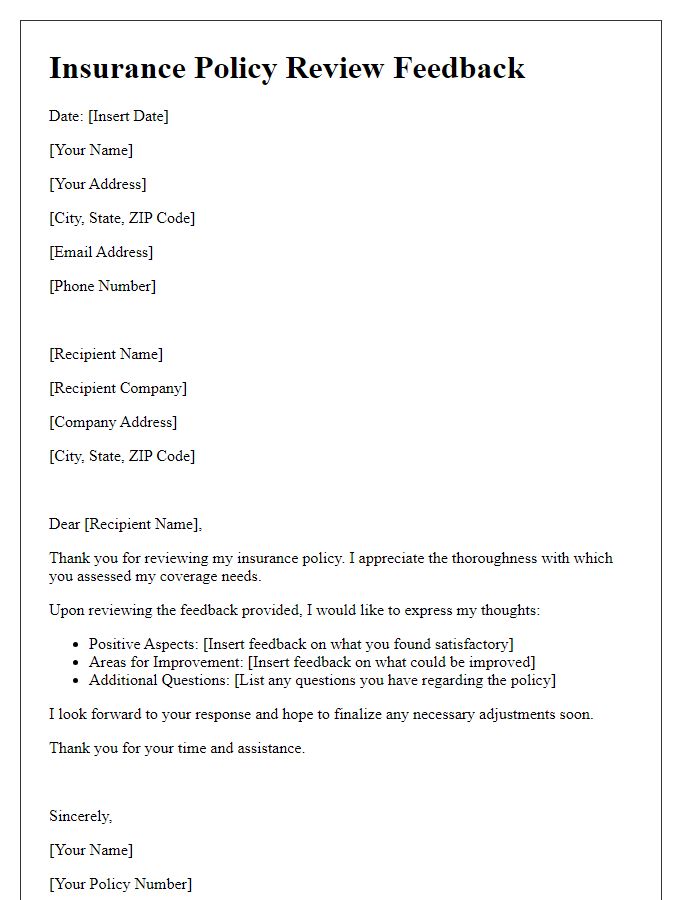

Are you feeling a little uncertain about your current insurance policy? It's completely natural to want a thorough review, especially as your needs and circumstances evolve. Understanding the fine print and ensuring you're adequately covered can make a significant difference in your peace of mind. So, let's dive deeper into the essentials of an insurance policy reviewâread on to discover how to ensure you're on the right track!

