Are you looking to enhance your insurance policy with a rider that perfectly fits your needs? Adding a rider is a smart way to customize coverage and ensure you're completely protected against unforeseen events. Whether it's life, health, or auto coverage, the right rider can offer added peace of mind for you and your family. Keep reading to discover how to effectively request a rider addition to your policy and ensure your coverage is tailored to your unique situation!

Personal Information

To ensure comprehensive coverage for individuals, it is crucial to include additional riders within an insurance policy, such as a life insurance policy or an auto insurance policy. Adding riders, such as a spouse rider or child rider, enhances the benefits for family members, providing peace of mind during unexpected events. Specific personal details, including full name, date of birth, and relationship to the primary policyholder, are essential for accurate processing. Additionally, relevant documents, such as identification and proof of relationship, must accompany the request to validate the addition of the rider. The requested change should be communicated clearly to the insurance provider, specifying the rider type, effective date, and any premium adjustments that may occur.

Policy Details

Rider addition to an insurance policy can enhance coverage by including specific benefits or features. The rider, such as an Accidental Death Benefit, often provides additional financial security for the insured's beneficiaries. In policies like whole life or term life insurance, adding a rider may involve specific terms, which should be clearly outlined in the policy documentation. A policy number typically identifies the main insurance agreement, ensuring that any modifications or additions can be accurately processed by the insurance provider. Riders may also come with additional premiums, which can vary depending on the type of coverage selected. It's essential to review the policy details thoroughly before requesting a rider addition to understand potential costs and benefits fully.

Specific Rider Information

A specific rider addition to an insurance policy, such as a critical illness rider, can enhance financial protection by providing a lump-sum benefit upon diagnosis of specified illnesses. Critical illness policies typically cover major conditions like heart attacks, strokes, or cancer, aligning with World Health Organization (WHO) prevalence data that indicates these ailments constitute a significant percentage of health-related claims. By including this rider, policyholders can secure necessary funds for treatment expenses, which may reach thousands of dollars depending on the severity and nature of the illness, ensuring peace of mind during challenging times. In addition, specific riders may also address income replacement or payment of medical costs related to hospitalization, fostering a comprehensive coverage approach for unpredictable health events.

Reason for Addition

Rider addition to an insurance policy enhances coverage. Riders, also known as endorsements, provide supplemental benefits tailored to individual needs. For example, adding a critical illness rider can increase financial support during medical emergencies. Added protection might cover specific conditions like cancer or heart disease and can involve increased premiums depending on the risk assessment. Common places where these policies are offered include life insurance companies and health insurance providers, often requiring documentation of medical history and current health status. Riders clarify policy limitations and expand coverage, making it an essential consideration for policyholders seeking comprehensive protection.

Contact Information

Rider additions to insurance policies can enhance coverage options tailored to individual needs. Contacting the insurance provider, whether through dedicated customer service numbers or official email addresses, is essential for initiating this process. Important details such as policy number, coverage type, and specific rider requests must be clearly outlined to facilitate smooth processing. Additionally, understanding the potential costs associated with adding a rider can inform budgeting decisions, as premium adjustments may occur based on extended coverage. Having personal and policy information readily available streamlines communication with agents, ensuring prompt response times and efficient updates to the existing policy framework.

