Navigating a cross-border inheritance dispute can be a daunting process, often filled with layers of legal complexities and emotional challenges. It's essential to understand the nuances of international law and how they apply to your unique situation. In this article, we'll break down key aspects of cross-border inheritance issues, providing clarity and guidance for those facing similar challenges. So, let's dive deeper into this topic and empower you with the knowledge you need to find resolution.

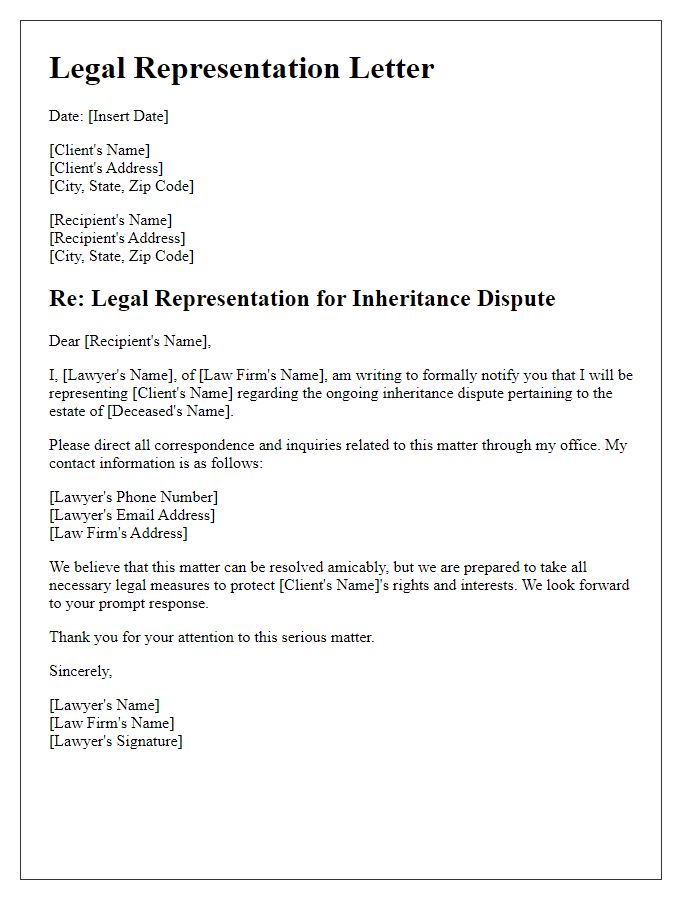

Legal jurisdiction and applicable laws

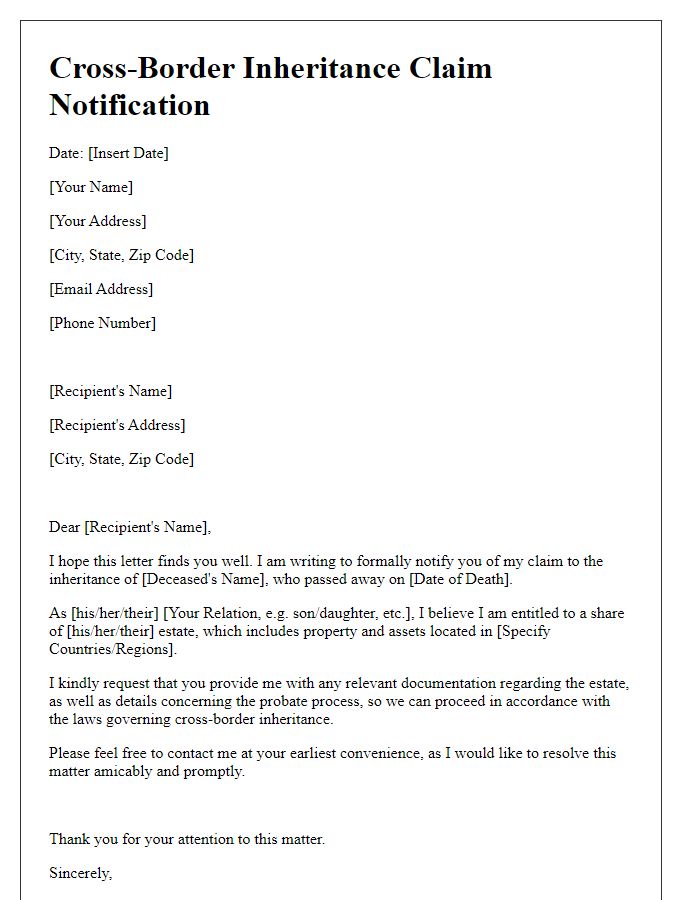

Cross-border inheritance disputes often hinge on legal jurisdiction and applicable laws, particularly when multiple nations are involved. Jurisdiction refers to the authority of a court to hear a case, influenced by factors such as the domicile of the deceased (the individual who passed away) and the location of their assets, which may include real estate in countries like France or bank accounts in the United Kingdom. Applicable laws vary significantly; for instance, the European Union's Succession Regulation (Regulation (EU) No 650/2012) allows for a single jurisdiction to apply to inheritances across member states, simplifying disputes involving French and German law. Differing legal frameworks, such as common law in the United States versus civil law in Spain, complicate these matters, creating potential conflicts over asset division and claims by heirs (immediate family