Are you feeling overwhelmed by the intricacies of your insurance coverage? Navigating the world of policies and claims can be daunting, but understanding your options is key to making informed decisions. In this article, we'll break down how to effectively request an insurance coverage analysis to ensure you're getting the most out of your policy. Ready to take control of your insurance journey? Keep reading to discover how simple it can be!

Clear Policy Details

Understanding insurance coverage requires clear policy details that outline the specific terms, conditions, and limitations associated with the coverage type. Key components include premium amounts, deductibles (the amount policyholders must pay before coverage kicks in), and the extent of coverage (what is included and what is excluded). For instance, health insurance policies may specify coverage for routine check-ups, emergency services, and prescription medications, while excluding cosmetic procedures or pre-existing conditions. Additionally, geographical limitations (certain policies may not cover international incidents), and claim procedures (steps required to file a claim) are critical details that clarify rights and obligations of the insured. Reviewing these aspects helps in evaluating overall adequacy and appropriateness of the coverage.

Specific Coverage Areas

Analyzing specific insurance coverage areas in comprehensive policies, such as homeowners insurance, auto insurance, and health insurance, provides essential insights into potential protections and limitations. Homeowners insurance typically covers property damage, personal liability, and loss of use, often requiring up to $300,000 in dwelling coverage based on local real estate values. Auto insurance policies include liability coverage mandated by state laws, often ranging from $15,000 to $250,000 per accident, as well as collision and comprehensive coverage options that protect against vehicle damages beyond accidents. Health insurance analysis should focus on coverage areas like preventive care, hospitalization, and outpatient services, often dictated by ACA regulations, which require essential health benefits to be included. Understanding these specifics can help identify gaps in coverage and facilitate better financial planning.

Claim History Overview

Insurance coverage analysis requires a comprehensive review of claim history. Individuals seeking to understand their policy outcomes and coverage limits often review documents spanning numerous years. Essential elements include the date of each claim (often recorded in MM/DD/YYYY format), the nature of incidents (such as auto accidents, property damage, or health claims), and total claim amounts--figures that can influence future premium costs. Specific insurance providers, like State Farm or Allstate, may have particular insights based on their unique databases, while regional factors, such as weather-related incidents, can also play a significant role. Furthermore, reviewing denied claims provides critical information about coverage gaps and limitations that might affect future submissions.

Requested Documentation

Insurance coverage analysis involves reviewing policy details and claim processes specific to insurance types like health, auto, and home insurance. Obtaining the requested documentation includes understanding coverage limits, exclusions, and premium amounts. Key documents may involve the insurance policy itself, declarations pages that summarize coverage, and any endorsements or riders that modify standard coverage. Additionally, claim history reports provide insight into past claims and their resolutions, which help assess the effectiveness of the coverage. A thorough analysis aids in understanding potential gaps and helps make informed decisions about insurance needs.

Contact Information

Contact information serves as a crucial component for initiating an insurance coverage analysis request. This includes details such as the customer's full name, telephone number, and email address, ensuring efficient communication. Additionally, the physical address (including street, city, state, and ZIP code) is vital for verifying the coverage status of policies in specific jurisdictions. It is also beneficial to include policy numbers (unique identifiers assigned by the insurance company) related to requested coverage evaluations, as this facilitates accurate and prompt processing. Including a brief description of the type of coverage under review, such as auto, home, or health insurance, helps direct the request to the appropriate department.

