Are you feeling overwhelmed by the complexities of filing a cyber liability insurance claim? You're not aloneâmany businesses encounter challenges when navigating this critical process. Understanding the necessary steps and the right documentation can make all the difference in ensuring a smooth and efficient claim experience. Join us as we explore key tips and insights to simplify your claim journey and help you get back to business as usual!

Policy Number and Coverage Details

Cyber liability insurance policies provide vital protection against financial losses due to cyberattacks and data breaches affecting businesses. Policies typically include coverage for incident response costs, legal fees, and notifications required by laws, such as the General Data Protection Regulation (GDPR) in Europe. Understanding policy numbers, such as those starting with "CL" followed by six digits, is essential for claim processing. Coverage details may vary across providers, with limits for data recovery costs, which can be up to $1 million, and liability coverage that might reach $5 million, depending on the plan chosen. Businesses must document incidents thoroughly, tracking dates and affected systems to strengthen their claims when submitting to insurance companies.

Description of Cyber Incident

A data breach incident occurred on March 15, 2023, impacting the customer database of TechSolutions Inc., based in San Francisco, California. Unauthorized access by a malicious actor compromised over 5,000 sensitive customer records, containing personal identifiable information (PII) such as names, addresses, social security numbers, and financial data. The intrusion was detected through routine cybersecurity monitoring after unusual login activity was observed. Immediate containment measures were enacted, including system isolation and forensic investigation by a cybersecurity firm, CyberGuard Inc. Following the breach, it was determined that outdated software vulnerabilities and weak password protocols contributed to the incident. The company notified affected customers and initiated credit monitoring services, incurring additional costs of approximately $150,000 for recovery efforts.

Documentation of Damages and Losses

Cyber liability insurance claims require comprehensive documentation of damages and losses incurred due to a cyber incident, such as a data breach or ransomware attack. Essential elements include detailed incident reports highlighting the date and nature of the breach, specific vulnerabilities exploited, and how the incident was discovered. Financial losses should be itemized, encompassing direct costs like forensic investigations costing upwards of $10,000, notification expenses exceeding $7 per affected individual across hundreds of clients, and potential business interruption losses resulting from system downtime that could reach thousands of dollars per hour. Additionally, any legal fees incurred while addressing regulatory compliance issues or lawsuits related to the breach must be included. It's crucial to gather all supporting evidence, including communication logs and invoices, to substantiate the claim thoroughly.

Timeline of Events and Response Actions

A comprehensive timeline of events related to a cyber incident highlights crucial moments in identifying and addressing a security breach. On July 15, 2023, unauthorized access to the company's server, located in the primary data center in Austin, Texas, was detected, resulting in a potential data leak involving sensitive customer information. Immediate investigation initiated on July 16, 2023, led to the deployment of cybersecurity experts from CyberSecure Solutions. By July 18, 2023, critical systems were isolated to prevent further breaches. Internal communications were sent to employees on July 20, 2023, outlining updated security protocols. Affected customers were notified on July 25, 2023, with information on preventive measures and support channels. An analysis report, summarizing the incident and response, was submitted to the insurance provider on August 1, 2023, to initiate the cyber liability insurance claim process.

Contact Information for Follow-Up

Cyber liability insurance claims can be intricate and require precise documentation to facilitate the recovery process. Essential contact information is necessary for efficient follow-up, including the policyholder's name, policy number, and the insurance provider's contact details, such as phone number and email. Additionally, including specific dates related to the incident, such as the date of the cyber event and when the claim is submitted, will aid in tracking the timeline. Clearly listing witnesses or involved parties, along with their contact information, improves clarity. Accurately identifying the extent of the data breach, potential financial losses, and legal implications highlights the relevance of the claim and supports a comprehensive evaluation by the underwriters.

