Are you navigating the tricky waters of a dispute with your insurance agent? It can feel overwhelming, especially when you're trying to understand your rights and responsibilities. Fortunately, crafting a well-structured letter can be a powerful step towards resolving any misunderstandings or issues. Join me as we explore effective strategies for writing a persuasive letter that can help you reclaim your peace of mind and ensure you get the assistance you deserve.

Accurate Policy Information

Accurate policy information is crucial for resolving disputes with insurance agents, particularly in property insurance or health insurance cases. Clarity in policy terms, such as coverage limits and deductibles, often impacts claim processing. For instance, an auto insurance policy may outline comprehensive coverage clauses applicable to theft (often defined as a $1,000 maximum limit), while health insurance benefits might detail exclusions for pre-existing conditions (often requiring documentation for validity). Misinterpretations can lead to significant financial implications for insured parties. Ensuring that both the client and the agent understand the specific provisions, such as the policy effective date or any riders attached (like additional coverage for floods), is essential in addressing discrepancies effectively.

Clear Communication Channels

Effective communication plays a crucial role in resolving insurance agent disputes. Establishing clear communication channels can prevent misunderstandings and facilitate a smoother resolution process. Utilizing various platforms, such as email (providing written records), phone calls (allowing for immediate feedback), and face-to-face meetings (encouraging more personal engagement), can enhance discussions. Documenting all interactions and agreements in detail is essential, as records can clarify expectations and commitments. Additionally, having an effective escalation process ensures that serious issues can be addressed promptly, involving supervisors or management when necessary. Maintaining a respectful and professional tone throughout exchanges fosters a cooperative environment conducive to resolution.

Documentation and Evidence

To resolve disputes with insurance agents effectively, meticulous documentation and compelling evidence are crucial. Start by compiling all relevant communication records, including emails, phone call logs, and written correspondence with the insurance agent. Gather policy documents, claim forms, and any amendments made to the initial agreement. Collect photographs of damages or losses that substantiate the claim and take note of any witness statements that affirm your account of events. Record specific dates and times of incidents and discussions to establish a timeline. This thorough compilation will provide a comprehensive overview, aiding in the resolution process and ensuring your case is well-supported with factual evidence.

