When life takes unexpected turns, it's crucial to be prepared, especially when it comes to protecting your loved ones. Updating your funeral insurance policy is an essential step in ensuring that everything is in order during difficult times. This article will guide you through the key elements to consider and the process to make necessary updates smoothly. Join me as we explore how to secure peace of mind for both you and your family.

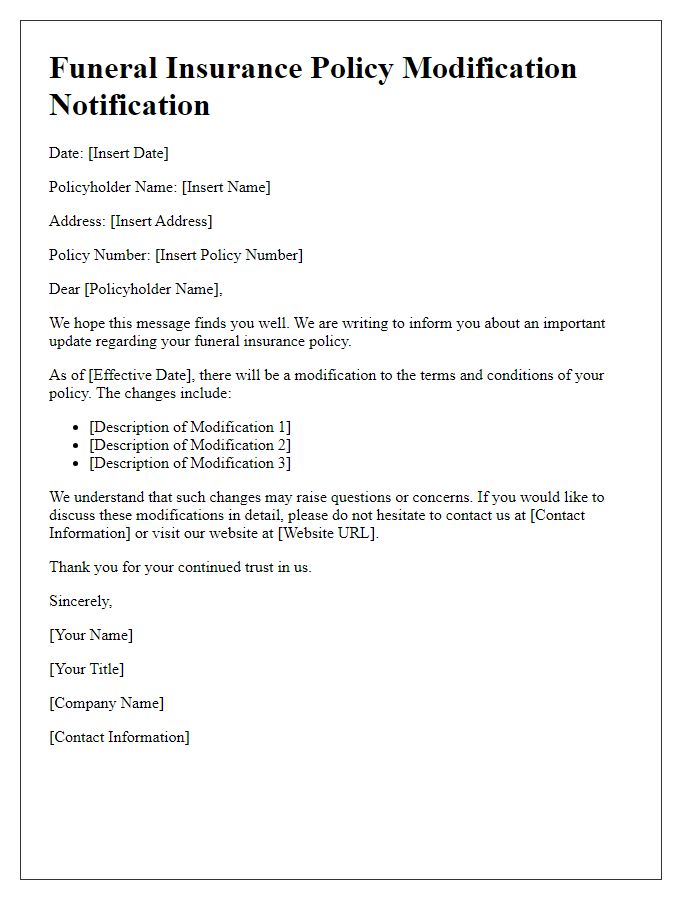

Policyholder Information

The funeral insurance policy update process involves essential details regarding the policyholder's information, such as their full name, date of birth, and contact details. This information becomes paramount in ensuring accuracy and effective communication between the insurance provider and the beneficiary. Policy numbers, typically nine to twelve digits long, serve as unique identifiers for each funeral insurance plan, allowing for quick access to specific details about coverage options and benefits. Regular updates are crucial to reflect any changes in the policyholder's status or contact information, ensuring that loved ones receive timely support during their difficult times. Additionally, it is advisable to maintain updated records of any beneficiaries included in the policy, as this will facilitate smoother claims processes in the unfortunate event of the policyholder's passing.

