Changing your address can be a bit of a chore, but it's important to keep your insurer in the loop to ensure your coverage remains intact. Notifying your insurer about your new address ensures that all communications, policies, and claims are seamlessly managed. Plus, it helps you avoid any potential coverage gaps that may arise from outdated information. Curious about how to draft the perfect letter for this task? Read on to find out!

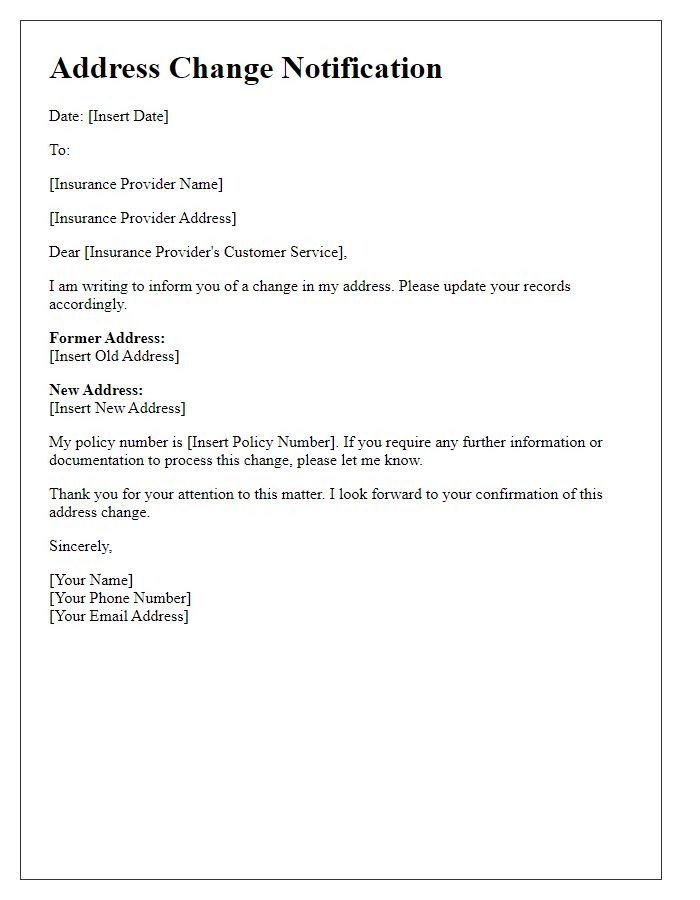

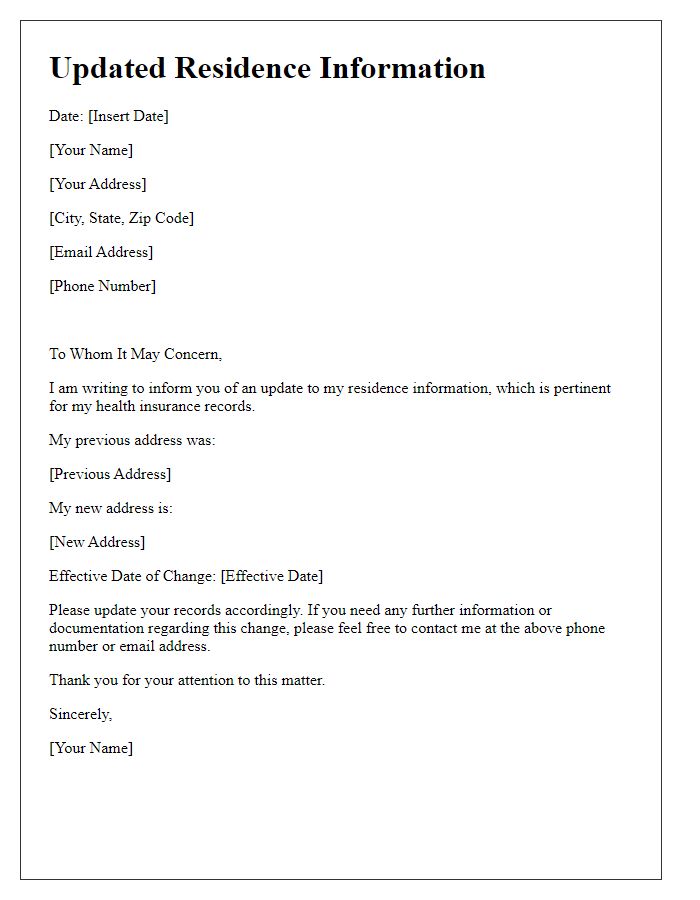

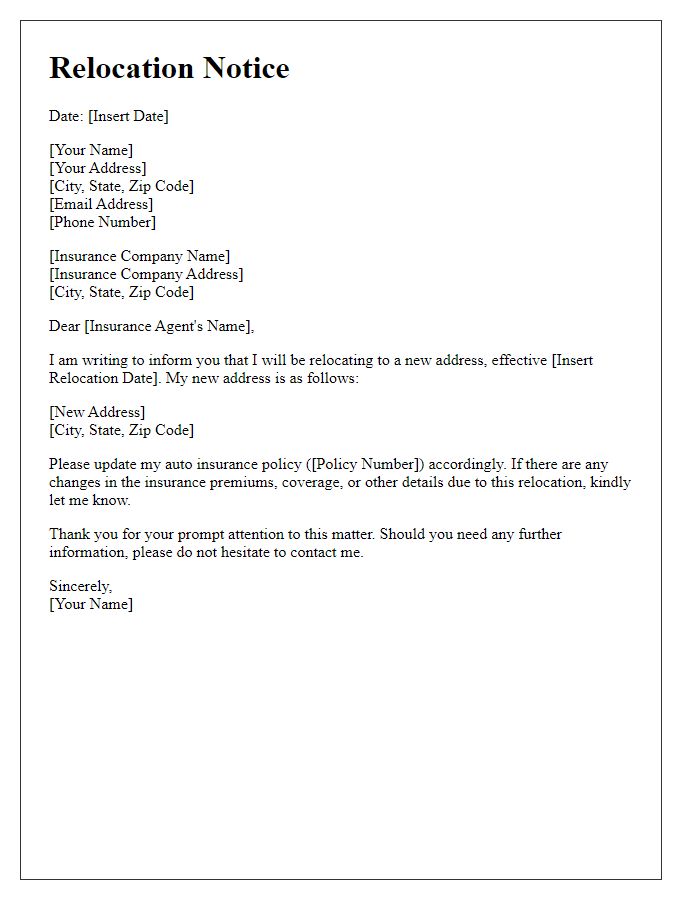