Resolution Timeline

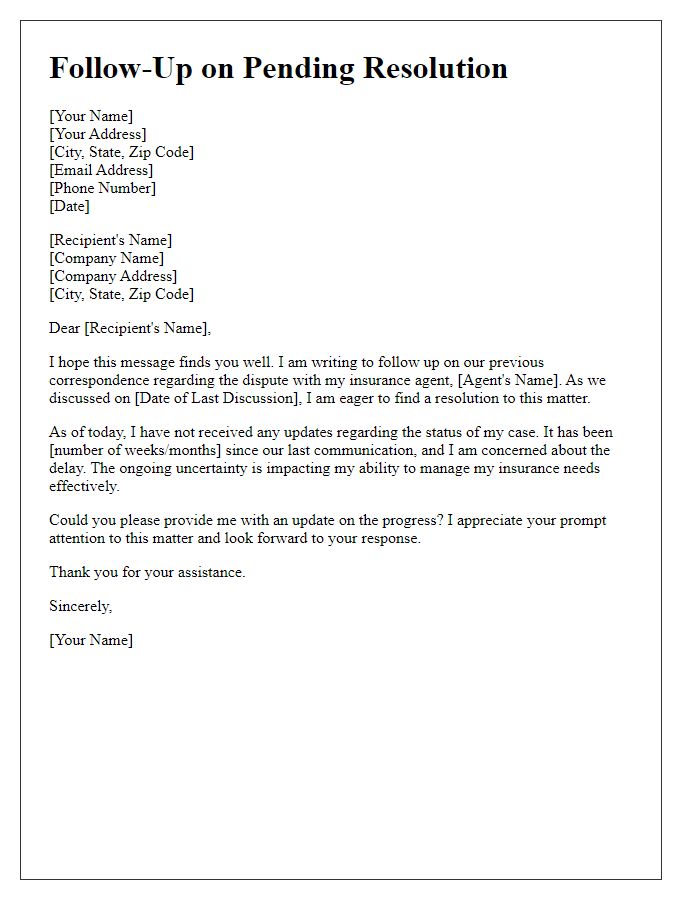

The resolution timeline for an insurance agent dispute typically spans several critical phases, each with distinct durations and actions. Initial contact often occurs within 48 hours of the dispute being reported, facilitating a preliminary review of the issue. Following this, the investigation phase usually lasts between one to two weeks, during which documentation such as policy details and correspondence records are collected and analyzed. After the investigation, a resolution proposal is commonly issued within five business days, outlining potential solutions or actions required. If both parties agree, resolution can be finalized within an additional week, with confirmation sent via email or written notice. Should further negotiations be necessary, this may extend the timeline by another week or more, depending on complexity. Overall, an effective resolution may be achieved within three to six weeks from the initial reporting of the dispute.

Legal and Regulatory Compliance

Legal and regulatory compliance within the insurance industry is crucial for maintaining trust and integrity. The National Association of Insurance Commissioners (NAIC) sets essential guidelines and standards. Insurance agents must adhere to state-specific regulations, avoiding practices that could lead to consumer harm or financial loss. Breaches can result in penalties, license revocation, or civil lawsuits. Regulatory bodies, such as state insurance departments, monitor compliance through regular audits and investigations. Transparency in policy sales, clear communication of terms, and ethical conduct are vital for agents to foster positive relationships with clients. Legal frameworks also protect consumers, ensuring they receive fair treatment and rightful claims.

