When it comes to understanding the ins and outs of insurance claims, navigating the various criteria can feel overwhelming. We've all been there, staring at fine print and wondering what exactly qualifies for coverage. In this article, we'll break down the key elements that determine your eligibility and streamline the claims process for you. So, let's dive in and help demystify the world of insurance claimsâread on to discover the essential criteria!

Policyholder Identification Information

Policyholder identification information is crucial for processing insurance claims effectively. This data typically includes the policyholder's full name, which verifies their ownership of the insurance policy. Policy number serves as a unique identifier for the specific coverage, enabling the insurance company to access relevant details. Date of birth affects eligibility and underwriting criteria, ensuring the policy complies with age-related stipulations. Contact information, including email and phone number, is essential for communication regarding claim status. Additionally, any secondary policyholders or beneficiaries must be identified to address potential payout issues. Clear documentation of this information expedites the claims process, leading to quicker resolution and payment.

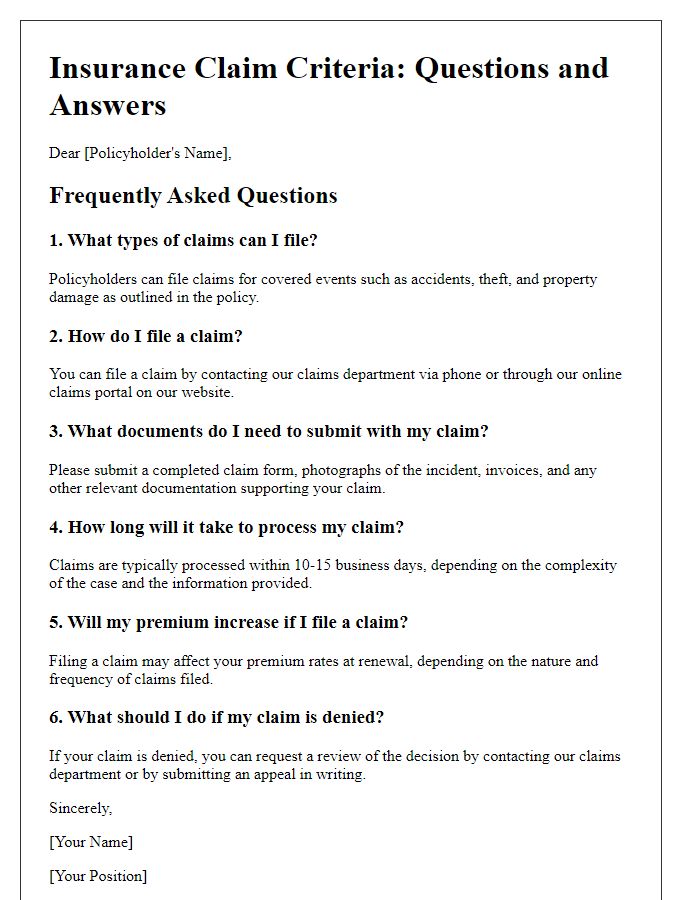

Policy Details and Coverage Limits

Insurance policy details vary significantly between providers, typically outlining the specific terms under which claims can be made. Coverage limits are critical, indicating the maximum amount the insurance company will pay for a covered loss. For instance, a homeowner's policy might have a dwelling coverage limit of $300,000 for repairs or rebuilding due to events like fire or vandalism. Additional structures, personal property, and liability coverage often come with their own limits, which require thorough understanding. Moreover, policy specifics such as deductibles (fixed amounts that policyholders must pay before insurance coverage kicks in) and exclusions (situations not covered by the policy) are equally important for assessing potential claims. Customers should regularly review their policy details to ensure adequate coverage in case of unforeseen events.

Incident Description and Date

An insurance claim requires a clear and comprehensive incident description to facilitate the evaluation process. For example, if a car accident occurred on January 15, 2023, at 3:00 PM on Main Street in Springfield due to a collision with another vehicle at an intersection, detailing exact circumstances is vital. Include relevant information such as weather conditions (overcast with occasional rain), visibility issues (limited due to the setting sun), and road conditions (wet due to rain). Specific details about the vehicles involved, including make, model, and license plates, along with the involvement of any witnesses, strengthen the claim. Accurately documenting the event and date contributes to a seamless claims process, ensuring that all necessary information is provided to support the claim.

