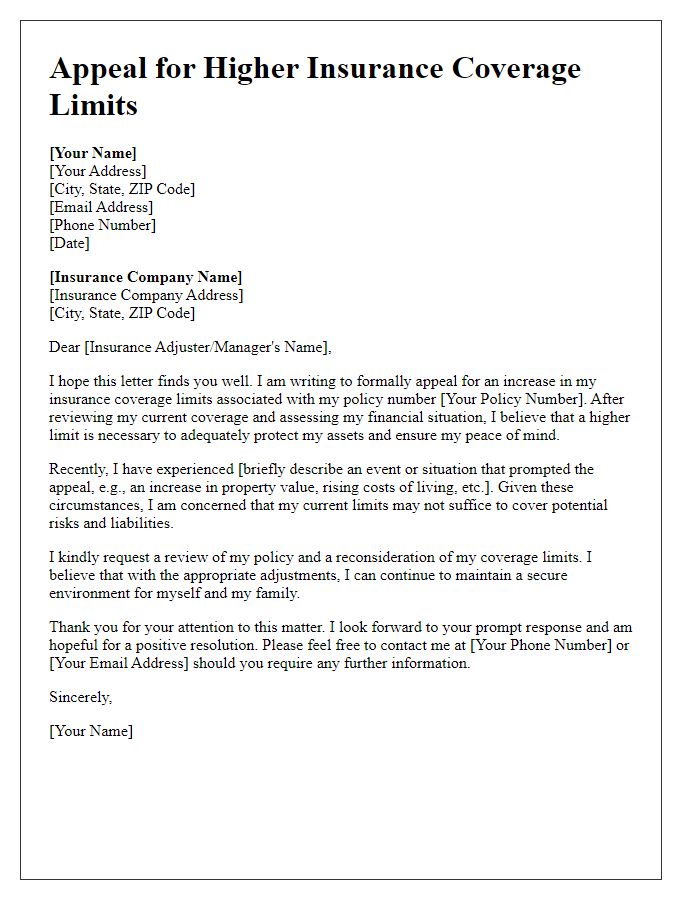

Are you considering increasing your insurance coverage limit but unsure how to begin? It's essential to ensure that your assets are adequately protected, and an increase in your coverage can provide you with peace of mind. In this article, we'll guide you through a sample letter template that clearly outlines the necessary steps for requesting an insurance coverage limit increase. So, let's dive in and get you the protection you deserve!

