Navigating the world of construction delays can be quite a challenge, especially when it comes to filing for insurance claims. It's essential to understand the intricacies involved, as delays can often lead to significant financial losses. In this article, we'll break down the process of creating a compelling letter for your construction delay insurance claim, ensuring you communicate your concerns effectively. Ready to learn the essential steps? Keep reading to discover valuable tips!

Policyholder Information

Construction delays can significantly impact project timelines and financial outcomes, affecting both residential and commercial properties. Delay claims often arise from unforeseen incidents like severe weather events, labor shortages, or supply chain disruptions. Policyholders, such as contractors or property owners, must meticulously document the nature and duration of delays, including specific dates and impacted stages of construction. Insurance policies typically require the notification of delays within a stipulated timeframe, emphasizing the necessity of clear communication. Essential documents include project schedules, correspondence with subcontractors, and weather reports from credible sources, which can strengthen the claim's validity. Timely submission to the insurer may lead to potential compensation for lost revenue, extended project costs, or additional expenses incurred during the delay period.

Project Details

Construction delays can significantly impact project timelines and budgets, particularly in large-scale developments such as commercial buildings or residential complexes. For a project valued at $2 million, a delay of even a few weeks can lead to substantial financial losses. Insurance claims related to these delays often involve meticulous documentation, including contracts, change orders, and correspondence. A construction project, such as the recently initiated Greenfield High-Rise located in Houston, Texas, may face setbacks due to factors like adverse weather conditions, permitting issues, or supply chain disruptions. These challenges necessitate detailed records of communication with subcontractors and suppliers to substantiate claims. The claim process may require evidence such as construction schedules and progress photos to establish a timeline that showcases the impact of delays. Furthermore, industry standards and local regulations can also influence the outcome of these claims, making it vital to understand the specificities of the situation.

Description of Delay

Inclement weather can significantly impact construction schedules, such as excessive rainfall recorded at 5 inches over a 48-hour period, which halted work on critical phases of the project. Delays may also arise from unforeseen supply chain disruptions, including the inability to procure essential materials like steel and lumber due to global shortages caused by events like the COVID-19 pandemic. Furthermore, issues with subcontractor availability, as seen when a key electrical contractor faced staffing shortages, can lead to substantial delays in project timelines. Legal disputes with neighboring property owners may also arise, resulting in temporary cessation of construction activities due to required mediation processes. All these factors contribute to potential delays in project completion, necessitating an insurance claim for financial recovery due to the unexpected disruptions.

Documentation and Evidence

Construction project delays can incur significant financial losses, leading to the necessity for construction delay insurance claims. Detailed documentation is essential, including contracts outlining timelines, schedules (such as Gantt charts used for planning), and any correspondence (emails or letters) indicating reasons for delays. Photographs of the construction site displaying work progress or lack thereof also serve as crucial evidence. In addition, records of weather conditions (historical weather data from local meteorological services) impacting construction schedules or unforeseen events (like equipment failures or materials shortages) should be compiled. Testimonies from subcontractors (individuals or companies providing specialized labor) or project managers detailing the nature and impact of delays reinforce claims. All supporting documentation should be organized chronologically to establish a clear narrative of events leading to the delay.

Claim Amount Calculation

When assessing construction delay insurance claims, precise calculation of claim amounts is essential. Key factors include direct costs such as increased labor expenses, material price surges, and equipment rentals, which can escalate due to project timeline extensions. Indirect costs such as loss of revenue from delayed project completion, incurred financing costs, and the impact on cash flow also play a significant role. Documentation should clearly outline the specific delay events, such as unforeseen weather conditions (e.g., hurricanes or heavy snow), regulatory changes, or material supply chain disruptions (like the COVID-19 pandemic) that contributed to the delay. Detailed records including invoices, timesheets, and correspondence related to the delay should accompany the claim submission to strengthen the case for compensation. The total claim amount should reflect the aggregate of these calculated costs while adhering to policy coverage limits and terms outlined in the construction delay insurance agreement.