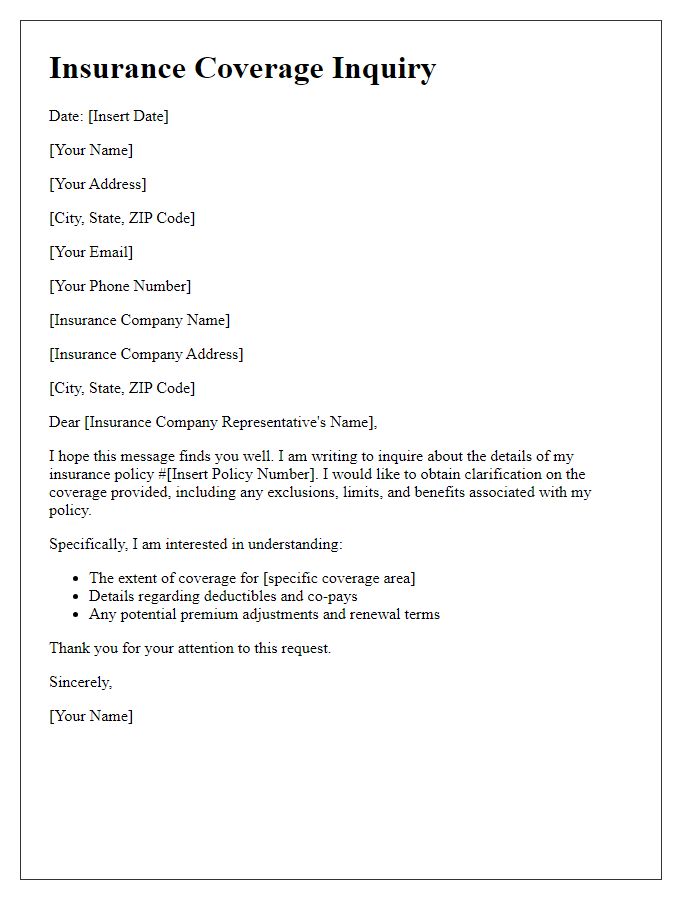

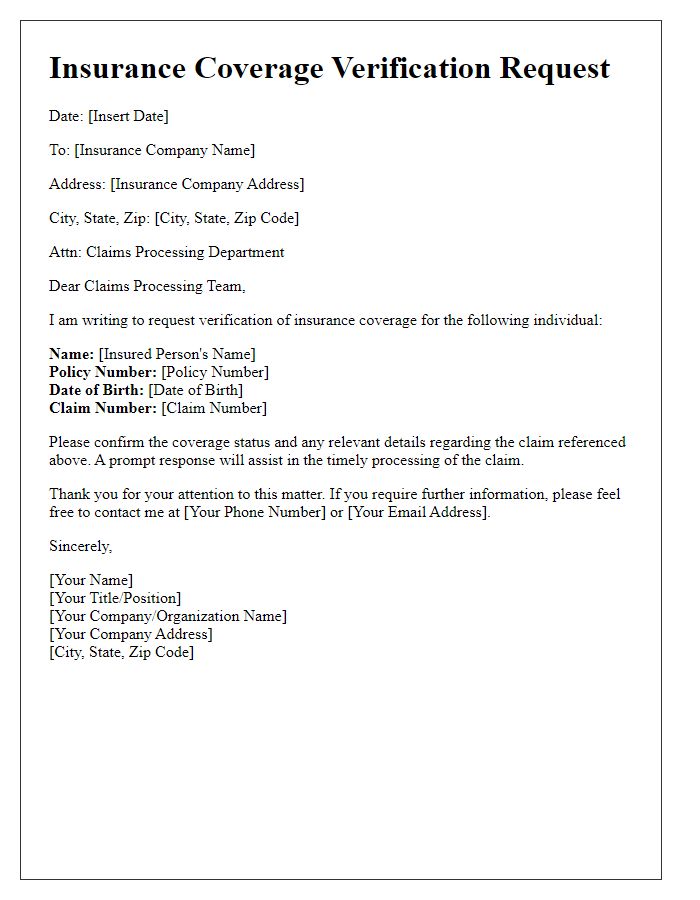

Letter Template For Insurance Coverage Analysis Request Samples

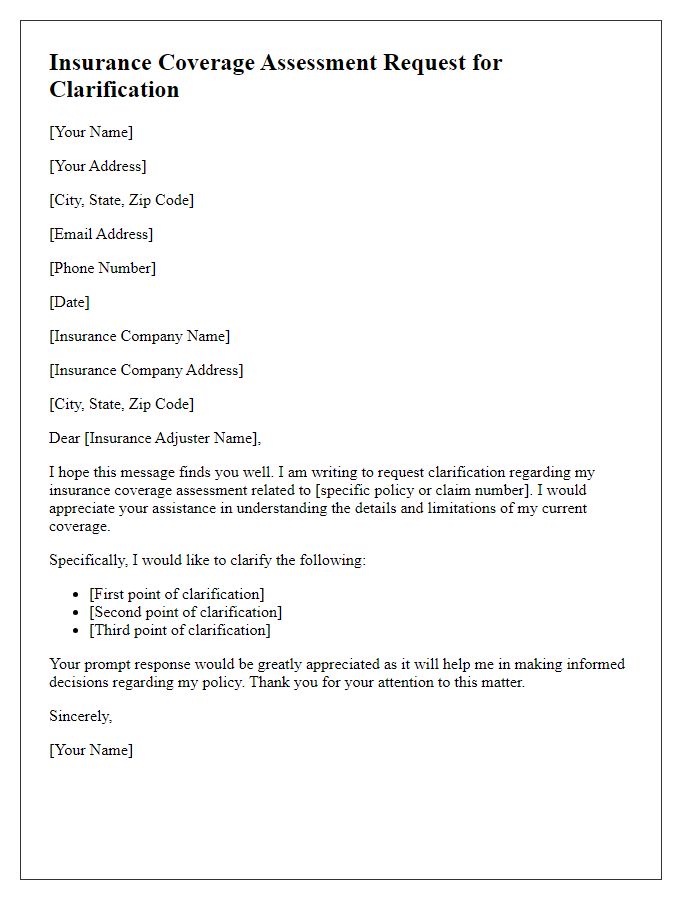

Letter template of insurance coverage assessment request for clarification

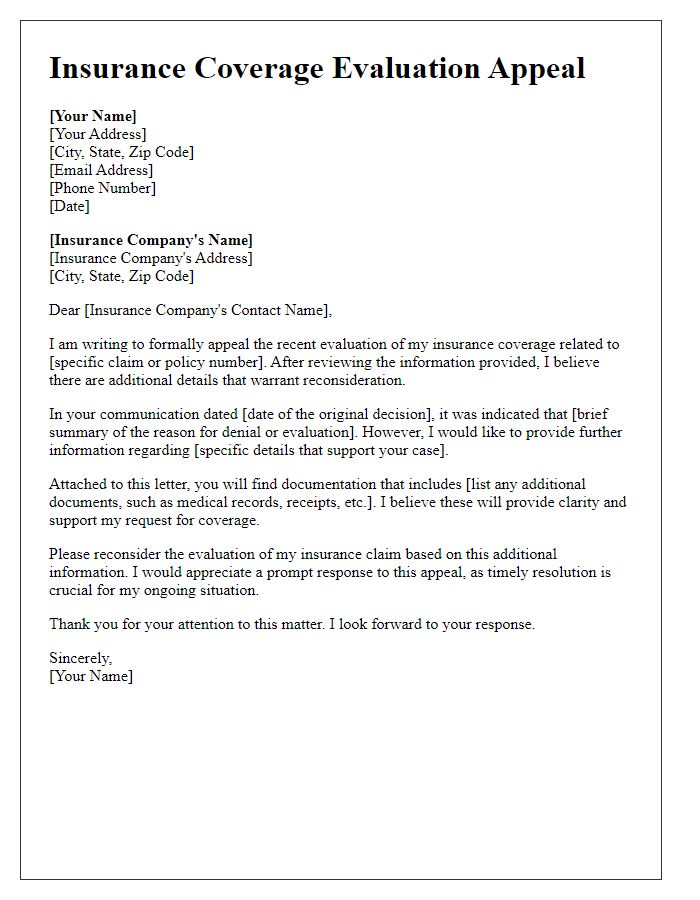

Letter template of insurance coverage evaluation appeal for additional information

Letter template of insurance coverage examination inquiry for comprehensive review