Letter Template For Cyber Liability Insurance Claim Samples

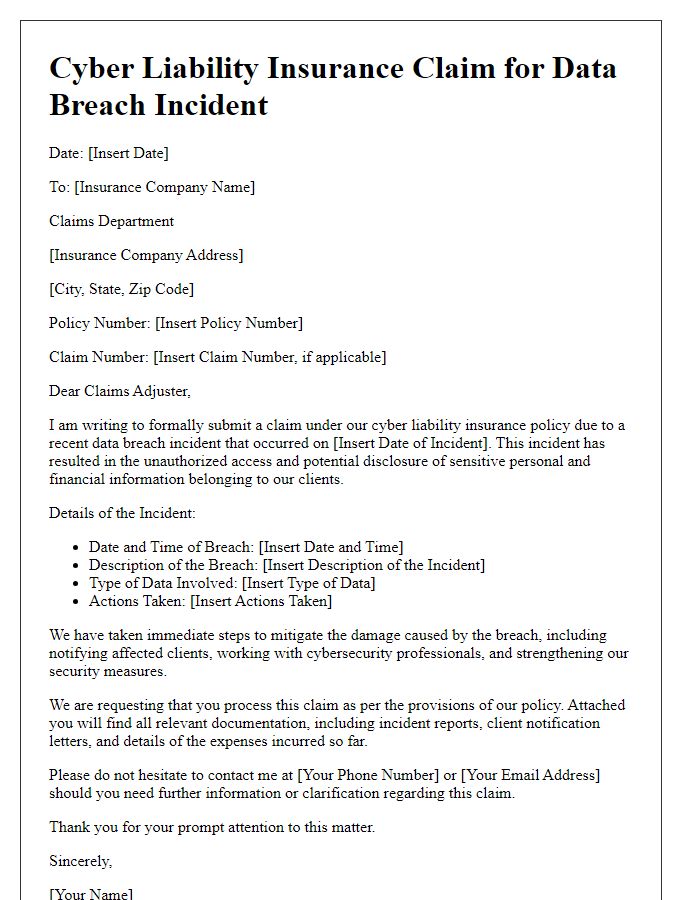

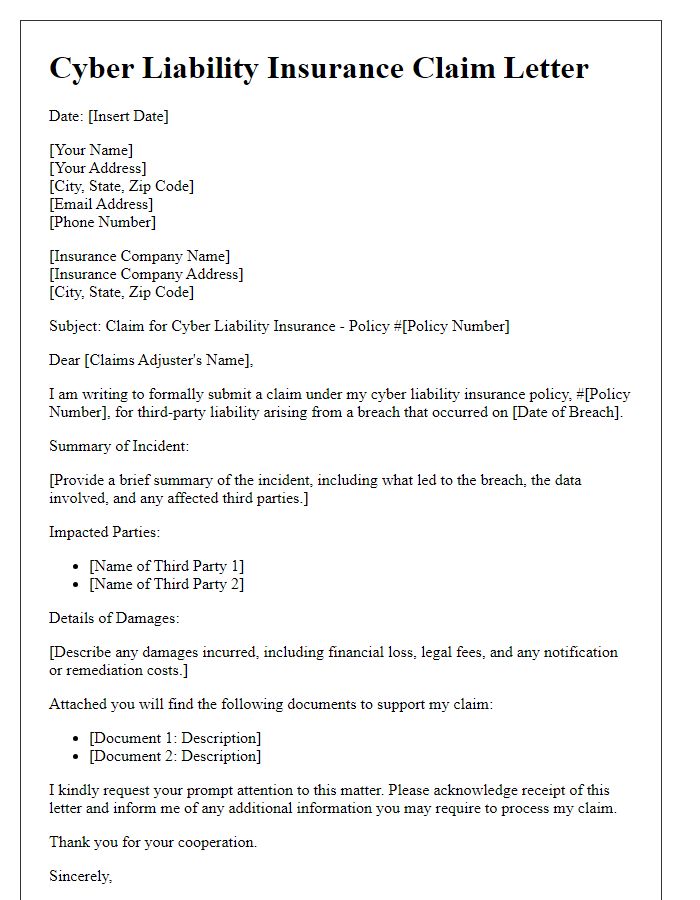

Letter template of cyber liability insurance claim for data breach incident.