Letter Template For Construction Delay Insurance Claim Samples

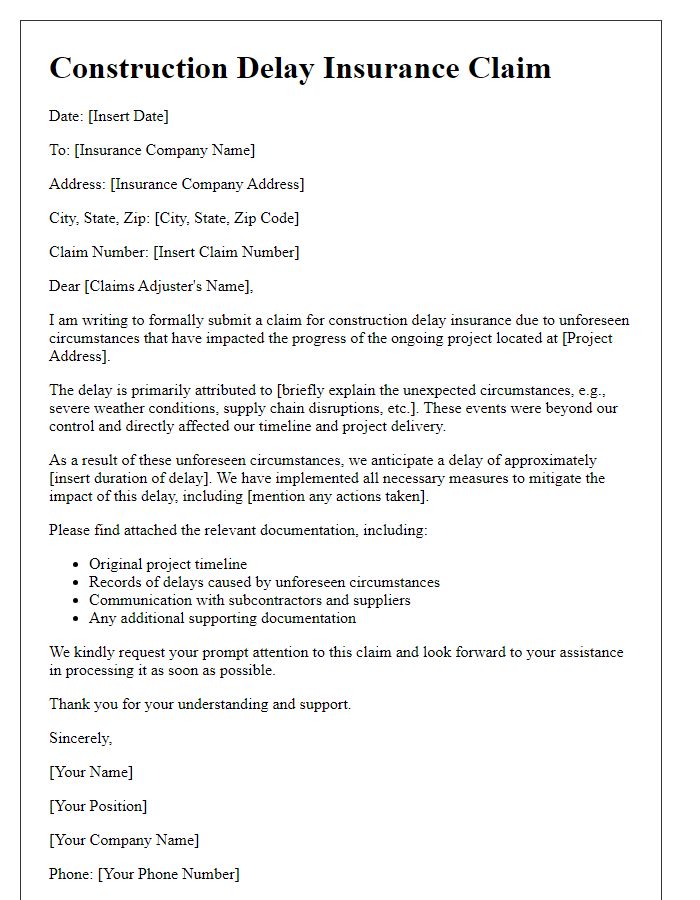

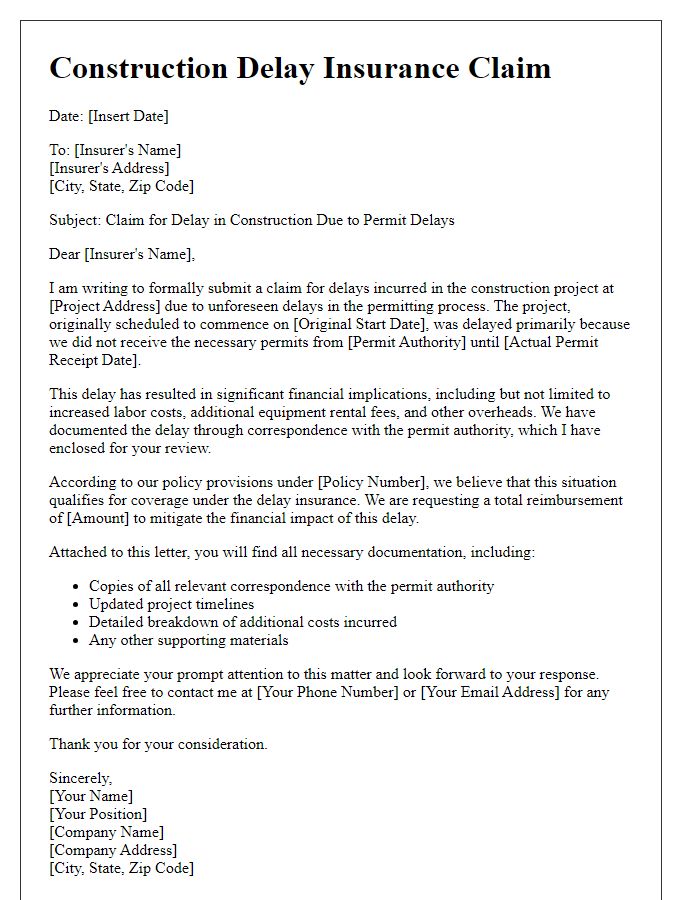

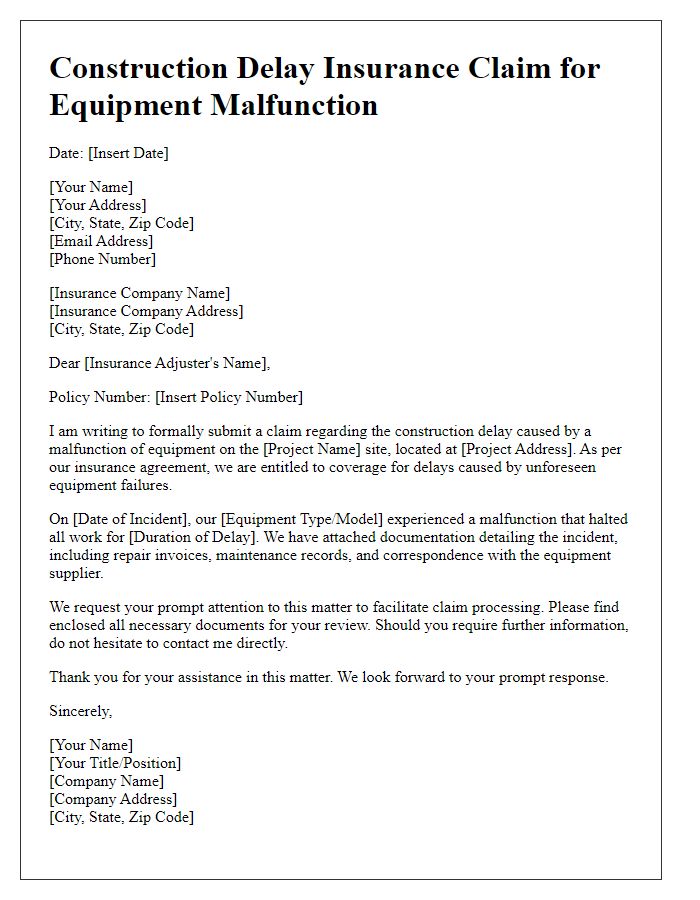

