Are you feeling overwhelmed about filing your insurance claim? You're not alone; many people find the process daunting and confusing. However, with the right approach and a clear template in hand, it can be a much simpler task than you might think. Let's dive into some essential tips and a straightforward letter template that will guide you through the insurance claim filing process with easeâread on to discover more!

Policy Information

Filing an insurance claim involves providing detailed policy information for accurate processing. Essential elements include the policy number (an alphanumeric code unique to each insurance policy), policyholder's name (the individual or entity covered by the insurance), and the type of coverage (such as health, auto, or home insurance). Additional details such as the effective date (the date the policy went into force, usually found in the policy documentation) and expiration date (the date when the policy coverage ends, indicating renewal requirements) must be included to ensure the claim aligns with the active coverage period. Each insurance company may have specific requirements for submitted information, so reviewing the policy document for exclusions or limits related to the claim is important.

Claim Details

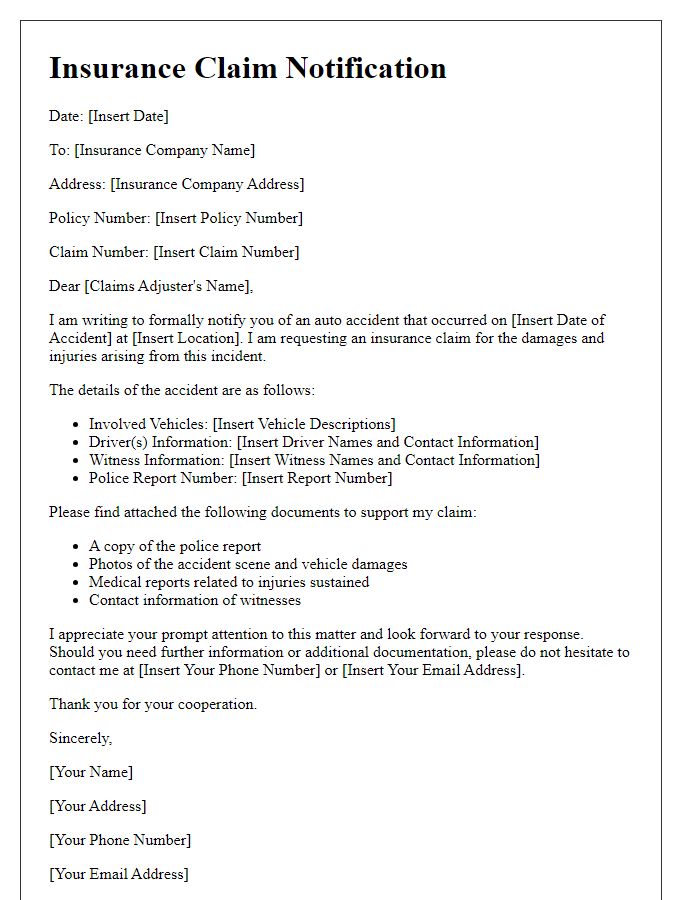

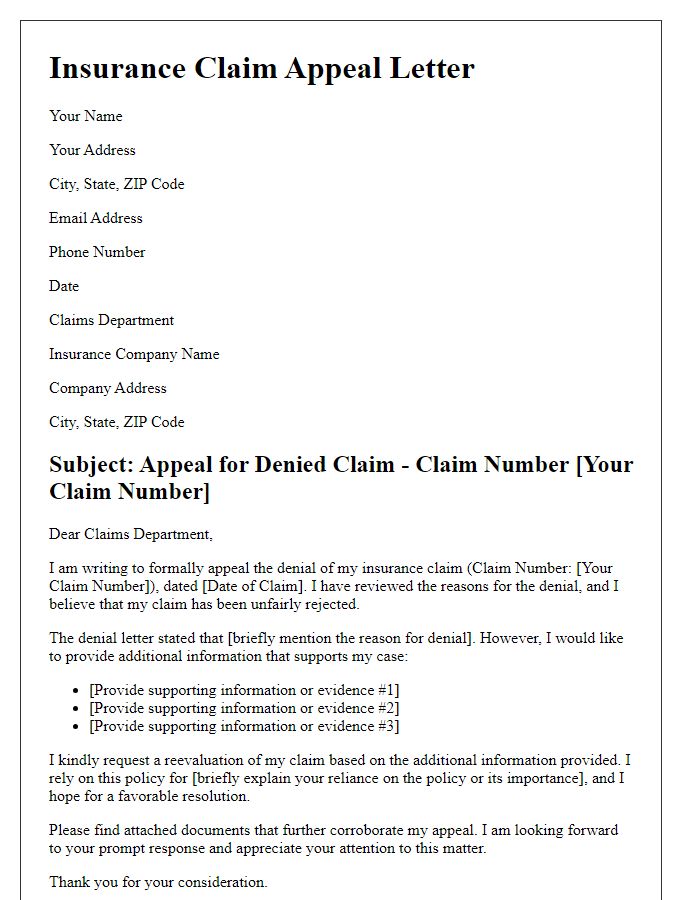

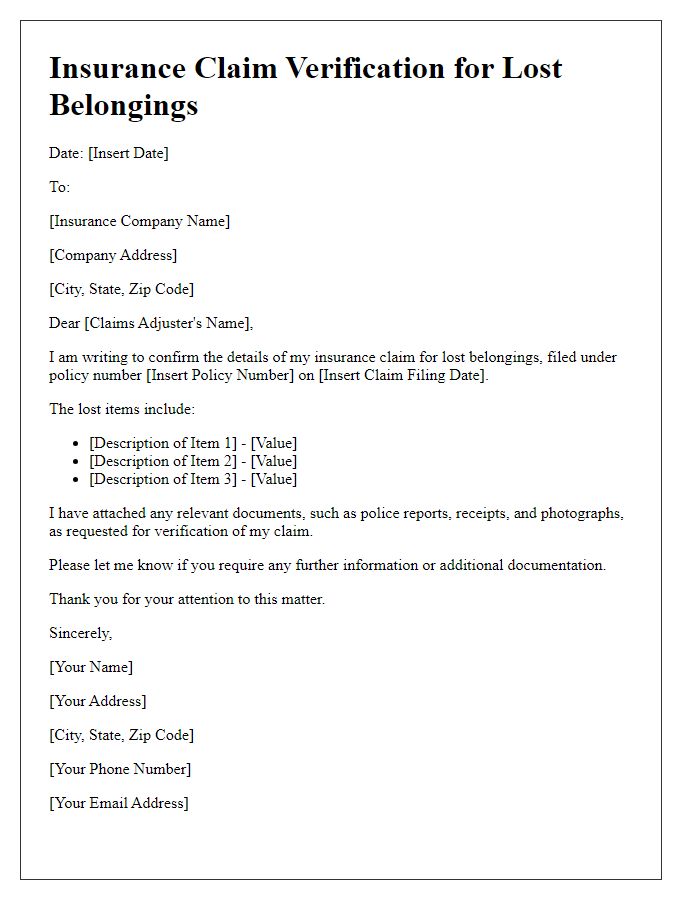

Filing an insurance claim requires precise information regarding the incident. Essential details include the claim number, policy number, and date of loss (such as the event leading to the claim, for instance, a car accident occurring on March 15, 2023). Provide a thorough description of the incident (for example, damage caused by a hailstorm in Denver, Colorado, resulting in roof damage) and list all affected property or items (like a vehicle or household items), along with their approximate values. Include a summary of the damages (quantifiable, like $5,000 for damages) and any supporting documents (such as police reports or repair estimates). Clear records ensure a smoother claims process and timely compensation.

Incident Description

In the early morning hours of June 15, 2023, a severe thunderstorm swept through Smithtown, causing significant property damage. High winds, gusting up to 70 miles per hour, uprooted trees, resulting in one massive oak tree crashing onto the roof of a residential home located on Maple Avenue. The impact created a substantial breach in the roofing structure, leading to water intrusion and damage in multiple rooms, including the living room and master bedroom. Local authorities reported over 200 incidents of similar damages throughout Smithtown, with emergency services being inundated with calls for assistance. This incident not only caused immediate property loss but also created a hazardous living environment due to exposed roofing and potential mold growth from subsequent rain exposure.