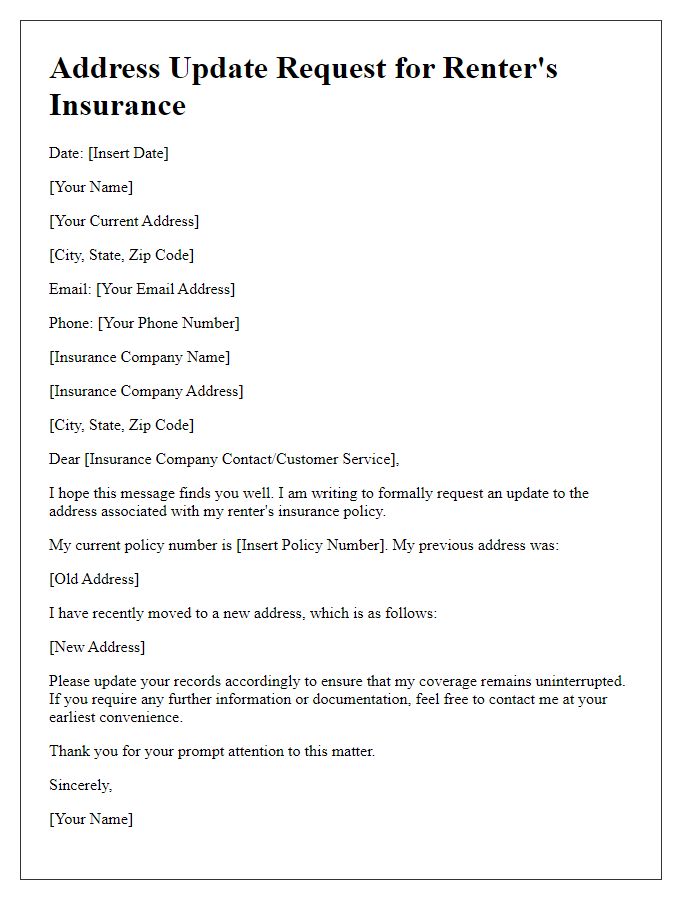

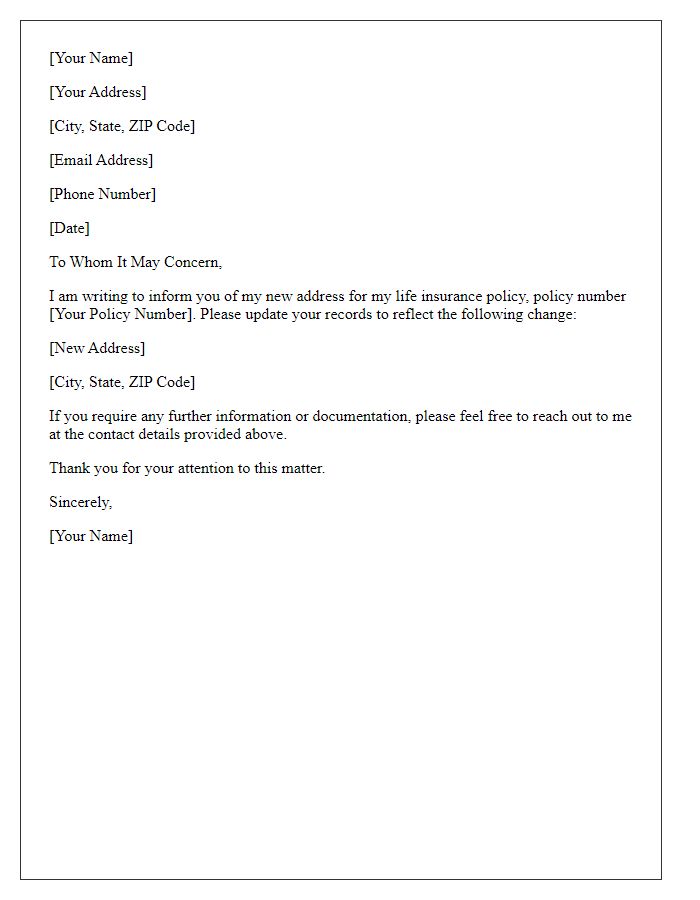

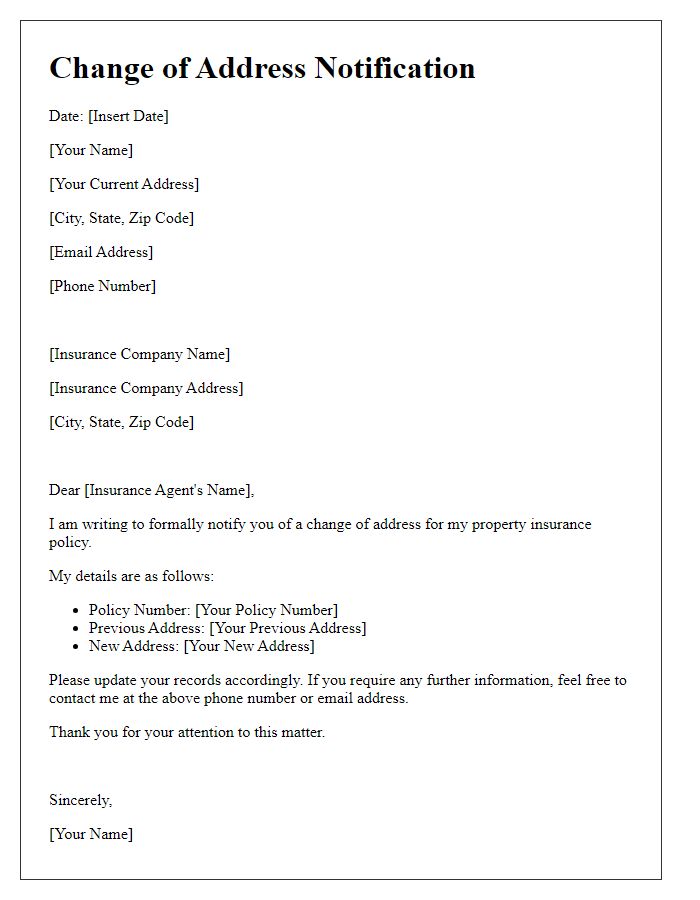

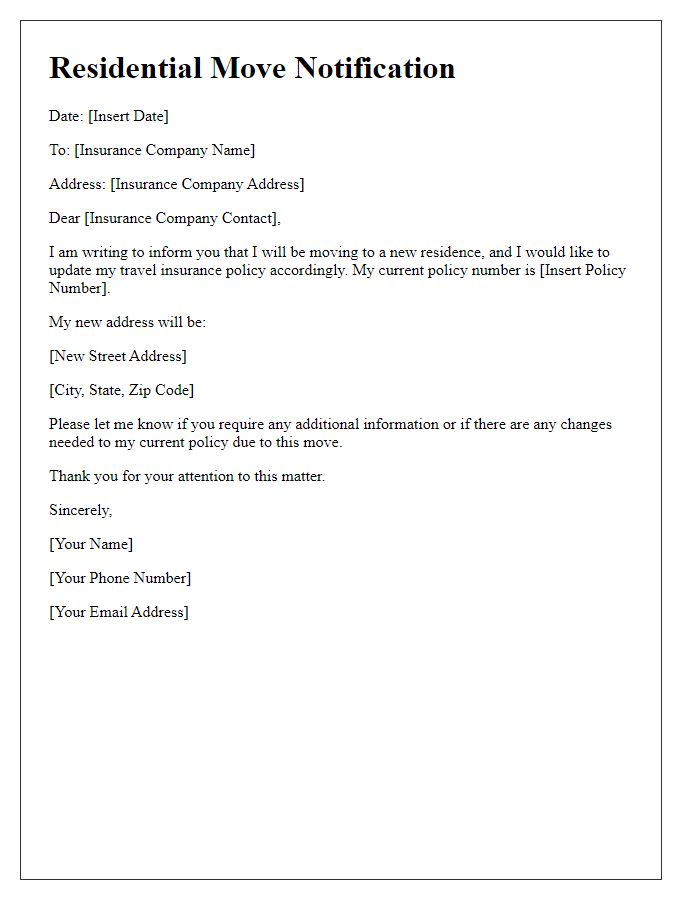

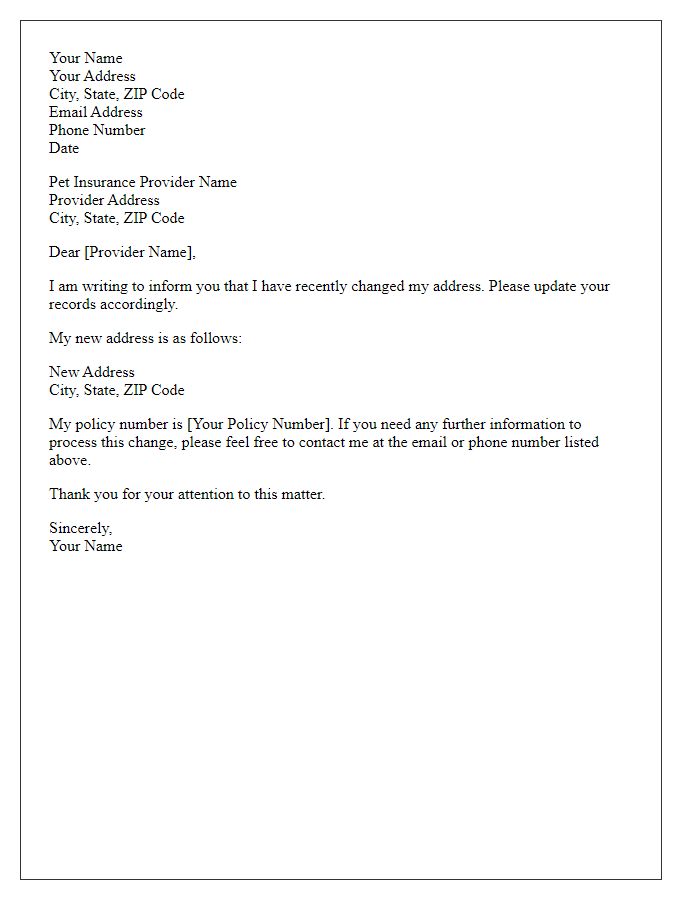

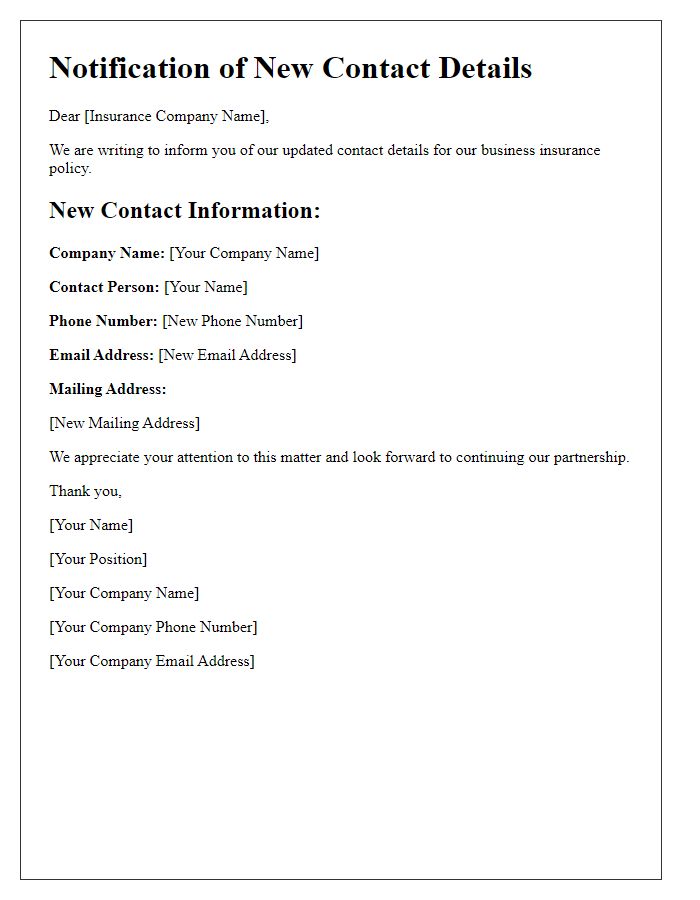

Policyholder's name and contact information

Address changes must be communicated to insurers promptly. Policyholders should provide their full name, including any middle initials or suffixes, and current contact details, such as phone numbers (including area codes) and email addresses. The updated address must include complete street information, city, state, and zip code, ensuring accurate and timely updates in the insurer's records. This notification helps maintain seamless communication regarding policy changes, claims, and billing information, preventing any lapses in coverage or service.