Letter template of construction delay insurance claim due to unforeseen circumstances.

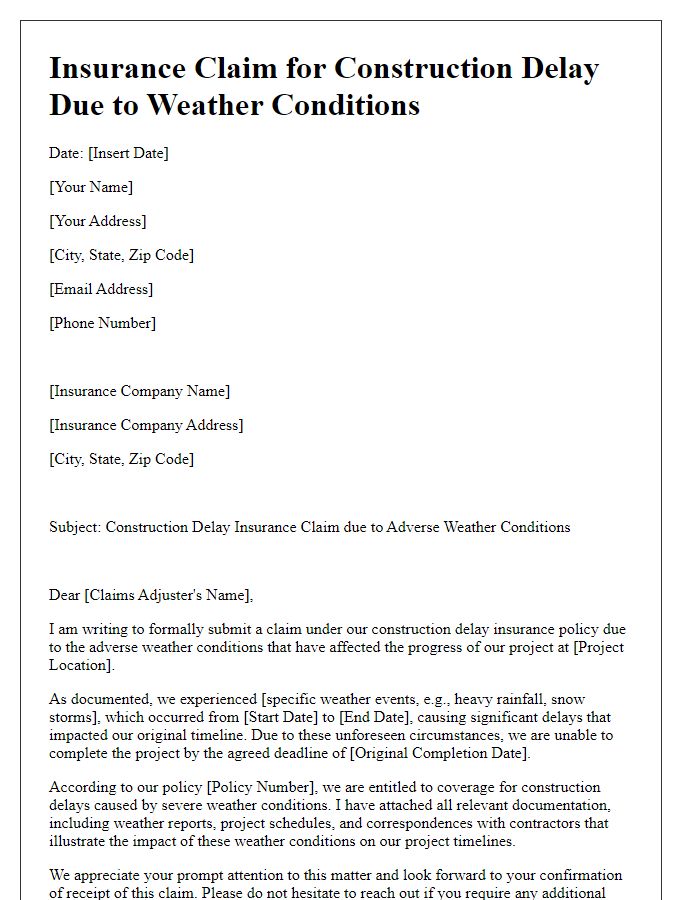

Letter template of construction delay insurance claim related to weather conditions.

