Are you looking to navigate the process of an insurance endorsement application with ease? Whether you're updating coverage, adding a new vehicle, or making modifications to your existing policy, having the right letter template can streamline your application. This guide will provide you with all the essential elements to include, ensuring your request is both clear and professional. So, let's dive in and explore how you can craft the perfect letter for your insurance endorsement needs!

Accurate Policy Information

Accurate policy information is crucial for insurance endorsements, ensuring clarity and compliance with legal standards. Incorrect details can lead to delays or denial of claims. Essential components of policy information include the policy number, coverage limits, effective dates, and the names of all insured parties. Verification of these details is necessary before submission to the insurance provider's underwriting department. Furthermore, any amendments in property value, insured assets, or risk factors must be documented to align with the terms of the endorsement. This diligence promotes a seamless endorsement process and safeguards against future liabilities.

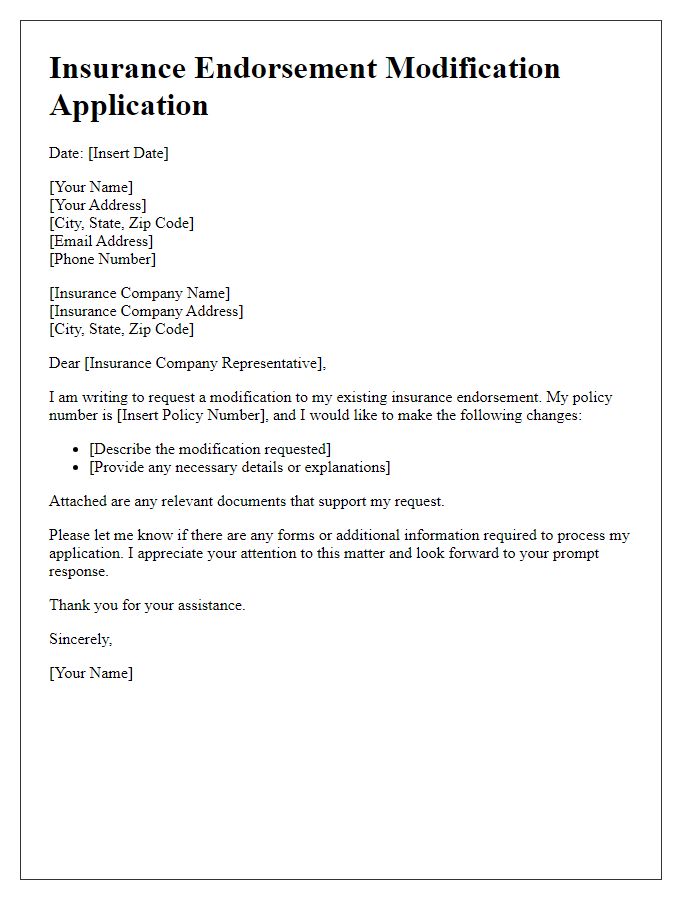

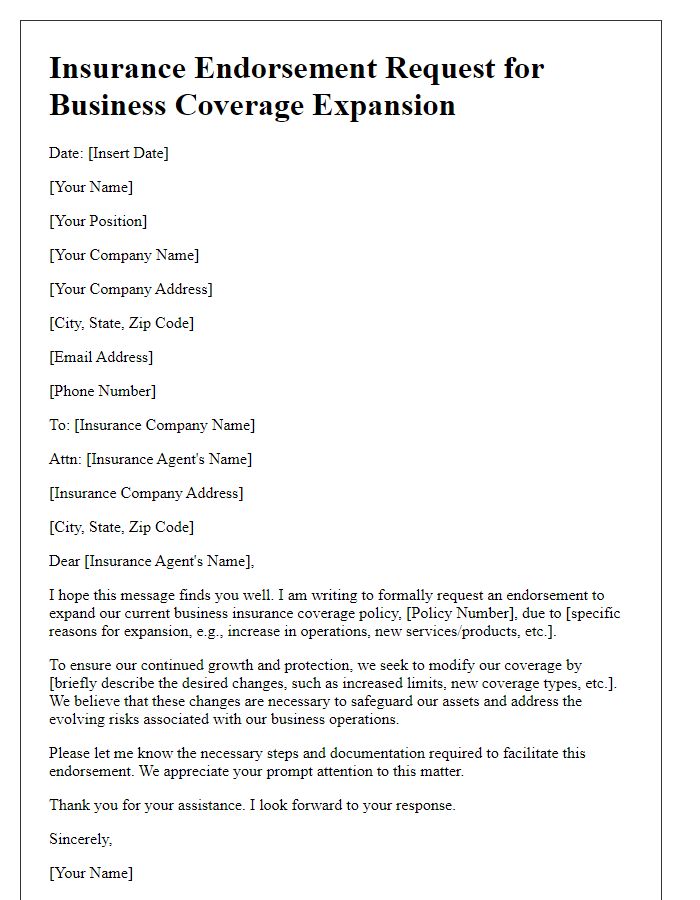

Clear Description of Endorsement Request