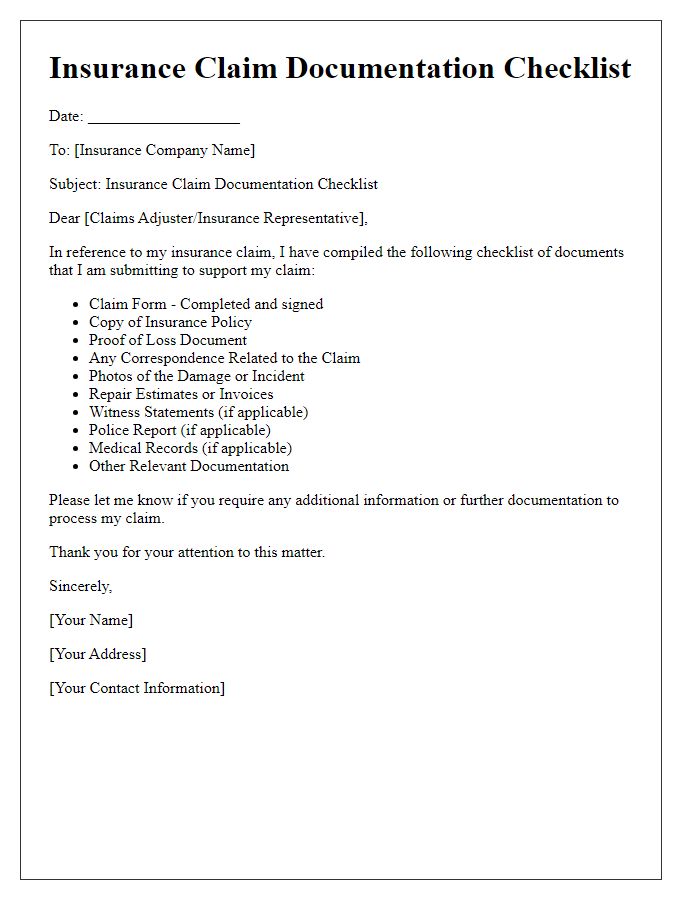

Supporting Documentation

Filing an insurance claim requires comprehensive supporting documentation to substantiate the claim. Essential documents typically include a detailed incident report, photographs of damages, and any relevant police reports if applicable. For property damage claims, receipts for repairs or replacement items (preferably dated within the last year) should be enclosed, along with an inventory of damaged goods. Medical claims necessitate medical records, bills, and treatment notes from healthcare providers, specifying the diagnosis and treatment procedures. Additionally, a signed claim form from the insurance company detailing the policy number and claim number is crucial. This thorough compilation aids in expediting the claims process, ensuring an effective review by the insurance adjuster.

Contact Information

In the process of filing an insurance claim, it is essential to provide accurate contact information for effective communication between the insured party and the insurance provider. Essential details include the full name of the claimant, mailing address (including street, city, state, and ZIP code), telephone number for immediate contact, and email address for correspondence. Accurate contact information ensures that all notifications regarding the claim status, documentation requests, and any additional inquiries can be efficiently processed, reducing potential delays in the claims process.