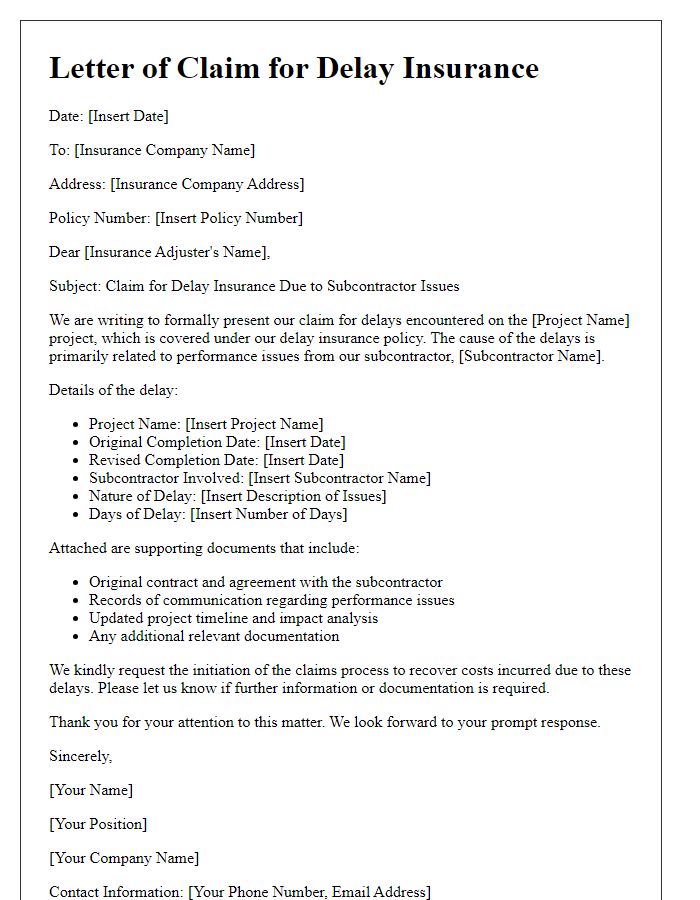

Letter template of construction delay insurance claim for subcontractor issues.

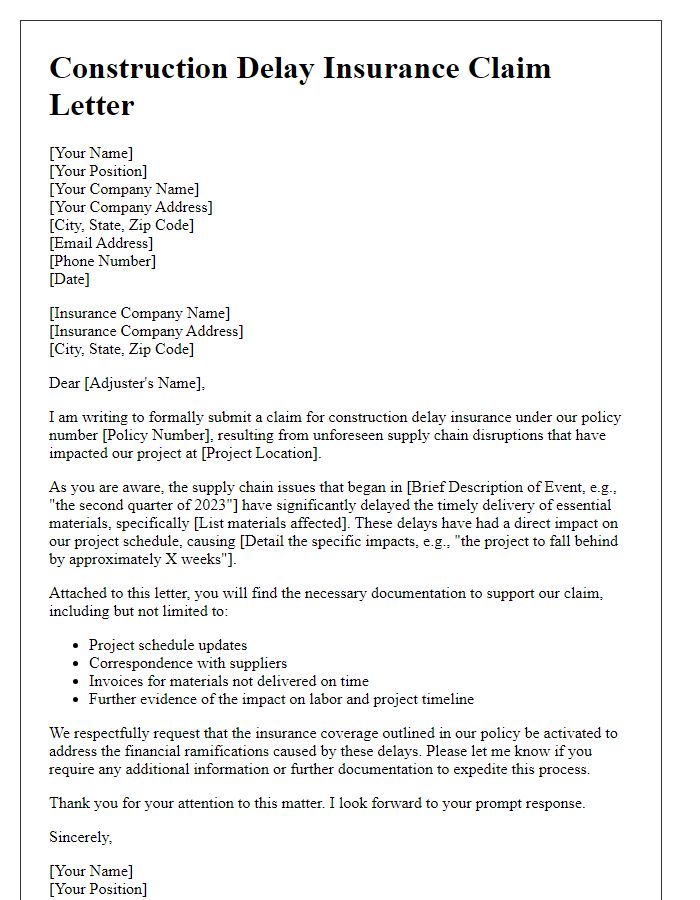

Letter template of construction delay insurance claim stemming from supply chain disruptions.