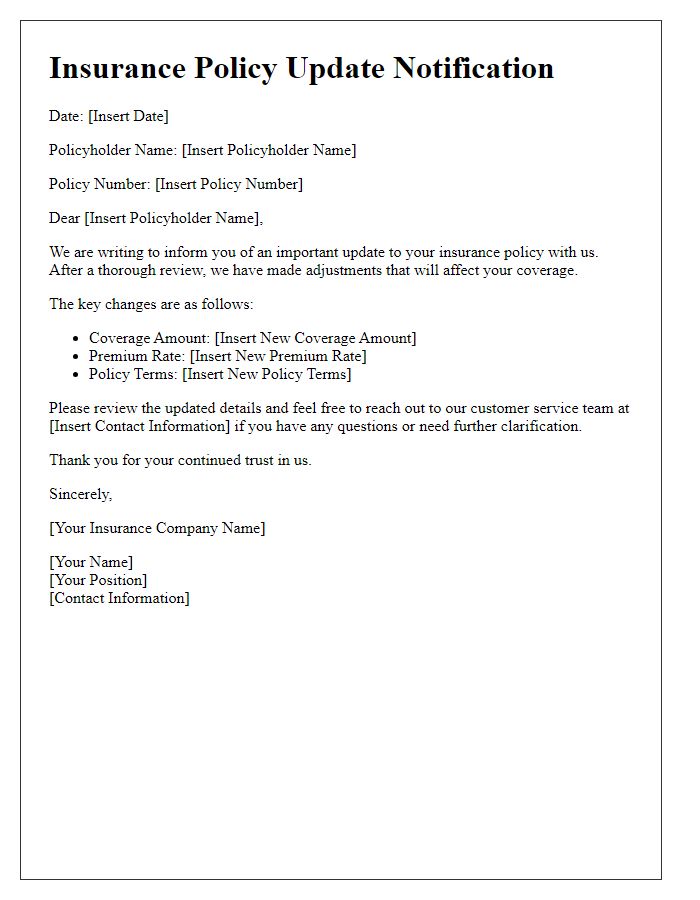

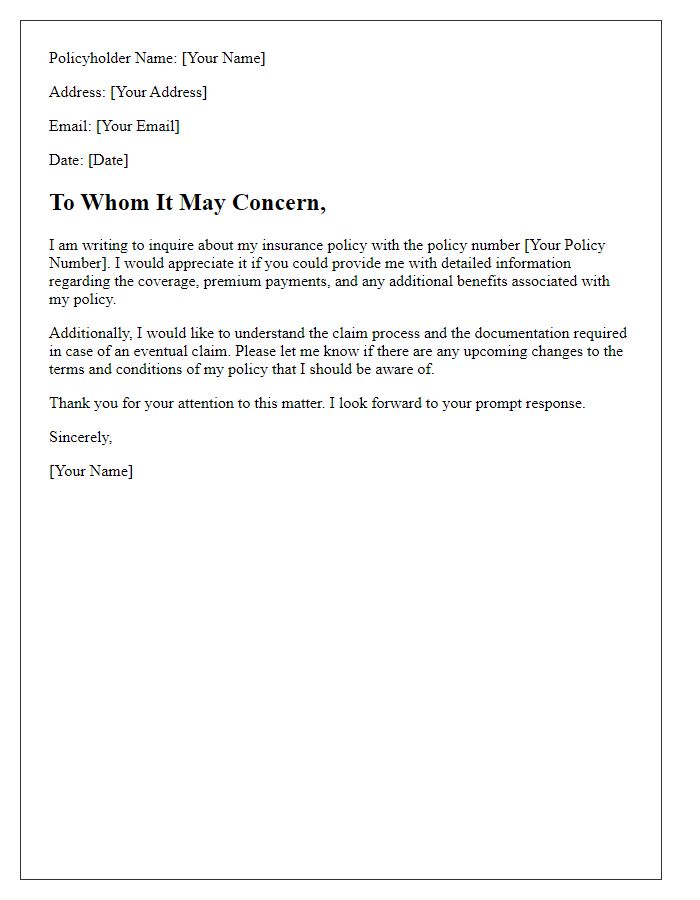

Policy Coverage Details

A comprehensive insurance policy review should encompass essential coverage details, including property loss, liability limits, and specific endorsements. Property loss coverage typically protects against events like fire, theft, and natural disasters, with many policies offering an aggregate limit ranging from $100,000 to $1 million based on the property's assessed value. Liability limits, often necessary for personal or commercial property, can commonly be set at $300,000, with options available to raise coverage to $1 million or higher, depending on risk factors. Specific endorsements, such as flood or earthquake coverage, may be necessary based on geographic location, often requiring additional premiums reflecting local risks. Understanding exclusions is crucial, as many policies may not cover certain risks like mold damage or claims from intentional acts, ensuring policyholders have a clear sense of their protections. Regularly reviewing these details ensures sufficient coverage against evolving risks and maintains compliance with lender requirements, particularly for properties in high-risk areas.

Premium Payment Terms

Insurance policy premium payment terms often dictate the financial obligations of the policyholder. Timely payments, typically on a monthly or annual basis, can prevent coverage lapses and ensure continued protection. Various payment methods may be accepted, including credit card transactions, electronic fund transfers, or traditional checks. Grace periods, usually ranging from 10 to 30 days, may be offered for overdue payments, allowing policyholders a brief extension before penalties or cancellations occur. Additionally, discounts might be available for policyholders who opt for automatic payments or pay premiums in full upfront. Understanding these terms is crucial for maintaining insurance coverage and avoiding potential financial setbacks.

