Are you overwhelmed by the thought of closing costs when purchasing a new home? It's completely normal to feel a bit anxious about potential expenses that come with your big investment. In this article, we'll break down the typical closing cost estimation process, helping you understand what to expect and how to budget effectively. So, grab a cup of coffee and let's dive into the detailsâyour financial clarity starts here!

Header: Company Name, Address, Contact Information

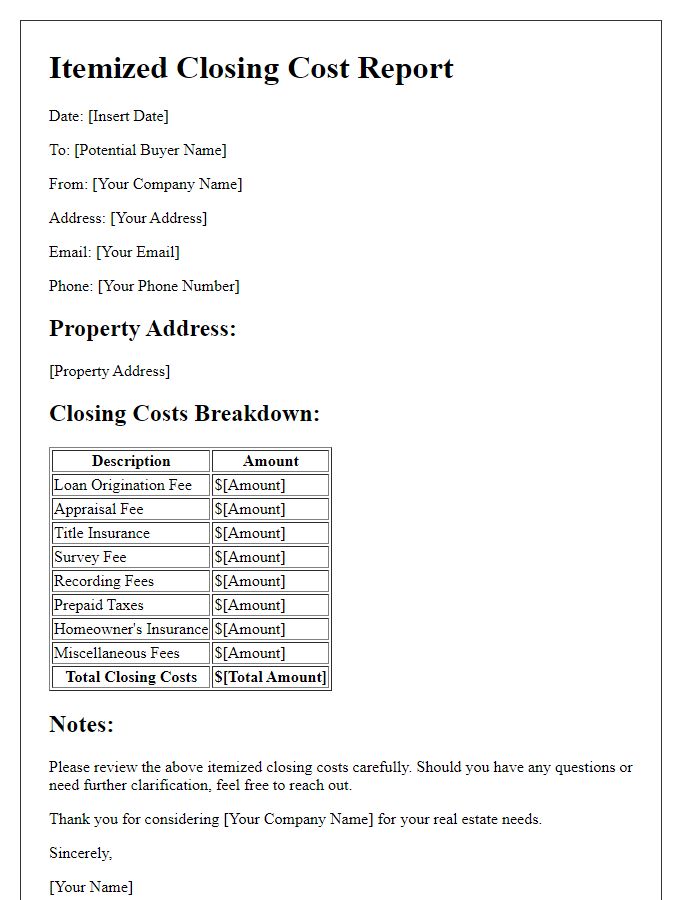

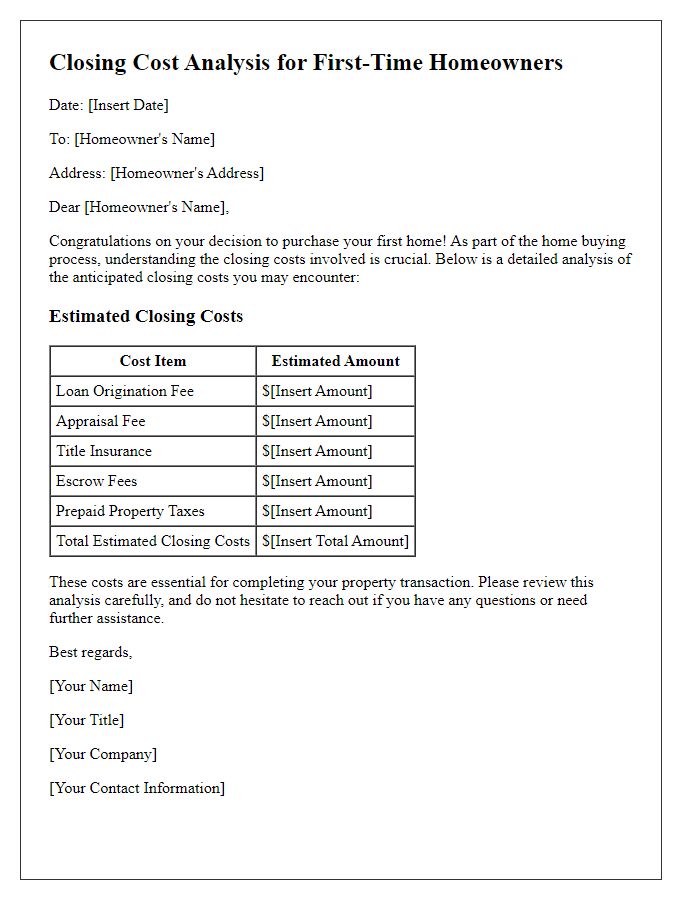

Estimating closing costs involves a detailed breakdown of various expenses typically incurred in real estate transactions. Closing costs can range between 2% to 5% of the purchase price of a property, with significant categories including lender fees, title insurance, escrow fees, and recording fees. For example, lender fees encompass charges such as origination fees (usually 0.5% to 1% of the loan amount), and processing fees can reach up to $500. Title insurance, often mandated to protect both the buyer and lender from claims against the property, can cost between $1,000 and $2,500 based on the property's value. Escrow fees, which facilitate the closing process by acting as a neutral third party, can vary widely, typically around $300 to $700 depending on the location and complexity of the transaction. Moreover, recording fees paid to state or local governments for recording the new deed can be around $50 to $150. Clear, itemized estimates of these costs assist buyers in preparing for the financial responsibilities associated with purchasing real estate.

