Are you concerned about potential antitrust violations in your industry? Navigating the complexities of antitrust laws can be daunting, but staying informed is crucial for fostering fair competition. In this article, we'll break down the essentials of antitrust violation notifications, helping you understand your rights and responsibilities. Dive in to learn more about how to protect your business from unfair practices!

Clear identification of involved parties

The antitrust violation notification must start with a clear identification of the involved parties, including relevant details such as company names, addresses, and registration numbers. For instance, Market Leaders Inc., a corporation registered in Delaware with an IRS Employer Identification Number 123-456789, and Competitor Corp, based in New York, with registration number 987654321. Further details may include the nature of the businesses, such as Market Leaders Inc., specializing in software development for retail analytics, and Competitor Corp, providing cloud-based logistics solutions. This specificity is essential for establishing the context of the alleged violations, ensuring that all relevant parties are accurately represented in the documentation process.

Specific description of the alleged violation

Antitrust violations can severely impact market competition and consumer choices, as seen in cases involving price-fixing or monopolistic practices. For example, in a scenario where a leading company in the tech industry conspires with competitors, pricing software products above market value can harm consumer access and stifle innovation. Specific details, such as the involvement of companies like Company A and Company B, alongside documented communications regarding pricing agreements, highlight the gravity of the situation. Regulatory agencies, such as the Federal Trade Commission (FTC), often investigate these practices, which can lead to significant fines and mandated changes in business operations. Reporting such violations helps maintain fair competition, benefitting both consumers and the economy.

Relevant legal statutes and regulations

Antitrust violations can have significant legal implications for businesses operating within competitive markets. The Sherman Act, enacted in 1890, prohibits monopolistic practices and empowers courts to take action against companies that engage in anti-competitive behaviors. The Federal Trade Commission Act, established in 1914, further protects consumers from unfair methods of competition and deceptive acts. Additionally, the Clayton Act, passed in 1914, addresses specific practices like price discrimination and exclusive dealing. These legal statutes collectively create a framework for promoting fair competition and consumer protection in the United States. Organizations must remain vigilant to ensure compliance and avoid penalties, including substantial fines and potential imprisonment for executives involved in antitrust activities.

Documentary evidence and supporting data

Antitrust violations, such as anti-competitive practices, can significantly distort market dynamics and harm consumers. In the case of corporate mergers or acquisitions, relevant documentary evidence may include financial statements, transaction records, and internal emails. Supporting data can encompass market share analysis, price-setting behaviors, and customer complaints. Regulatory bodies like the Federal Trade Commission (FTC) utilize this evidence to assess compliance with Section 1 and Section 2 of the Sherman Act. If violations are identified, penalties may include substantial fines or mandatory divestitures, significantly impacting corporate operations and consumer choice.

Request for corrective action or response timeline

Antitrust violations can significantly impact competition in markets, leading to consumer harm and stifling innovation. Affected parties must address practices such as price-fixing, monopolistic behavior, or extensive market share control. Major organizations investigated by regulatory bodies like the Federal Trade Commission (FTC) often face scrutiny regarding compliance with antitrust laws. A clear request for corrective action should include a timeline, typically ranging from 30 to 90 days, to ensure a prompt response. Additional details such as specific violations, market analysis, and potential consumer effects enhance clarity and urgency in the notification process.

