Hey there! We all know that life can get busy, and sometimes bills slip through the cracks. If you find yourself in the position of needing to remind someone about a late payment, it's essential to strike the right balance between professionalism and understanding. In the following article, we'll share a sample letter template to help you craft a courteous and effective late payment reminder noticeâso you can keep your interactions positive and maintain those valuable relationships. Ready to learn more?

Professional and polite tone

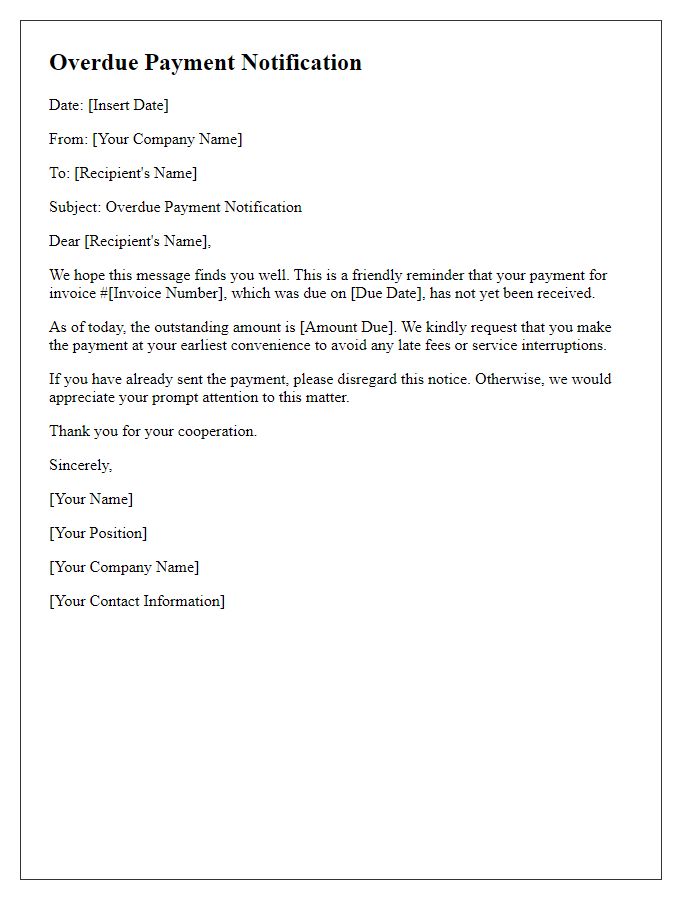

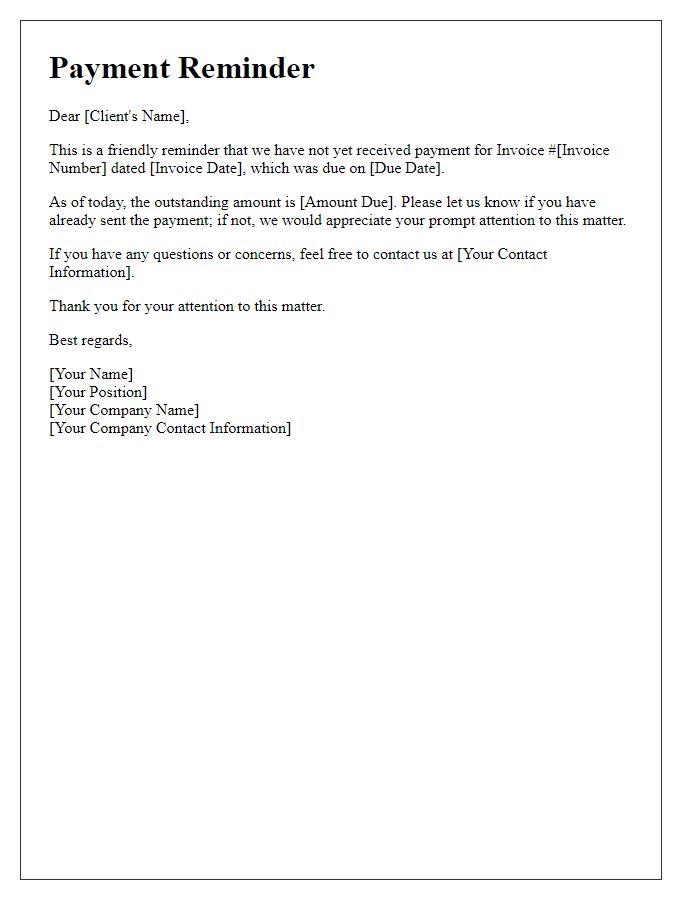

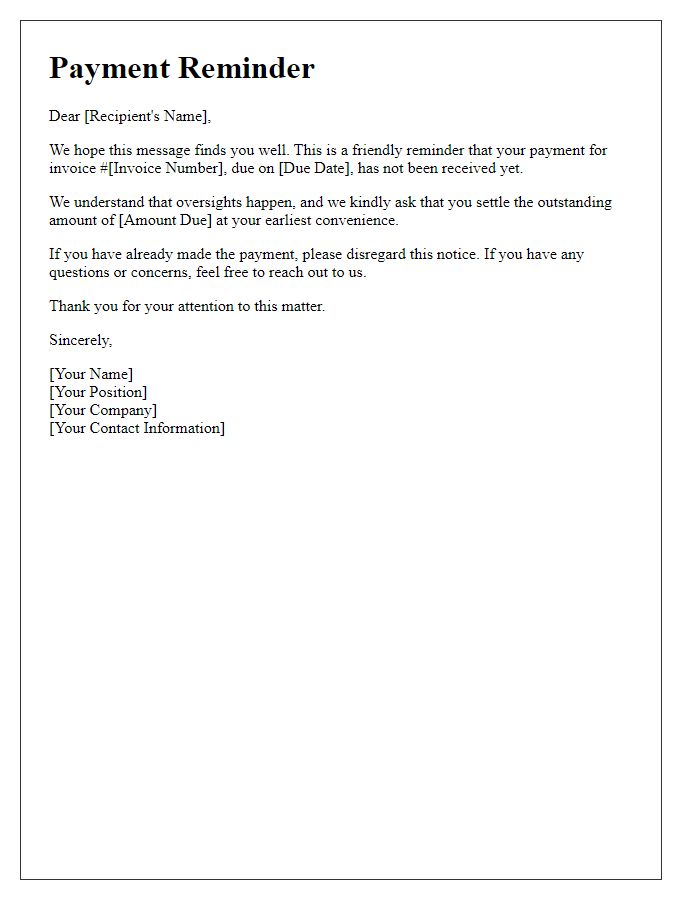

A late payment reminder notice serves as a crucial communication tool for businesses to remind clients of past-due invoices professionally while maintaining a polite tone. This notice typically emphasizes the outstanding amount, original due date, and any relevant invoice numbers for clarity. Companies often specify the payment methods accepted, encouraging prompt action to settle the debt. Legal terminology may be included, referencing terms from the service agreement, ensuring clarity on potential late fees or interest charges that could apply. Polite language should be prioritized, thanking the recipient for their attention to the matter and expressing appreciation for their cooperation in resolving the outstanding balance swiftly.

Clear due date and amount owed

A late payment reminder notice highlights an important financial commitment. Including a clear due date such as December 15, 2023, emphasizes urgency for the recipient. The amount owed, for instance, $500, serves as a precise figure to evoke a prompt response. Adding a brief mention of the original service, like a subscription for software services, reinforces context around the payment. Additionally, initiating contact early, perhaps one week after the missed deadline, can foster a cooperative approach for resolution. Incorporating information about potential late fees, for example, a $25 penalty, may also encourage timely payment.

Consequences of non-payment

