Hello there! Have you ever found yourself puzzled when your annual premium invoice arrives? You're not alone; many people share the same curiosity about the details and breakdown of their charges. In this article, we'll unravel the common questions surrounding annual premium invoices, making it easier for you to understand what you're paying for. So, let's dive in and demystify those invoices togetherâread on!

Contact Information

Annual premium invoices often generate inquiries regarding payment details and policy coverage. For instance, policyholders may seek clarification about payment due dates or premium adjustments stemming from recent coverage changes. Accurate contact information streamlines this process, encouraging efficient communication between customers and insurance representatives. Including direct lines and email addresses specific to billing queries can further enhance the resolution experience. Providing a dedicated section for frequently asked questions related to annual premium fluctuations can preemptively address common concerns, improving customer satisfaction.

Invoice Details

The annual premium invoice inquiry reveals critical billing information for policyholders, highlighting invoice numbers, premium amounts, and due dates. Each policyholder receives a unique invoice (often labeled with 12-digit identifiers), detailing coverage periods that commonly span one year. Payment deadlines typically range from 30 to 60 days post-invoice issuance, ensuring compliance and preventing lapses in coverage. A breakdown of associated fees with potential discounts for early payment is often included, enhancing transparency. Additionally, communication channels for inquiries, such as customer service phone numbers or email addresses, are provided, ensuring policyholders can promptly address any discrepancies or concerns regarding their invoice statements.

Inquiry Purpose

The annual premium invoice, prepared by the insurance provider, outlines the total cost of coverage for a specified period, often a calendar year. Maintaining comprehensive health insurance, such as a Preferred Provider Organization (PPO) plan, can significantly impact financial planning. Coverage details are crucial, including deductibles, premiums, and co-pays, which directly influence monthly budgeting. Discrepancies in invoice amounts can stem from recent policy changes, individual health assessments, or shifts in coverage levels, necessitating clarification. Addressing specific line items, such as multi-car discounts or wellness incentives, may provide insights into potential savings. Clear comprehension of the invoice fosters informed decision-making regarding premium payments and potential adjustments to coverage or providers.

Request for Clarification

Annual premium invoices detail the payment obligations for various insurance policies, such as health, auto, or home insurance. Questions about premium amounts can arise due to factors like policy changes, risk assessments, or coverage adjustments. For instance, a change in personal circumstances, such as new construction or acquired assets, can impact home insurance premiums significantly. Review date stamps on the invoice indicate when the premium calculation took place, which is essential for understanding any fluctuations. In the context of customer service, prompt clarification is crucial, especially if invoice details include unexpected surcharges or discrepancies in quoted rates. Understanding the breakdown of the invoice helps ensure accurate budget forecasting for insurance expenditures.

Closing and Contact Instructions

Annual premium invoices represent financial commitments policyholders make to maintain coverage, usually in insurance sectors such as health, auto, or property. These invoices typically specify amounts due, payment deadlines, and policy details. Closing instructions may include confirmation of payment methods, such as electronic funds transfer (EFT) or credit card options, and emphasize the importance of timely payments to avoid lapses in coverage. Contact information should be clear, providing dedicated customer service numbers or email addresses for inquiries. Prompt communication channels (like 24/7 support lines) enhance customer satisfaction and address any concerns effectively.