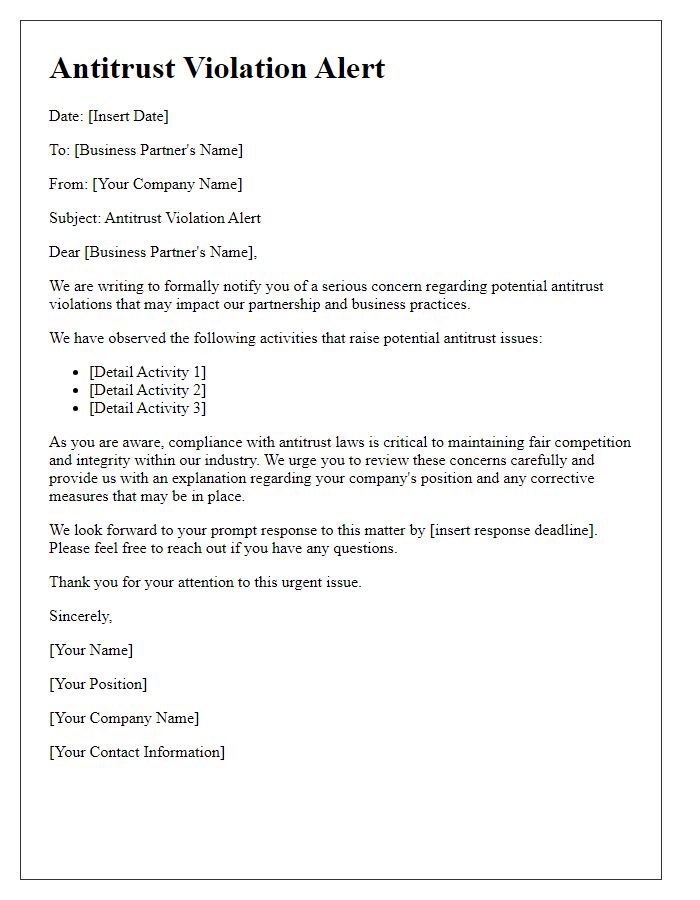

Letter Template For Antitrust Violation Notification Samples

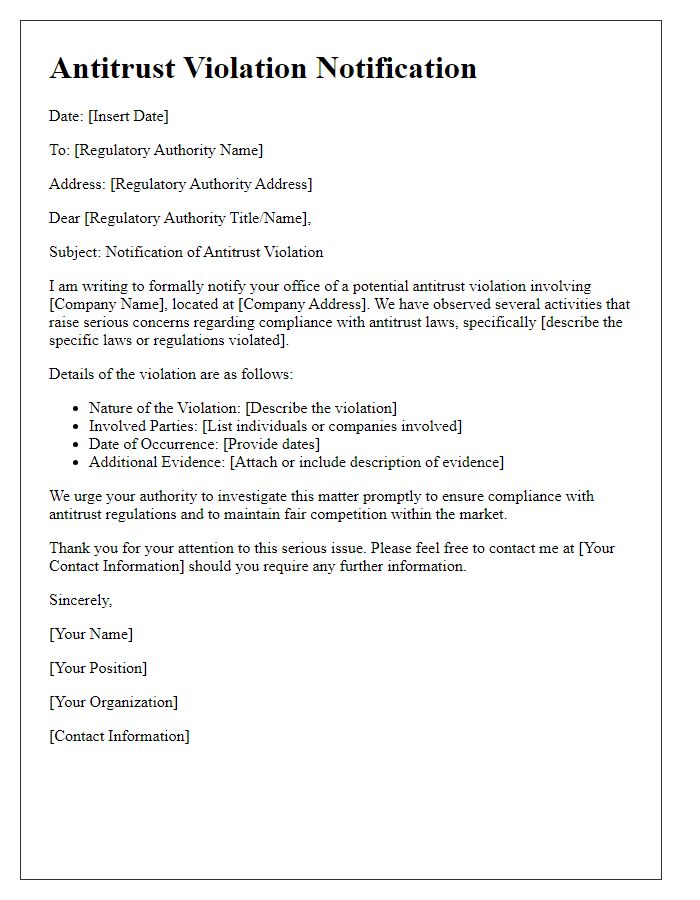

Letter template of Antitrust Violation Notification for Regulatory Authorities