members and distant relatives). Efficient resolution of these disputes often requires expert legal counsel familiar with international estate law and conflict of laws principles, highlighting the significance of preparing accurate and comprehensive legal documents.

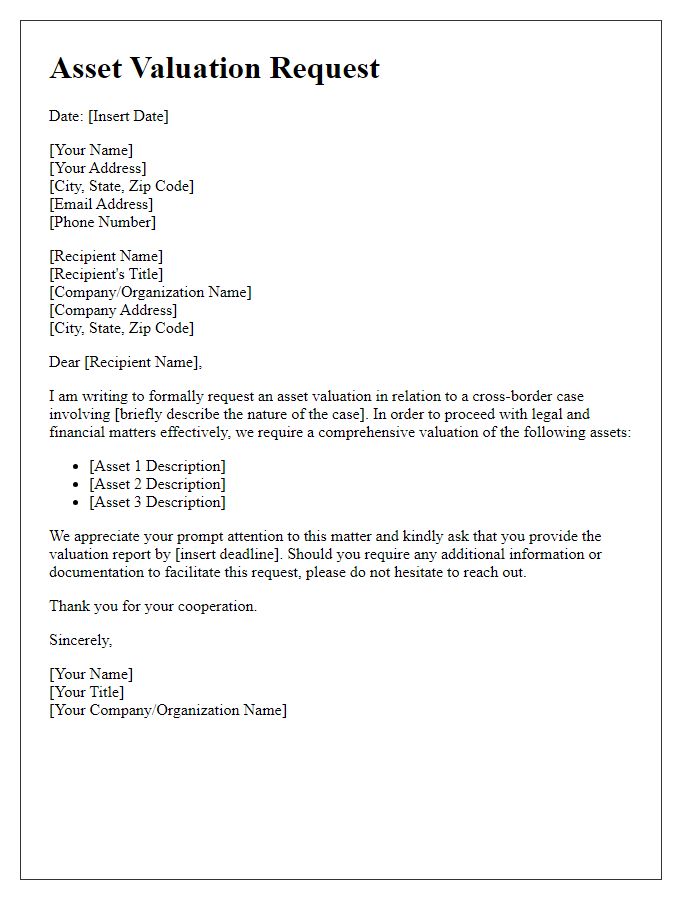

Detailed description of assets involved

The cross-border inheritance dispute involves a diverse array of assets that span multiple jurisdictions, including real estate, financial investments, and personal property. The primary real estate asset is a luxury villa located in Marbella, Spain, valued at approximately EUR2 million. This property has been under the ownership of the deceased since 2010 and is registered with the local land registry. Additionally, a commercial office building located in London, UK, generates an annual rental income of PS120,000, contributing significantly to the overall estate value. Financially, there are several investment accounts held at a major brokerage firm in New York, USA, with an estimated total value of $500,000, comprised of stocks, bonds, and mutual funds. Personal property includes a vintage car collection appraised at $250,000, comprising rare models from the 1960s, along with art pieces valued at $300,000, featuring works by renowned artists. The complexities of navigating these assets across different legal systems are exacerbated by the varying laws of inheritance applicable in Spain, the UK, and the USA, making the dispute particularly intricate.