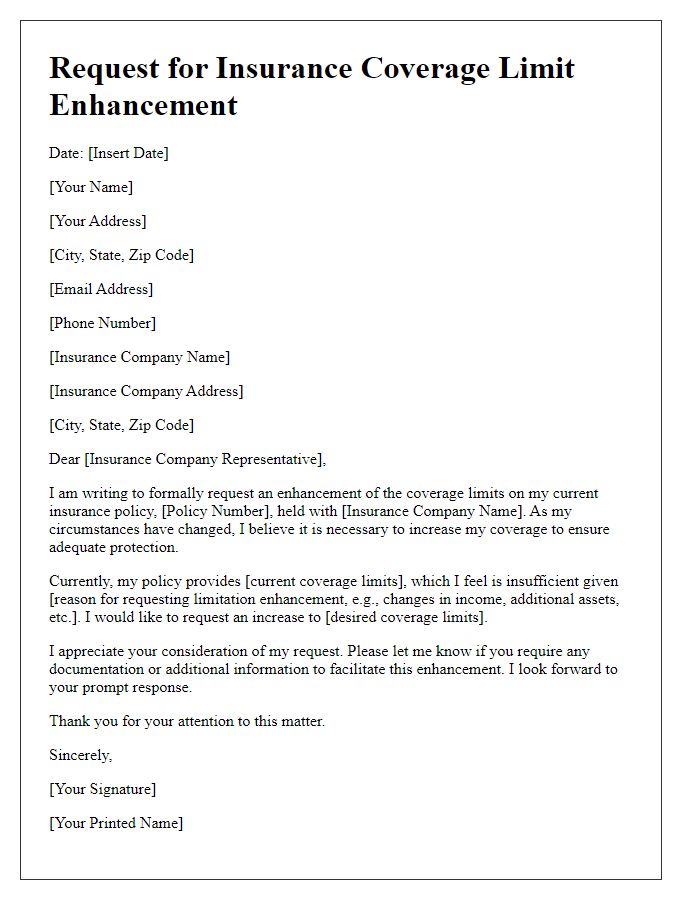

Policyholder Information

Insurance coverage limits often require adjustments to meet evolving needs. Policyholders, individuals or businesses insured under a specific policy, should carefully consider their current coverage amounts in light of potential risks, assets, and liabilities. For instance, homeowners may face increased risks due to local weather events, such as Hurricanes in Florida, and may need to request a coverage limit increase on their property insurance. Furthermore, small business owners in bustling areas like New York City may reassess their general liability coverage, recognizing the potential financial impact of accidents or lawsuits. Understanding policy details, including deductibles and premium adjustments, is crucial before formally submitting a request for an increase in coverage limits.

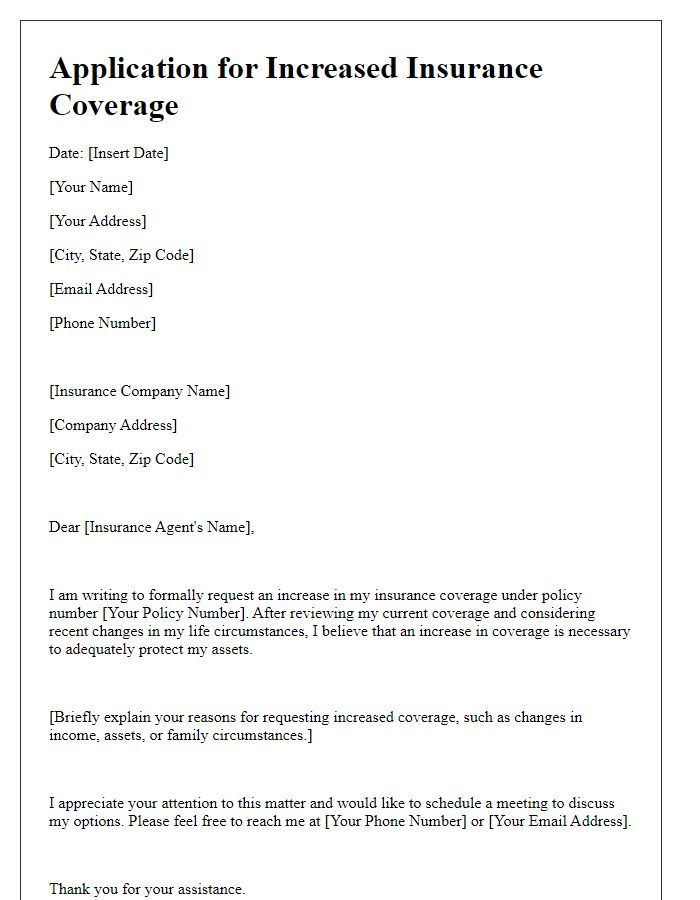

Current Coverage Details

Current insurance coverage details reveal the standard policy limits that protect valuable assets. For example, a homeowners insurance policy typically includes dwelling coverage, which insures the home structure for amounts like $250,000, offering a safety net against risks such as fire or theft. Personal property coverage can encompass belongings such as electronics and furniture, often set at a limit of 50% of dwelling coverage, translating to $125,000 in this case. Further, liability protection, which safeguards against legal claims or injuries occurring on the property, usually carries a limit of $300,000. Additional structures coverage, protecting fences or detached garages, might be an extra 10% of the dwelling limit. Recognizing evolving needs can emphasize the importance of re-evaluating these limits to ensure adequate protection against unforeseen events or inflation.