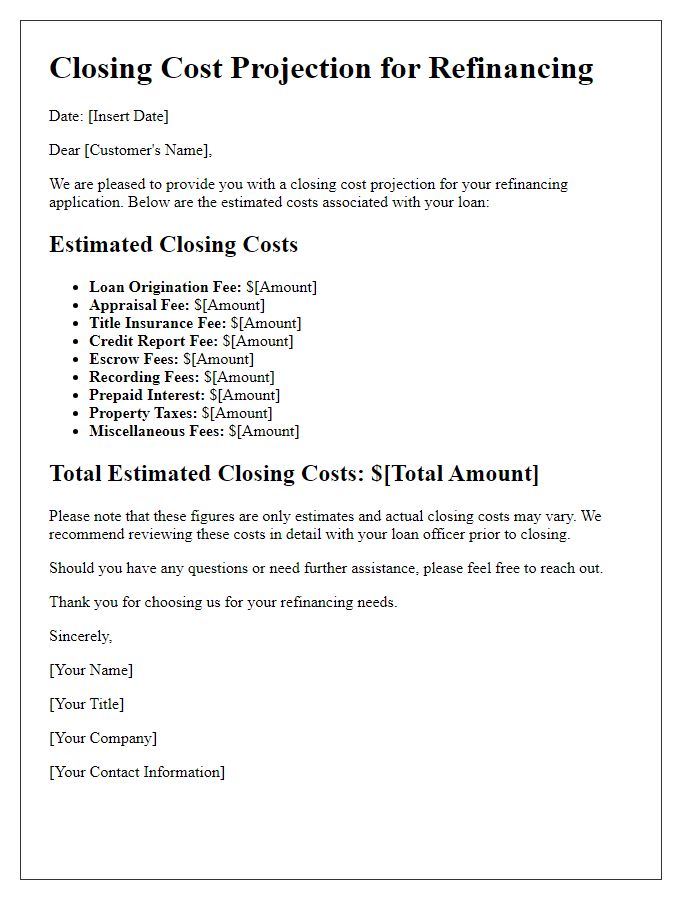

Subject Line: "Closing Cost Estimation Breakdown

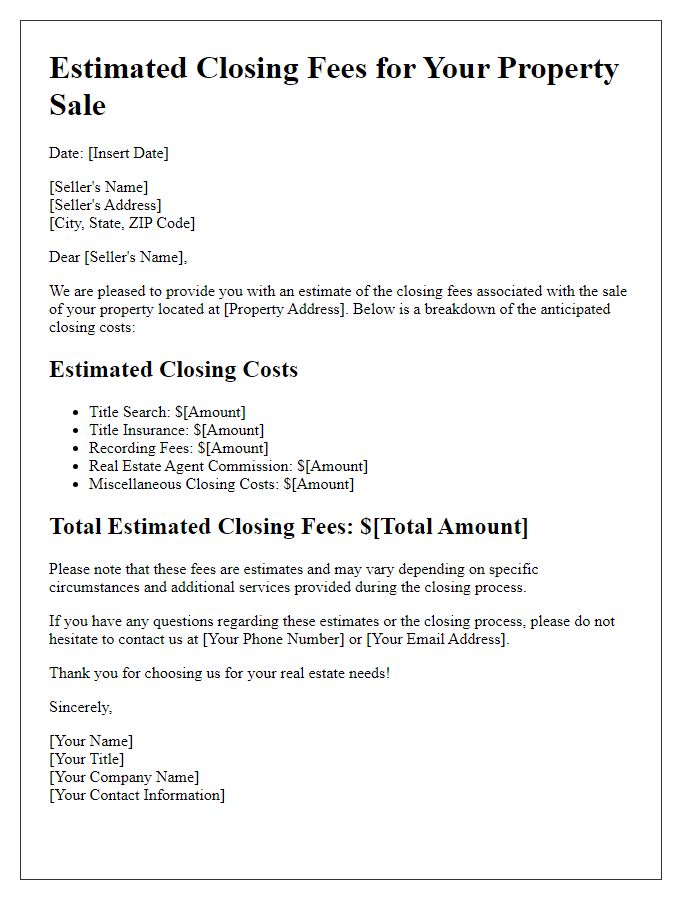

Closing costs can represent a significant portion of the home buying process, typically ranging from 2% to 5% of the purchase price in the United States. Various fees are included, such as loan origination fees (averaging around 0.5% to 1% of the loan amount), title insurance (costing several hundred dollars depending on state laws), appraisal fees (typically between $300 and $600), and property taxes (which may vary based on local tax rates). Additionally, homeowners insurance, which can cost around $1,000 annually, and recording fees associated with the property deed, often totaling between $50 and $150, should be considered. Each of these elements contributes to the overall financial commitment necessary to finalize a real estate transaction successfully, usually concluded during the closing meeting where the exchange of property ownership takes place.

