Are you ready to secure your peace of mind once again? As your insurance policy approaches its renewal date, it's essential to revisit the coverage options that keep you protected. This is not only a reminder but also a chance to consider any updates or changes that may benefit you in the coming year. So, let's dive into the details and explore what you need to know about your insurance renewal!

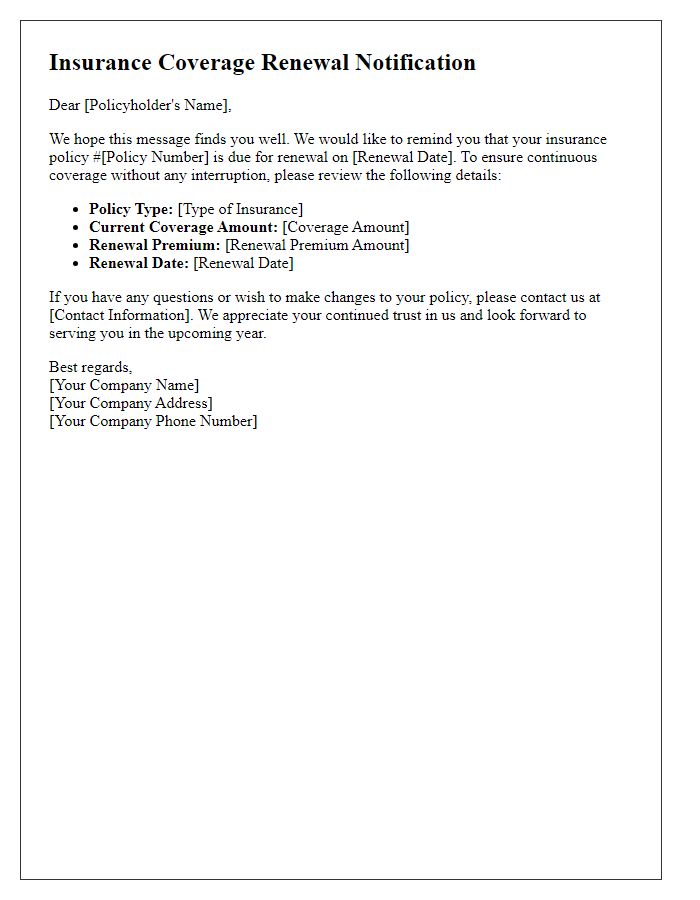

Personalization and customization

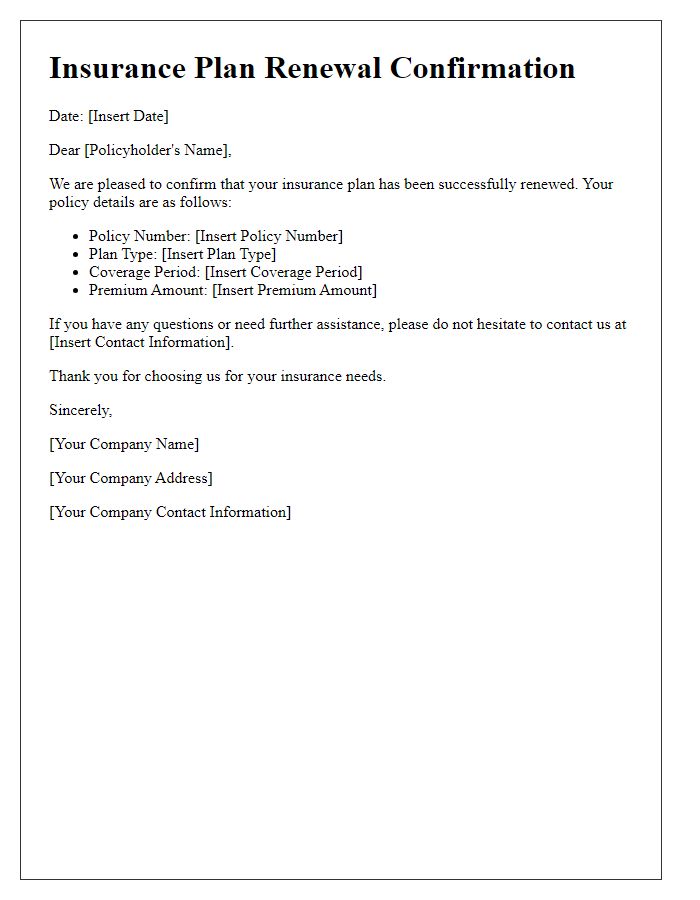

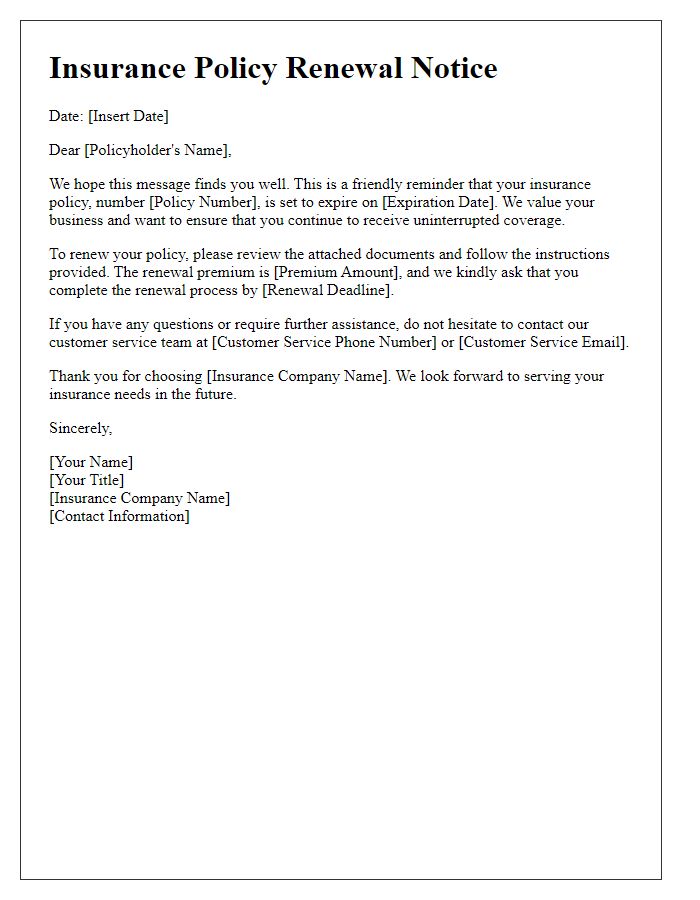

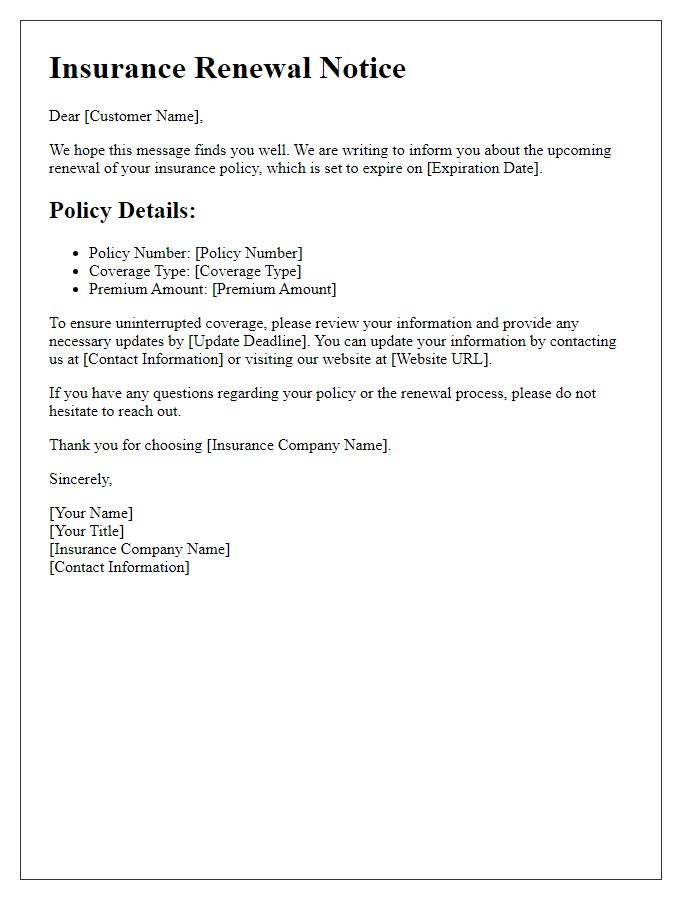

Insurance policy renewal notices require careful personalization and customization to effectively communicate important details and