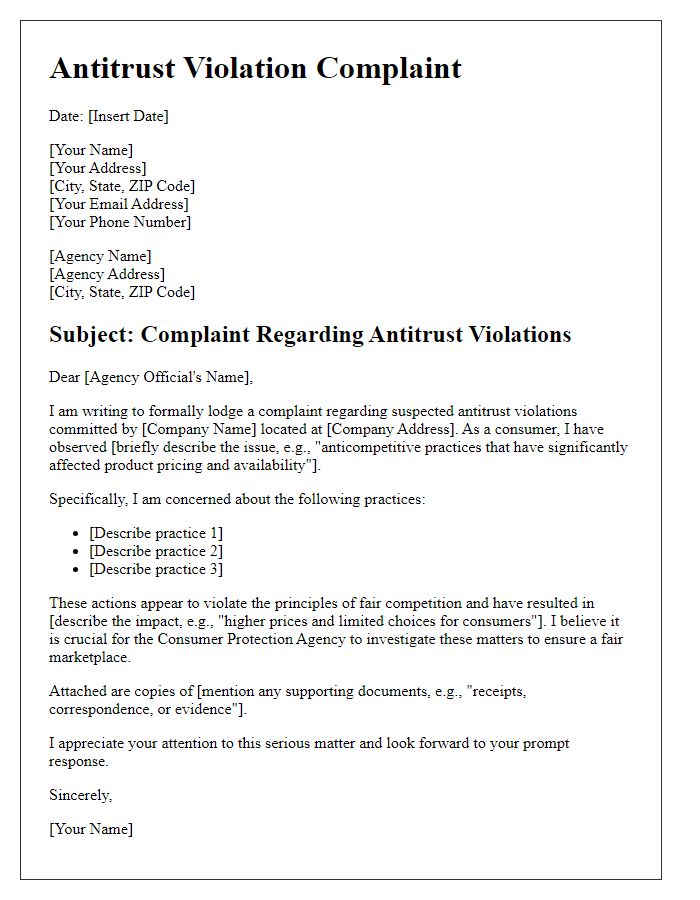

Letter template of Antitrust Violation Complaint for Consumer Protection Agency

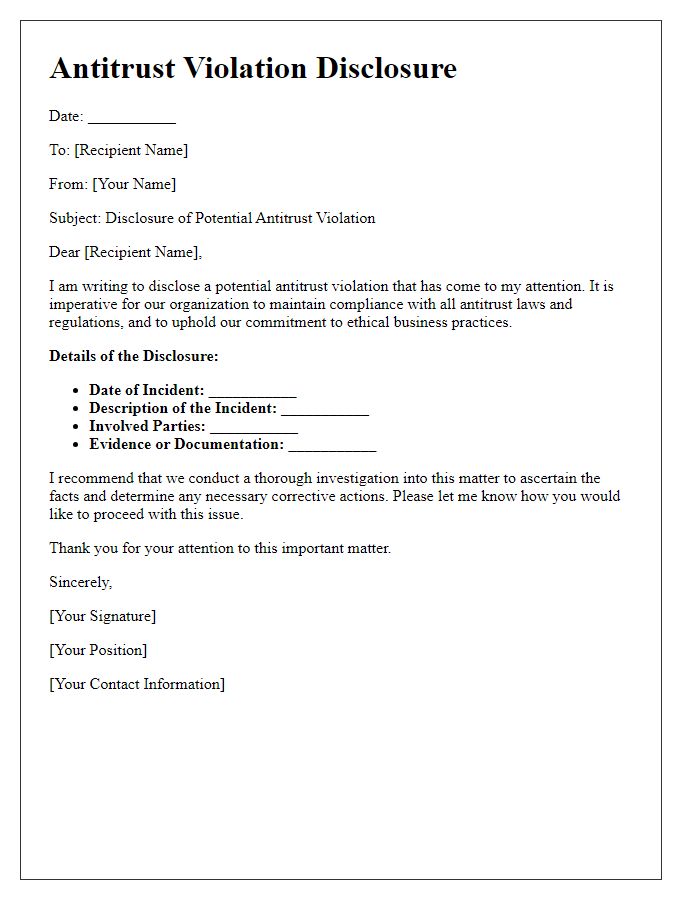

Letter template of Antitrust Violation Disclosure for Internal Compliance

Comments