Opening Greeting: Recipient Name, Address

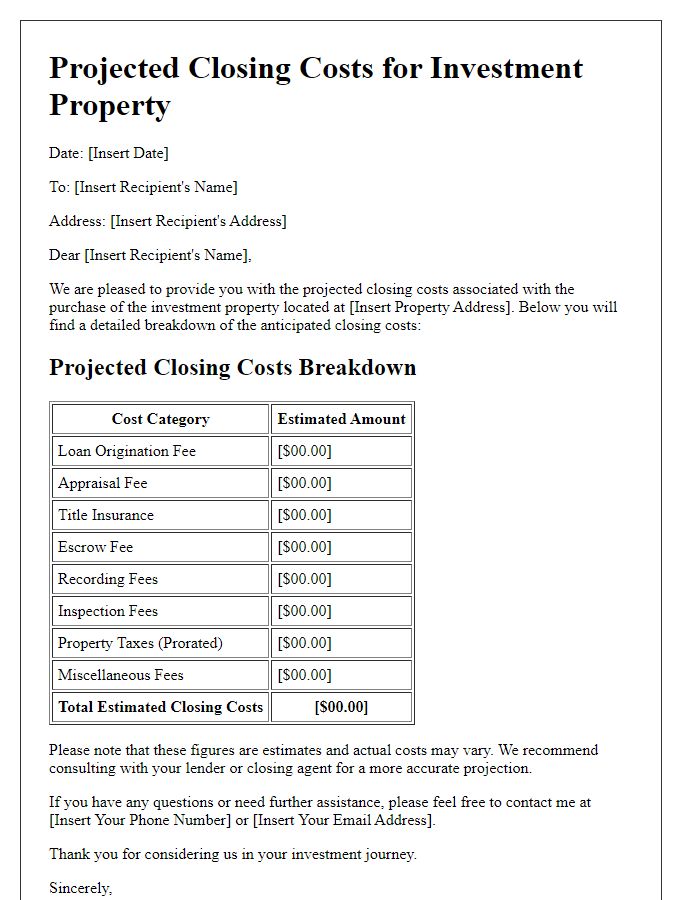

Closing cost estimations provide essential insights for homebuyers navigating real estate transactions, detailing expenses incurred during property acquisition. Factors influencing these costs include lender fees, title insurance expenses, appraisal fees, and property tax adjustments, typically totaling between 2% to 5% of the home's purchase price. For example, purchasing a $300,000 home may incur closing costs ranging from $6,000 to $15,000. Additionally, local regulations in metropolitan areas such as New York or Los Angeles may impact overall fees due to higher property values. Accurate breakdowns include documentation of each line item, ensuring transparency and aiding buyers in budget allocation for their impending purchase.