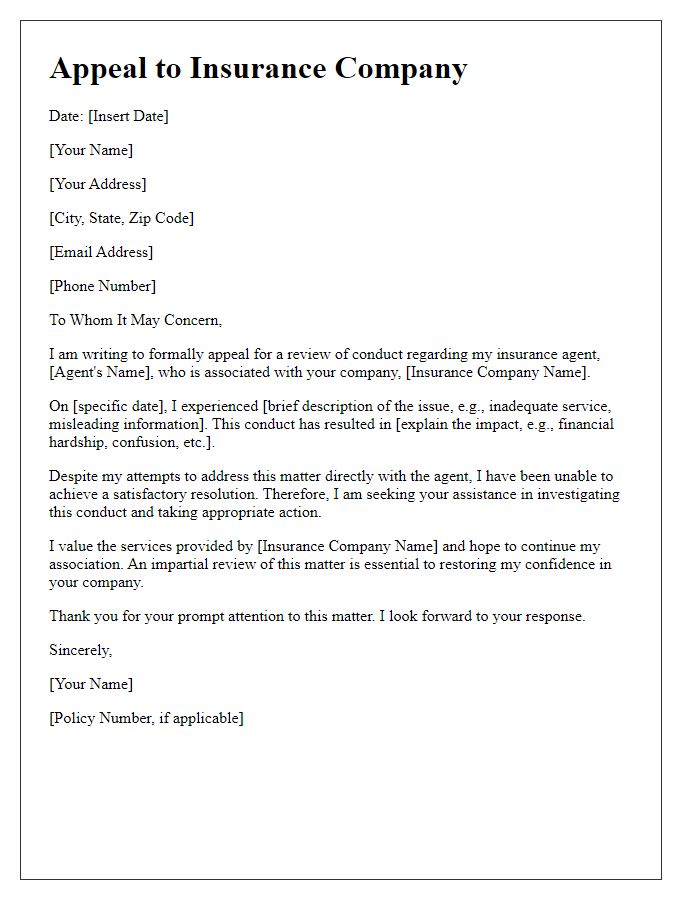

Letter Template For Resolving Insurance Agent Dispute Samples

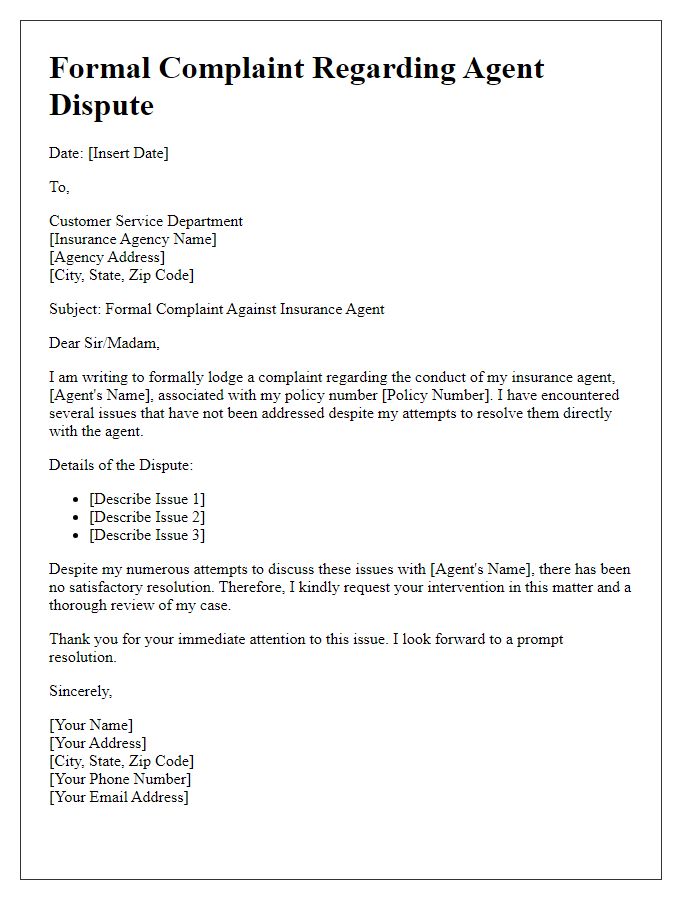

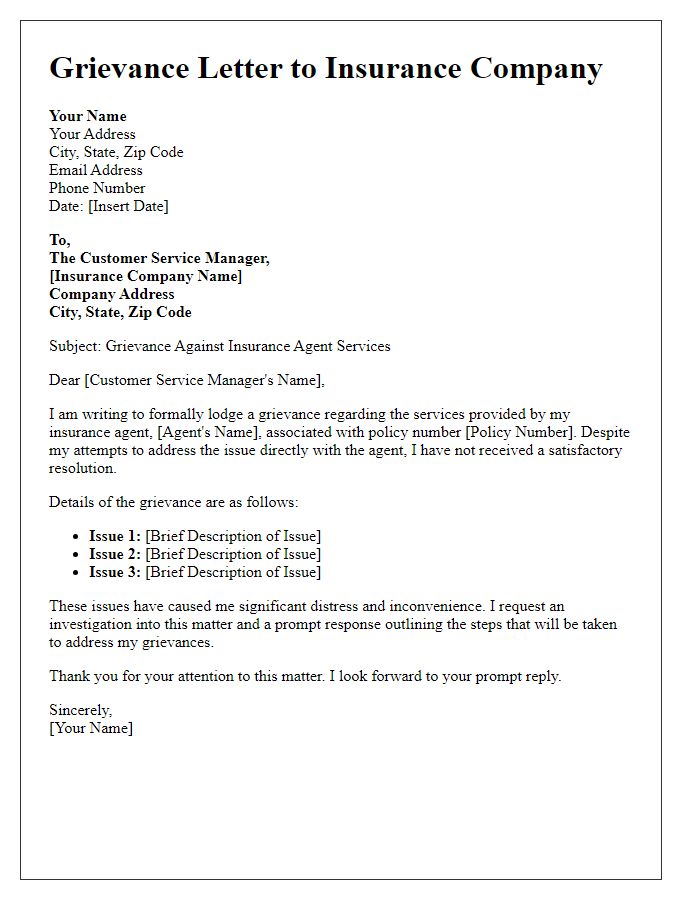