Insurance endorsement applications often require clear and precise descriptions to ensure that the requested changes are understood and accurately processed. An endorsement request may include modifications such as increased coverage limits, the addition of new insured parties, or the alteration of property details. For example, when requesting a revision to a homeowner's policy, the applicant might specify the inclusion of a newly acquired vintage car, with a description indicating its make (e.g., 1967 Ford Mustang), model, and current market value (estimated at $30,000). This also might entail an update of liability coverage limits reflecting the new asset's value to provide adequate protection. Each detail assists insurance providers in assessing risks and establishing appropriate terms for coverage adjustments.

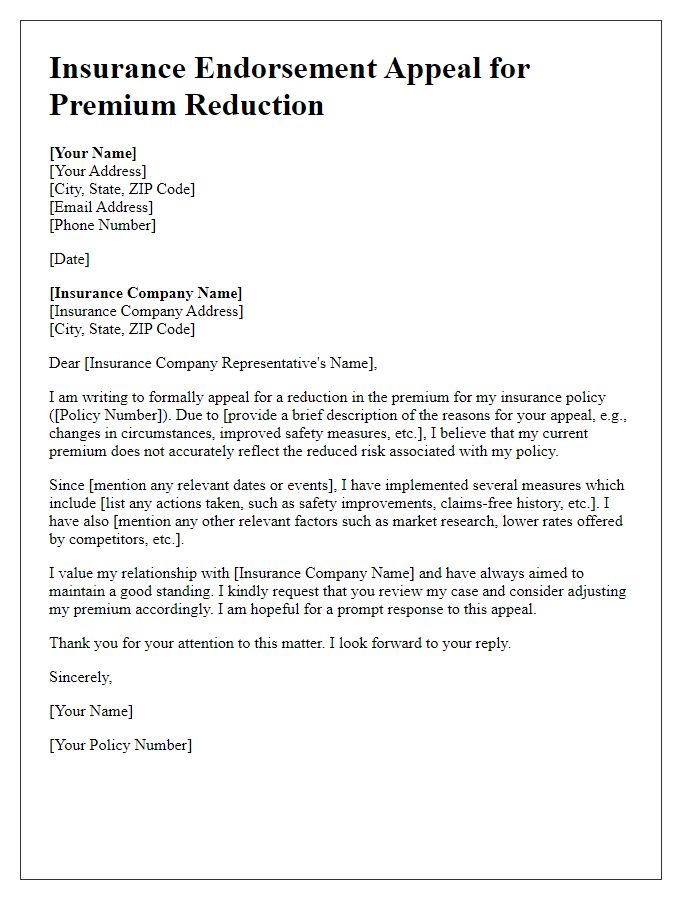

Justification for Endorsement

The insurance endorsement application requires a clear justification to support changes in coverage. Recent events have highlighted the need for enhanced protection, particularly for properties in flood-prone areas, like the Atlantic coast. Statistics show a 30% increase in extreme weather incidents over the past decade, emphasizing the urgency for property owners to reassess their coverage. An example includes Hurricane Ida in 2021, which caused over $75 billion in damages across the southeastern United States. Adjustments in the policy may include adding riders for natural disasters, ensuring comprehensive coverage aligns with current risks. Regular policy reviews can safeguard assets, providing peace of mind amid evolving environmental challenges.