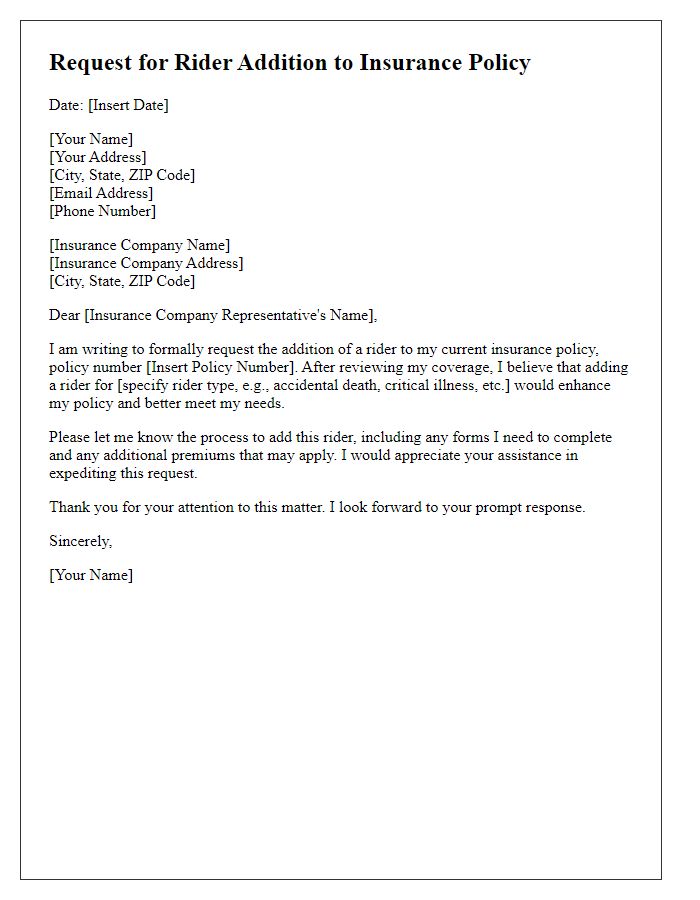

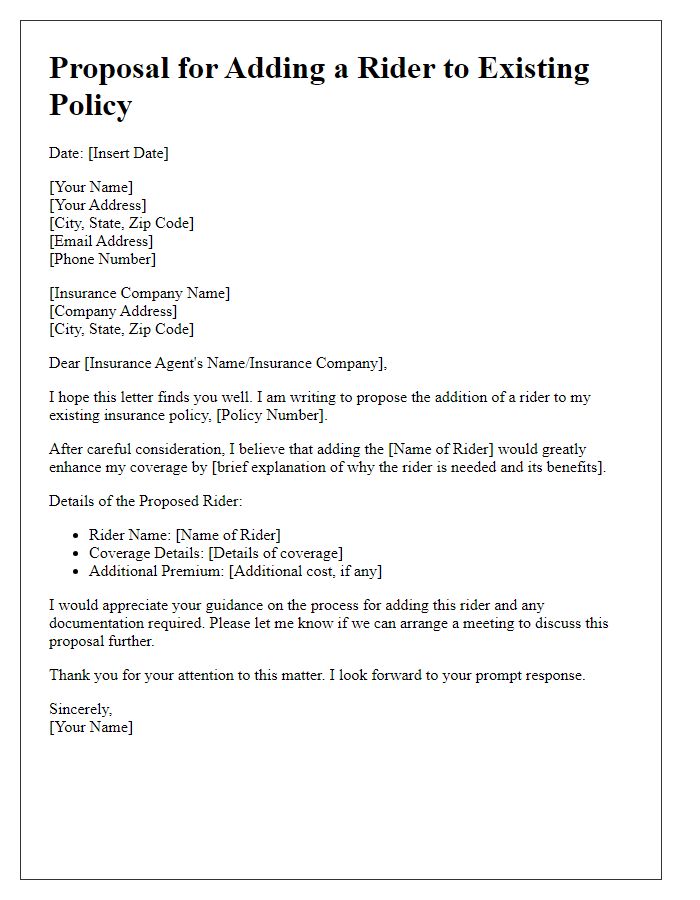

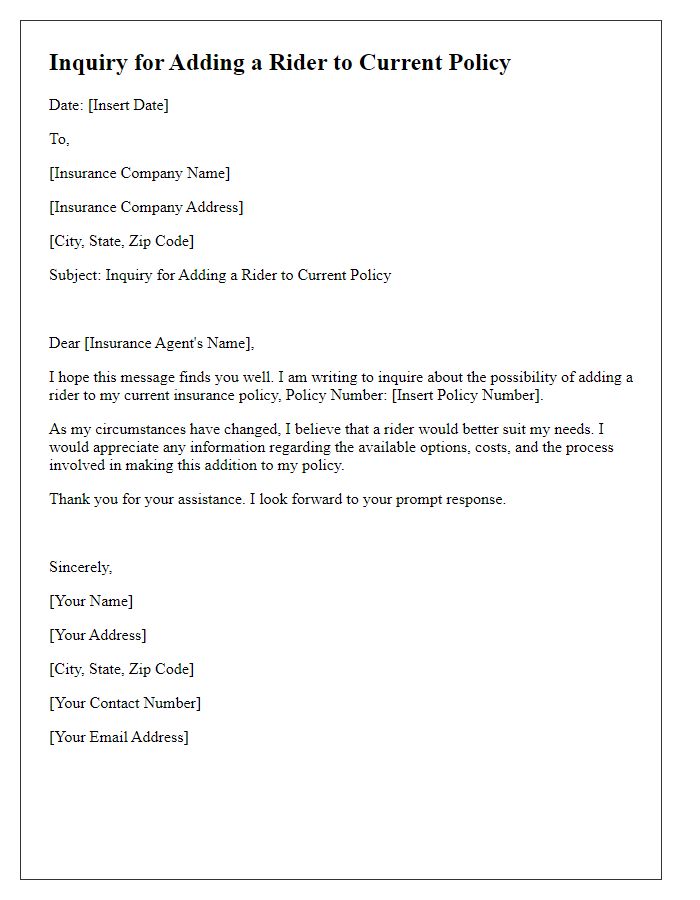

