Are you feeling overwhelmed by the complexities of navigating a liability insurance claim? You're not aloneâmany people find this process daunting, especially when facing delays or denied claims. In this article, we've crafted a clear and concise letter template to help you effectively escalate your liability insurance claim, ensuring that your voice is heard. So, let's dive in and empower you with the tools to take control of your situation!

Specific Claim Details (Policy Number, Incident Date)

A liability insurance claim escalation often involves crucial claim details that guide the review process. The policy number, a unique identifier assigned to an insurance policy, allows for tracking and management of claims. The incident date, when the event leading to the insurance claim occurred, plays a vital role in establishing the timeline and context of the situation. These details are essential for ensuring that the claim is processed efficiently and accurately within the insurance company, like State Farm or Allstate, known for their extensive claims handling systems. Providing comprehensive information regarding the circumstances of the claim, including any relevant documentation such as police reports, photographs, or witness statements, can significantly enhance the chances of a favorable outcome.

Clear Statement of Complaint or Issue

A liability insurance claim escalation often arises from unresolved issues concerning policy coverage or disputed claim settlements. Claimants may feel dissatisfied due to delays in processing, inadequate compensation amounts, or insufficient communication from the insurance provider. Specific incidents, such as a traffic accident in Los Angeles, California, or property damage due to a storm in Florida, can further complicate the process, leading individuals to seek clarity on their coverage terms outlined in their policy documents. Escalating the claim typically involves submitting detailed documentation of the incident, previous correspondence with the insurance company, and a clear statement indicating the desired outcome, such as a reevaluation of the claim or a comprehensive explanation of the denial. This process may require engaging legal assistance or a consumer advocacy group to ensure the claim receives necessary attention.

Relevant Supporting Documentation (Photos, Reports)

Incorporating relevant supporting documentation is crucial when escalating a liability insurance claim, as it strengthens the case and provides clear evidence of the incident's details. Photographs capturing the scene, such as damage to property or injuries, allow for a visual understanding of the circumstances surrounding the claim. Detailed reports from events, such as police reports or incident reports from first responders, can provide official accounts and timelines of the incident. Additionally, medical records detailing injuries or treatments can substantiate claims of physical harm. Collectively, these documents serve as critical components in the escalation process, facilitating a thorough evaluation by the insurance adjuster, and ultimately influencing the outcome of the claim.

Previous Correspondence History with Insurer

Escalation of a liability insurance claim often arises from unresolved issues with an insurer, requiring a thorough overview of previous correspondence. Claim reference number 1234567 pertains to an incident that occurred on March 15, 2023, at Main Street Park in Springfield, where a slip and fall resulted in significant injuries to an individual. Initial notification sent on March 20, 2023, detailed the incident and included photographs, witness statements, and medical records. Follow-up emails dated April 5, 2023, and May 10, 2023, inquired about claim status without response. A phone call on June 1, 2023, confirmed the claim was under review but no updates provided. The most recent correspondence dated June 15, 2023, expressed frustration regarding delays and requested a timeline for resolution. The lack of communication and prolonged handling is now prompting this escalation.

Request for Prompt Resolution or Immediate Action

A liability insurance claim escalation occurs when a policyholder seeks urgent attention regarding claims processing. The escalation aims to expedite resolution for claims, often related to incidents such as personal injuries or property damage. In the case of an unresolved claim, a policyholder may cite the claim number (e.g., 123456) and the date of the incident (e.g., January 15, 2023) to ensure clarity. Documentation like photographs of the event location (e.g., Main Street, Springfield) and medical reports from local hospitals can support the urgency of the request. This communication often requests immediate action from claims adjusters, emphasizing the necessity of timely responses to alleviate any financial burdens incurred. Additionally, regulatory deadlines may apply, making prompt resolution critical to remain compliant with state insurance regulations.

