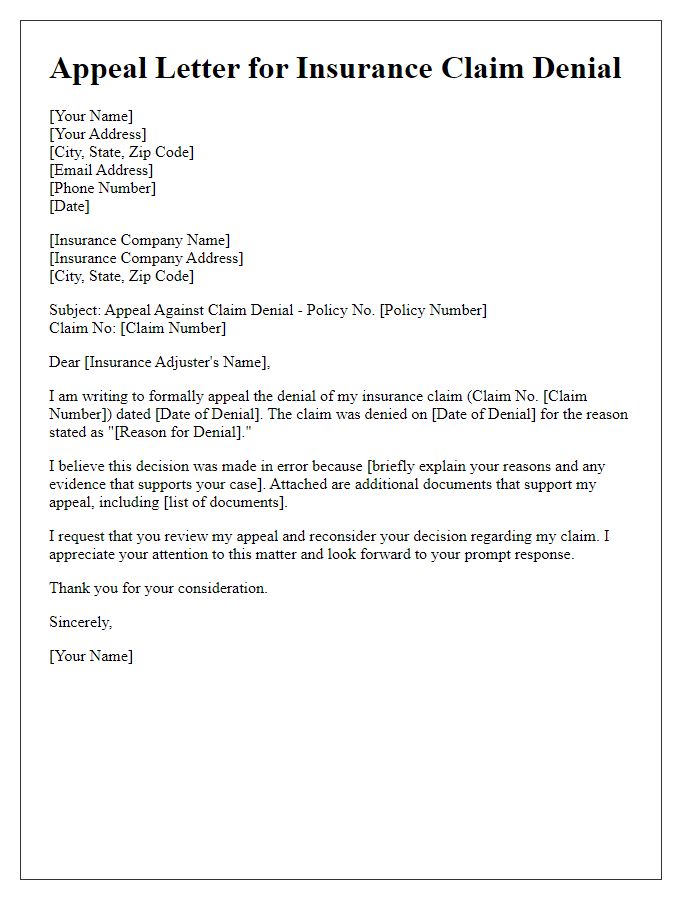

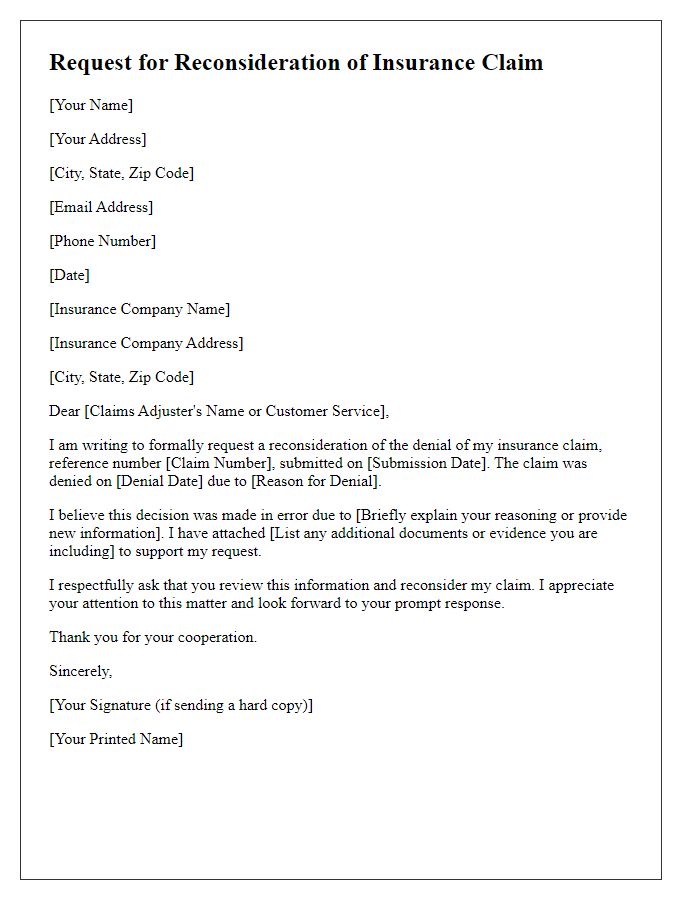

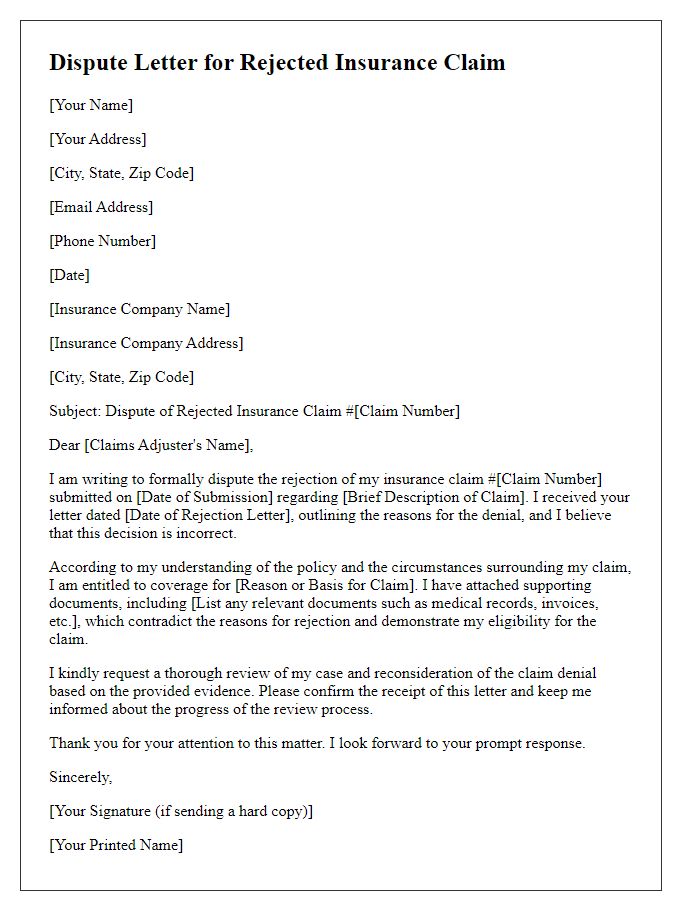

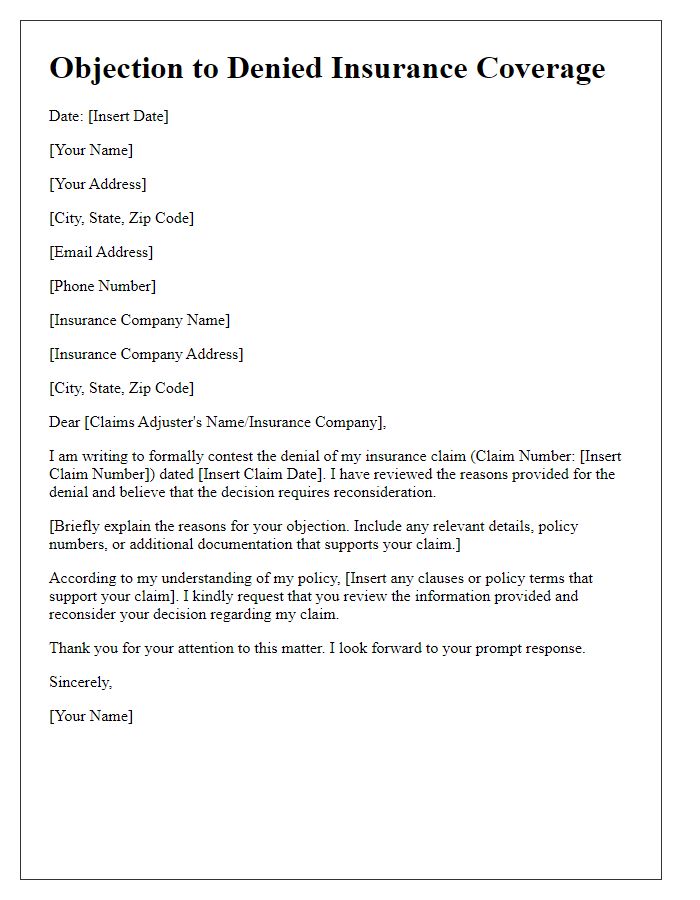

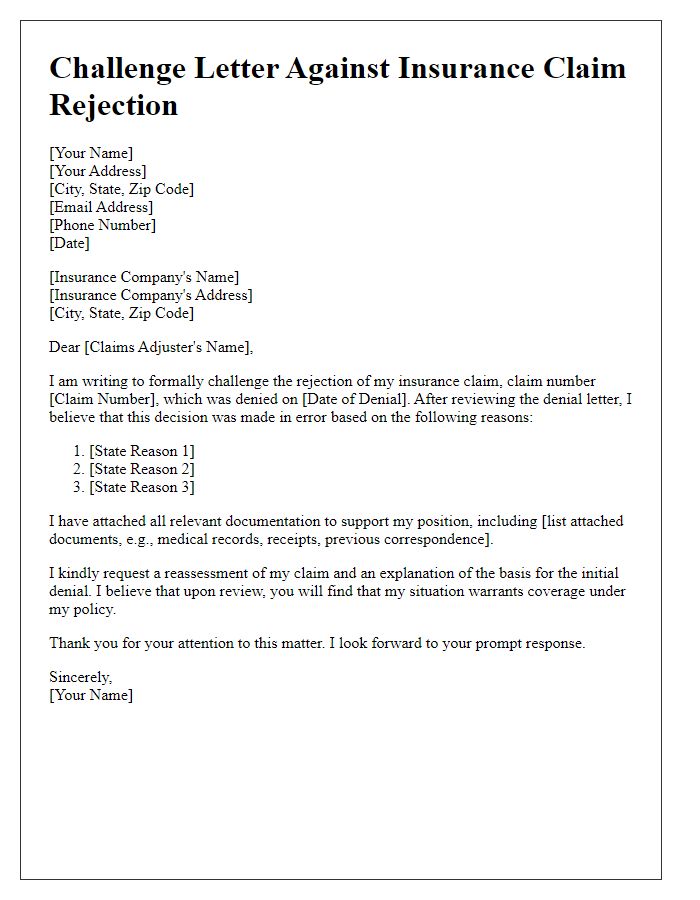