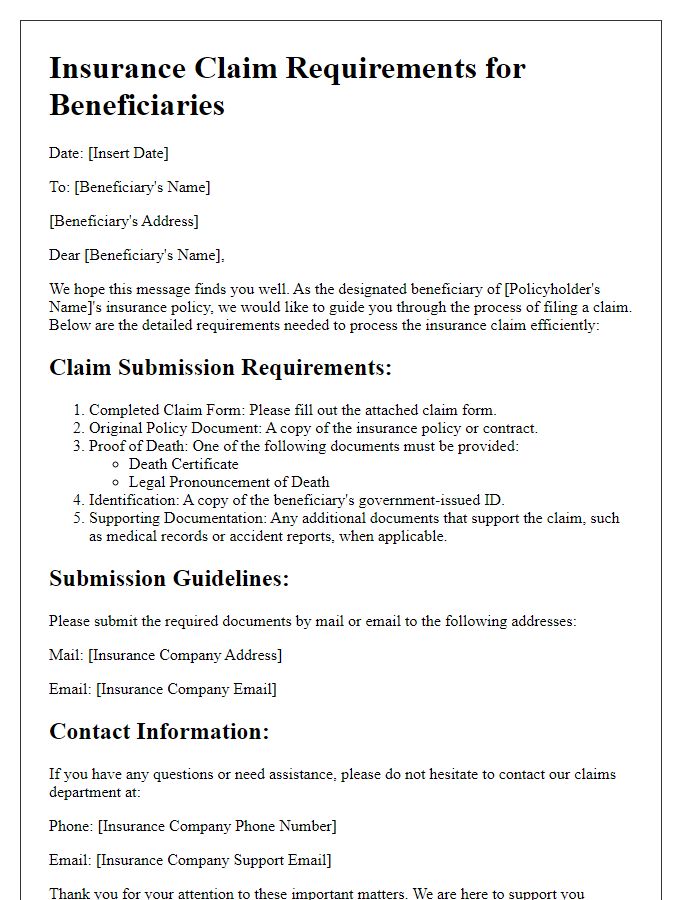

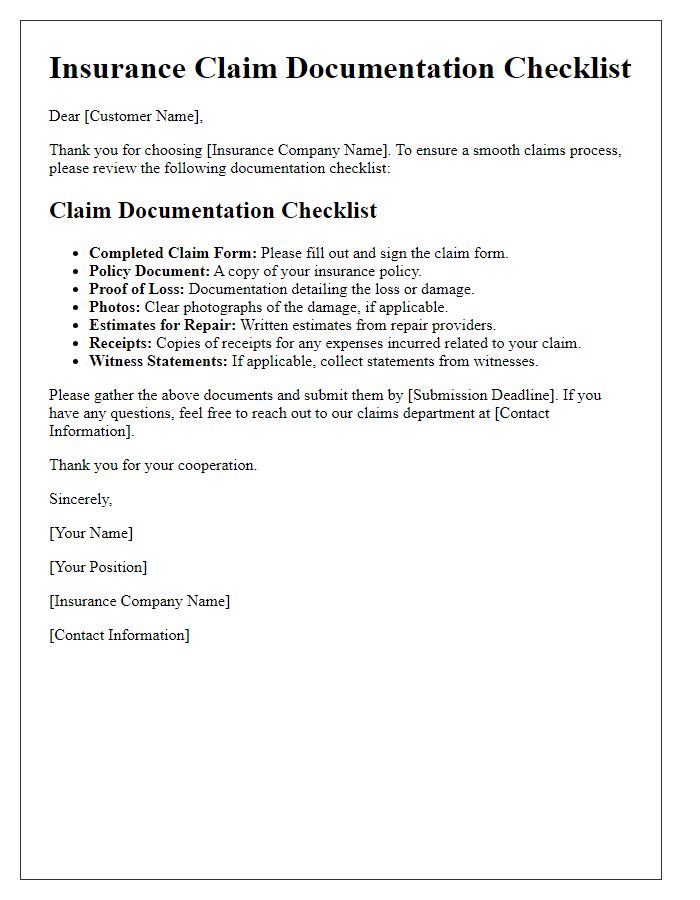

Supporting Documentation Requirements

Comprehensive insurance claims require supporting documentation to ensure a successful review process. Essential documents include a completed claims form, which outlines the details of the incident or loss, and proof of loss, such as invoices or receipts reflecting the financial impact incurred. Photographic evidence, depicting the affected property or damage, provides clarity and helps validate the claim. Additionally, any police reports or official records related to theft, accidents, or damage, depending on the nature of the claim, must be submitted. For health-related claims, medical records and bills, along with a detailed explanation from healthcare providers, illustrate the treatment received and expenses involved. Submitting all required documentation enhances the likelihood of prompt processing and approval by the insurance provider.

Claim Processing Timeline and Contact Information

The insurance claim processing timeline varies significantly depending on the complexity of the claim. Standard claims, such as those for minor automobile accidents, typically take between 7 to 14 days for initial processing. However, more complex claims, such as those involving extensive property damage from natural disasters like hurricanes or floods, can take weeks or even months to resolve fully. Claimants should ensure they provide all necessary documentation, including police reports, damage assessments, and photographs, to expedite the process. For further assistance or inquiries about specific claims, clients can reach the claims department at the dedicated contact number (1-800-555-0199) or through the online portal available on the company's website. Regular updates will be provided via email, ensuring transparency throughout the claim assessment process.

Letter Template For Insurance Claim Criteria Explanation Samples

Letter template of detailed insurance claim requirements for beneficiaries

Letter template of insurance claim documentation checklist for customers

Letter template of common insurance claim criteria questions and answers

Comments