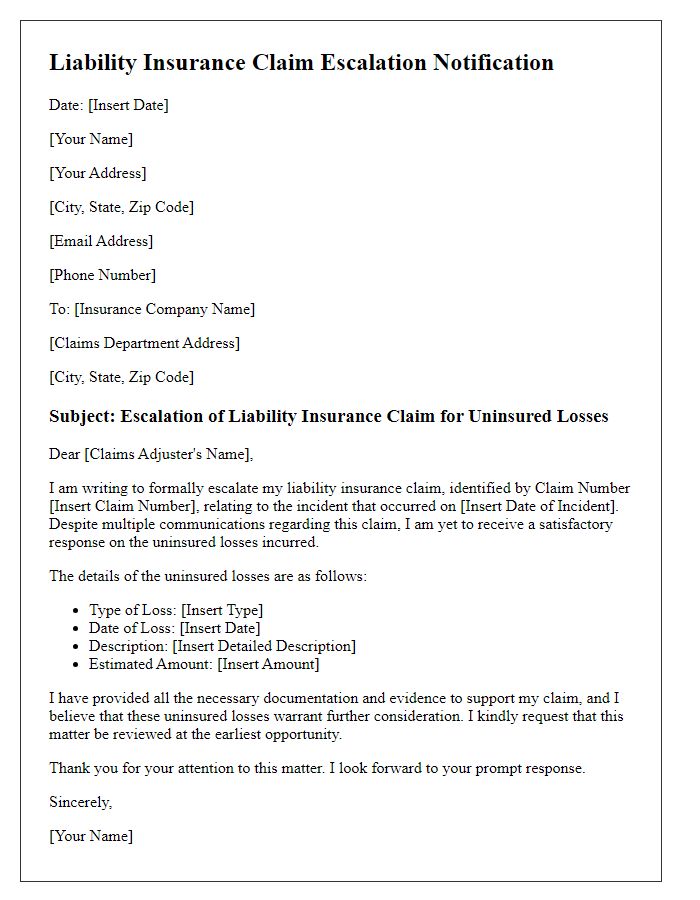

Letter Template For Liability Insurance Claim Escalation Samples

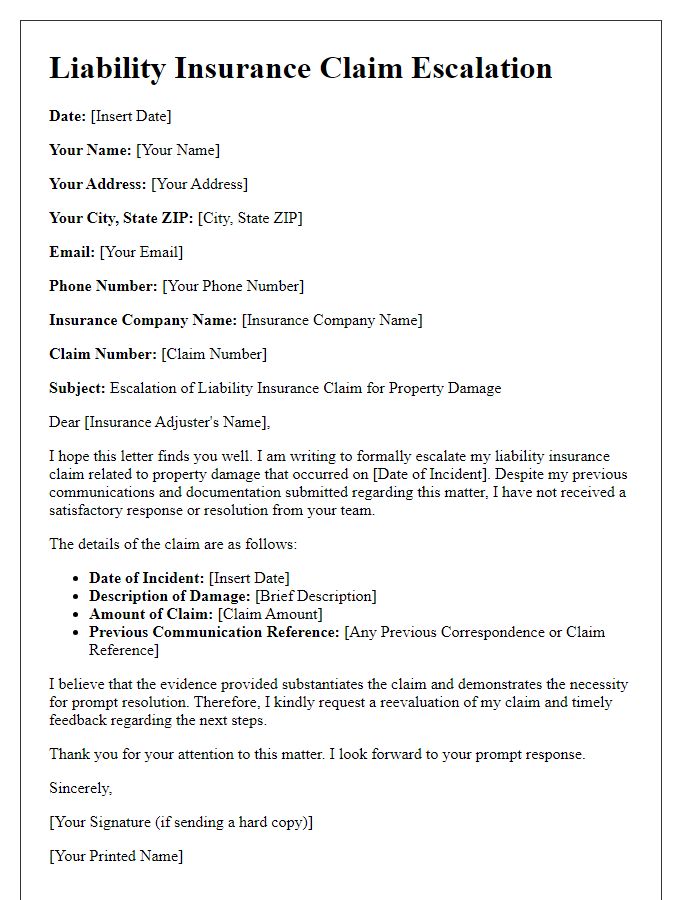

Letter template of liability insurance claim escalation for property damage.

