Are you ready to ensure your home is protected with the best insurance coverage possible? Scheduling a home insurance inspection is a crucial step in understanding your policy options and identifying potential risks. This friendly conversation between you and your insurance provider can lead to tailored solutions that fit your unique needs. Join us as we explore the essentials of preparing for your upcoming appointment and what to expect during the inspection processâread on to get the insights you need!

Contact Information

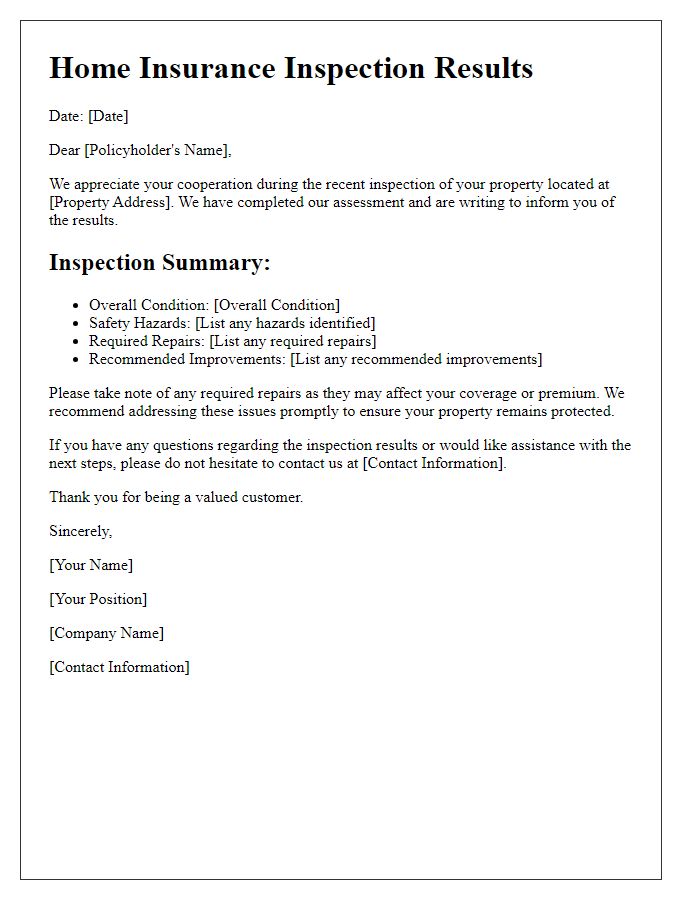

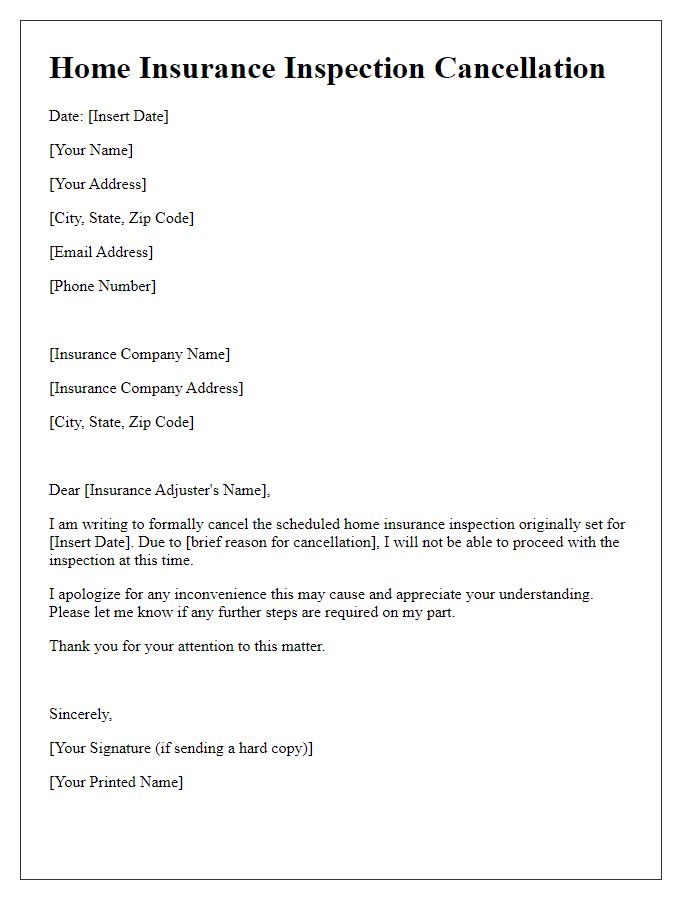

Home insurance inspections play a crucial role in assessing property risk and ensuring adequate coverage. Insurers typically conduct these evaluations to identify potential hazards, such as outdated electrical systems or inadequate plumbing, that could lead to claims. During the inspection process, homeowners may need to provide access to various areas of the property, including the attic, basement, and exterior, ensuring that inspectors can thoroughly assess the condition of the home. Following the inspection, insurers may offer recommendations for repairs or enhancements that can lower premiums or increase property value, ultimately impacting the homeowner's insurance policy.

Purpose of Inspection

Home insurance inspections serve to assess risks associated with a property to determine suitable coverage and premiums. Inspectors evaluate conditions of key elements such as roofing, plumbing, wiring, and structural integrity. Identifying potential hazards (e.g., outdated electrical systems from the 1960s or roof damage from storm events) can lead to tailored recommendations for improvements. For insurers, this data aids in mitigating liability and ensuring policyholders maintain safety standards. This proactive approach diminishes the likelihood of claim disputes and fosters a clearer understanding of the home's insurability status, ultimately benefiting both the homeowner and the insurer.

Date and Time

Home insurance inspections are essential evaluations conducted by insurance companies to assess property conditions, coverage adequacy, and potential risks associated with homes, typically scheduled at convenient times for homeowners. Commonly requested dates and times for appointments include weekdays and early evenings, aligning with typical work hours. Inspectors usually check for key attributes such as roof condition (age, material type), structural integrity (foundation stability, wall damages), and safety features (smoke detectors, security systems). Homeowners often receive confirmations via email or phone call, ensuring clarity regarding preparation and specific requirements needed before the inspection, including property access arrangements.

Preparation Instructions

Home insurance inspection preparation requires careful organization and attention to detail to ensure a smooth process. Gather all relevant documents, including the current insurance policy and any previous inspection reports, typically from the last 2 years. Make a checklist of necessary home features such as plumbing systems (including leaks), electrical systems (wiring age and condition), roof details (age and type), and any safety installations (smoke detectors, carbon monoxide detectors). Ensure that access points to attics, basements, and crawlspaces are clear of clutter. Schedule maintenance tasks, such as servicing HVAC units or clearing gutters, ahead of the appointment. Check for compliance with local building codes and gather receipts for recent upgrades or renovations to showcase the home's value and safety measures. Confirm the scheduled time with the inspector, typically a professional from the insurance company, to avoid any last-minute inconveniences and ensure an efficient inspection process.

Contact for Questions

Homeowners insurance inspections assess property condition and coverage adequacy. Appointment scheduling typically involves trained inspectors from insurance companies, ensuring thorough evaluation of key areas like roofing, plumbing, and electrical systems. Homeowners should prepare documentation, including previous inspection reports and maintenance records. Inspectors may review safety features, such as smoke detectors and security systems, to determine compliance with policy standards. Questions regarding coverage options, premiums, and claim processes can arise, making it crucial to contact the insurance representative for clarification. Timely communication can enhance understanding and lead to more favorable inspection outcomes.

Comments