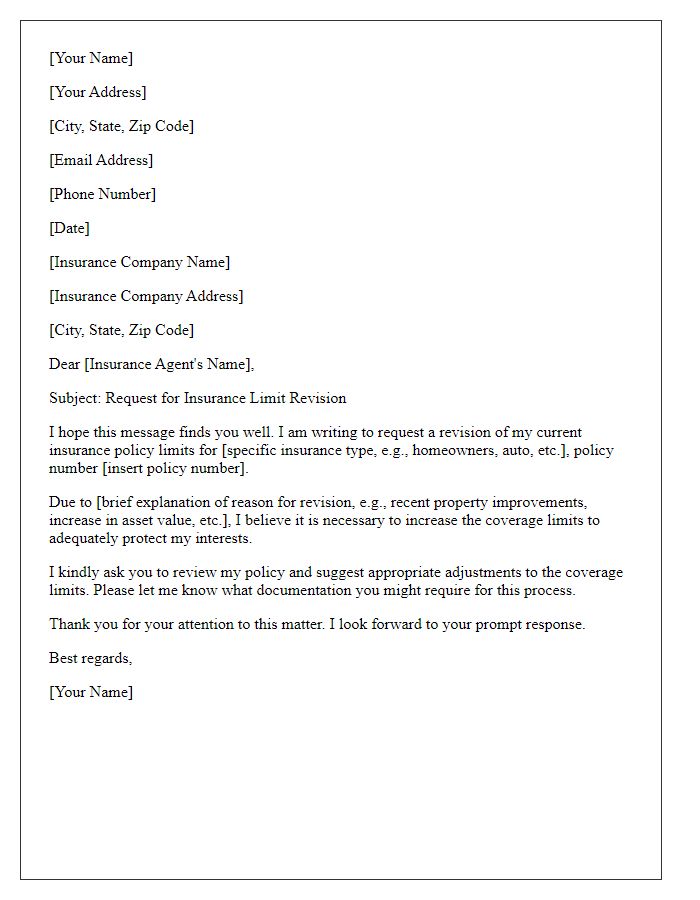

Reason for Coverage Limit Increase

Requesting an increase in insurance coverage limits is essential for ensuring adequate protection against potential risks. Increased property values, particularly in metropolitan areas experiencing rapid growth, may necessitate higher coverage limits to safeguard assets effectively. For instance, homes in cities like San Francisco or New York can appreciate swiftly, where median home prices often exceed $1 million. Additionally, considering changing life circumstances, such as the birth of a child or acquiring new assets, accentuates the need for expanded coverage to mitigate financial losses in unforeseen events. Rising healthcare costs and advancements in medical technology further push the need for enhanced health insurance limits, as treatment for severe conditions can reach hundreds of thousands of dollars. Regularly reviewing and adjusting insurance coverage ensures that individuals remain protected in an evolving financial landscape.

