Are you feeling overwhelmed by commercial debt? You're not alone, as many businesses face financial challenges that can feel insurmountable. Fortunately, debt restructuring offers a lifeline, allowing companies to negotiate new terms that can ease their burden and pave the way for recovery. Dive into our article to explore effective strategies and valuable tips for successful commercial debt restructuring!

Debtors' Financial Status Overview

Debtors' financial status overview should highlight several critical aspects, including total outstanding debts, payment history, income sources, and assets. Total outstanding debts, such as loans or credit obligations, typically exceed $500,000 for small to medium-sized businesses. Analyzing payment history reveals trends; for example, consistent late payments over the past year may suggest cash flow issues. Review of income sources should include revenue streams, such as sales figures reaching $1 million annually and seasonal fluctuations affecting liquidity. Additionally, asset evaluation might consist of physical assets, such as machinery valued at $250,000, and intellectual property, which could significantly enhance overall financial stability. Comprehensive assessments of these areas inform effective restructuring strategies aimed at improving financial health and ensuring sustainable operations.

Proposed Restructuring Terms

Proposed restructuring terms for commercial debt may include a reduction in the principal amount owed, adjustments to interest rates (potentially lowering from 8% to 5%), and an extension of the repayment period (possibly stretching from 5 years to 10 years). Additionally, the inclusion of a grace period (typically lasting 6 to 12 months), during which no payments are required, is common to provide temporary relief. Other considerations might involve the negotiation of a more flexible payment schedule, allowing for seasonal adjustments based on cash flow variability, especially relevant in industries like retail or agriculture. Legal documentation may require completion by a certified attorney specializing in financial agreements, ensuring compliance with local regulations in jurisdictions such as New York or California.

Payment Plan Details

Commercial debt restructuring often involves negotiating a payment plan to manage outstanding obligations effectively. A structured payment plan may include specific terms such as total debt amount, interest rate adjustments, and a timeline for repayment. For instance, a company may owe $500,000 to multiple creditors, requiring a revised plan to settle this debt over a 24-month period. Monthly payments could be set at $20,833, with a potential reduction in interest rates from 8% to 5% to alleviate financial strain. Furthermore, legal considerations, such as compliance with the Bankruptcy Code and ensuring adherence to contractual obligations, must be addressed to protect both creditors and debtors during the restructuring process. Transparency in communication and documentation is critical to ensure all parties have a clear understanding of the new repayment terms.

Legal and Regulatory Compliance

Commercial debt restructuring involves navigating complex legal and regulatory frameworks to ensure compliance. Statutes such as the Bankruptcy Code (Title 11 of the United States Code) provide the legal underpinnings for formal restructuring processes. Key regulatory bodies, including the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), impose regulations on financial institutions involved in debt negotiations. Jurisdictions may have specific laws governing creditor-debtor relationships, with elements such as preferential transfers and avoidance actions needing careful consideration. The involvement of legal counsel skilled in corporate bankruptcy law ensures adherence to all legal requirements. Firms must also consider state-specific regulations, such as California's Commercial Code, which can impose additional obligations on businesses during restructuring endeavors.

Timeline for Implementation

Commercial debt restructuring often involves a detailed and strategic timeline for implementation. The initial phase typically begins with a comprehensive assessment of the company's financial position, including assessing liabilities, assets, and cash flow projections, which may take about two to three weeks. Following this analysis, stakeholders such as creditors and financial advisors convene to establish the restructuring plan, often requiring an additional two weeks for negotiations and consensus-building. Once the plan is finalized, a legal framework is prepared, involving drafting and filing necessary documents, a process that may last four to six weeks depending on jurisdiction complexities. After obtaining approvals from key parties, implementation commences, expected to span several months, with interim reviews every 30 days to ensure compliance with the agreed terms, allowing for adjustments based on financial performance and market conditions. During this period, ongoing communication with all involved parties is crucial to navigate any emerging challenges and affirm that restructuring goals remain on track for sustainable business growth.