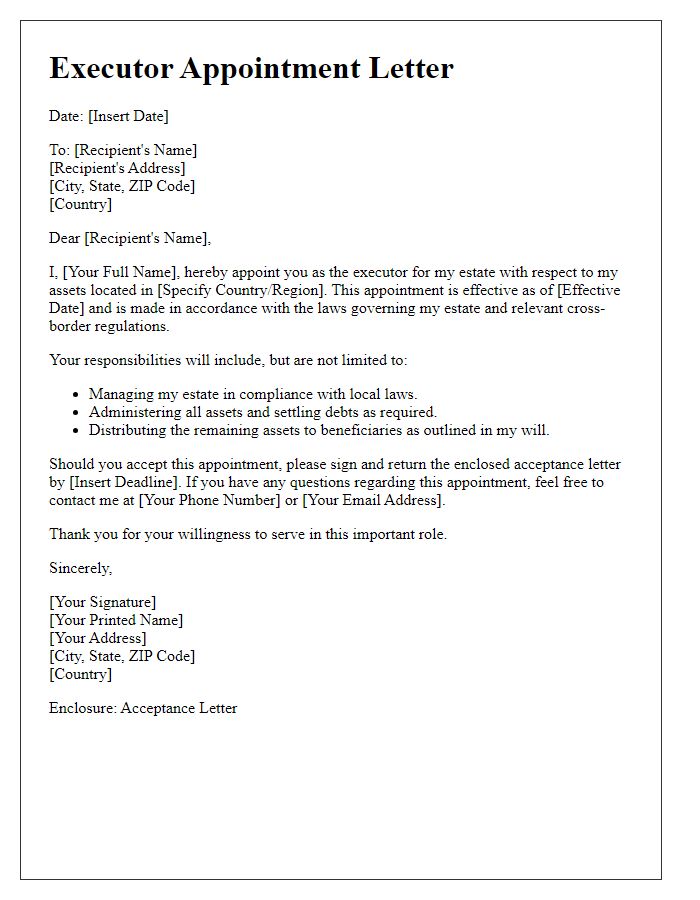

Identification of beneficiaries and their claims

In cross-border inheritance disputes, identification of beneficiaries often involves complex legal recognition across jurisdictions. Beneficiaries can include immediate family members, such as spouses (e.g., under laws in Germany, spouses may inherit up to 50%), children (in countries like France, children have reserved rights), and distant relatives (e.g., siblings may be considered under intestacy laws). Documentation such as wills, trust agreements, and death certificates requires validation across multiple legal systems. Claims can vary significantly, with some jurisdictions applying forced heirship rules, restricting how much a decedent can freely bequeath, whereas others allow for more discretion. Proper legal representation may be critical in navigating differing laws, such as the European Succession Regulation (EU 650/2012), which can influence the efficacy of claims. Specific timelines for submitting claims must adhere to local statutes, which can affect the outcome profoundly.

