Are you feeling overwhelmed by the insurance claims process? You're not aloneâmany people struggle with getting their claims approved in a timely manner. It can be frustrating to navigate the sea of paperwork and communication, especially when you believe you deserve a favorable outcome. If you're looking for a clear and effective way to escalate your insurance claim, keep reading for a comprehensive letter template that can help you make your case!

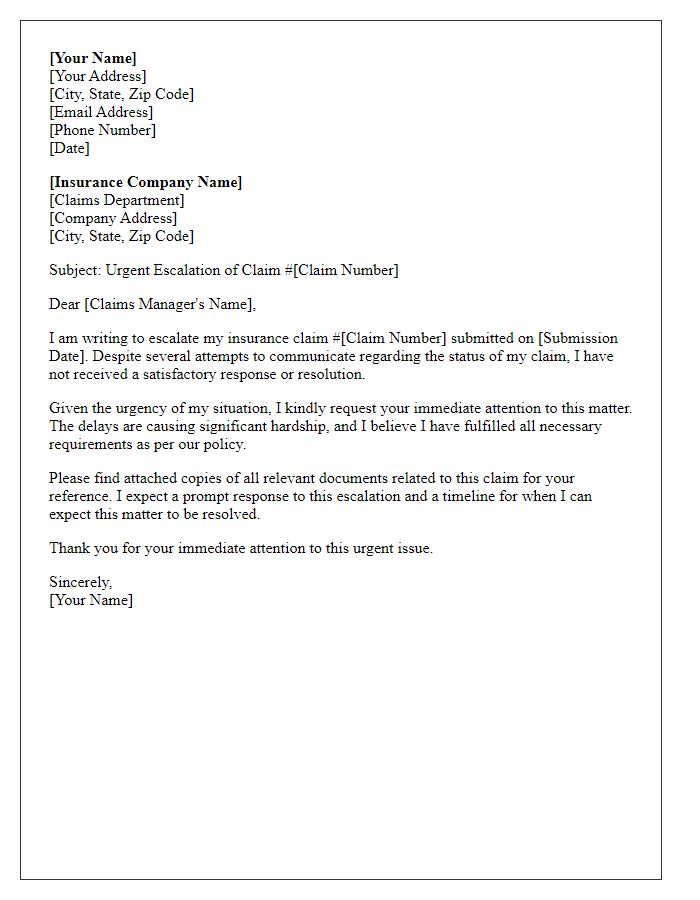

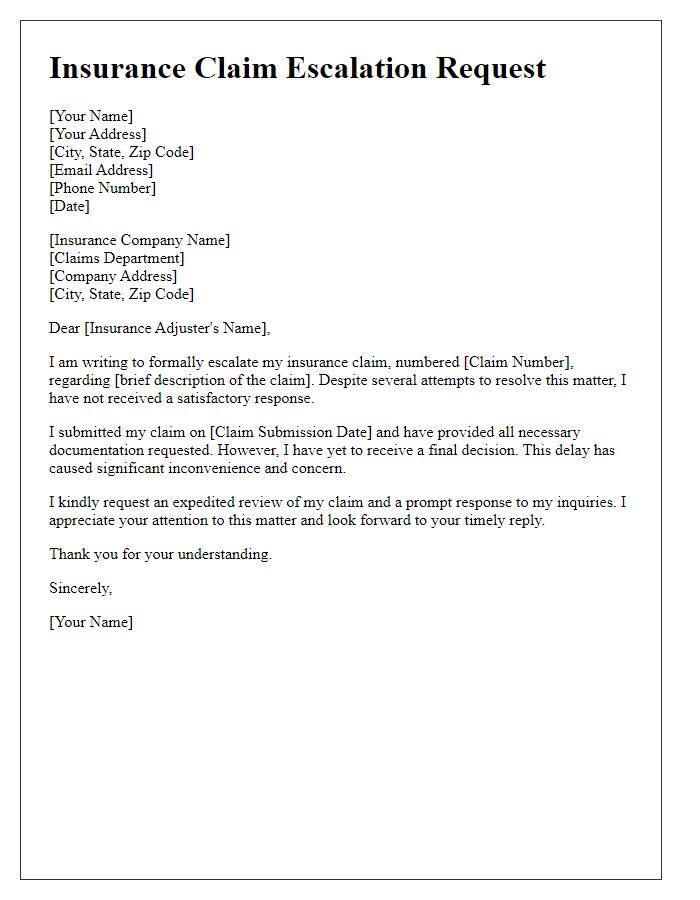

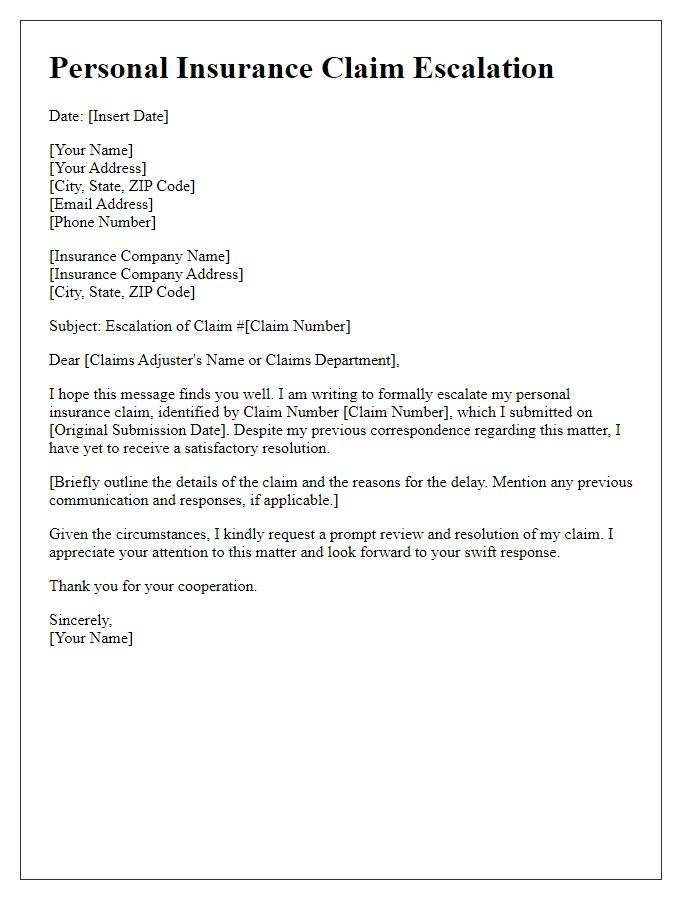

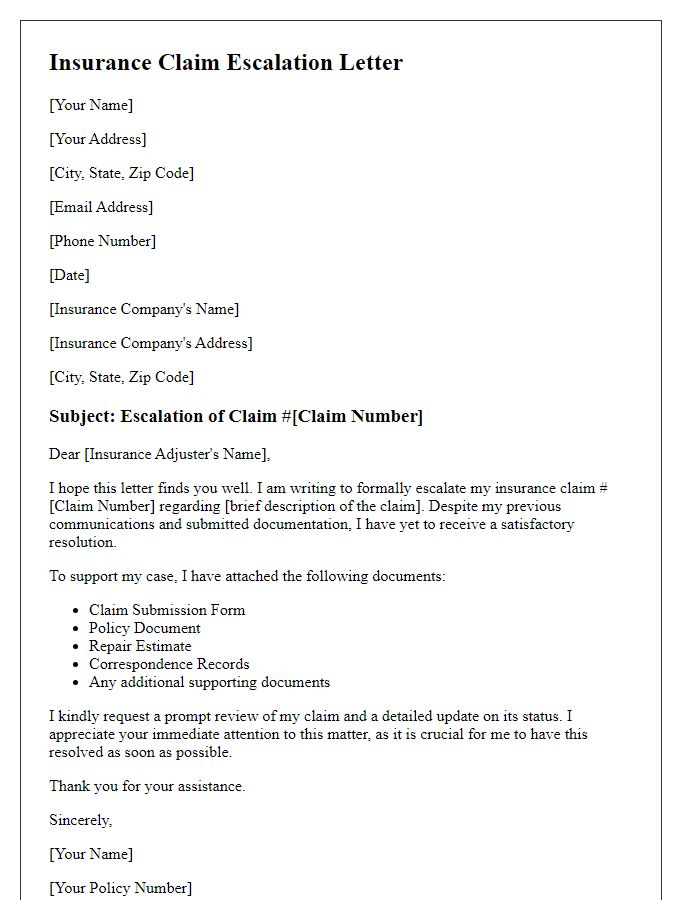

Policyholder details and policy number