Letter Template For Commercial Debt Restructuring Samples

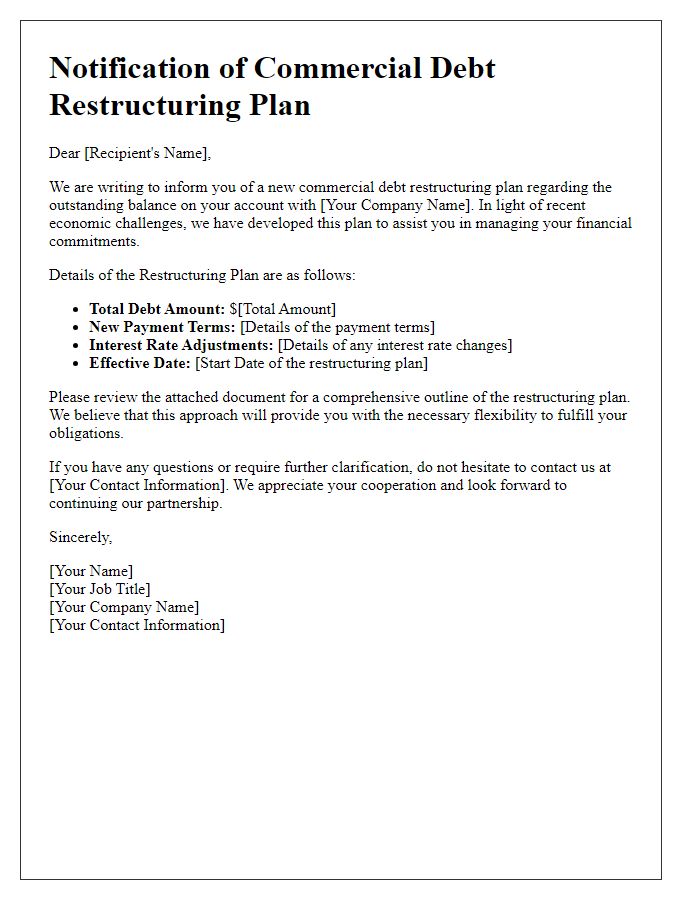

Letter template of notice for commercial debt restructuring negotiation.

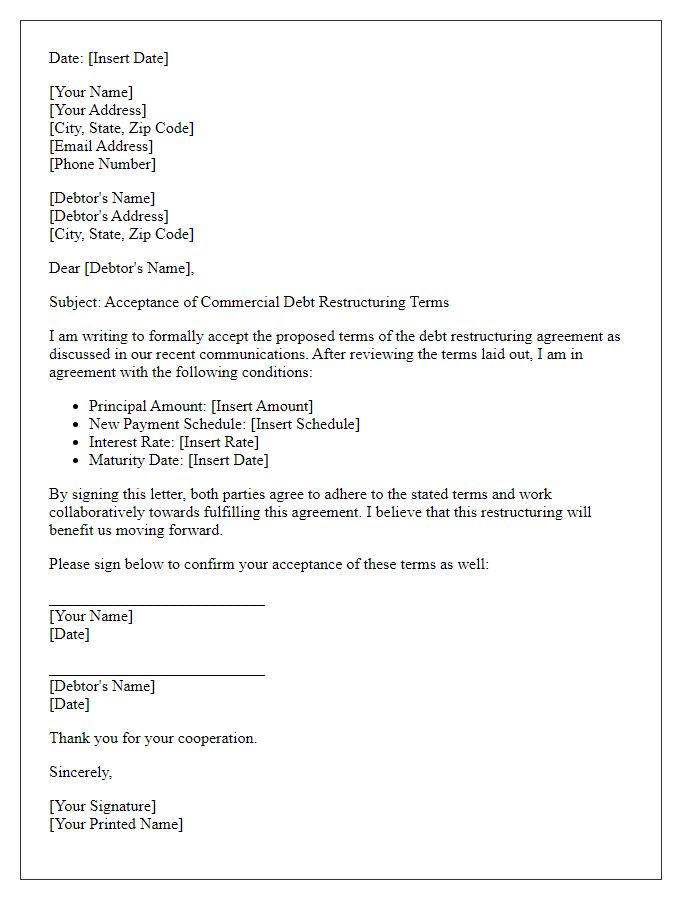

Letter template of confirmation for commercial debt restructuring terms.

Letter template of inquiry regarding commercial debt restructuring options.

Letter template of authorization for commercial debt restructuring discussions.

Letter template of follow-up for commercial debt restructuring proposal.

Comments