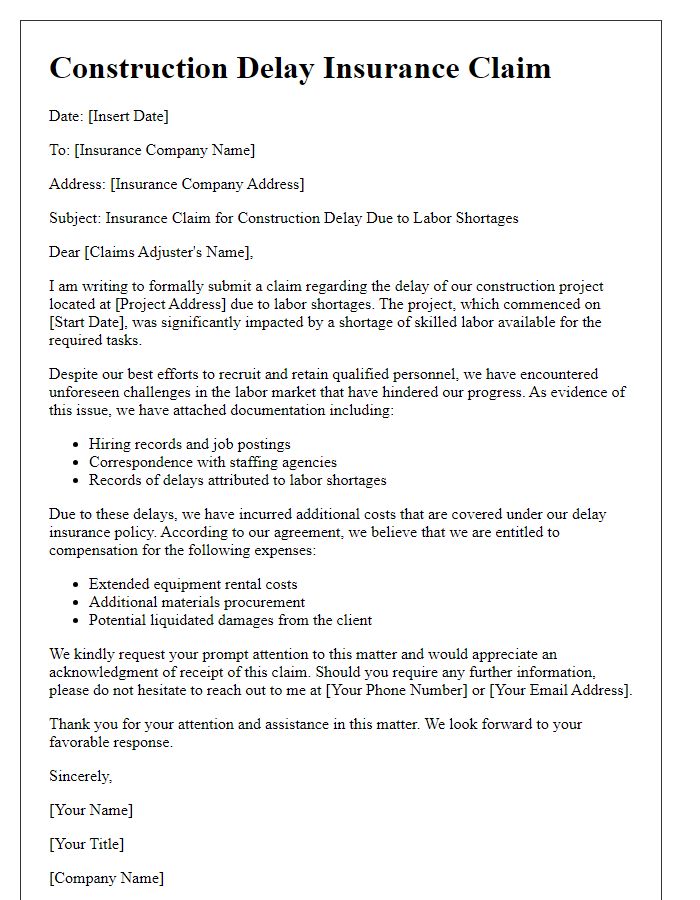

Letter template of construction delay insurance claim regarding labor shortages.

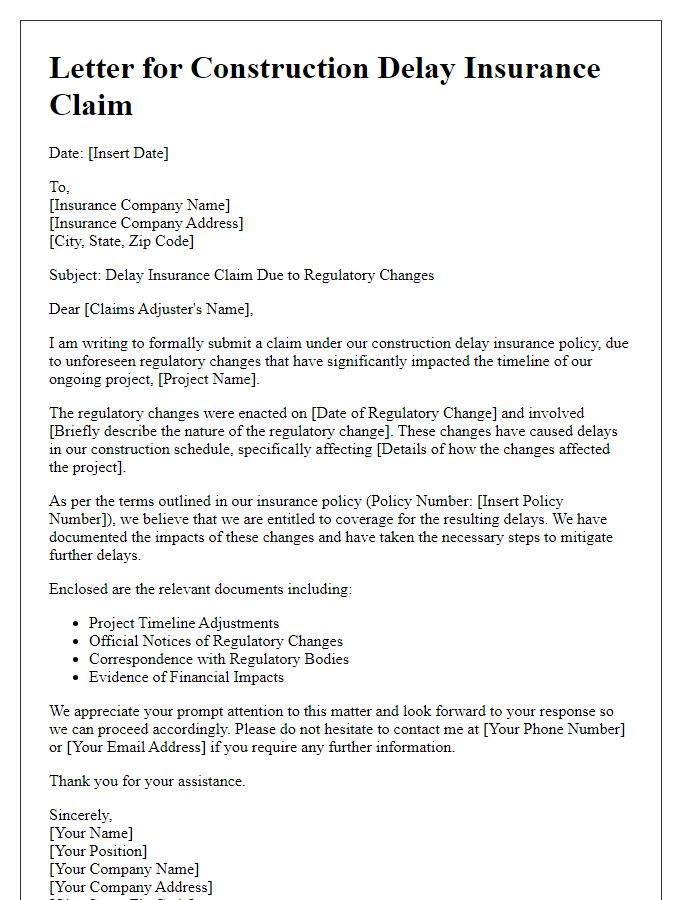

Letter template of construction delay insurance claim due to regulatory changes.