maintain customer engagement. Each notice should include the policyholder's unique policy number, name, and address to establish a personal connection. The renewal date must be clearly stated, along with reminders about coverage benefits and potential premium adjustments based on recent claims or changes in coverage. Additionally, information on claims history may strengthen the customer experience, while highlighting any new services or discounts available at renewal may enhance customer loyalty. Ensuring the language aligns with the policyholder's preferred communication style could significantly improve the overall effectiveness of the notice.

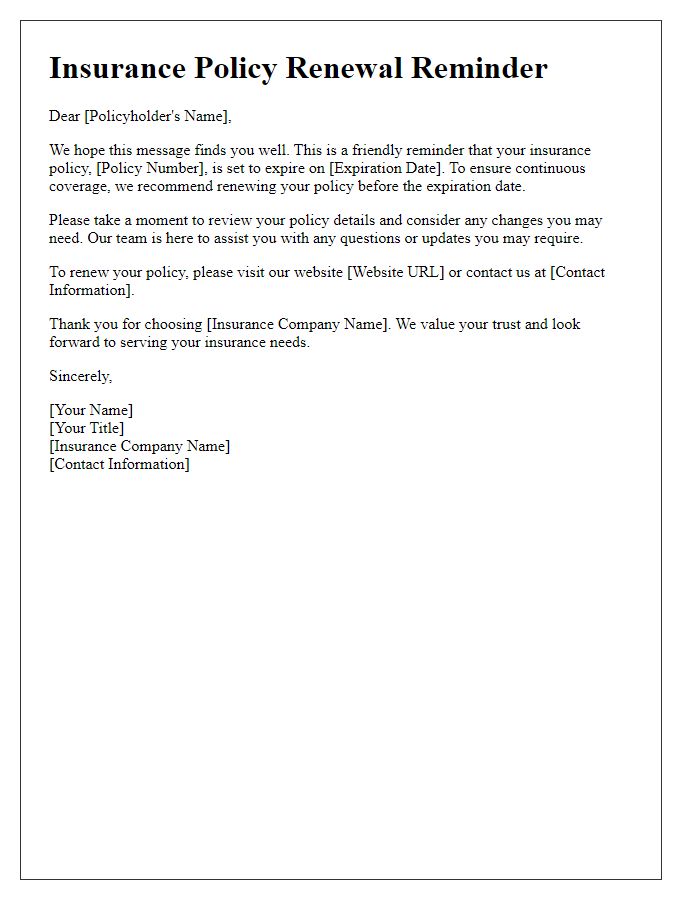

Clear subject line and purpose

Insurance policy renewal notices serve as official communications from insurers, reminding policyholders of upcoming expiration dates. Typically issued 30 days prior to the renewal deadline, these notices outline key details: policy number (unique identifier for documentation purposes), coverage limits (financial cap on claims), premium amount (cost for continued coverage), and renewal terms (conditions for policy renewal). Essential information includes the named insured (individual or entity covered), policy effective date (start of coverage), and a due date for premium payment (deadline to avoid lapse in coverage). The notice often emphasizes the importance of reviewing and updating personal information to ensure continued protection.