Effective Contact Details

Contact details play a crucial role in the insurance endorsement application process, facilitating efficient communication between the insured party and the insurance provider. Providing accurate information, such as the primary phone number (often a mobile line), email address, and mailing address, is essential for timely updates regarding policy changes. Specific attention should be given to the policy number, which serves as a unique identifier for the policyholder's account, ensuring streamlined processing of endorsements. It's also important to include preferred contact hours to accommodate both parties, enhancing the experience and response times throughout the endorsement application process.

Signature and Authorization

The insurance endorsement application requires a clear and concise signature and authorization section, ensuring the integrity of the application process. This section must include spaces for the applicant's full name, policy number, and type of endorsement requested. Additionally, it should feature a prominent area for the applicant's signature, validating their consent to the changes requested. Date of signature must be included as well, indicating the exact moment authorization was granted. Specific instructions regarding the handling of personal information as per local regulations, such as the General Data Protection Regulation (GDPR), should be noted to reassure applicants about their privacy rights. Correct completion of this section is vital for the processing of the endorsement by the insurance provider, such as State Farm Insurance or Allstate.

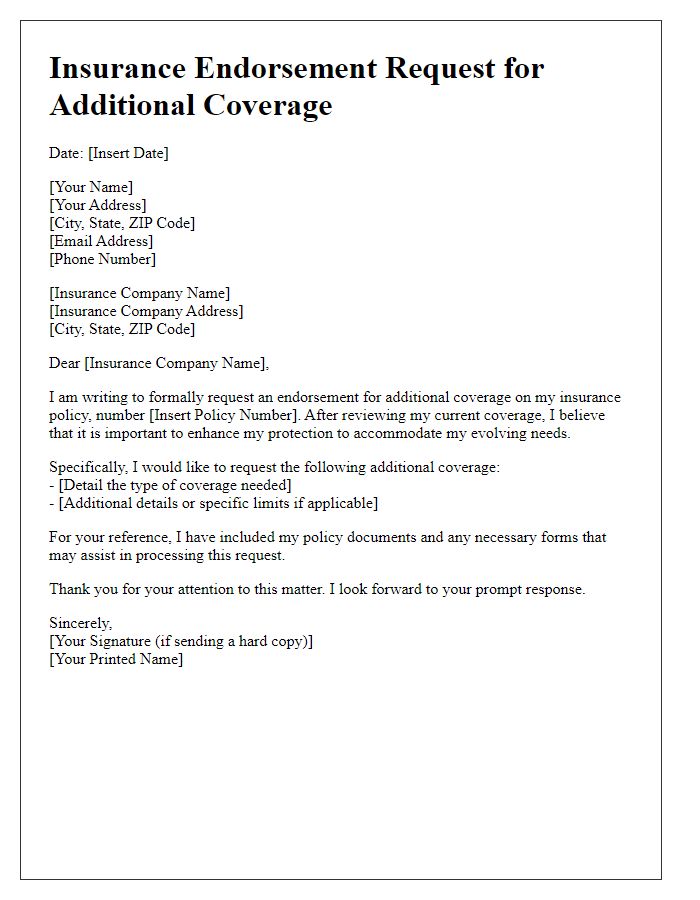

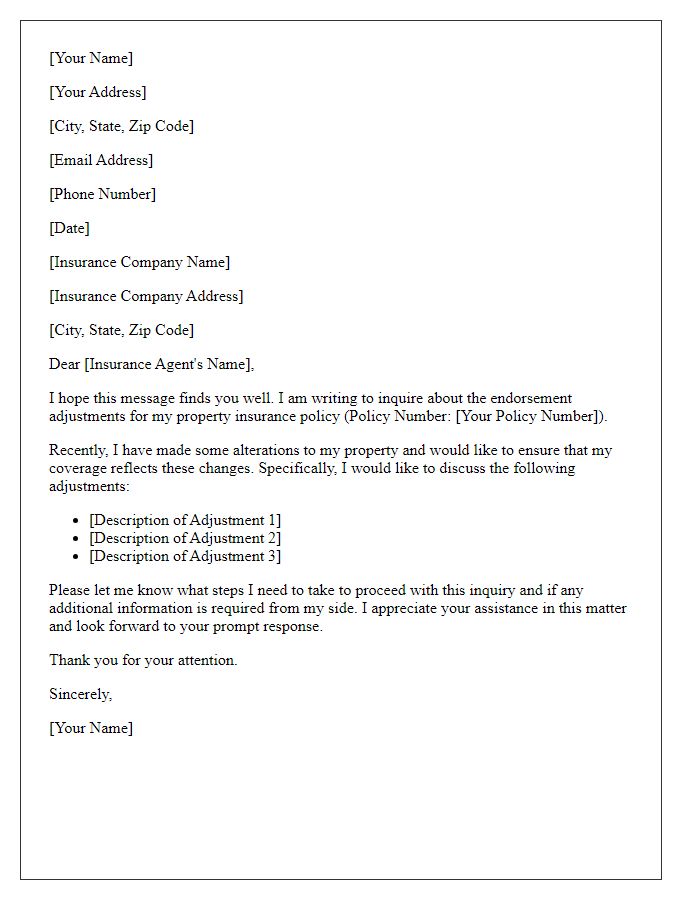

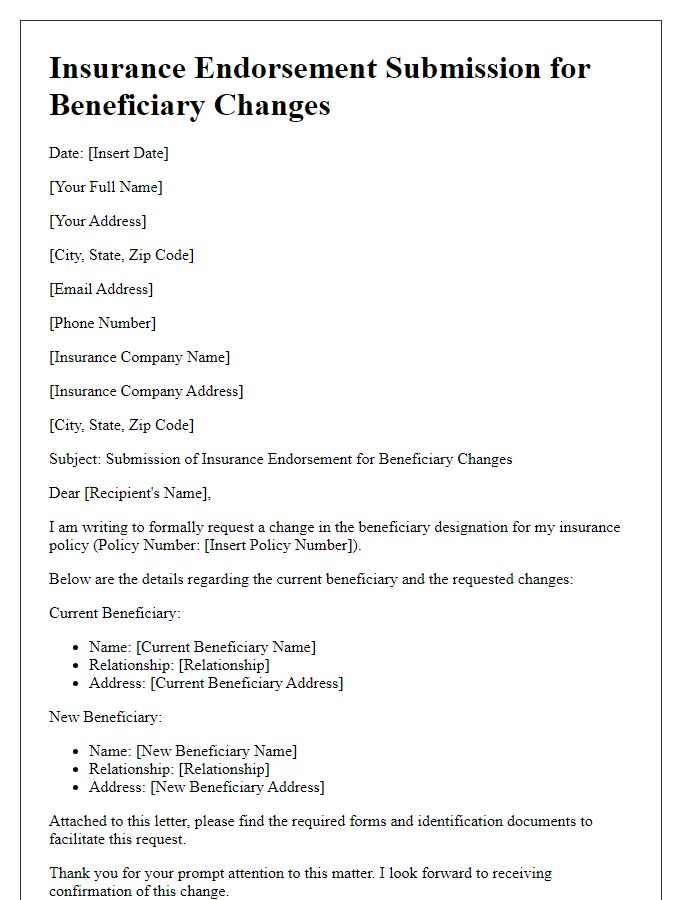

Letter Template For Insurance Endorsement Application Samples

Letter template of insurance endorsement request for additional coverage.

Letter template of insurance endorsement inquiry for property adjustments.

Letter template of insurance endorsement submission for beneficiary changes.