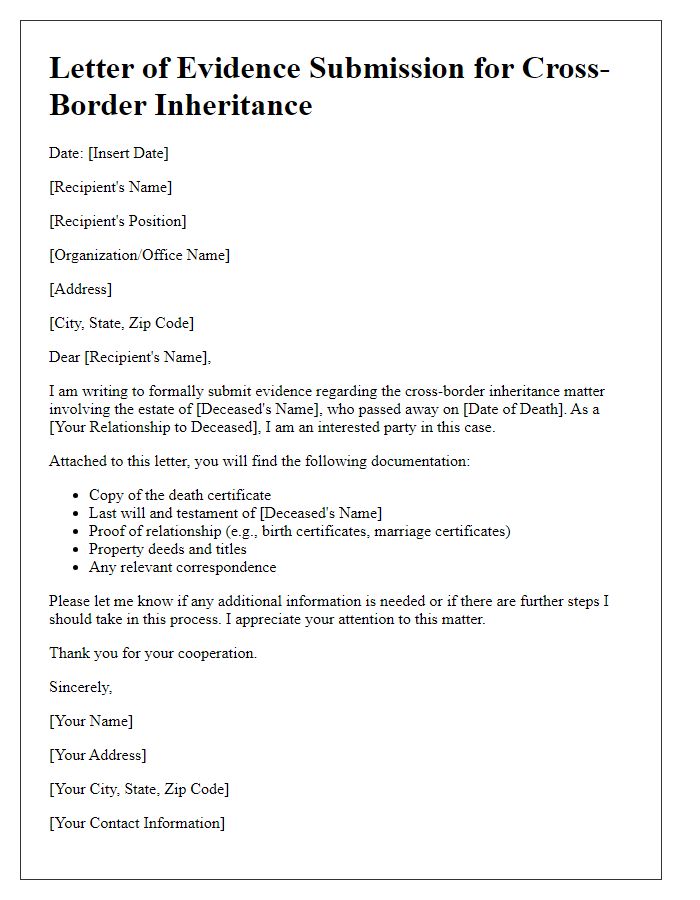

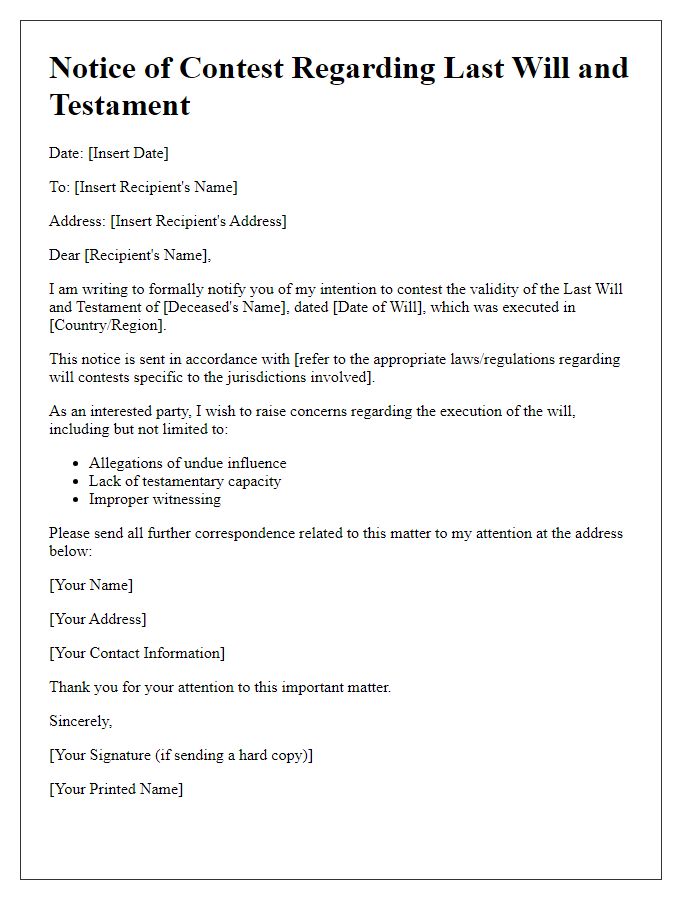

Evidence of validity of the will or trust

In cases of cross-border inheritance disputes, evidence of the validity of a will or trust is crucial for ensuring that the deceased's intentions are honored according to legal standards. The requirements for validating a will can vary significantly between jurisdictions; for instance, testamentary formalities may include notarization, witness signatures (typically two in many US states), or compliance with international conventions such as the Hague Convention on the Form of Testamentary Dispositions. In addition, the trust must be assessed based on its jurisdiction of establishment--common law jurisdictions often require clear declarations of trust, whereas civil law countries may rely on different forms of documentation. Specific legal terminology such as "testator" (the person who creates the will) and "beneficiary" (the person receiving the inheritance) plays a vital role in clarifying roles within the legal framework. Furthermore, demonstrating the testator's mental capacity at the time of drafting and adherence to the laws governing foreign property or estate taxes can be essential in validating the will or trust and facilitating the resolution of disputes among heirs across different countries.