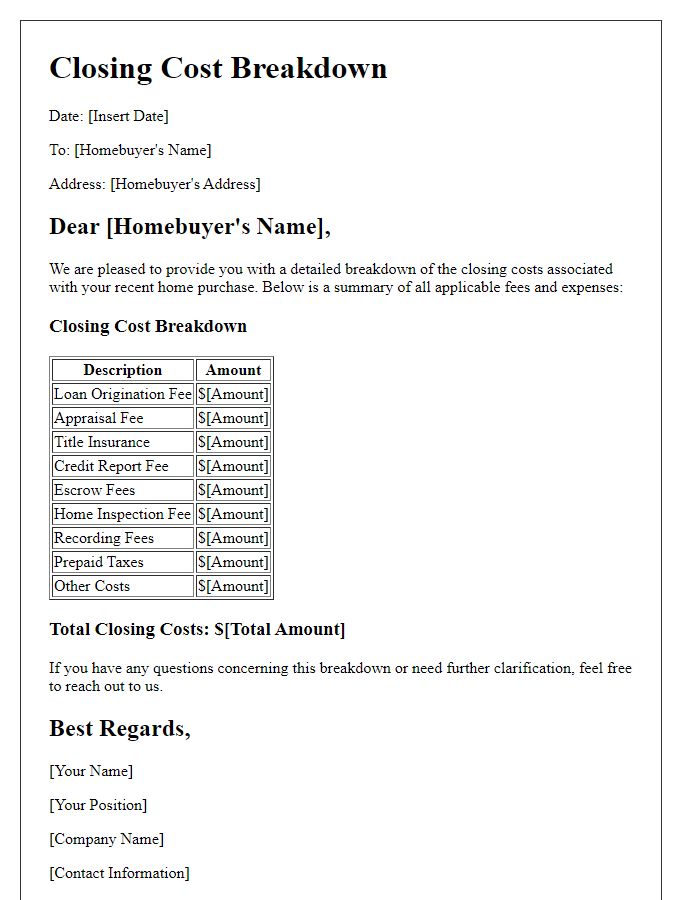

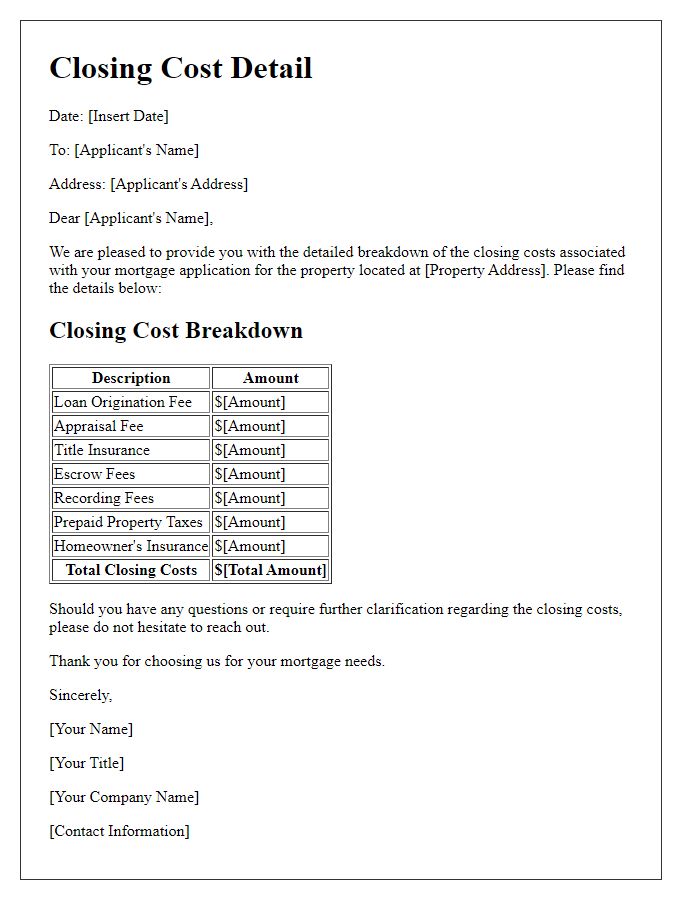

Closing Cost Breakdown: Itemized List with Descriptions and Amounts

Closing costs represent the fees and expenses incurred during the finalization of a real estate transaction, typically ranging from 2% to 5% of the home's purchase price. This financial summary includes items such as loan origination fees, which average around 0.5% of the mortgage amount; appraisal fees, generally costing between $300 and $500 for determining the property's value; and title insurance premiums, often around $1,000, protecting against any title disputes. Additional costs may involve recording fees, which can vary by state but usually fall between $50 and $100, and attorney fees, which might total $500 to $1,500, depending on the complexity of the transaction. Understanding this breakdown is essential for buyers to prepare their finances accurately before closing on a property, ensuring a smooth and informed experience during this pivotal real estate event.