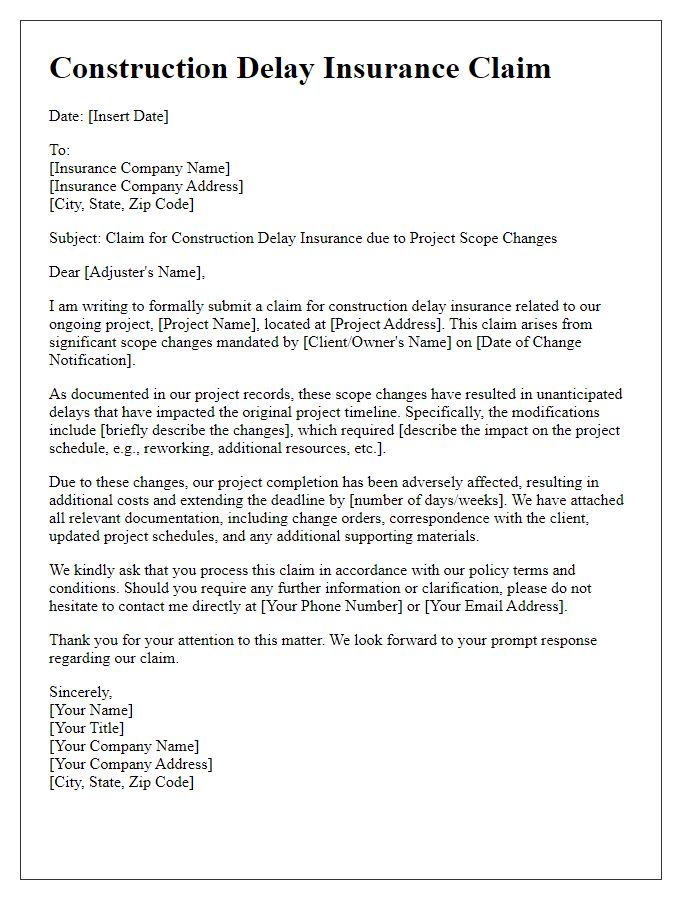

Letter template of construction delay insurance claim related to project scope changes.

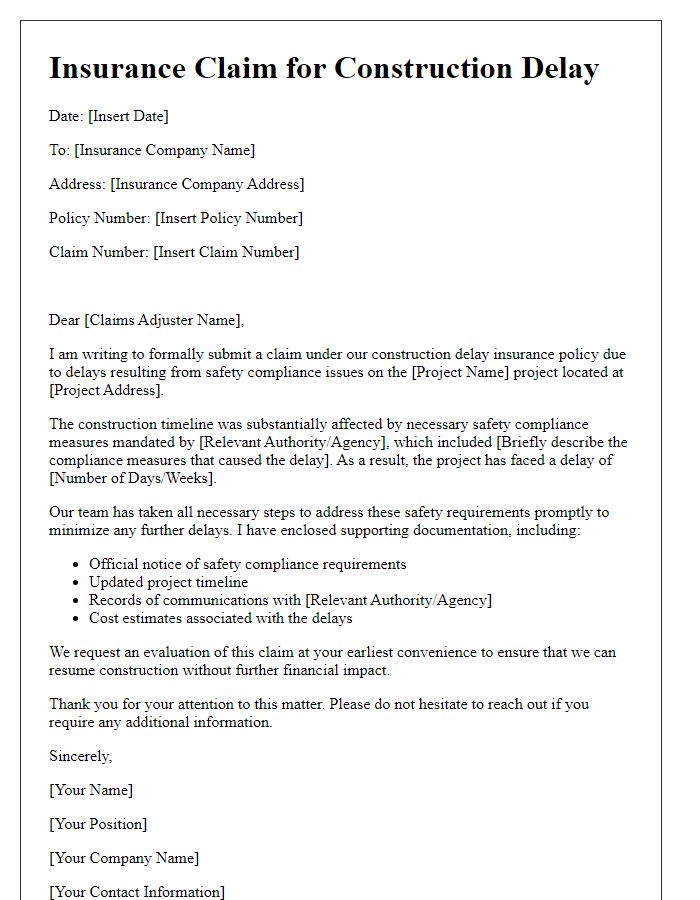

Letter template of construction delay insurance claim based on safety compliance delays.

Letter template of construction delay insurance claim involving permit delays.

Comments