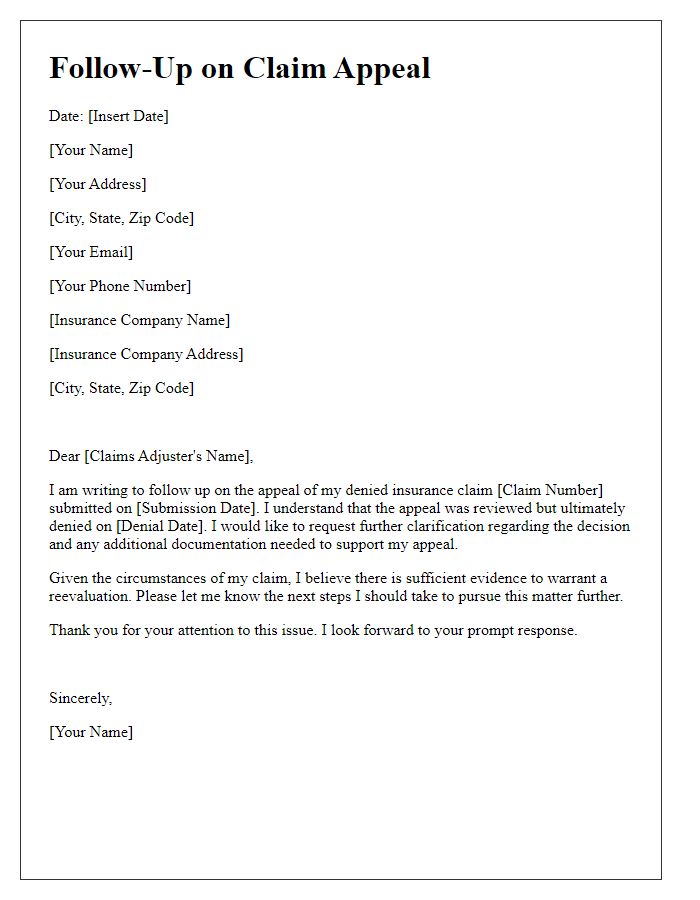

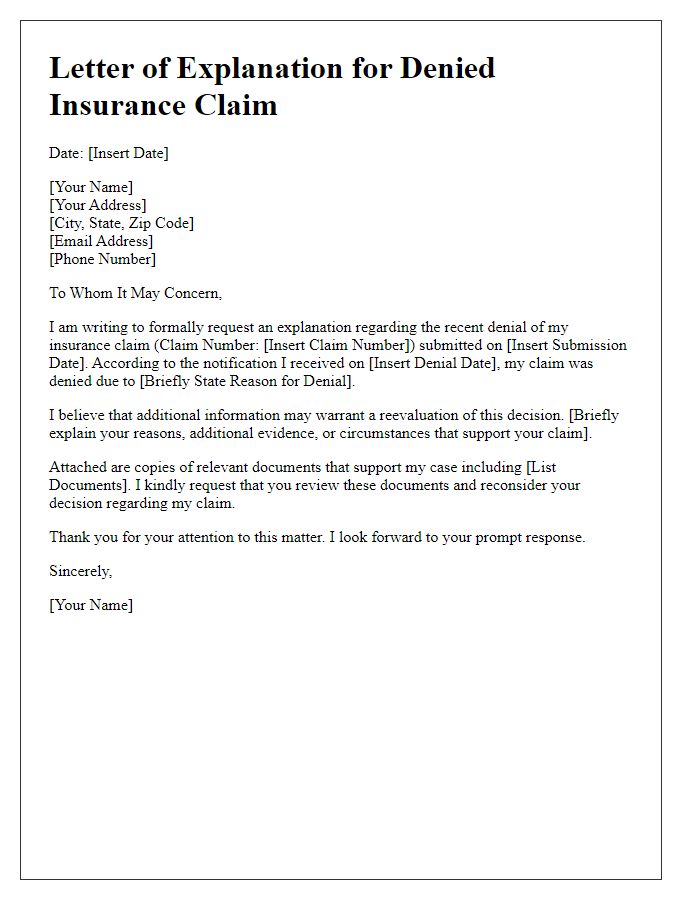

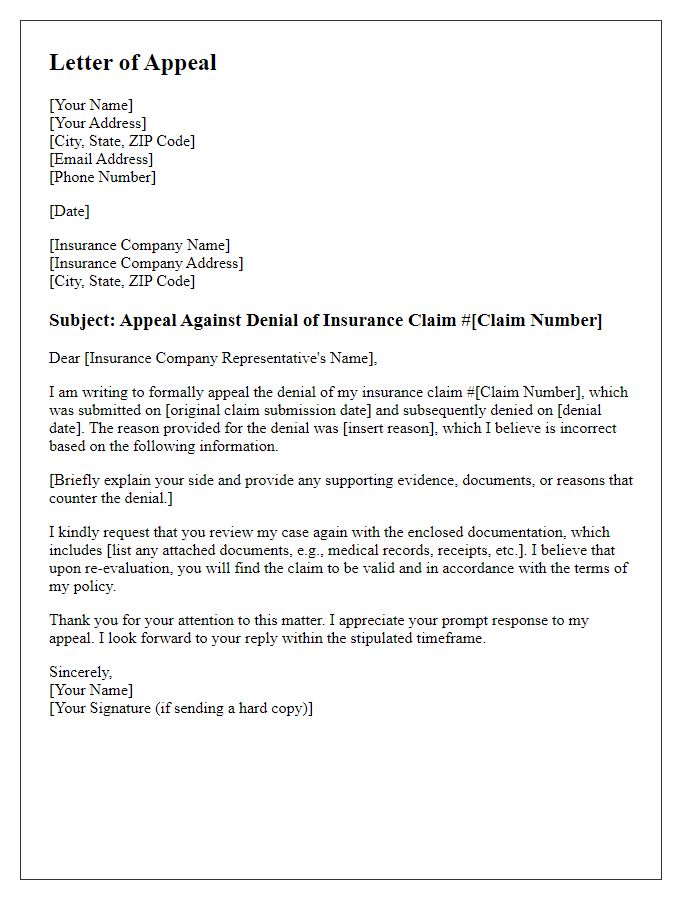

Have you ever faced the frustrating experience of having your insurance claim denied? It's more common than you might think, and many people feel overwhelmed when trying to navigate the appeals process. Fortunately, crafting a well-structured letter can make all the difference in getting your decision overturned. If you're ready to learn how to effectively appeal your denied insurance claim, keep reading for helpful tips and a sample template!