Letter Template For Annual Premium Invoice Inquiry Samples

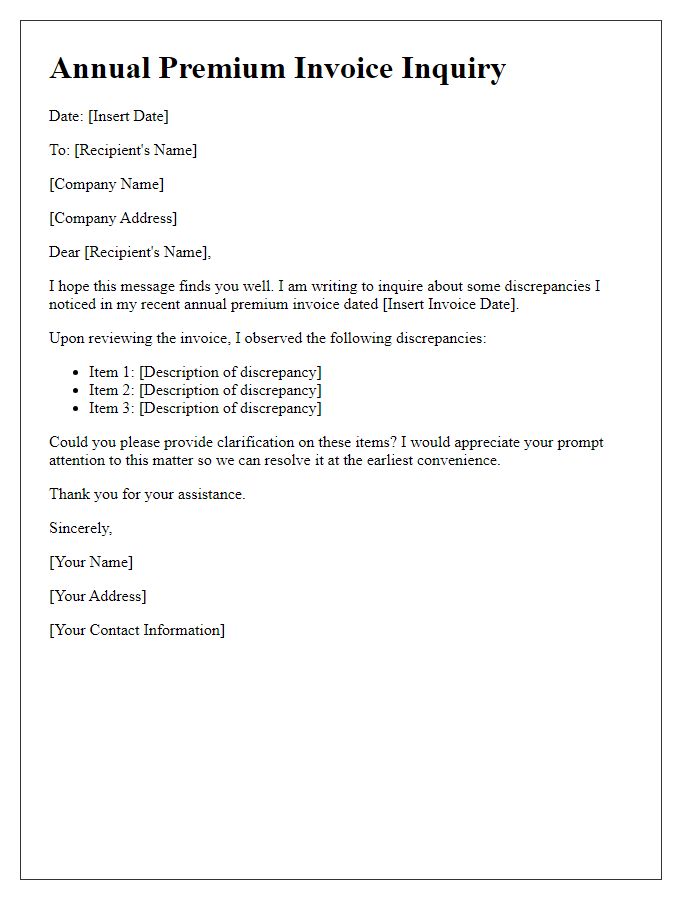

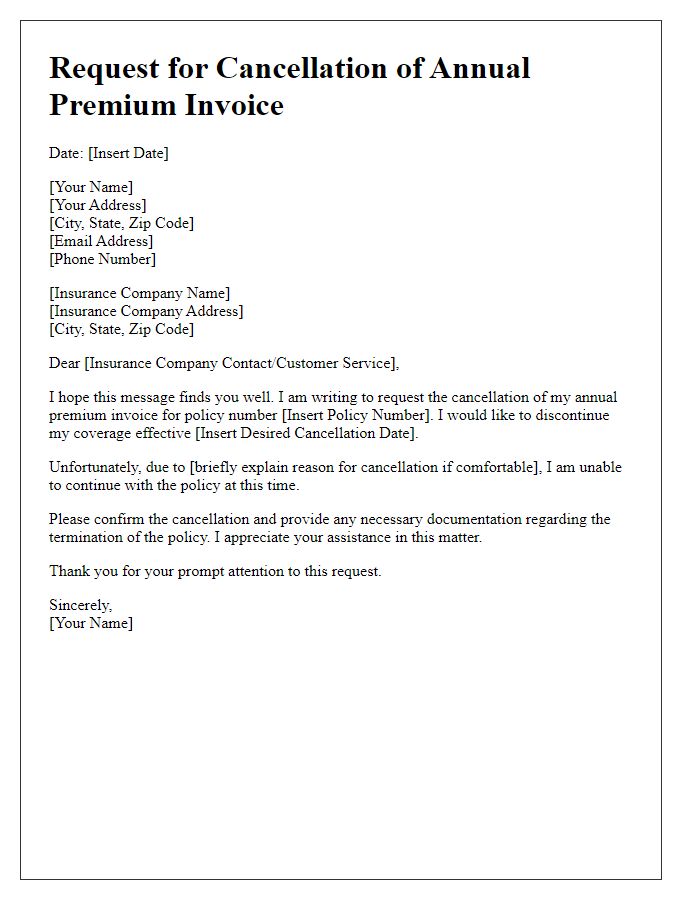

Letter template of annual premium invoice inquiry regarding discrepancies

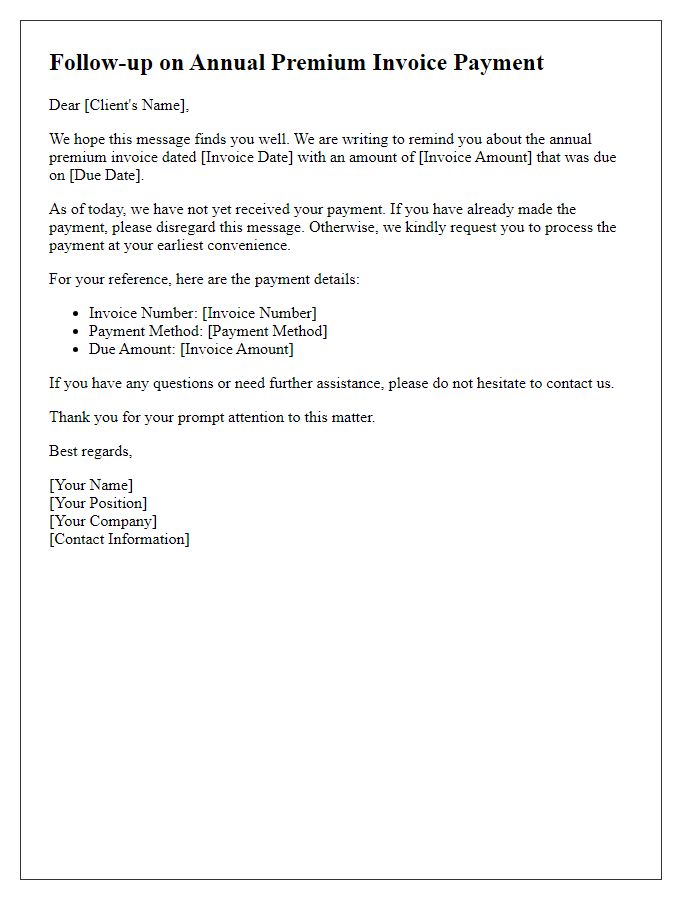

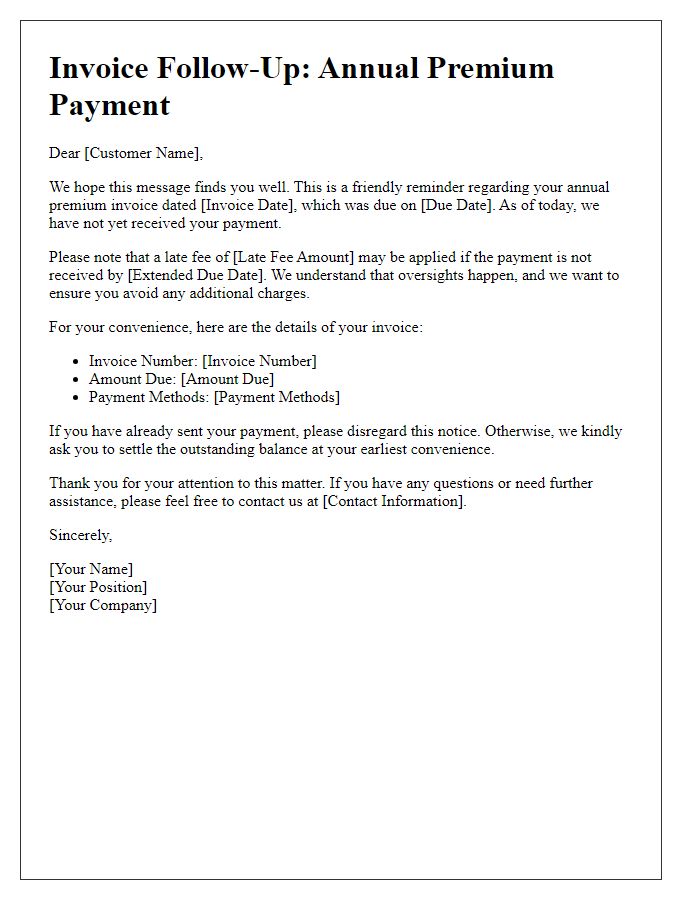