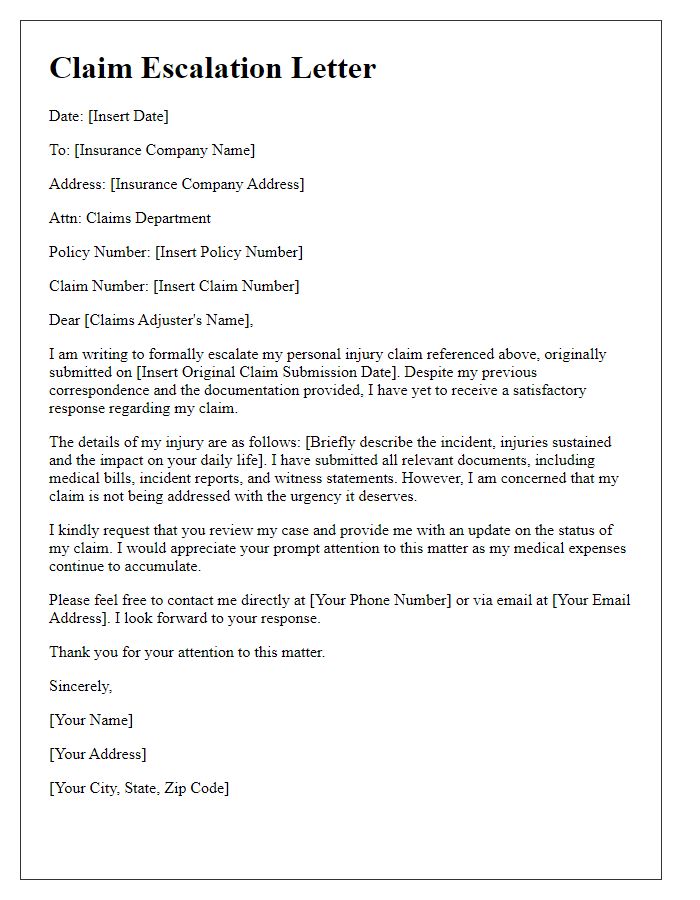

Letter template of liability insurance claim escalation for personal injury.

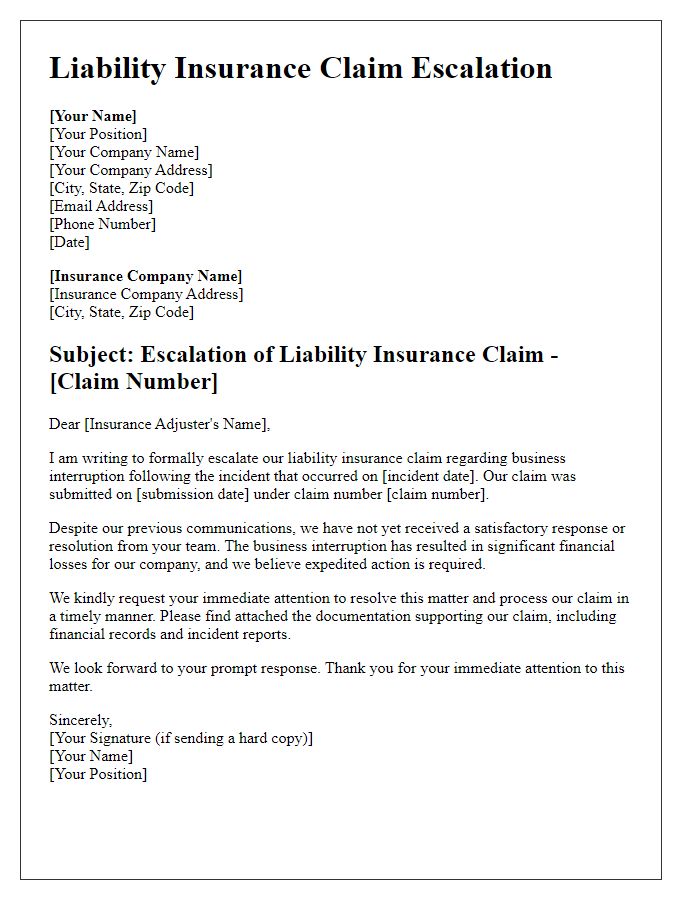

Letter template of liability insurance claim escalation for business interruption.