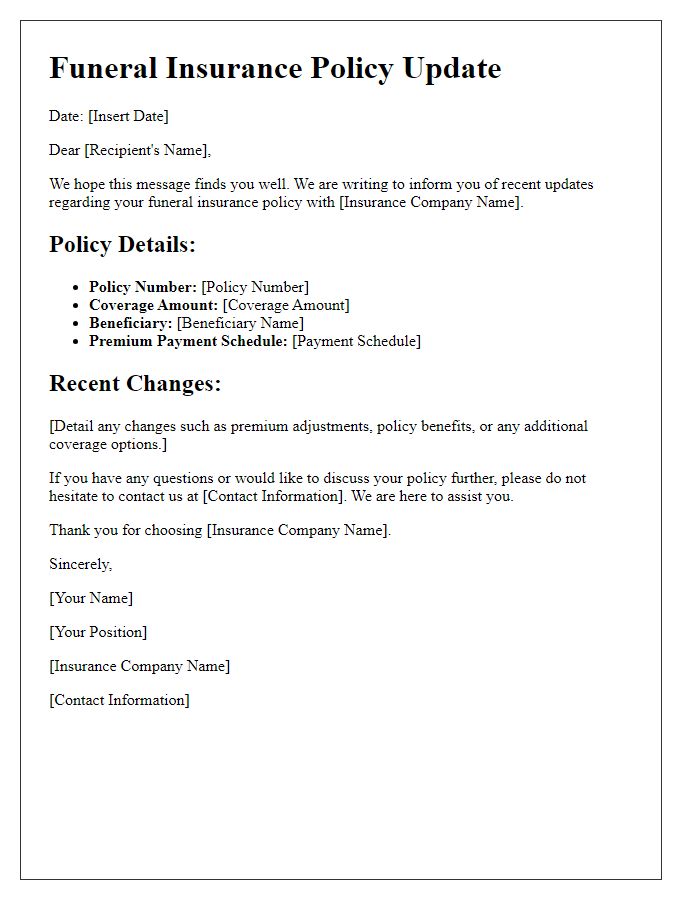

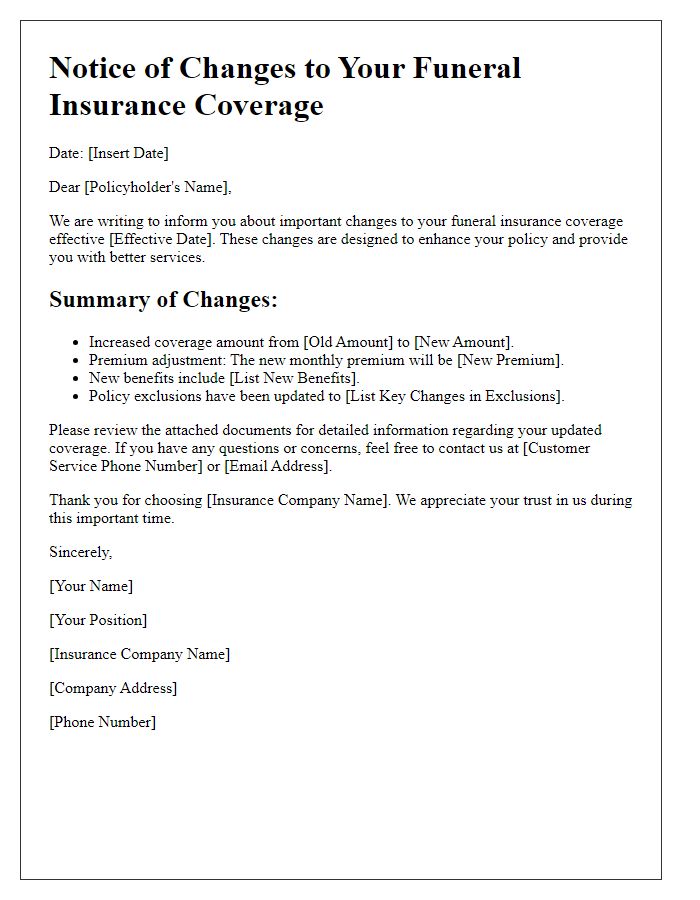

Updated Coverage Details

Funeral insurance policies provide crucial financial support during challenging times, ensuring that families are not burdened with unexpected costs related to end-of-life arrangements. The updated coverage details include an increase in the policy limit to $15,000, allowing families in major metropolitan areas, like New York City or Los Angeles, to cover rising funeral costs due to inflation. Additionally, the policy now offers optional riders for specific burial preferences like green burials or cremation services, which are on the rise in various regions. Beneficiaries will receive a streamlined claims process, with a commitment to payout within 48 hours in most cases, significantly easing the financial strain during such a difficult period. Furthermore, automatic annual reviews will adjust coverage to maintain relevance with current funeral service industry trends, ensuring all policyholders remain adequately protected.

Payment and Premium Adjustments

Funeral insurance policies require careful management to ensure families are adequately covered during difficult times. Premium adjustments often reflect changes in policy terms or holder circumstances, such as age or health status. For instance, insurers may adjust premiums based on the average cost of funeral expenses, which can vary by region, such as in urban areas like New York City compared to rural settings in Nebraska. Regularly reviewing beneficiary details and payment schedules ensures that loved ones receive the intended support without unexpected financial burdens later. Additionally, understanding state regulations surrounding funeral insurance can impact policy options and necessary adjustments.

Additional Benefits and Riders

The recent update to the funeral insurance policy includes several additional benefits and riders designed to enhance coverage and provide greater financial security for policyholders and their families. The new benefits include a grief counseling service, accessible 24/7, aimed at supporting grieving families during difficult times. Additionally, the policy now offers coverage for inflation protection, ensuring that the funeral expenses keep pace with rising costs over the years, which averages a 3-5% increase annually. A significant rider has been introduced as well: the accidental death benefit, which provides an extra payout in cases of unexpected death resulting from accidents. This rider can act as a safeguard, offering up to double the original coverage amount. The policy updates also feature customizable memorial options, allowing families to tailor ceremonies according to personal values and cultural preferences, ensuring that the final rites are both meaningful and respectful.

Contact Information for Queries

Funeral insurance policies provide essential financial support during bereavement, covering costs such as burial expenses and memorial services. Policyholders should ensure that contact information for queries is up-to-date to avoid delays in claims processing during sensitive times. Accurate phone numbers, emails, and mailing addresses facilitate swift communication with insurance providers, such as [Insurance Company Name]. Updates can be requested via customer service hotlines or online portals, ensuring beneficiaries have access to vital information and support. Regularly reviewing and confirming these details enhances the reliability of the funeral insurance policy.

Comments