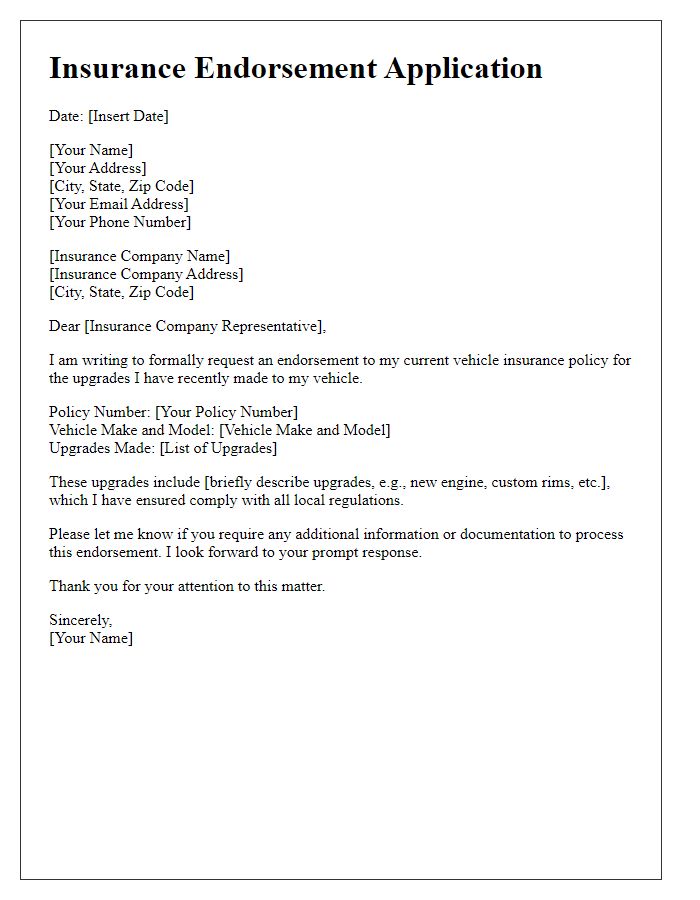

Letter template of insurance endorsement application for vehicle upgrades.

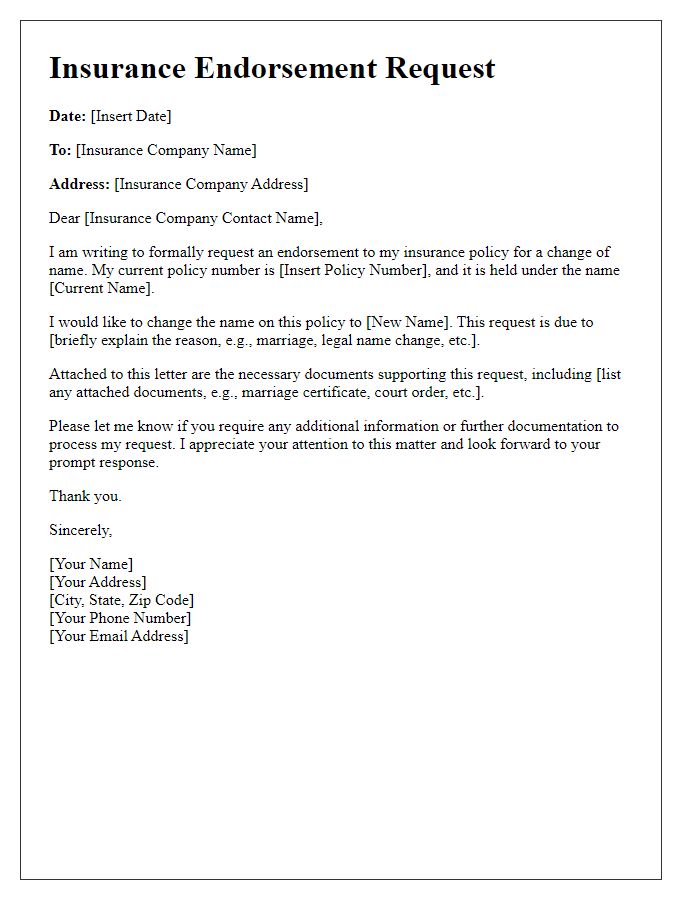

Letter template of insurance endorsement request for policy name change.