Policyholders often encounter difficulties during the insurance claim process, necessitating escalation for resolution. The policyholder's details, including name, address, and contact number, should be clearly stated. For instance, a policyholder named John Smith residing at 123 Elm Street, Springfield, with a contact number of (555) 123-4567, requires effective communication. Additionally, the policy number, such as IN-001234567, plays a crucial role in identifying the specific insurance contract that governs the claim. Proper documentation and timely submission facilitate the escalation process and ensure that the insurance company, like XYZ Insurance Corp, addresses the claim expeditiously.

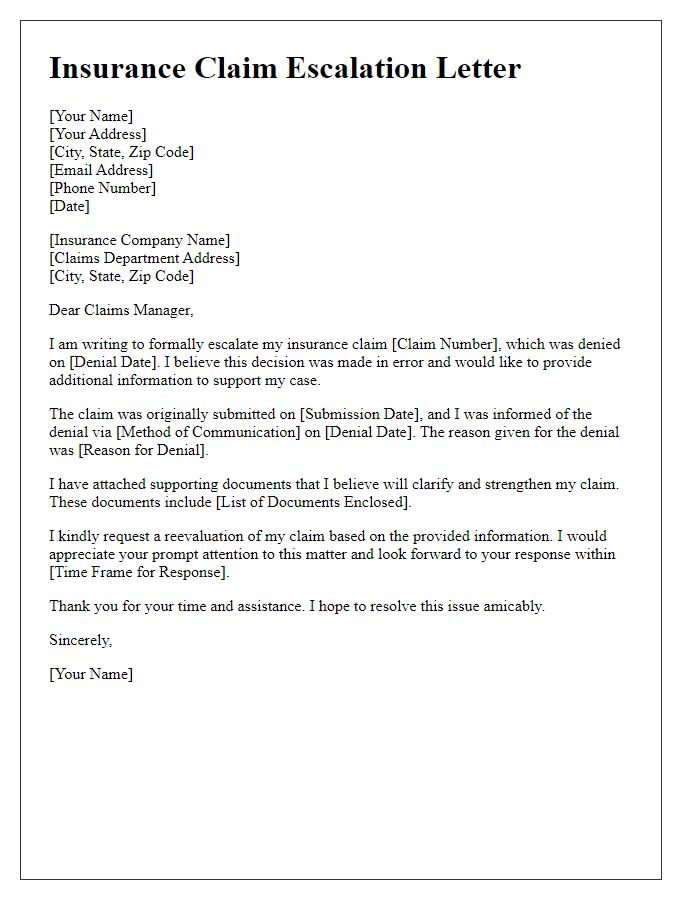

Summary of initial claim and response

The initial insurance claim submitted on March 15, 2023, regarding the water damage incident at 123 Maple Street, has received a preliminary response from XYZ Insurance Company on April 5, 2023. The claim, filed under policy number ABC123456, documented damages amounting to $15,000, including costs for repairs, mold remediation, and personal property loss. XYZ's response indicated only partial approval, covering $5,000, citing insufficient evidence for the remaining amount. The insurance adjuster visited the property on March 25, 2023, and documented visual assessments but did not include critical photographs of the extensive damage. Multiple follow-ups on this matter have taken place, resulting in slow communication and unresolved queries, prompting the need for escalation.