Exclusions and Limitations

Reviewing insurance policies reveals critical exclusions and limitations that can significantly impact coverage. Common exclusions such as pre-existing conditions within health insurance policies often leave policyholders vulnerable to unexpected medical expenses. In auto insurance, limitations may apply to high-risk activities, resulting in a lack of coverage during incidents while participating in extreme sports. Additionally, natural disasters like floods and earthquakes often feature exclusions in standard homeowners policies, necessitating separate policies for adequate protection. Knowledge of these exclusions is crucial for ensuring comprehensive coverage and avoiding unforeseen gaps in protection.

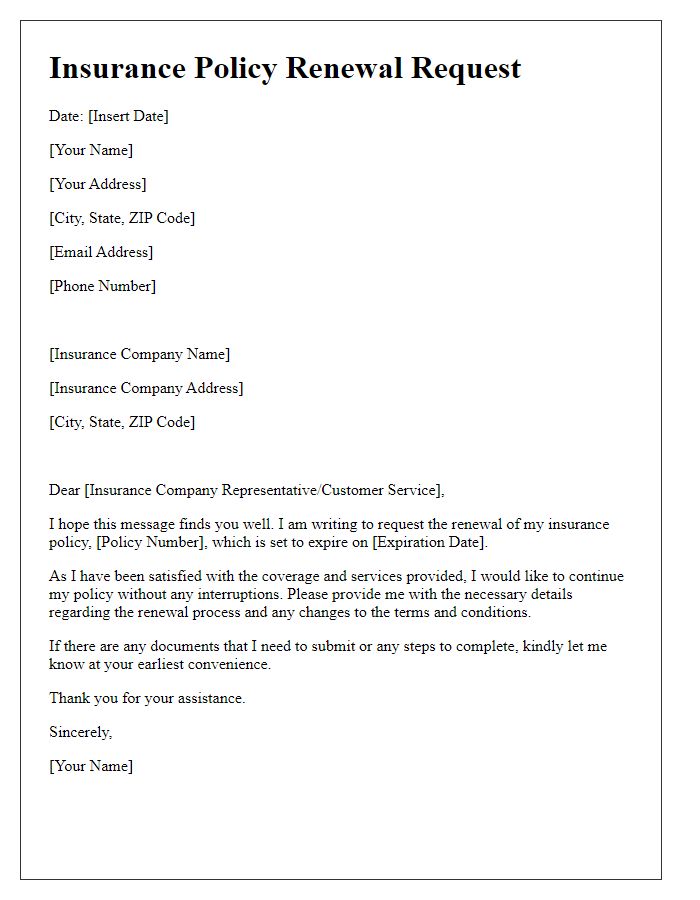

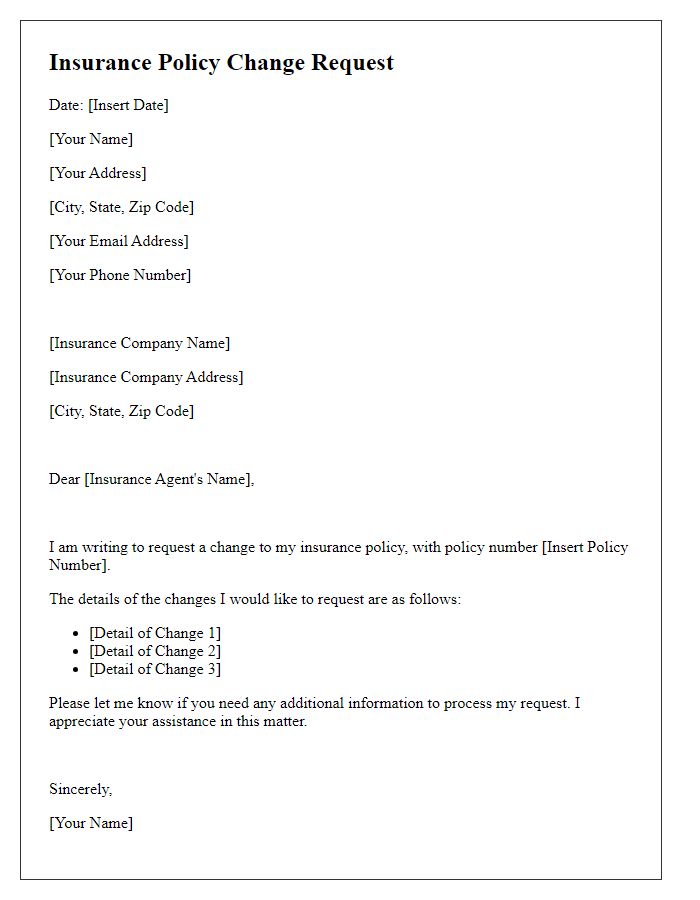

Renewal Process

The insurance policy renewal process involves several key steps that ensure continued coverage for policyholders. An insurance company typically sends a renewal notice (often 30 to 60 days before policy expiration) to the policyholder, detailing the current premium amount, coverage limits, and any changes in terms and conditions. Policyholders like individuals and businesses should carefully review the policy, assess their coverage needs, and compare quotes to avoid lapses in coverage. In many cases, policyholders