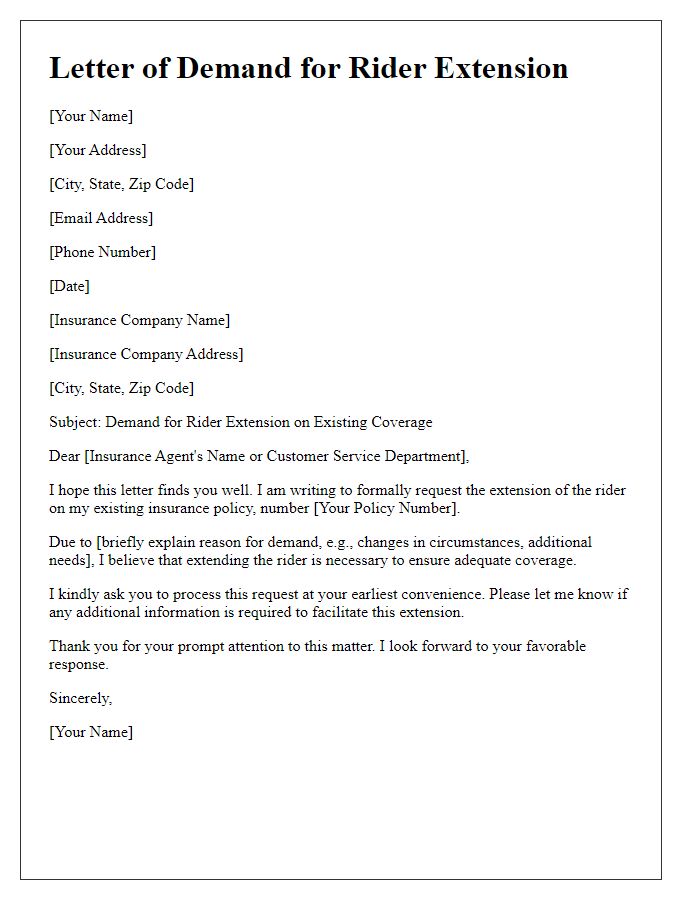

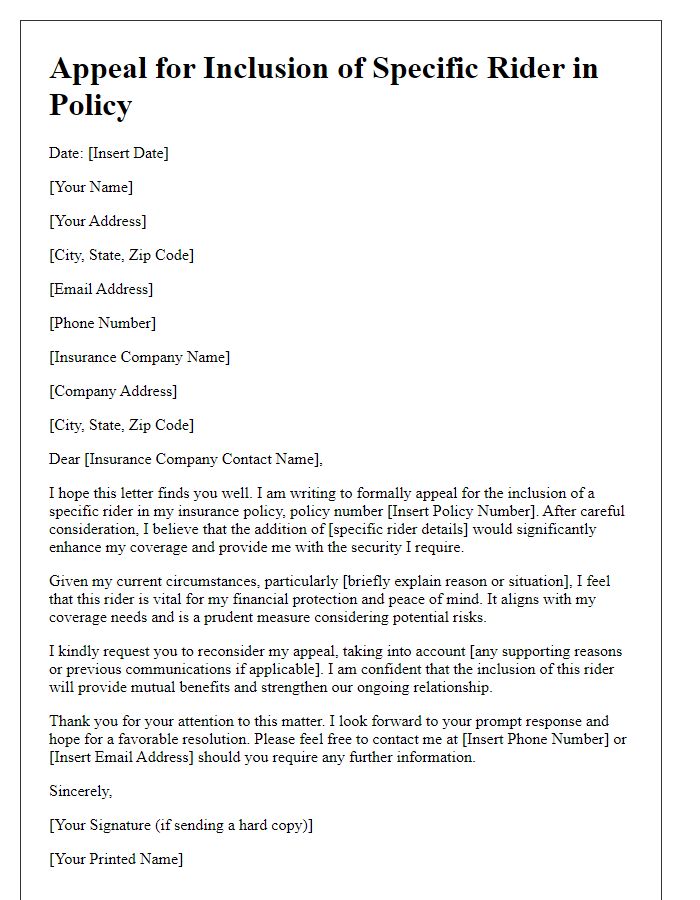

Letter Template For Requesting Rider Addition To Policy Samples

