Are you looking to solidify your financial agreements with a cross-collateralization approach? This letter template can help you navigate the complexities of such contracts, ensuring that both parties understand their obligations and rights clearly. By outlining the terms and conditions in a straightforward manner, you can create a solid foundation for your financial relationship moving forward. Want to learn more about drafting effective agreements?

Introduction and Parties Involved

The cross-collateralization agreement connects multiple loans using shared collateral resources, enhancing security for lenders and facilitating borrowing for borrowers. Key parties typically include lenders, such as commercial banks or credit unions, and borrowers, which may be individuals, small businesses, or corporations. The agreement delineates specific terms regarding the collateral assets, which can range from real estate properties in urban centers like New York City to valuable equipment in manufacturing facilities. Understanding the implications of shared collateral is crucial, as defaulting on one loan can jeopardize all assets involved in the agreement, impacting financial stability and credit ratings.

Definition and Terms of Collateralization

A cross-collateralization agreement involves using multiple assets as collateral to secure a single loan or a series of loans. This arrangement allows lenders to claim rights over various properties, enhancing security for their investment. Important terms include "collateral," which refers to the specific assets secured, such as real estate or vehicles; "loan agreement," documenting the financial terms and obligations; and "default," indicating failure to meet repayment obligations. Cross-collateralization may also influence credit risk assessment, as lenders evaluate the collective value of secured assets. Legal implications often require precise jurisdiction details, typically involving state or federal laws that govern secured transactions.

Obligations and Rights of Parties

The cross-collateralization agreement establishes a framework for securing obligations between two parties, typically a lender and a borrower. In this arrangement, the borrower pledges multiple assets as collateral to secure the repayment of a specific loan. The assets may include real property, vehicles, and financial instruments such as stocks or bonds. Both parties have defined rights; the lender has the right to claim any of the collateralized assets in case of default, while the borrower retains the right to use the assets unless a default situation arises. Additionally, the agreement outlines the obligations of the borrower to maintain the value and condition of the collateral, as well as to provide timely financial disclosures. Breach of any terms may lead to the lender exercising their rights to seize assets, enhancing their security against the risk of loss.

Default and Remedies

In a cross-collateralization agreement, the concept of default involves any failure to fulfill financial obligations across all associated loans secured by the same collateral, typically real estate or financial assets. For instance, if an individual defaults on a mortgage payment for a property located on Main Street, this can trigger remedies affecting all loans tied to that property, potentially including foreclosure or asset liquidation. Remedies available to the lender may include, but are not limited to, acceleration of the loan balance, wherein the lender may demand immediate payment of the total outstanding debt. Additionally, lenders may pursue legal actions such as seeking a court order to reclaim or sell the collateral. Under certain jurisdictions, specific statutory notice requirements must be fulfilled prior to initiating any remedy actions, ensuring compliance with local laws governing foreclosure and debt collection processes.

Governing Law and Jurisdiction

Governing Law and Jurisdiction are vital components of a cross-collateralization agreement, establishing the legal framework and venue for addressing disputes. This section typically specifies that the agreement shall be governed by the laws of a particular jurisdiction, such as the State of New York, known for its robust financial regulations. The chosen jurisdiction can impact the interpretation of legal terms and enforcement of rights. Additionally, it delineates the appropriate court system--whether federal or state--where potential disputes will be adjudicated, providing clarity for both parties involved. This legal clarity is essential for maintaining the enforceability of terms and protecting the rights of all stakeholders.