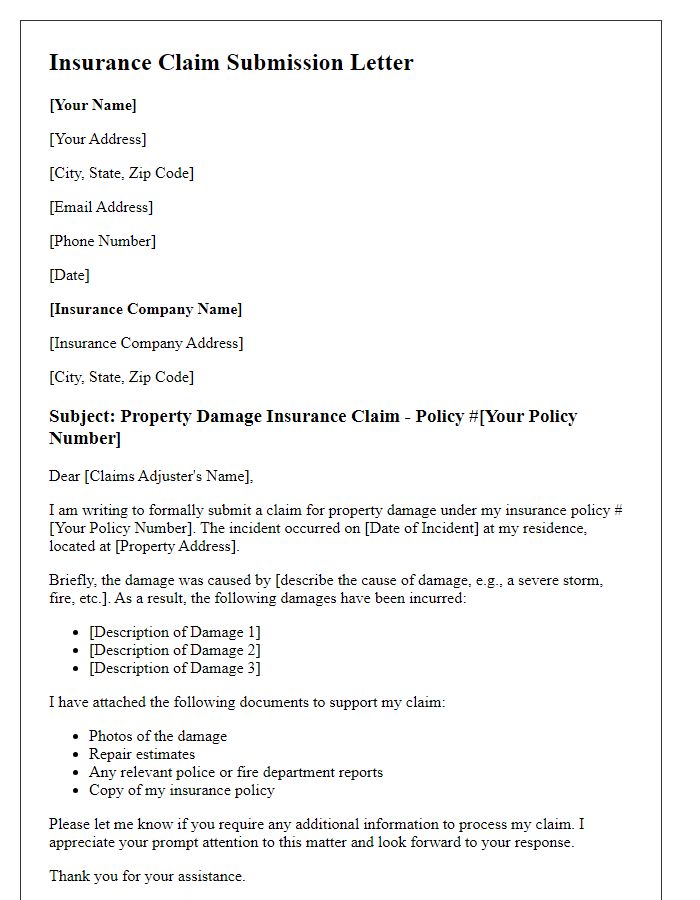

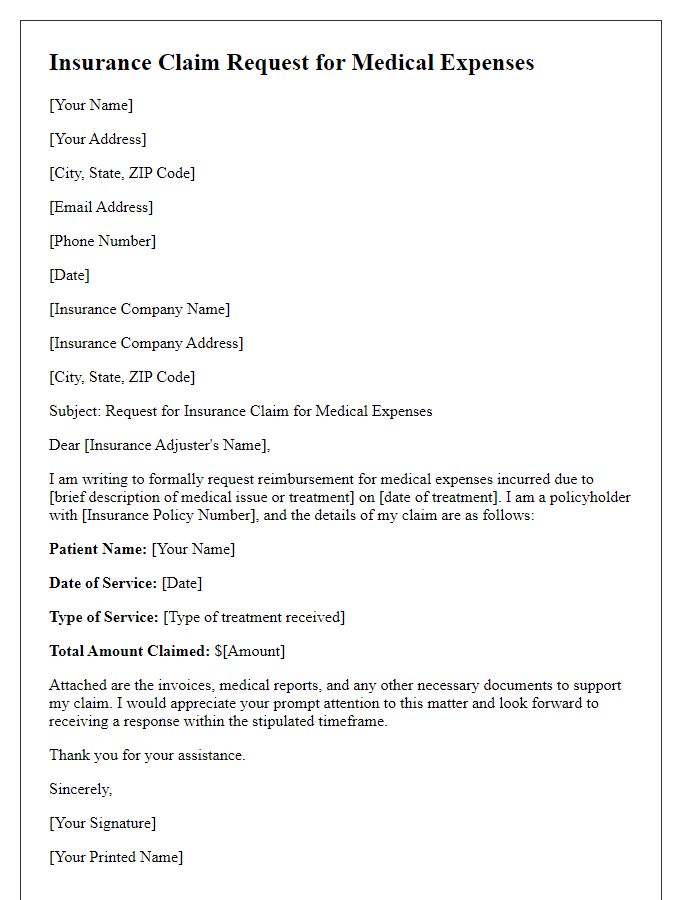

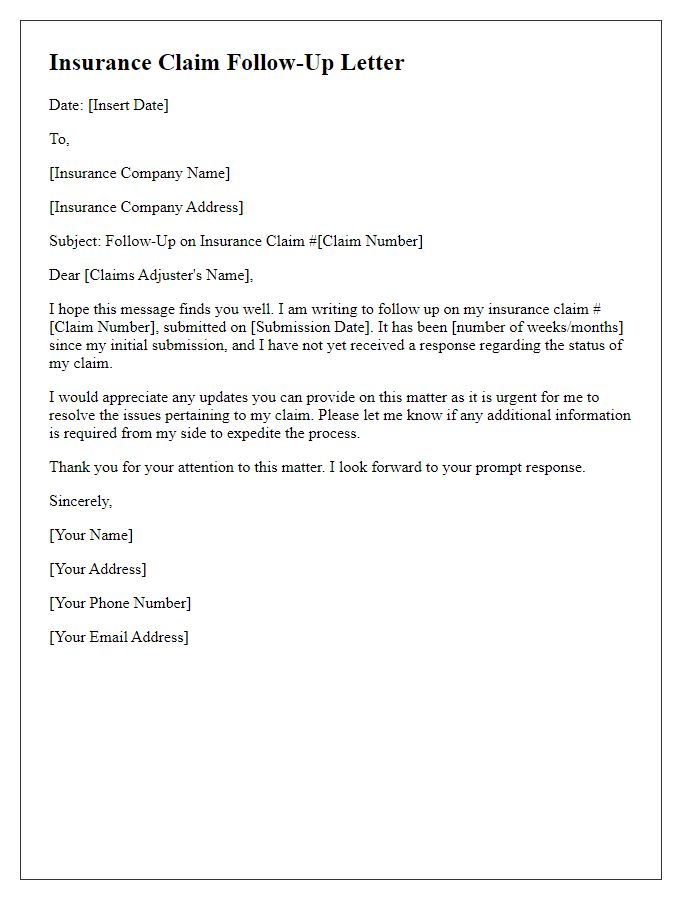

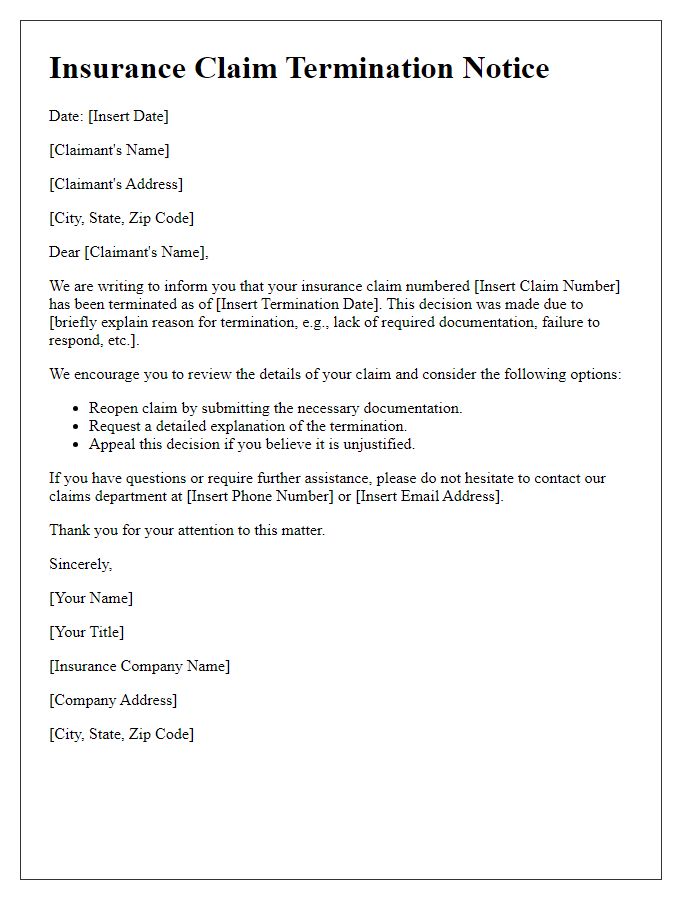

