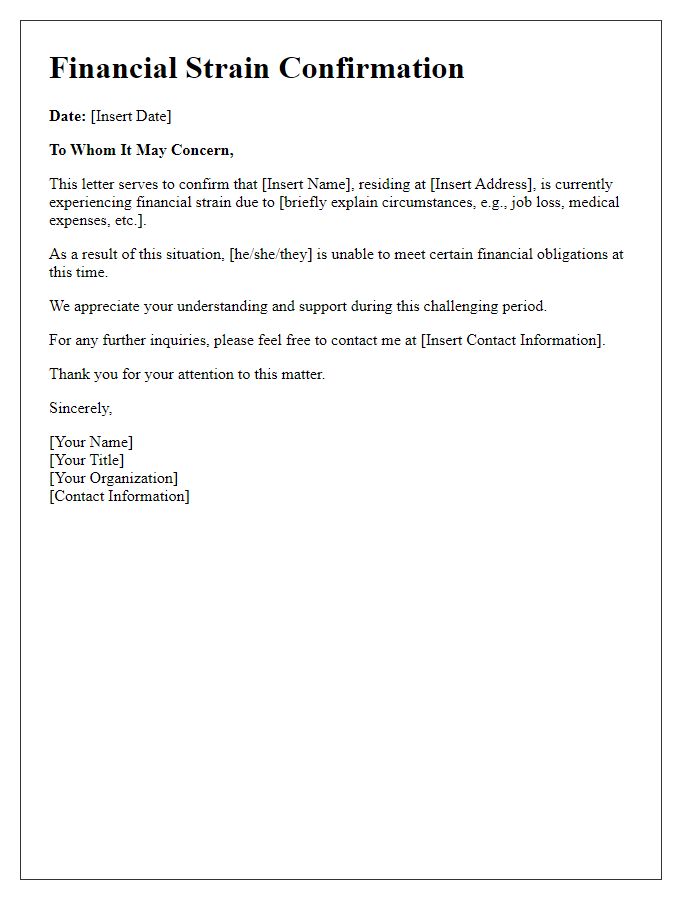

Assurance of maintained confidentiality.

Financial hardship declarations often involve sensitive personal and financial information. Organizations handling these claims must ensure strict confidentiality to protect the individual's privacy. Confidentiality ensures that information, such as income details, expenses, and personal circumstances, remains secure and is only accessible to authorized personnel. This assurance builds trust between the individual and the organization handling the declaration. Compliance with regulations, like the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) in the United States, further underscores the importance of confidentiality in these processes. Organizations should provide clear statements outlining their commitment to confidentiality and data protection measures in place, ensuring individuals feel safe when disclosing information related to their financial situations.

Final positive and encouraging remark.

A financial hardship declaration acceptance can provide a sense of relief and hope for individuals facing tough economic challenges. This acceptance typically signifies the acknowledgement of the difficulties being faced, offering an opportunity for individuals to regroup financially. By receiving support, individuals may gain access to essential resources, enabling them to navigate through difficult financial times. This can foster resilience and restore faith in their future, encouraging them to strive towards stability and prosperity once again. With unwavering determination and the right assistance, brighter days lie ahead, paving the way for renewed opportunities and success.

Comments