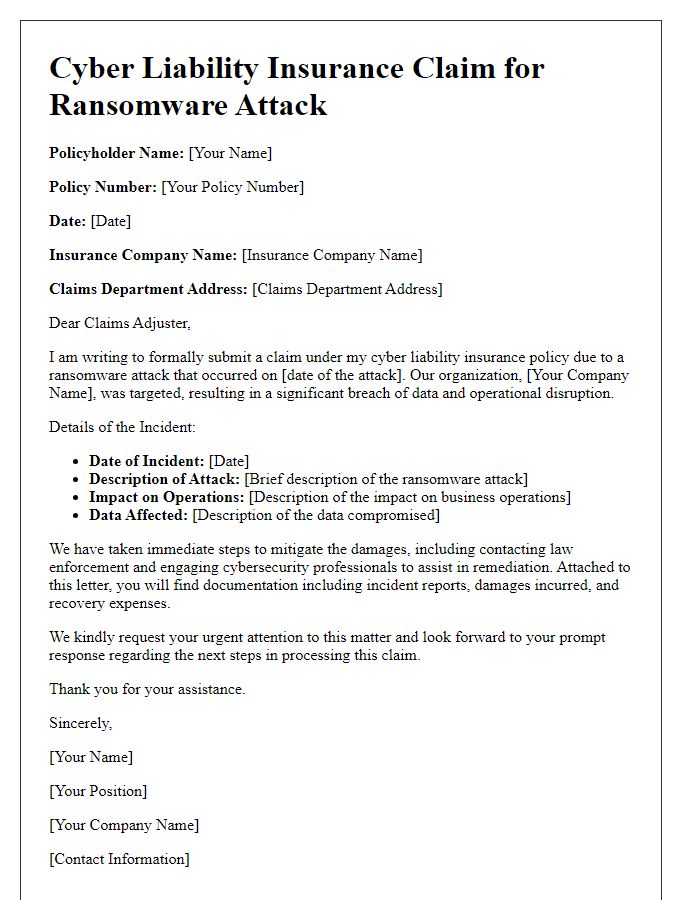

Letter template of cyber liability insurance claim for ransomware attack.

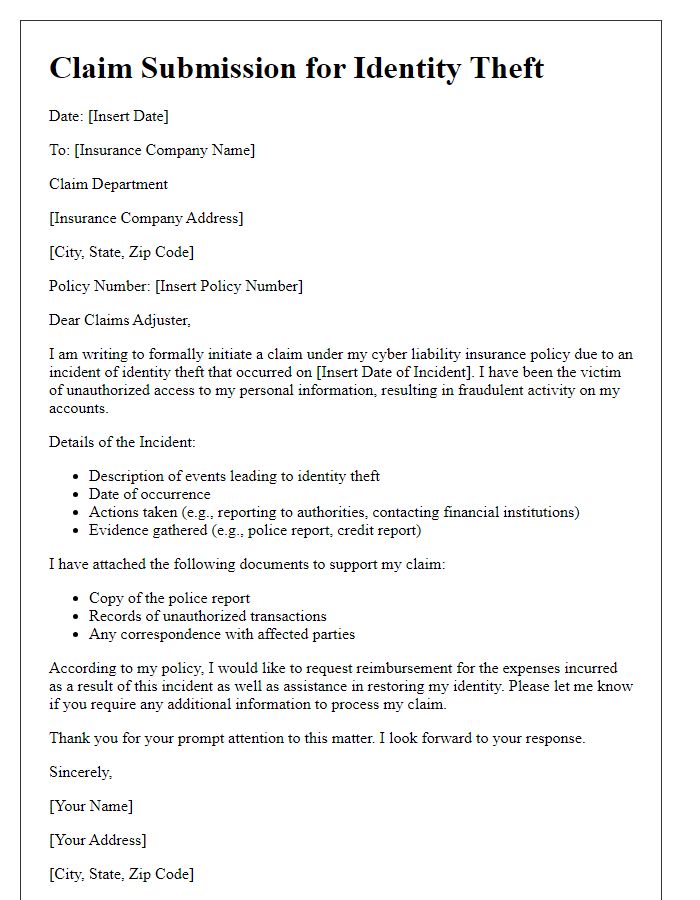

Letter template of cyber liability insurance claim for identity theft situation.