Letter template of formal complaint to insurance agency regarding agent dispute

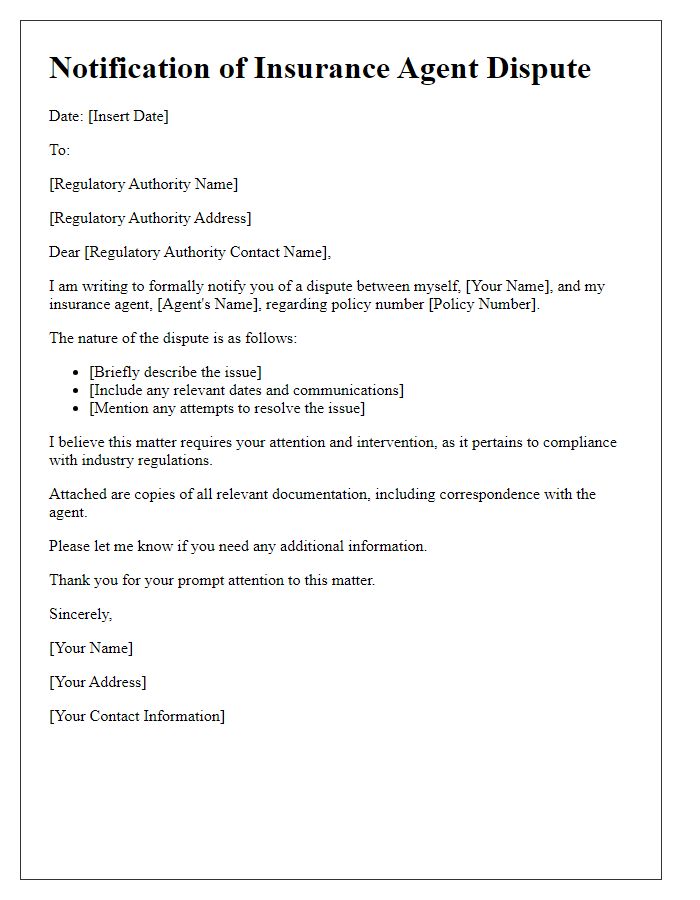

Letter template of notification of insurance agent dispute to regulatory authority