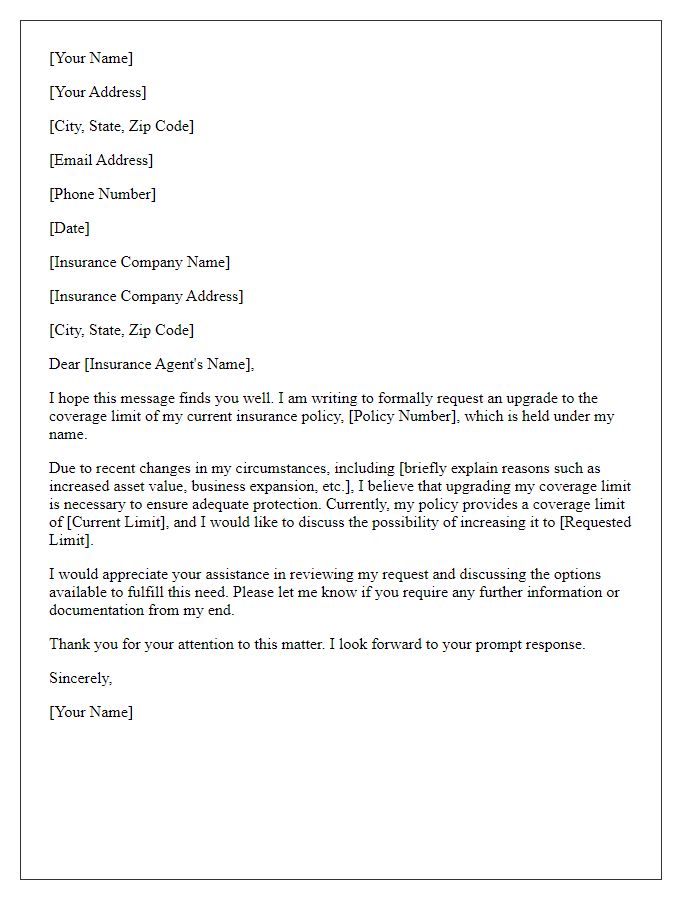

Desired Coverage Amount

Increasing insurance coverage limits can enhance financial protection against potential risks associated with severe incidents. A comprehensive evaluation of the desired coverage amount, reflecting factors like the value of assets, projected liabilities, and economic conditions, is crucial. For instance, homeowners in high-risk areas, such as hurricane-prone regions like Florida, may benefit from raising their policy limits to cover potential damages exceeding $300,000 due to natural disasters. Additionally, businesses operating in sectors like technology may consider elevating their liability coverage to $1 million to guard against costly lawsuits linked to data breaches or product failures. Regular reviews of current market trends and personal needs can guide policyholders in determining appropriate coverage levels.

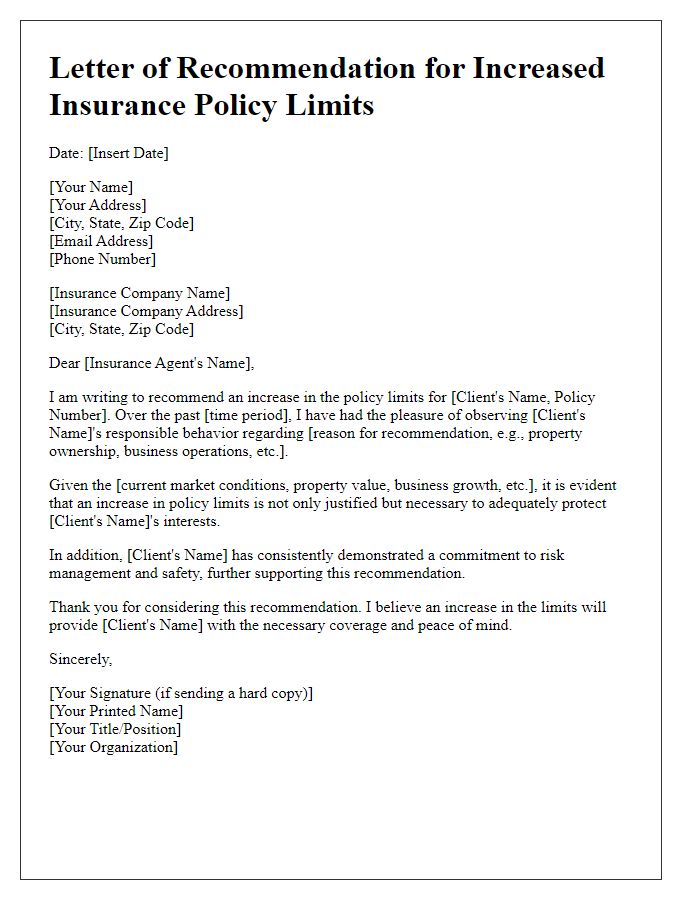

Contact Information and Signature

Contacting your insurance provider for an increase in coverage limit can enhance your financial protection. When drafting your request, include your policy number (specific to your coverage) to ensure efficient processing. Clearly mention the existing coverage limit, alongside your desired limit which could align with current market values, especially if your assets have appreciated. Highlight any recent changes in your personal circumstances, such as home renovations or acquisitions of high-value items, necessitating increased coverage. Provide your current contact information, including phone number and email, to facilitate swift communication. Lastly, include a formal signature for authenticity, ensuring all details necessary for processing your request are accessible.

Comments