Late payment on invoices can lead to serious consequences for businesses, including disruption of cash flow. Unresolved debts may incur late fees, typically ranging from 1% to 5% of the outstanding amount per month. Persistent non-payment can result in the engagement of collection agencies, which may impose additional costs and fees, affecting the financial stability of the business. Legal action may be pursued, escalating costs through court fees and attorney expenses. Moreover, a poor payment history can damage credit ratings, hindering future financing opportunities and resulting in higher interest rates on loans. This generates a cycle of financial strain that can inhibit growth and operational capacity. Timely payment ensures a sustainable and healthy business relationship, preserving trust and continuity in services.

Contact information for queries

Businesses often face cash flow challenges due to late payments from customers. Regular communication is essential to maintain financial stability. A late payment reminder notice serves as a critical tool in managing outstanding invoices. Typically, these notices include detailed information such as due dates, payment amounts, and specific terms agreed upon during the initial transaction. For any queries, contacts should include clearly stated email addresses and phone numbers of the accounts receivable department, ensuring quick and efficient resolution of any issues. It's important to foster a professional yet firm tone, encouraging timely responses and reinforcing the importance of adhering to payment schedules.

Call to action for prompt payment

Timely payment is crucial for maintaining a healthy financial relationship between businesses. Outstanding invoices, such as those exceeding 30 days, often indicate potential cash flow issues. For instance, a company facing cash shortages may struggle to meet operational costs. A late payment reminder notice serves as a formal communication to resolve overdue accounts, typically referencing specific invoices and amounts due. It is essential to maintain professionalism while emphasizing the importance of prompt payment to ensure business operations remain uninterrupted. Offering easy payment methods and clear contact information can facilitate quicker responses and reduce the risk of future late payments.

Comments