Policy information

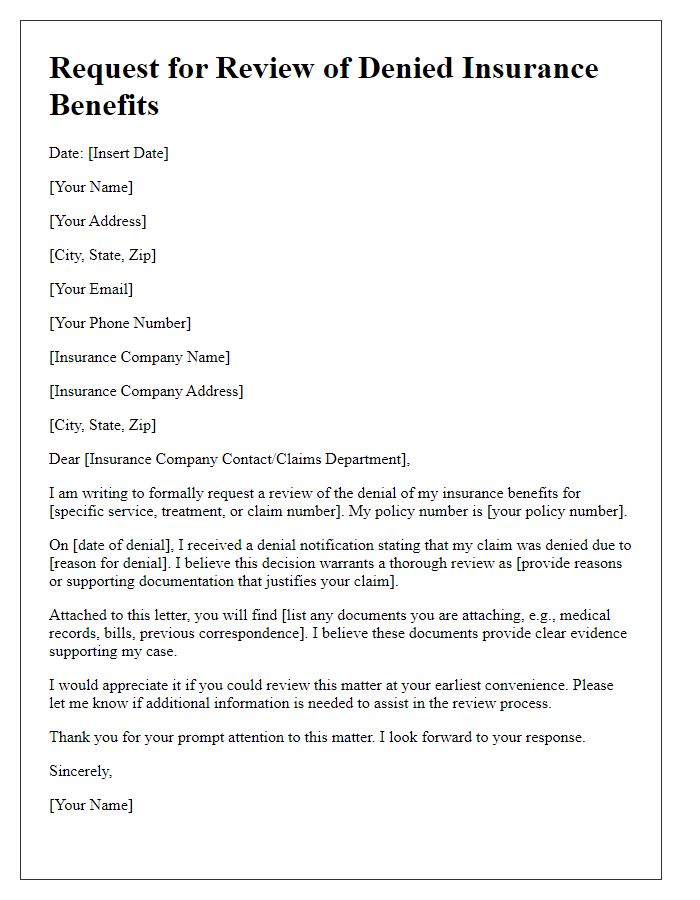

Navigating the intricacies of insurance policy frameworks can be challenging, especially when dealing with denied claims. Specific policy information, such as the policy number (often found on documentation or online account), is crucial for identification and reference. Filing an appeal requires a thorough understanding of the insurance contract, including terms and conditions that were allegedly violated. Furthermore, relevant timelines pertaining to claims processing (typically 30 days for initial claims and an additional 30 days for appeals) and communication (documenting each correspondence through email or recorded calls) can support your position in the appeal process. Accurate details from the claim itself, including dates of incidents, coverage limits, and any prior communications with insurance representatives, can strengthen your argument for reconsideration.

Specific denial reason

A denied insurance claim can lead to frustration and confusion, particularly when clear and specific reasons are given for the denial. Common reasons for denial may include insufficient documentation, pre-existing conditions, or claims submitted after the stipulated timeframe (usually within a year of the incident). Addressing these issues is crucial, as they can significantly impact the pathway to a successful appeal process. For instance, if an insurance policy specifically requires that medical records be submitted to validate a claim, lack of complete documentation can be a legitimate concern. It's essential to gather all relevant evidence, including bills, statements, and correspondence, that directly counteracts the insurer's stated reason for denial. By meticulously organizing this information and presenting a cohesive argument, individuals can enhance the likelihood of having their claims reconsidered effectively.

Supporting documentation

Many insurance claims can face denial due to insufficient supporting documentation or misunderstandings about the policy's terms. A comprehensive appeal often requires providing additional evidence, such as detailed medical records from healthcare professionals, photographs depicting on-site damages, or expert assessments. For instance, claims related to auto accidents may necessitate police reports, witness statements, or repair estimates to establish the legitimacy of the claim. Emotional distress caused by the incident should be documented through psychological evaluations or therapy reports, adding further credibility. Proper organization of these documents and clarity in articulating the reasons for appeal can significantly enhance the chances of a successful resolution with the insurance company.

Clear explanation of circumstances

An insurance claim denial can occur due to various reasons, including incomplete documentation or discrepancies in policy coverage. For instance, a homeowner's insurance claim for water damage may be denied if the policy specifically excludes flooding incidents. Affected homeowners (such as those in regions prone to heavy rainfall, like Houston, Texas) might find themselves confused and frustrated. Essential details include the date of the loss, the specific cause (like a broken pipe), and the policy number (including relevant terms and conditions). Providing clear photographs documenting the damage and repair estimates from licensed contractors can reinforce the appeal. To support the claim, presenting a detailed timeline of events leading to the loss (including conversations with insurance representatives) can be instrumental in demonstrating the validity of the appeal.

Contact information for further communication

In the event of a denied insurance claim, it is crucial to provide comprehensive contact information to facilitate further communication. Include your full name, such as John Smith, along with your insurance policy number (Policy #123456789) for reference. Additionally, provide a mailing address (e.g., 123 Main Street, Springfield, IL 62704) where correspondence can be sent. Include a reliable phone number (e.g., (555) 123-4567) for immediate inquiries, ideally during business hours (Monday to Friday, 9 AM to 5 PM). An email address (e.g., johnsmith@email.com) ensures prompt electronic communication. Clearly state your preferred method of contact to enhance the efficiency of the appeal process.

Comments