Letter template of annual premium invoice follow-up for payment confirmation

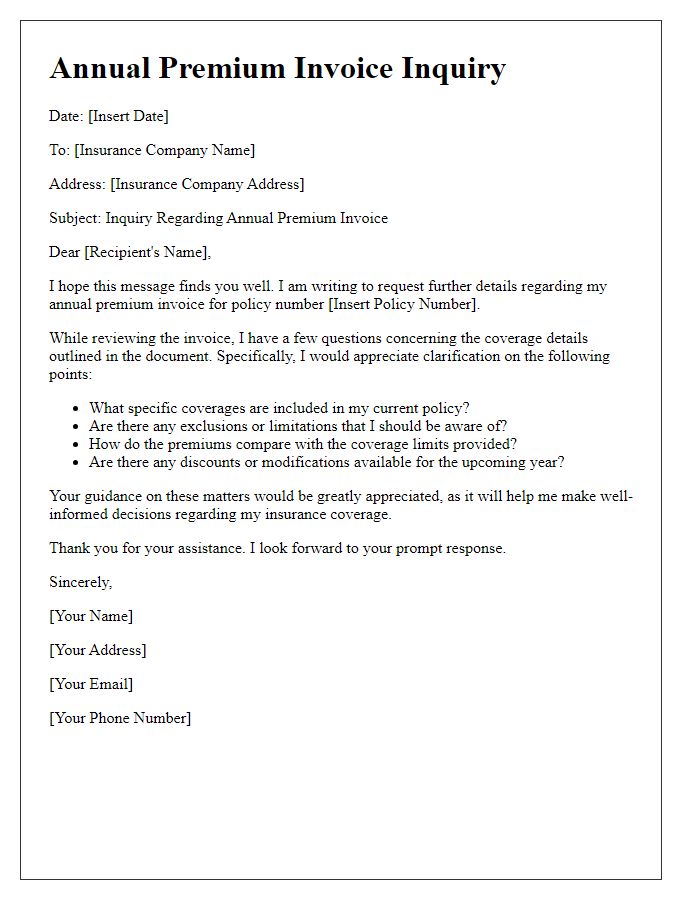

Letter template of annual premium invoice question about coverage details

Letter template of annual premium invoice request for a breakdown of charges

Comments