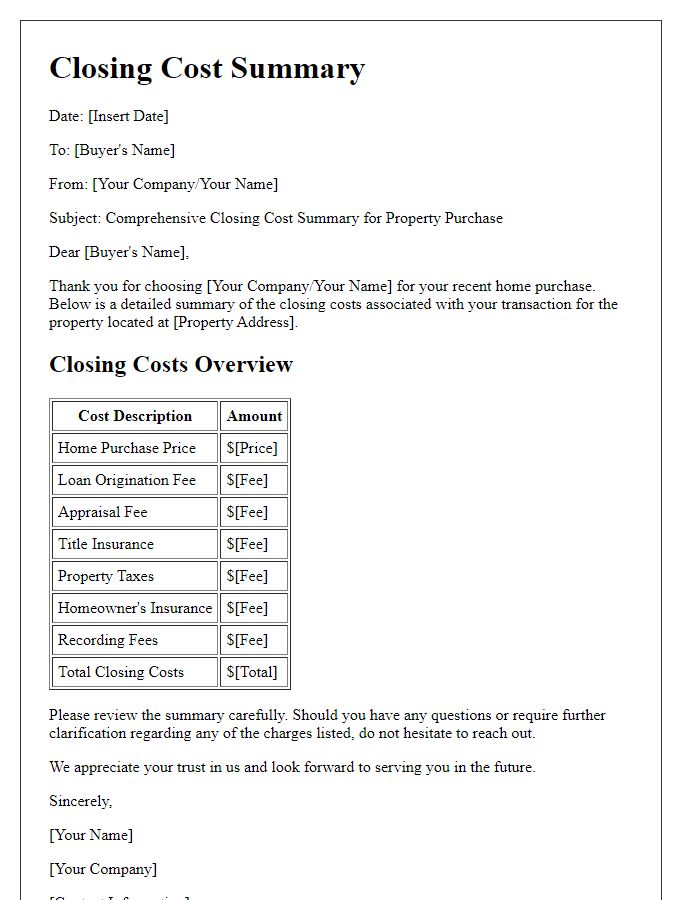

Closing Statement: Thank You Note and Contact Details for Queries

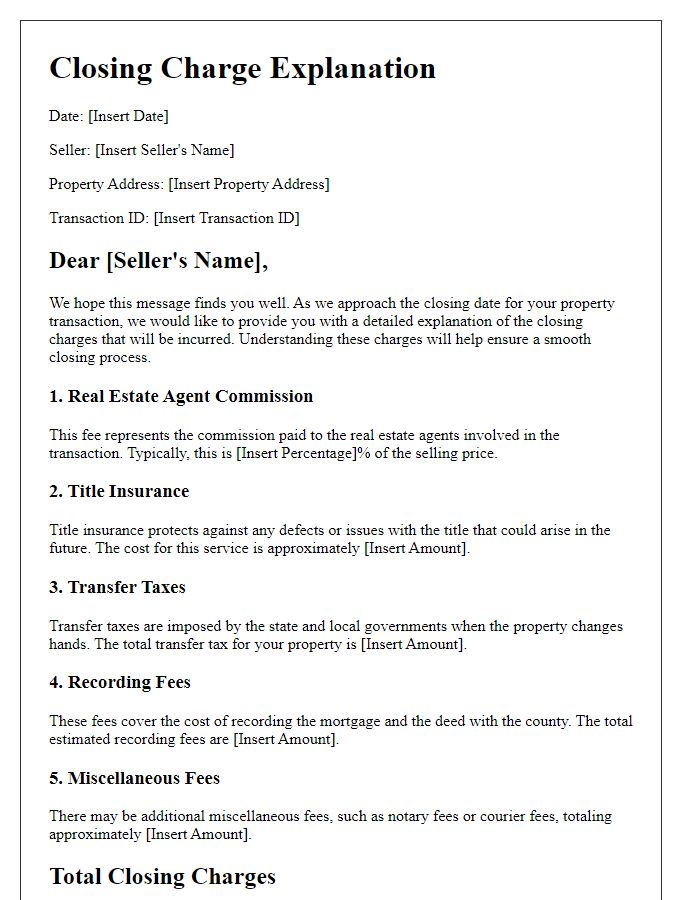

The closing statement plays a crucial role in real estate transactions, providing a detailed breakdown of closing costs associated with property purchases and sales. This document typically includes fees such as loan origination fees, title insurance (often ranging from $500 to $2,000 depending on the property's location), appraisal fees (averaging between $300 and $500), and pre-paid taxes or insurance premiums. In addition, the statement outlines costs related to escrow