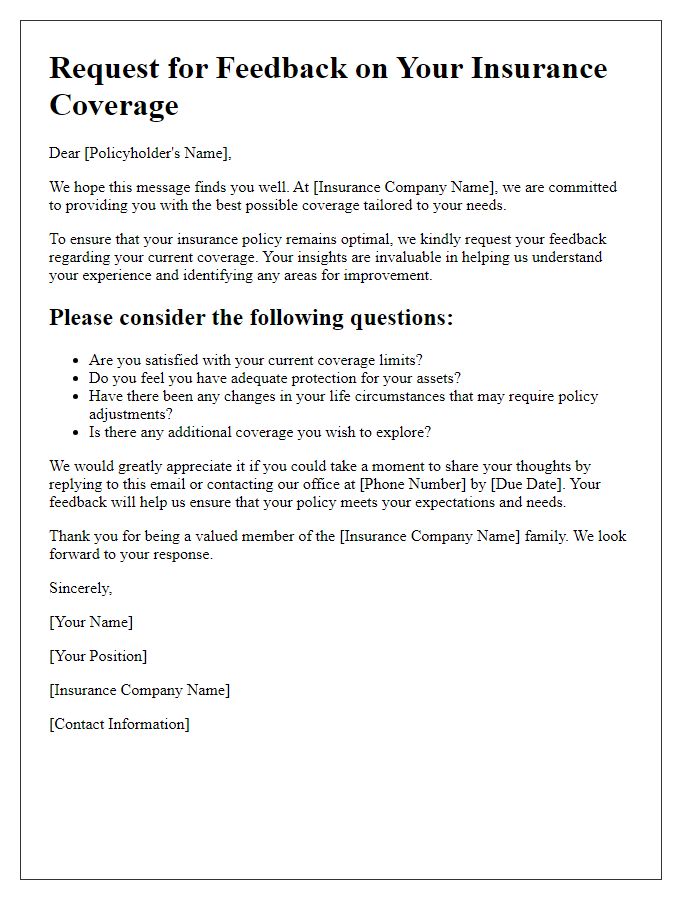

Letter template of insurance coverage feedback request for policy optimization

Letter template of insurance coverage consultation inquiry for expert advice

Letter template of insurance coverage exploration request for alternative options

Letter template of insurance coverage adjustment request for updated terms

Letter template of insurance coverage summary request for personal records

Comments