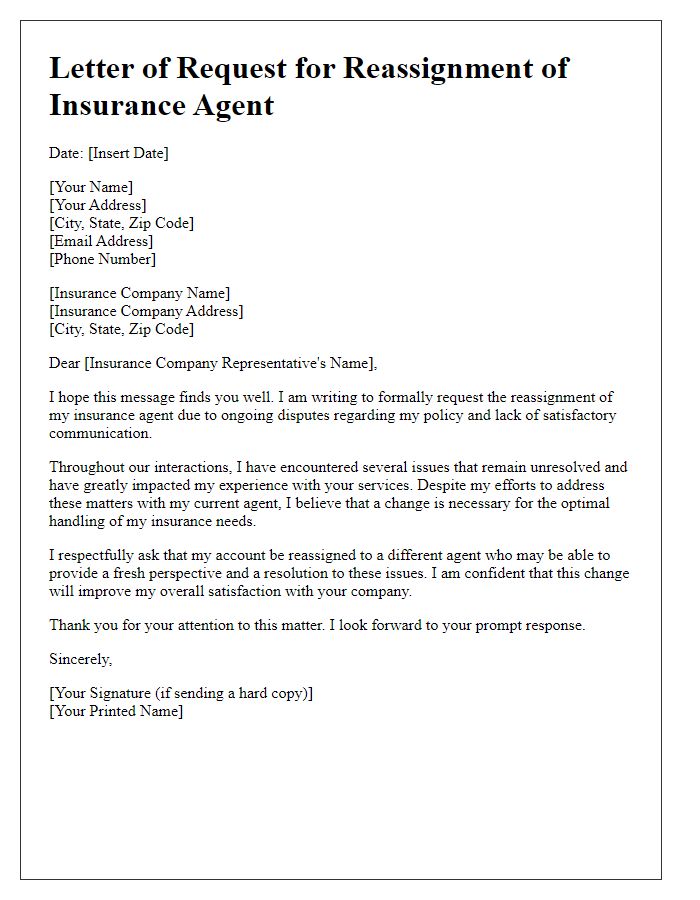

Letter template of request for reassignment of insurance agent due to dispute

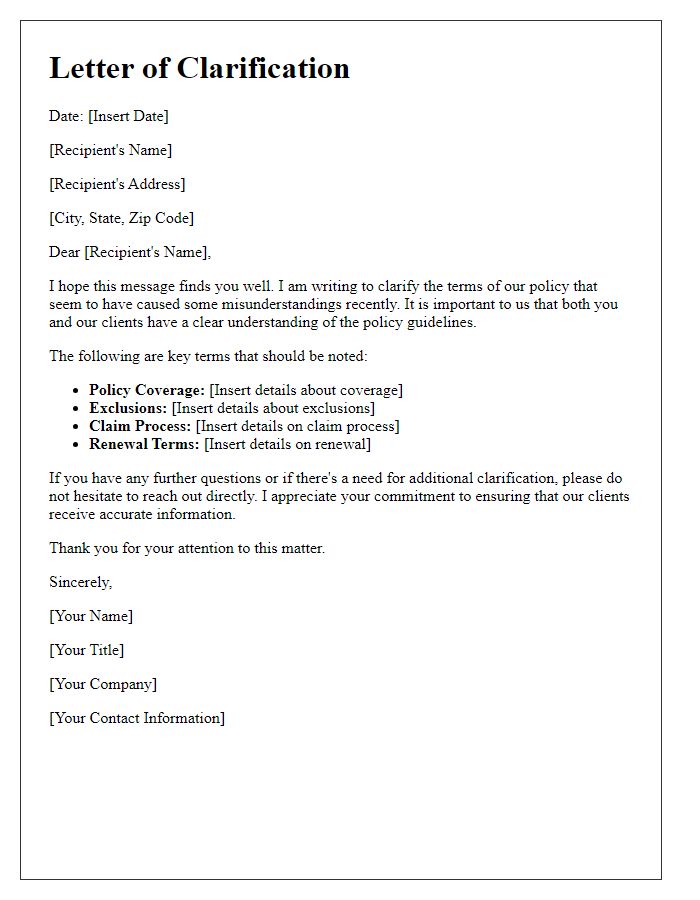

Letter template of clarification of policy terms to resolve agent misunderstanding