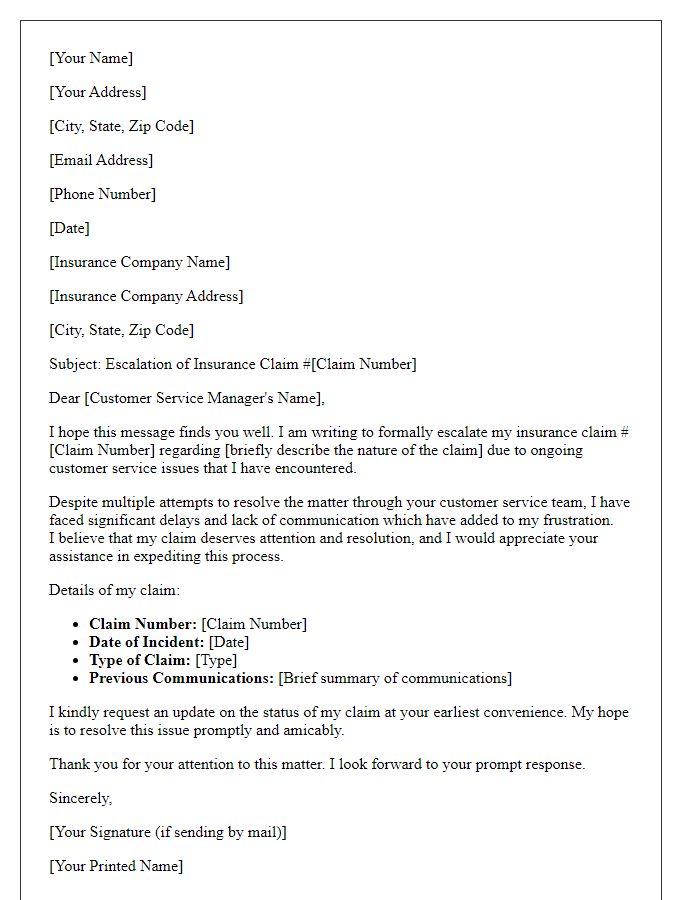

Detailed explanation of dissatisfaction

Dissatisfaction with insurance claim processes can stem from various factors, including inadequate communication from the insurance provider, delays in claim processing, inaccuracies in the assessment of damages, or insufficient compensation amounts. For example, a policyholder might experience frustration when their claim for property damage following a severe storm is met with a lengthy investigation process lasting over three months, despite clear documentation submitted, including photographs and repair estimates. Communication issues may arise when customer service representatives fail to provide timely updates or lack knowledge about the claim's status. Furthermore, if the final compensation amount is significantly lower than expected, especially when compared to repair costs outlined by certified contractors, it can greatly contribute to dissatisfaction. The cumulative effect of these experiences can lead to a feeling of neglect or a lack of accountability from the insurance company, prompting the need for escalation.

Supporting documents and evidence

Submitting an insurance claim requires comprehensive documentation to support the request for financial compensation. Essential items include the insurance policy number, timestamped photographs of the damages (specifically taken after the incident), and a detailed inventory of any lost or damaged items, including their respective values. A police report may be necessary for theft claims, while repair estimates from licensed contractors can validate the extent of the damage. Additionally, correspondence with the insurance adjuster, including their reference number and notes on phone conversations regarding the claim, can strengthen the case. All supporting documents should be organized clearly, with copies retained for personal records, ensuring that the claim is presented in a professional manner for efficient processing.

Request for reevaluation and desired outcome

Escalating an insurance claim can serve as a pivotal step in ensuring that the desired outcome is achieved. Specifically, policyholders may find themselves needing to request a reevaluation of a claim originally submitted for damages sustained during a severe weather event, such as the unprecedented hurricane that impacted the Gulf Coast in 2022. In high-stakes situations, the required documentation, including photographs of the damage, invoices for repairs, and previous correspondence with claims adjusters, plays a critical role in substantiating the request. Desired outcomes often include expedited processing of compensation claims or a revised settlement amount that accurately reflects the true extent of damages. Engaging with a higher-level claims representative can propel this process forward and enhance the likelihood of a favorable resolution.

Comments