can make necessary adjustments, such as increasing liability limits or adding new coverage options, during this period. Timely payment (usually within a specified grace period) of the renewal premium is essential to maintain insurance protection, preventing potential gaps in coverage that could lead to significant financial exposure during unforeseen events.

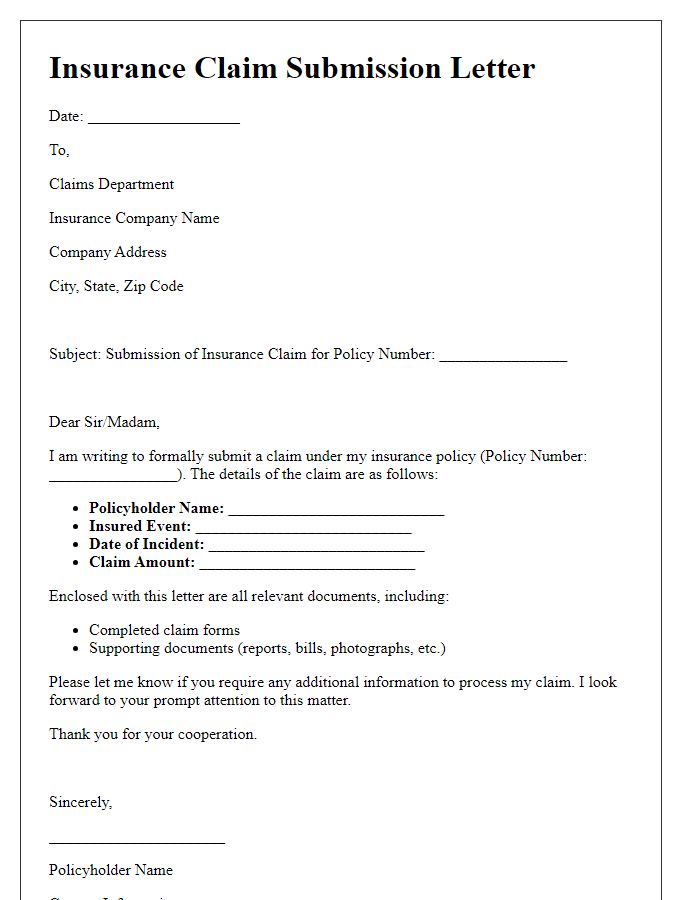

Claims Procedures

Insurance policy reviews often include essential claims procedures, covering necessary steps for filing a claim effectively. Policyholders must understand the specific requirements outlined in the insurance policy document, such as time limitations (often within 30 days of the incident), necessary documentation like photographs, repair estimates, and police reports, particularly for auto accidents or property damage. Insurers often provide a dedicated claims phone number, which can simplify the process by allowing immediate contact with a representative. Online claim submission portals are also common, enabling the upload of documents and real-time tracking of claim status, which enhances transparency and efficiency in claims processing. Comprehensive understanding of the claims procedures ensures smooth navigation through the complexities of insurance claims, minimizing delays and maximizing potential payouts.

Comments