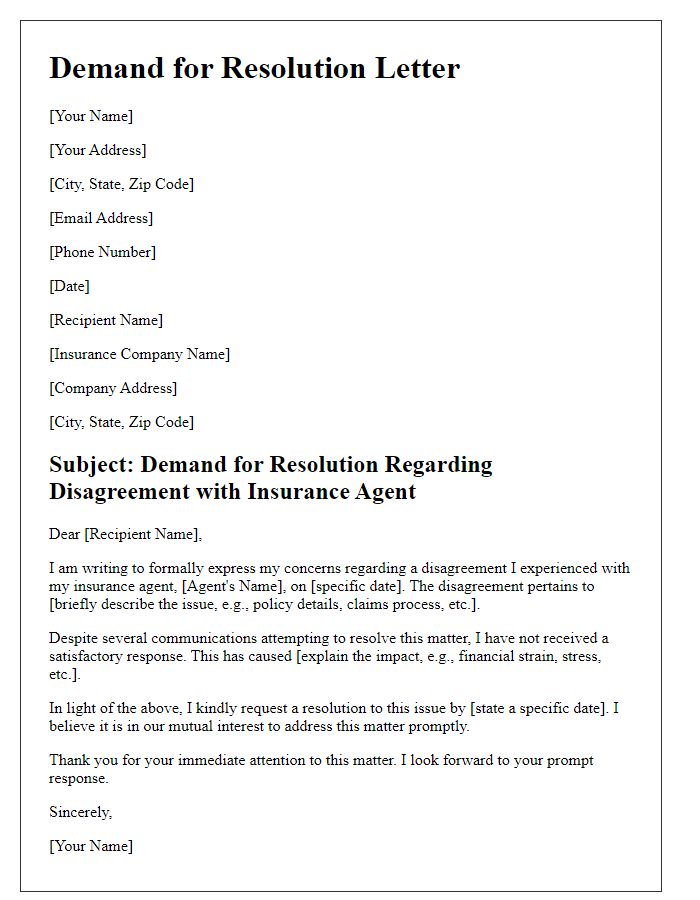

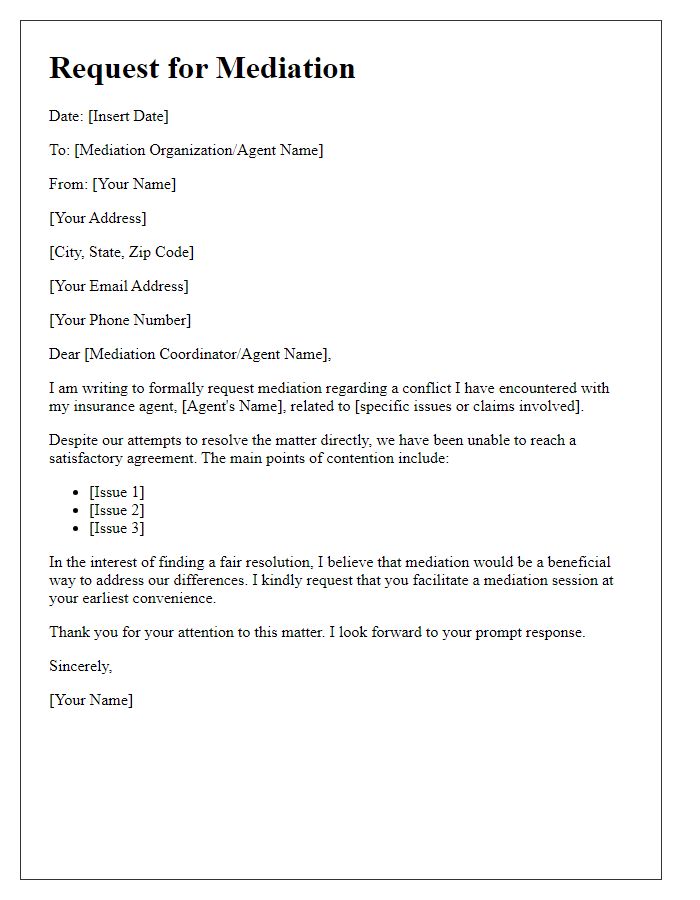

Letter template of demand for resolution following insurance agent disagreement

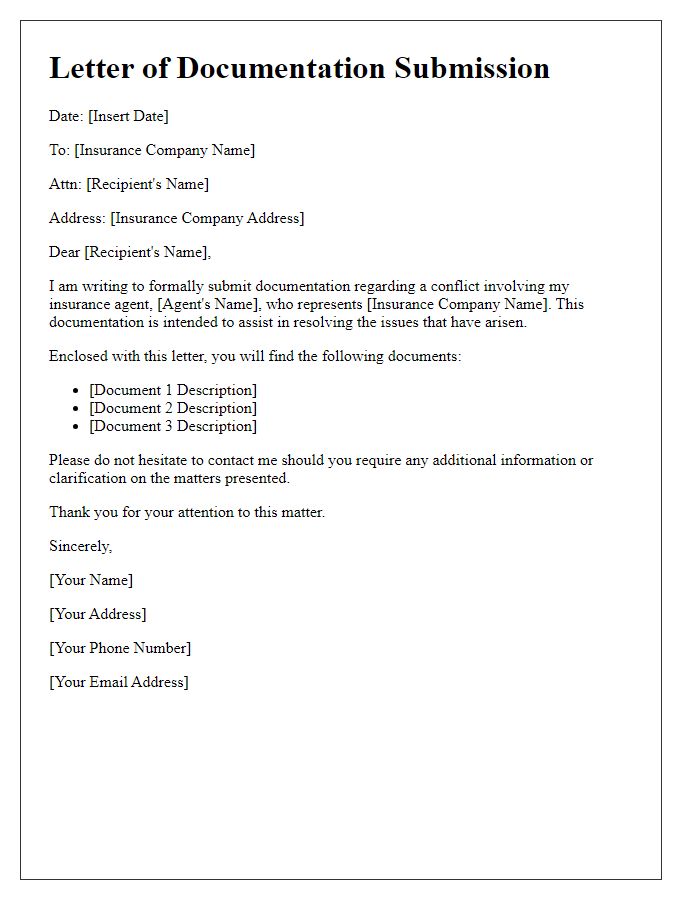

Letter template of documentation submission for insurance agent conflict

Comments