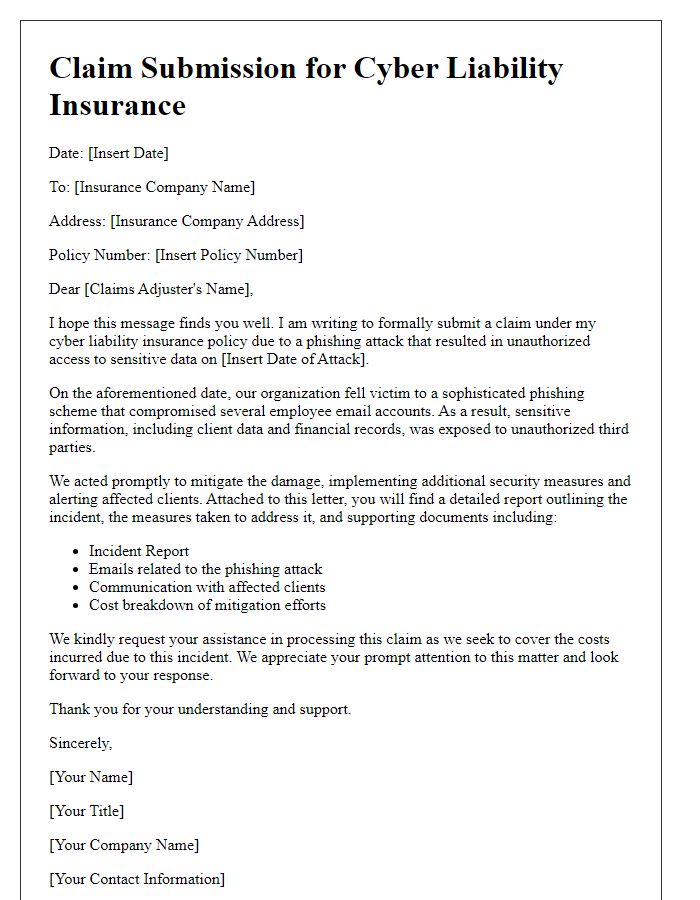

Letter template of cyber liability insurance claim for phishing attack exposure.

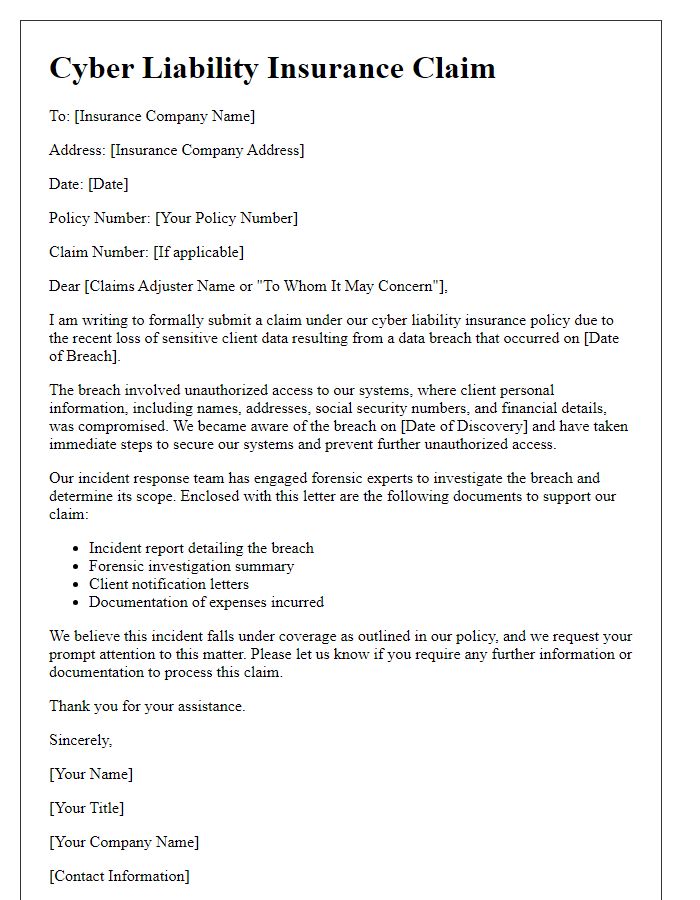

Letter template of cyber liability insurance claim for loss of sensitive client data.