Letter Template For Filing Insurance Claim Samples

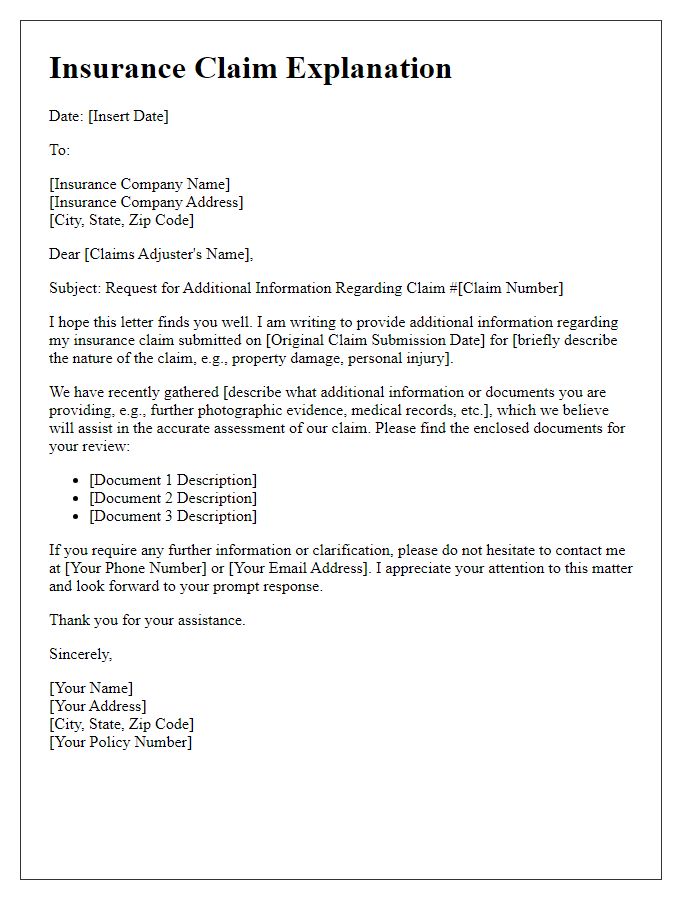

Letter template of insurance claim explanation for additional information.

Comments