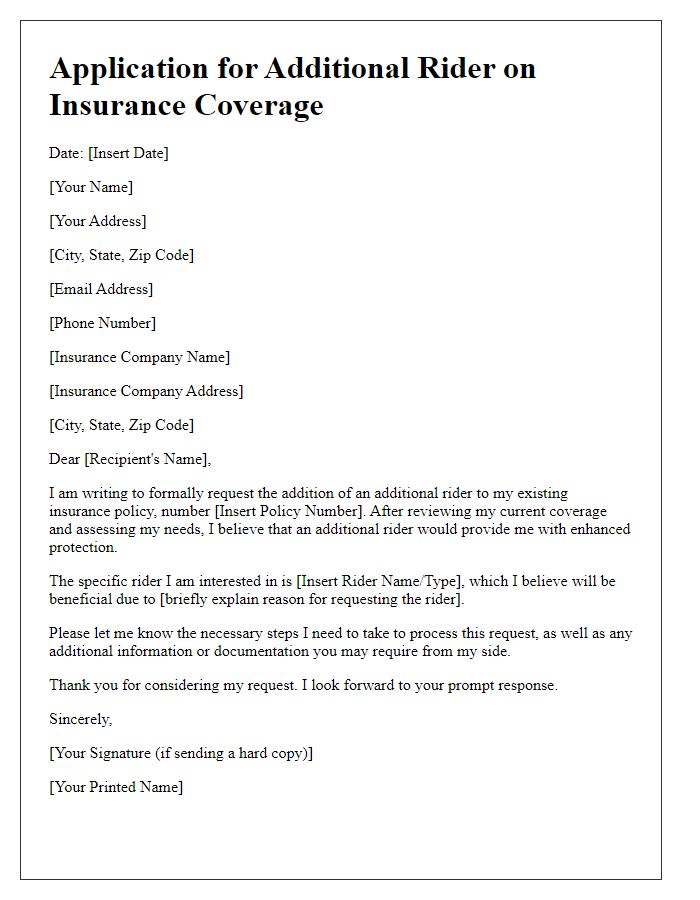

Letter template of Application for Additional Rider on Insurance Coverage

Comments