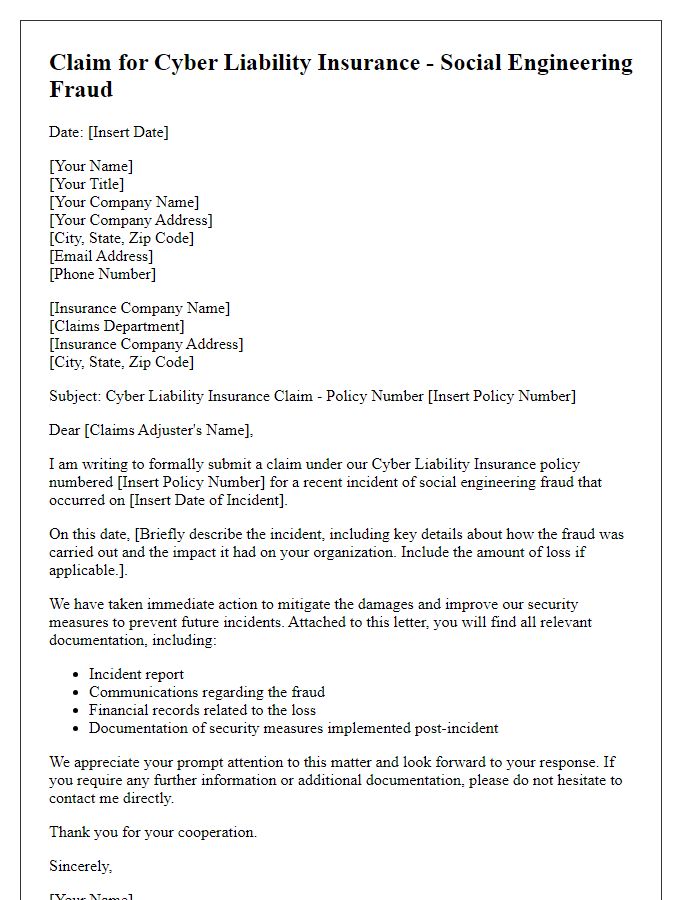

Letter template of cyber liability insurance claim for social engineering fraud.