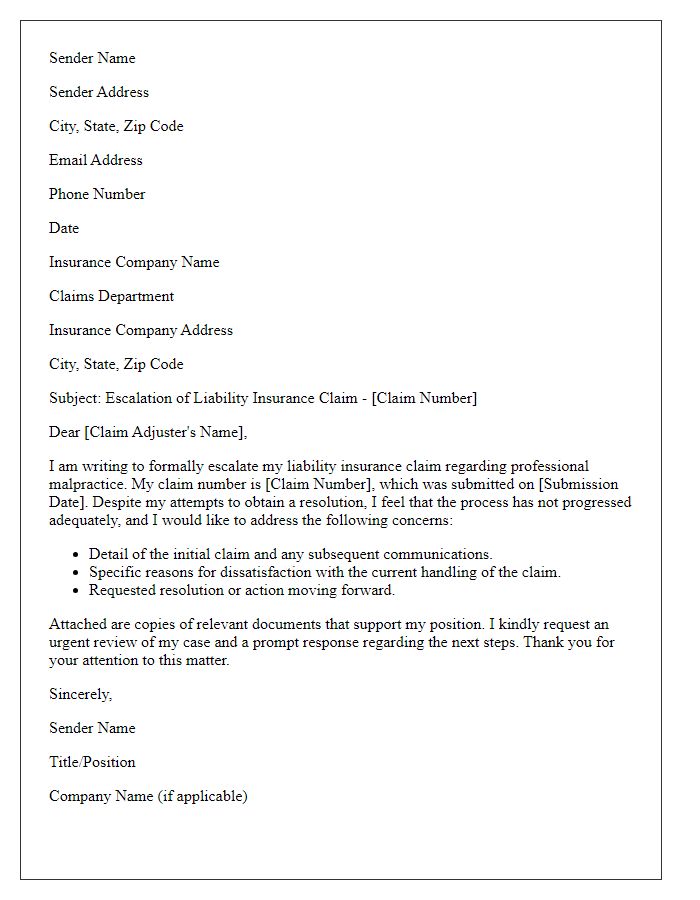

Letter template of liability insurance claim escalation for professional malpractice.

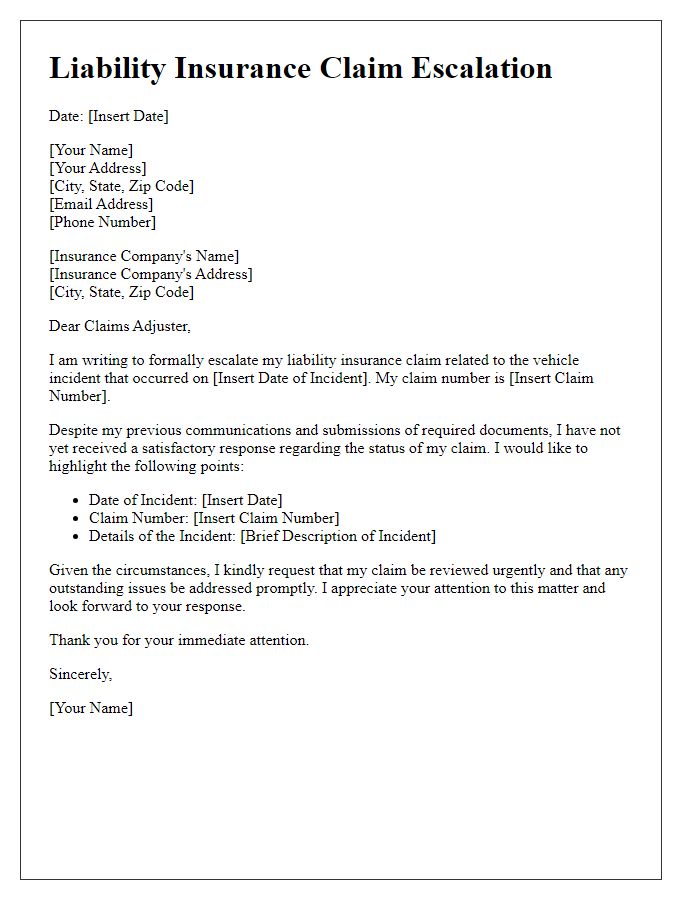

Letter template of liability insurance claim escalation for vehicle incident.

