Are you facing challenges with your loan or credit agreements? Understanding how to apply for a default interest rate can feel overwhelming, but it doesn't have to be. In this article, we'll break down the key steps and considerations to help you navigate this process smoothly. So, grab a cup of coffee, and let's dive in to explore how you can effectively address your situation!

Formal tone and clear structure

Default interest rates can significantly impact financial agreements, particularly for loans or credit accounts. A default interest rate typically applies after a borrower fails to make timely payments according to the agreed-upon schedule. This increased rate, often specified in the original loan agreement, can be considerably higher, sometimes exceeding 10% annually, depending on jurisdiction and lender policies. It serves as an incentive for borrowers to remain current on their obligations. Impacted agreements may include mortgages, personal loans, or credit cards issued within financial institutions such as banks or credit unions. Late payment can lead to financial repercussions, affecting credit scores and future borrowing capabilities.

Accurate financial details and terms

A default interest rate application requires precise financial details, including the principal amount (the original loan sum, typically listed in thousands or millions of dollars), the prevailing interest rate (often expressed as an annual percentage rate, or APR), and specific timelines (such as the default notice date, which may be set at 30 or 60 days post missed payment). Relevant terms include any applicable fees (like late payment fees, which could range from $25 to $100), the interest compounding frequency (daily, monthly, or annually), and the total amount due after default (including accumulated interest and fees). Additionally, the governing law jurisdiction should be mentioned, such as New York State law for clarity on legal enforcement.

Customer's account and loan information

Default interest rates can significantly impact a borrower's financial standing, particularly on loans obtained from banks or credit unions. For instance, a customer (e.g., Sarah Johnson) with a personal loan balance of $10,000 from First National Bank may face an increase in the interest rate from 5% to 10% after missing a payment deadline. This adjustment can result in an additional financial burden, costing Sarah approximately $1,000 more in interest over the next year. Maintaining up-to-date account information, including payment history and outstanding balances, is crucial for customers to avoid default scenarios. Regular reviews of loans, such as the 36-month auto loan for $15,000 also from First National Bank, can help customers stay on track with their financial commitments and mitigate potential penalties related to interest adjustments.

Justification for the default interest rate

In financial agreements, the application of a default interest rate serves as a critical mechanism for lenders to mitigate risks associated with borrower defaults. This default interest rate typically exceeds the standard interest rate, varying between 2% to 10% above the original rate, and is activated when borrowers fail to fulfill payment obligations on time, such as missed loan repayments or late credit card payments. Implementing this higher rate compensates lenders for the increased risk of default and covers potential costs associated with collection efforts. Furthermore, the default interest rate acts as a deterrent, encouraging timely payments from borrowers to maintain their financial health and creditworthiness. It is essential to communicate these terms clearly in loan agreements to ensure borrower awareness of consequences in case of default, which can affect both credit scores and future borrowing opportunities significantly.

Contact information for follow-up

Default interest rates, often reaching 18% to 24%, significantly impact overdue accounts, affecting businesses' cash flow and profitability. Properly documented correspondence, including invoices and payment reminders, is vital in enforcing these rates. Contact information, such as an updated email address or phone number, ensures effective follow-up on outstanding debts. Establishing a clear communication channel facilitates discussions regarding repayment plans or potential negotiations, ultimately aiding in the resolution of defaulted accounts. Legal considerations, including compliance with local regulations, must be reviewed when applying such rates to avoid potential disputes.

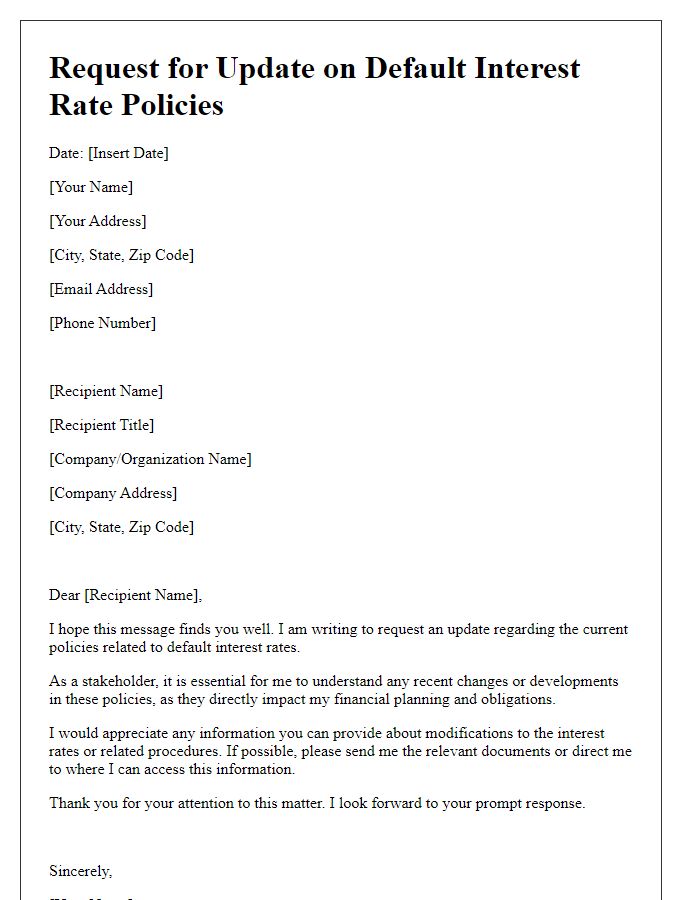

Letter Template For Default Interest Rate Application Samples

Letter template of application for default interest rate reconsideration

Comments