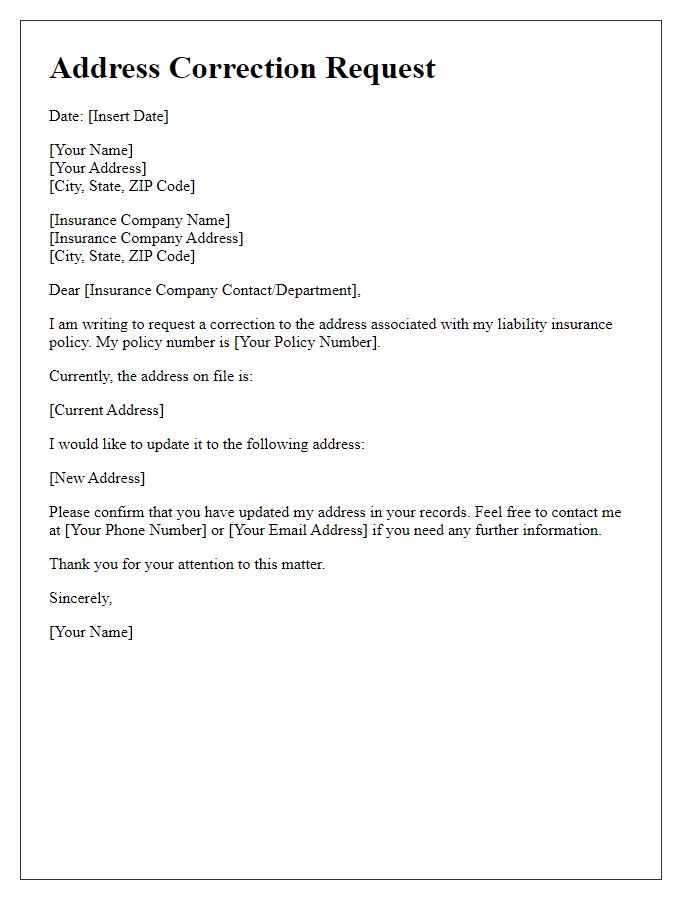

Policy number(s)

Updating personal information with an insurance provider ensures that policy records remain accurate and all communications can reach the policyholder effectively. Address changes might affect coverage details, billing information, and risk assessments, particularly in regions prone to natural disasters or where premiums vary significantly, such as California's fire-prone areas or Florida's hurricane zones. When notifying an insurer, it's essential to include the policy number(s) associated with home, auto, or health insurance to facilitate efficient processing. Prompt notification minimizes the risk of disruptions in coverage or miscommunication regarding claims.

Old address details

When policyholders relocate, it's essential to inform their insurance provider about the address change to ensure coverage continuity. The previous residential address must include street number, street name, city, state, and zip code for accurate record updates. Additionally, it's crucial to mention policy numbers associated with the old address, enabling insurers to locate the pertinent records easily. Notifying the insurer promptly about the new address helps maintain communication channels and facilitates quick processing of any claims or policy adjustments in the future.

New address details

A change of address notification is essential for maintaining effective communication with insurance providers, ensuring that critical documents and correspondence reach the correct location. When notifying an insurer, include specific details such as the current address and the new address, including the zip code, to avoid processing delays. Document all relevant policy numbers associated with your insurance policies, such as auto, home, or health insurance, to facilitate the update process. Providing a reliable contact number will enhance the insurer's ability to verify the change and address any potential issues. Maintaining accurate records helps in the timely processing of claims and reduces the risk of disruptions in coverage.

Effective date of address change

Insurers require timely notification of address changes to maintain accurate records and ensure uninterrupted service. An effective address change notice should include crucial details such as the policyholder's name, the old address, the new address, and the date when the new address will take effect, ideally aligning with the start of a new month (e.g., November 1, 2023). Additionally, incorporating the policy number helps in quick identification and processing by the insurance company's administrative staff. Providing multiple contact methods, such as phone numbers and email addresses, fosters quicker communication should the insurer require further details about the change.

Comments