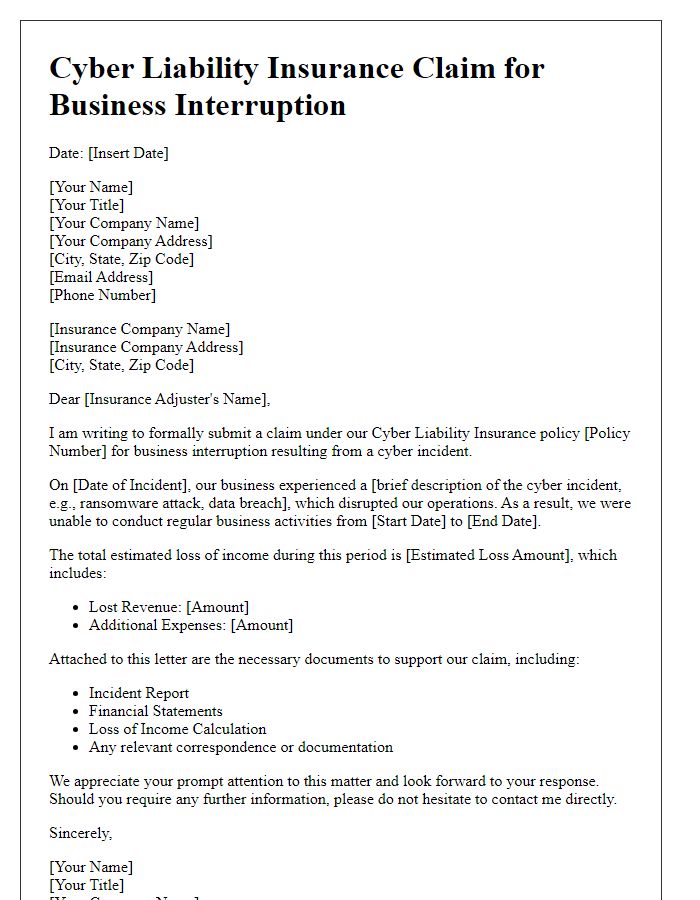

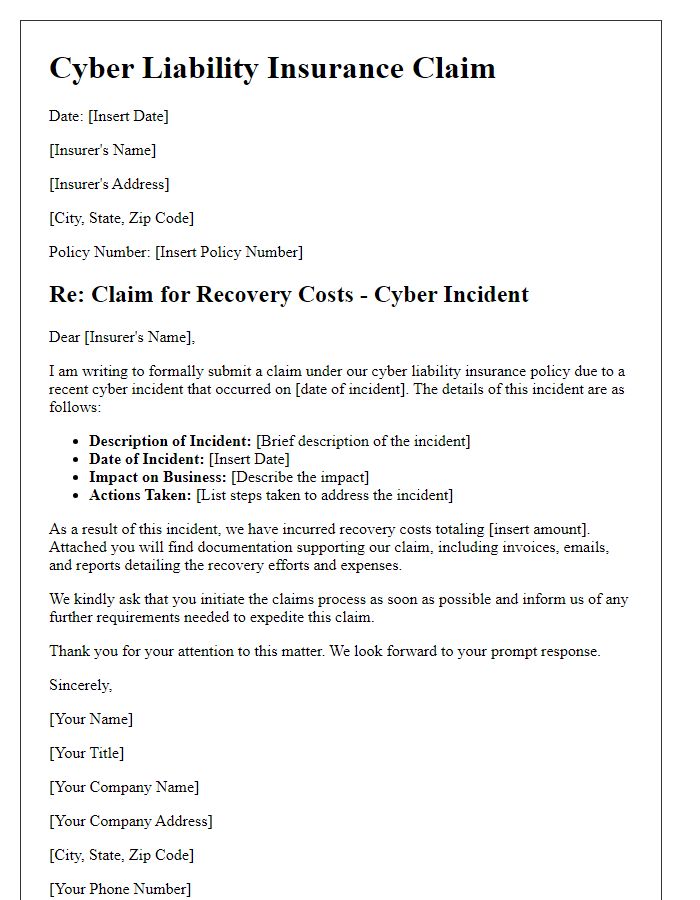

Letter template of cyber liability insurance claim for business interruption from cyber incident.

Letter template of cyber liability insurance claim for third-party liability arising from breach.

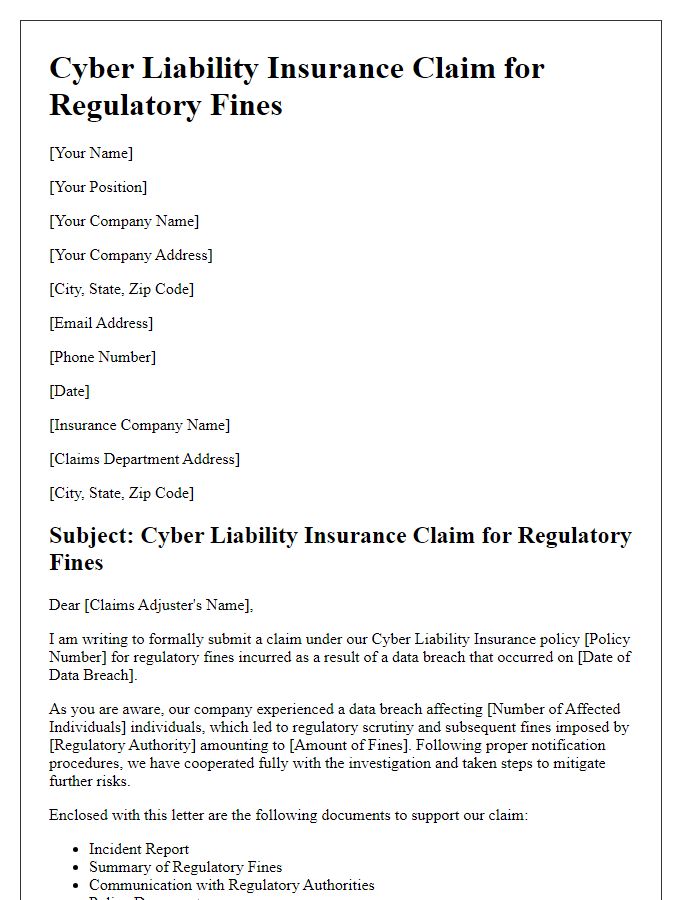

Letter template of cyber liability insurance claim for regulatory fines due to data breach.

Comments