services and recording fees for property deeds, all contributing to the final settlement amount. As a courtesy, a thank-you note is often included, expressing appreciation to clients for their trust and business, alongside contact details for queries, ensuring they have access to support for any post-closing questions or concerns they may have regarding their new property in cities like San Francisco, Los Angeles, or New York City.

Letter Template For Closing Cost Estimation Breakdown Samples

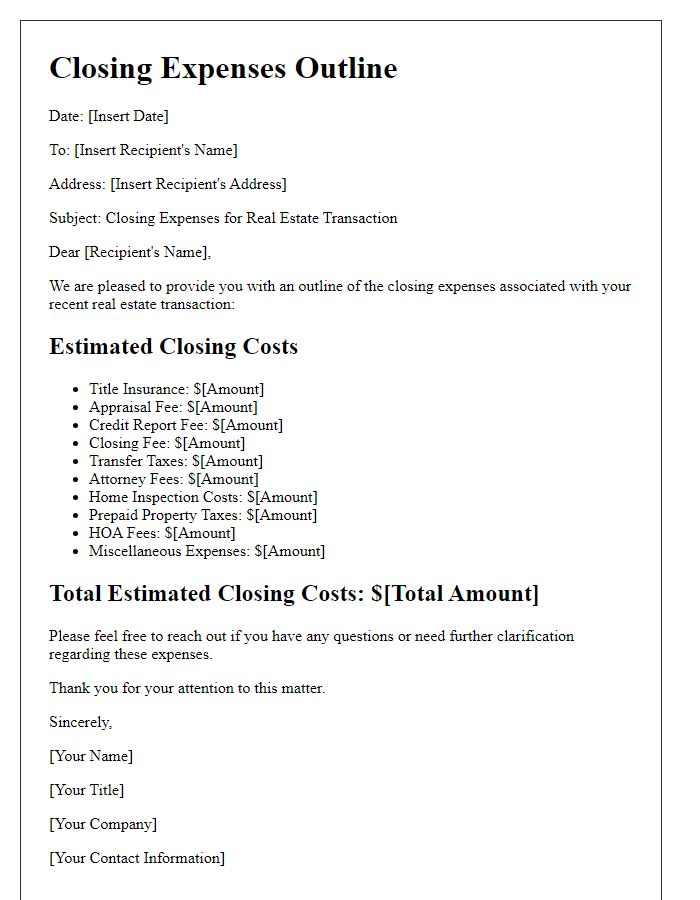

Letter template of closing expenses outline for real estate transactions

Comments