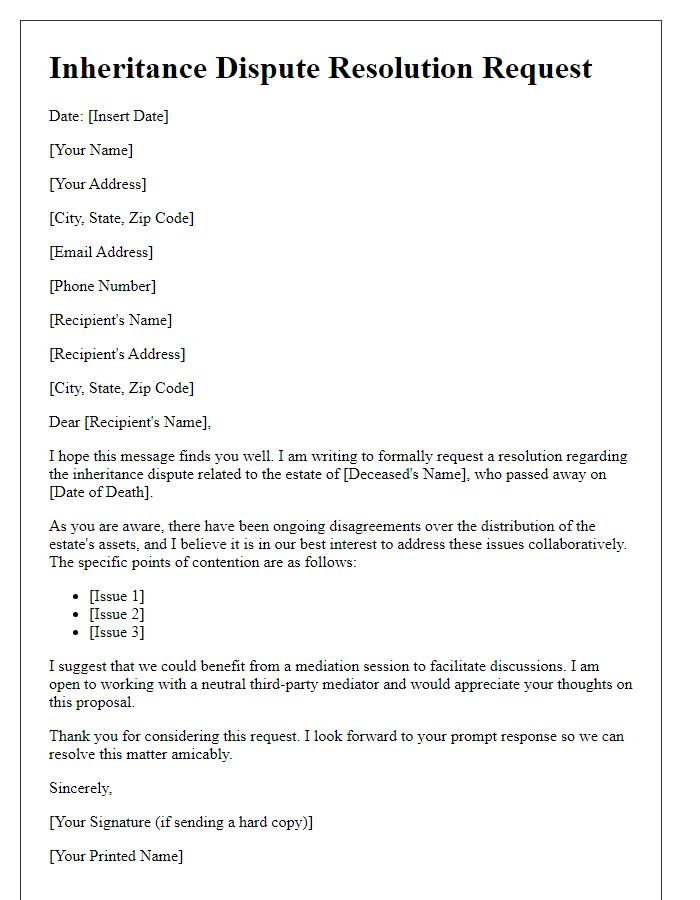

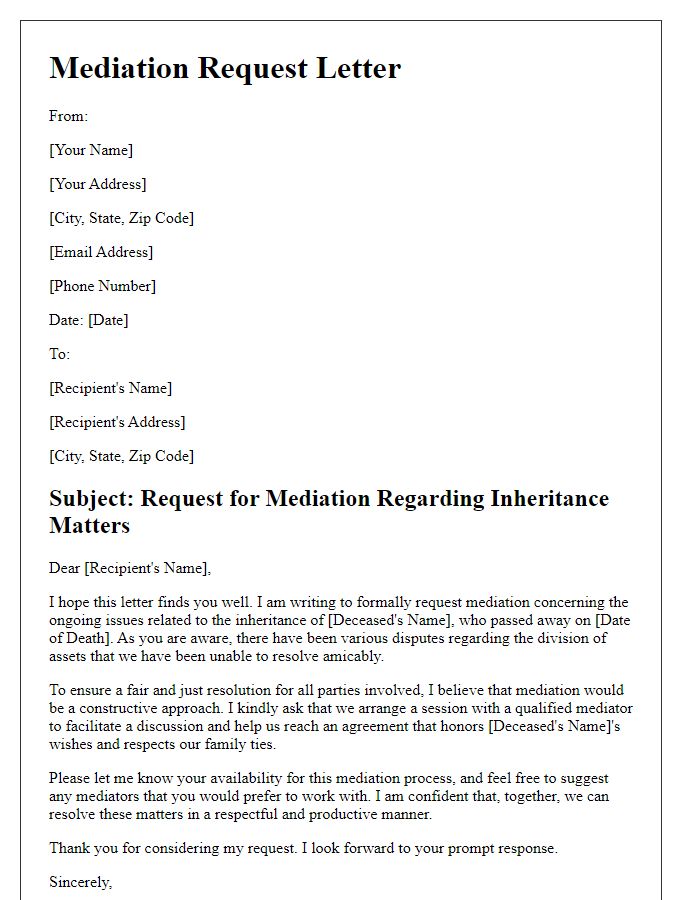

Conflict resolution and mediation options

Cross-border inheritance disputes often arise when family members from different countries disagree on the distribution of assets following a loved one's passing. Jurisdictions, such as the European Union countries, have diverse legal frameworks, complicating the process of resolving such conflicts. Mediation offers a constructive avenue to facilitate communication between disputing parties, promoting understanding and cooperation. For example, the Mediation Directive (2008/52/EC) provides a foundation for cross-border mediation practices across EU member states. An experienced mediator can help clarify each party's interests and find common ground, potentially avoiding costly and lengthy litigation in multiple jurisdictions. Additionally, resources such as local legal experts familiar with international law can significantly aid in navigating complex legal systems and ensure compliance with respective inheritance laws, like the Regulation (EU) No 650/2012, which addresses cross-border inheritance matters in the EU.

Comments