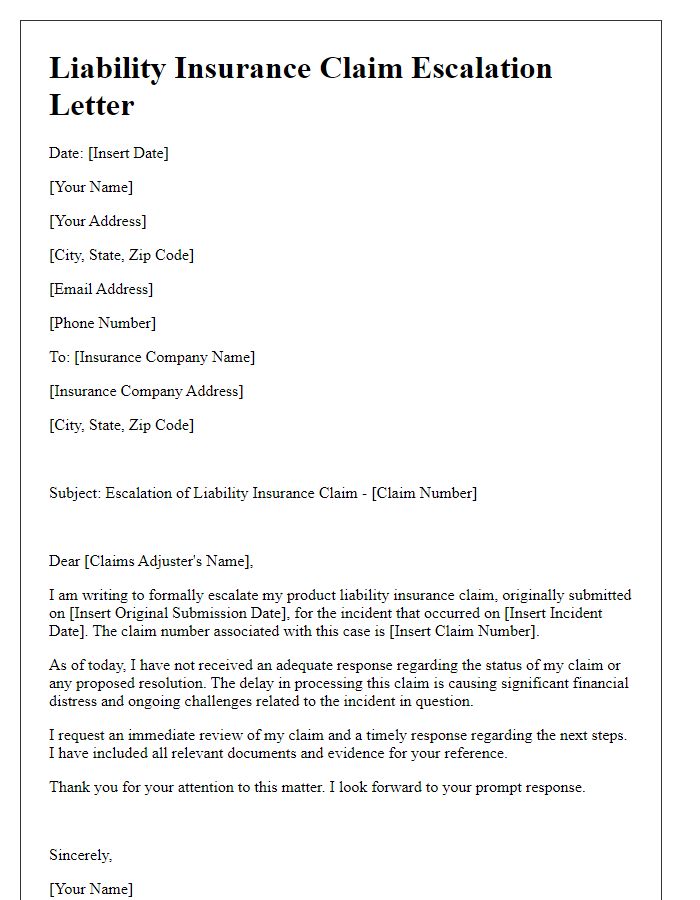

Letter template of liability insurance claim escalation for product liability.

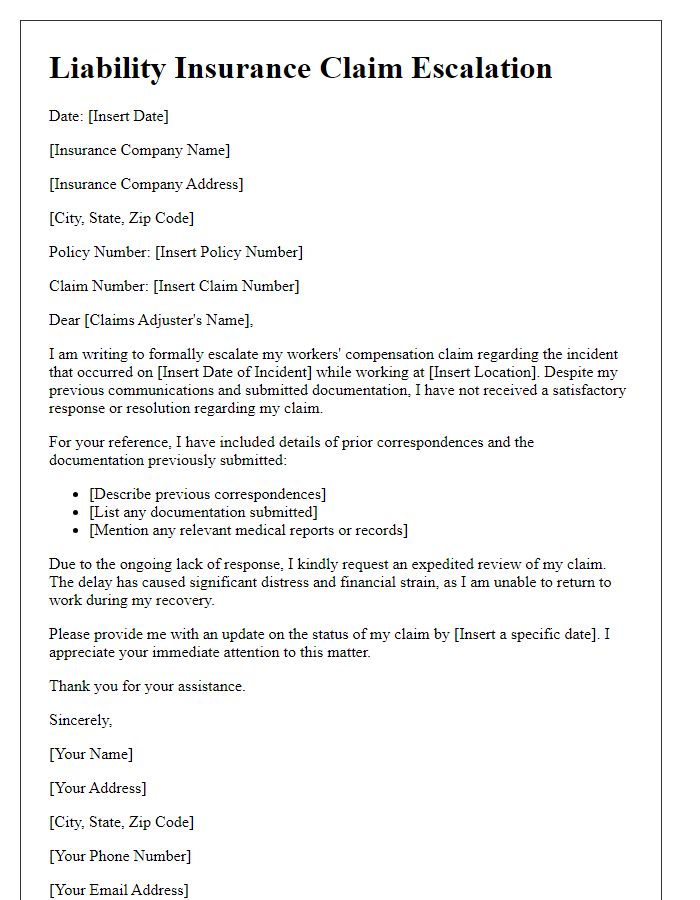

Letter template of liability insurance claim escalation for workers’ compensation.