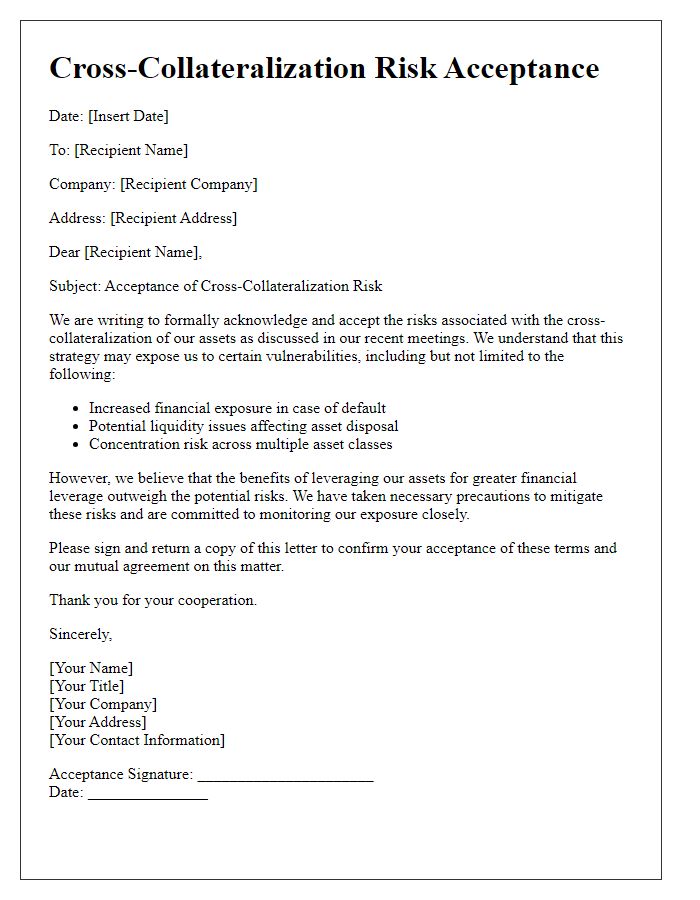

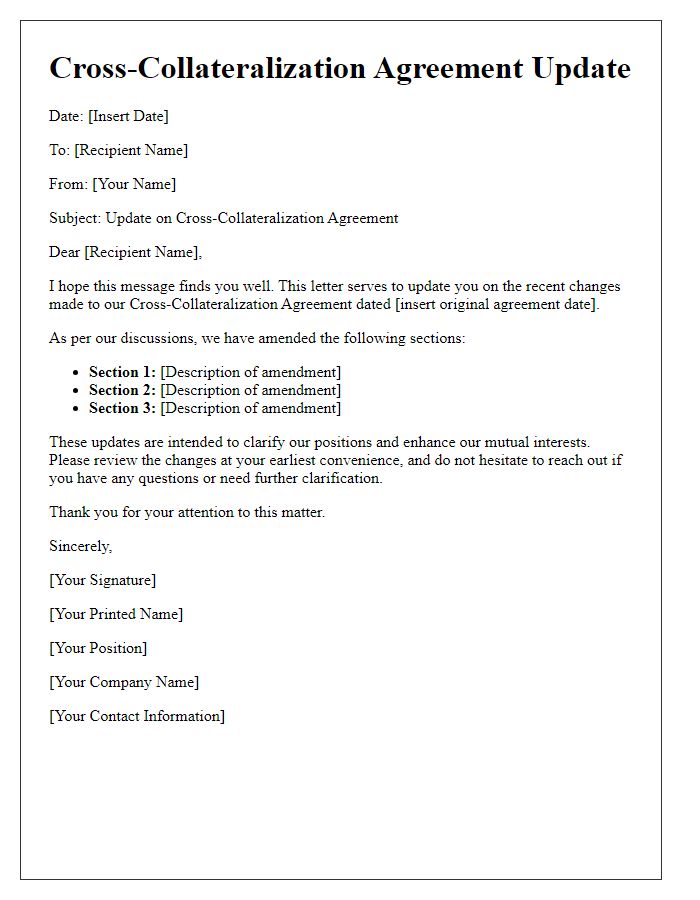

Letter Template For Cross-Collateralization Agreement Samples

Letter template of Cross-Collateralization Agreement between Lender and Borrower

Comments