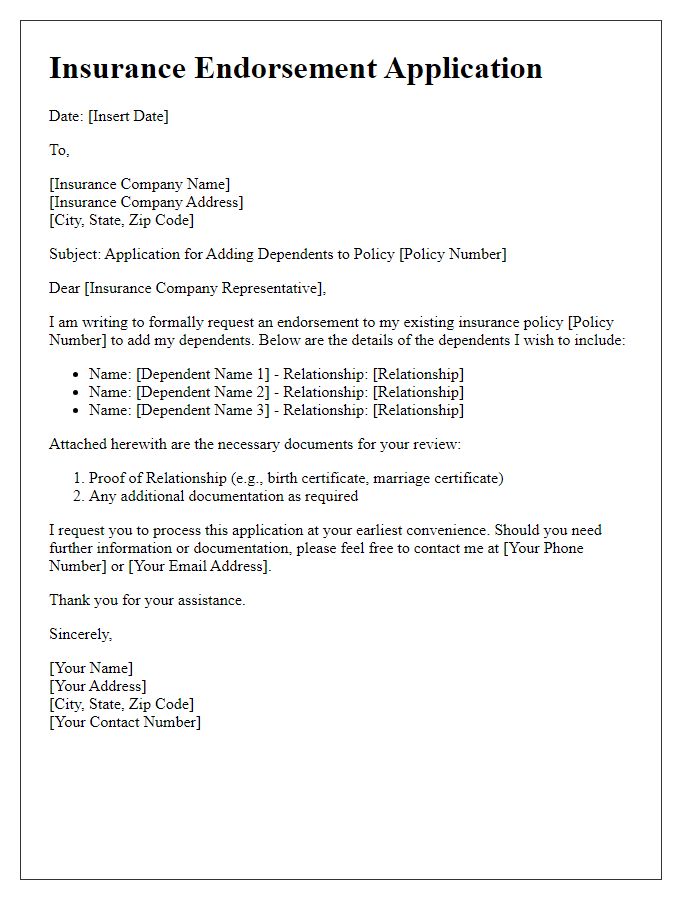

Letter template of insurance endorsement application for adding dependents.

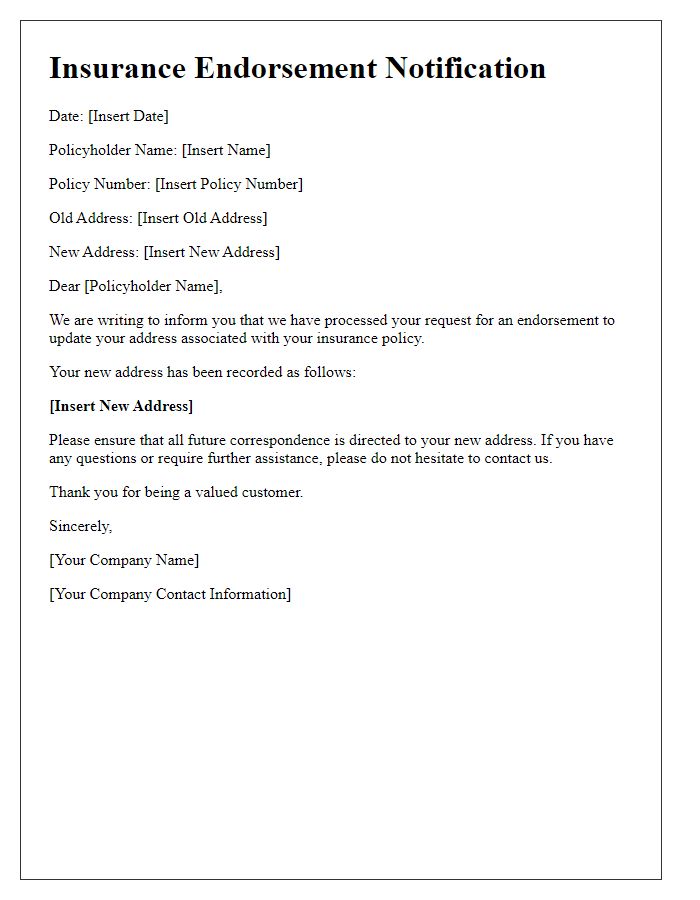

Letter template of insurance endorsement notification for address changes.

Comments