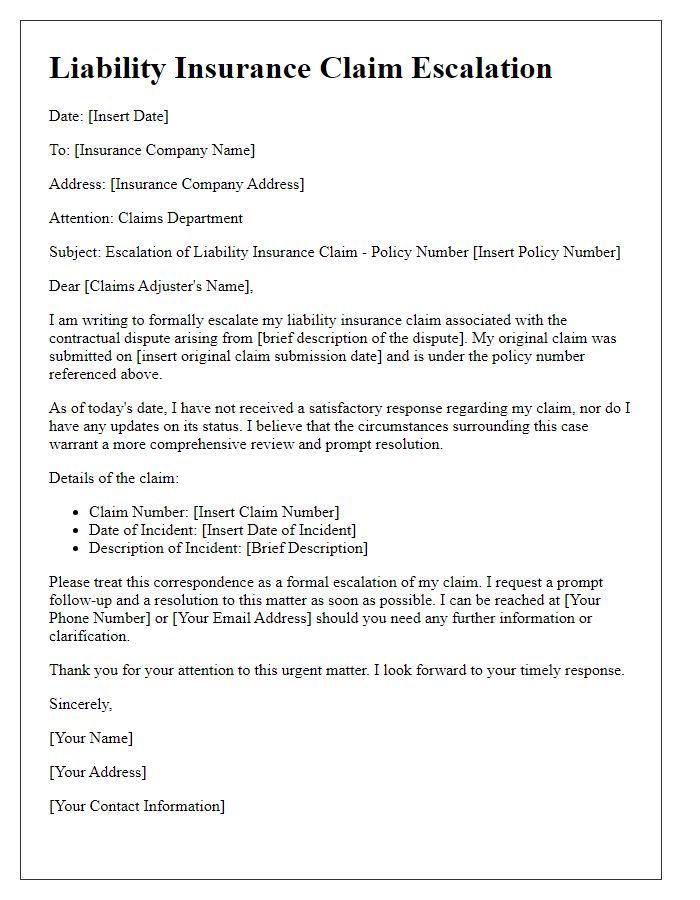

Letter template of liability insurance claim escalation for contractual disputes.

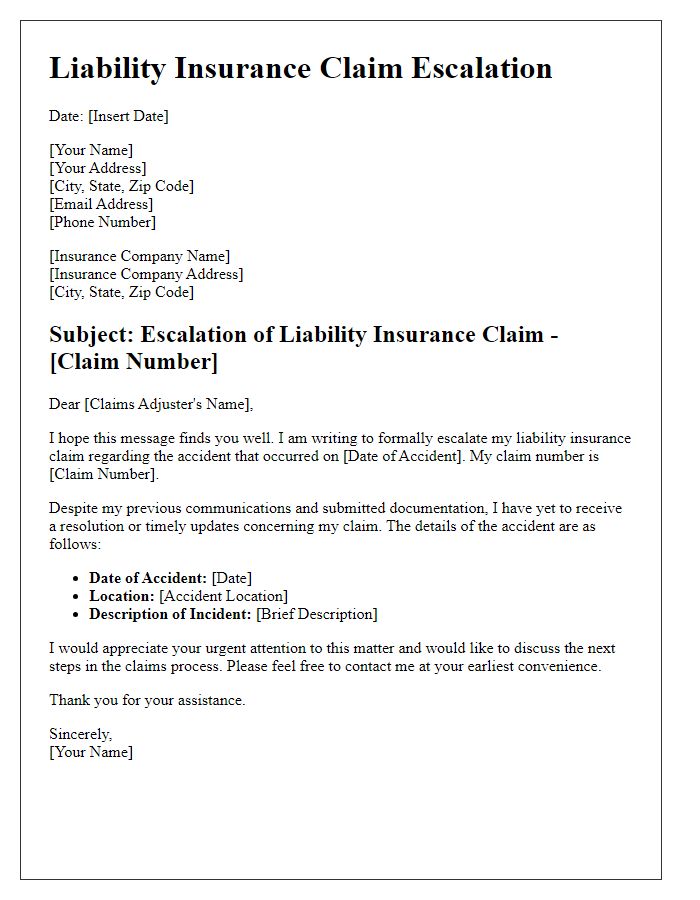

Letter template of liability insurance claim escalation for accident claims.

Comments