Policy details and renewal terms

Insurance policy renewal notifications play a critical role in keeping policyholders informed about their coverage. Details such as the policy number, expiration date, and terms of renewal should be clearly stated. Policy number serves as a unique identifier, essential for processing renewal efficiently. The expiration date, for example, June 30, 2024, highlights the urgency of timely action. Renewal terms may include premium adjustments, coverage changes, or specific conditions that must be met for continued protection. Additionally, dates for payment, typically 30 days before expiration, should be emphasized to prevent any lapse in coverage. Such communications help ensure that policyholders remain aware of their obligations and benefits under the insurance agreement.

Premium payment information and options

Insurance policy renewal notices provide essential information regarding premium payments and available options. Policyholders should be informed about the total premium amount due for renewal, typically displayed prominently (such as $750 due by March 1, 2024). Various payment options are available: online payment via secure portal, direct bank transfer, or payment by check, along with respective due dates. Additionally, it is important to highlight any penalties for late payments, such as a 5% late fee applicable after March 15, 2024. Optional automatic renewal settings may facilitate uninterrupted coverage, ensuring that the policy remains active without manual intervention. Policyholders are encouraged to review coverage details and benefits before making payments.

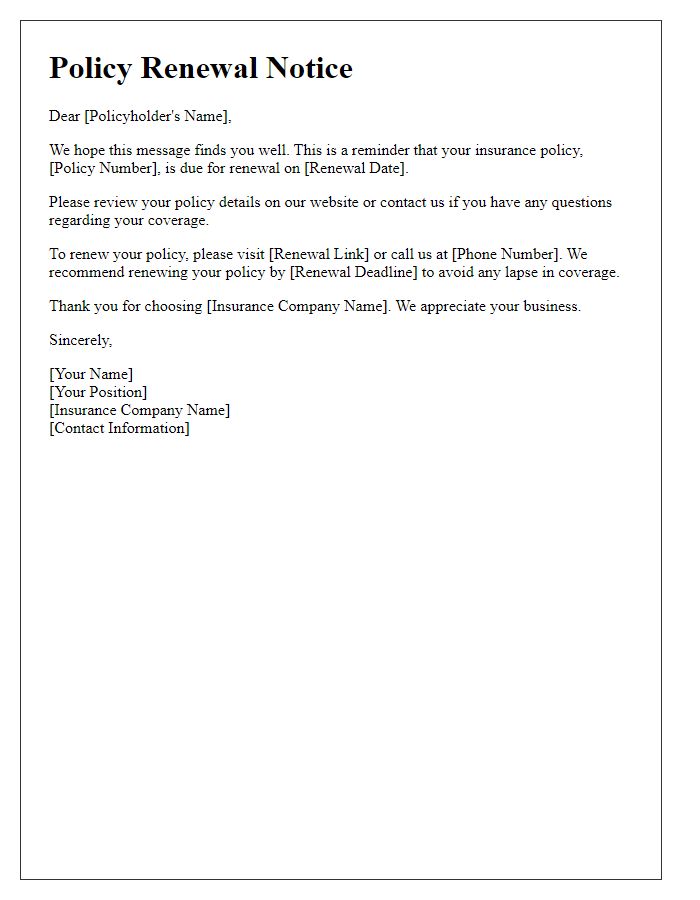

Contact information and assistance availability

Insurance policy renewal notices typically include contact information for customer service and details on assistance availability to help policyholders navigate their options. For example, the notice may provide a toll-free phone number, such as 1-800-123-4567, for immediate assistance during business hours (9 AM to 5 PM EST, Monday to Friday). Additionally, email options for inquiries (e.g., service@insurancecompany.com) and online chat features on the company's website enhance accessibility. Contacting the claims department may be crucial for policyholders needing specific information regarding their claims or coverage changes. Accessing FAQs on the insurer's website can also assist in resolving common issues.

Comments