Hello there! If you've recently changed your contact information, it's essential to keep your insurance agent updated to ensure uninterrupted service and accurate communication. A quick letter can help streamline this process and maintain a solid relationship with your insurer. Curious about how to craft the perfect note? Keep reading for a handy template and expert tips!

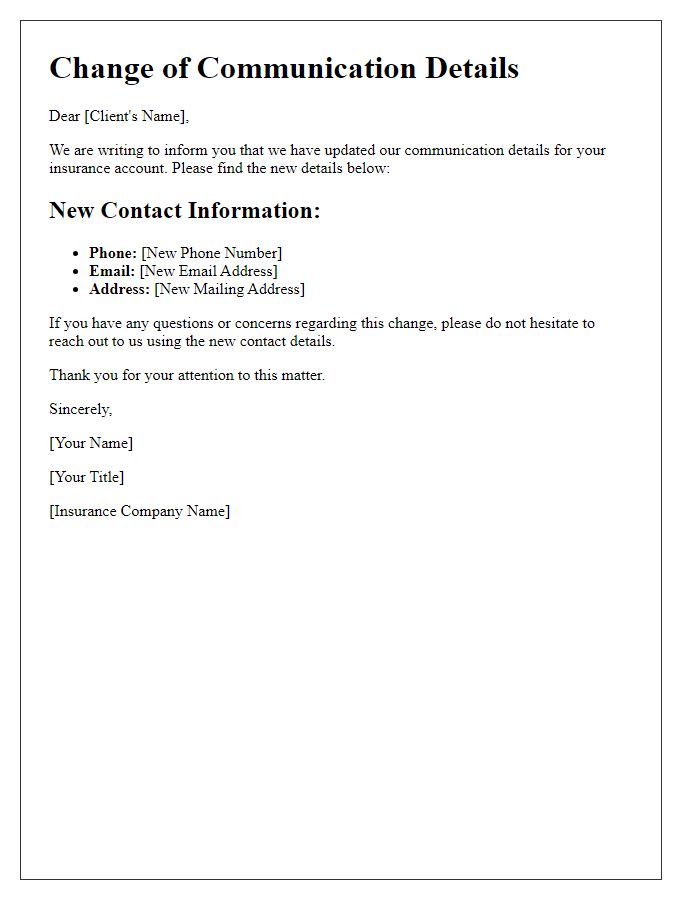

Clear and concise subject line.

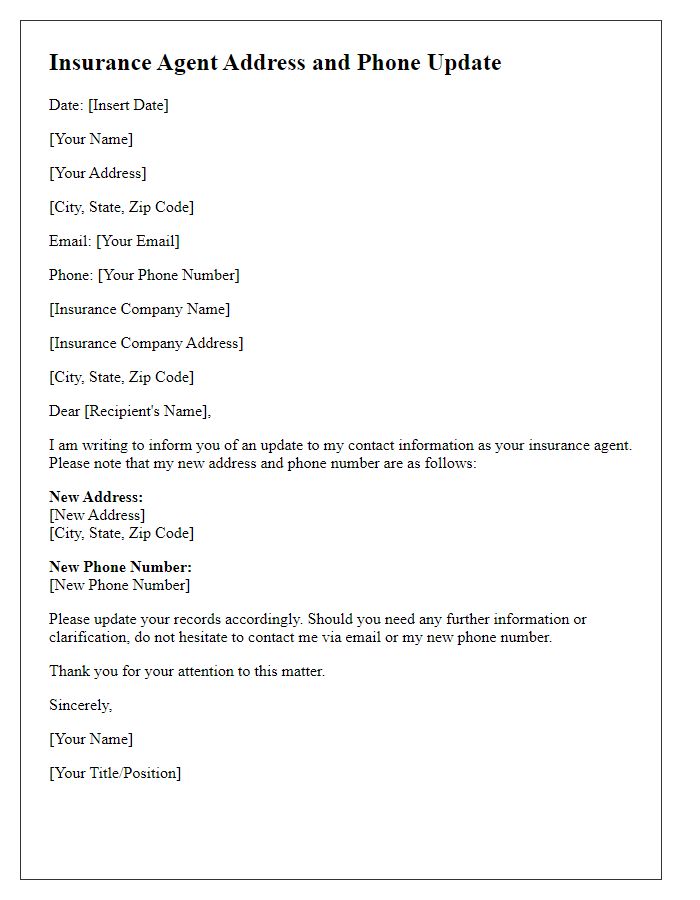

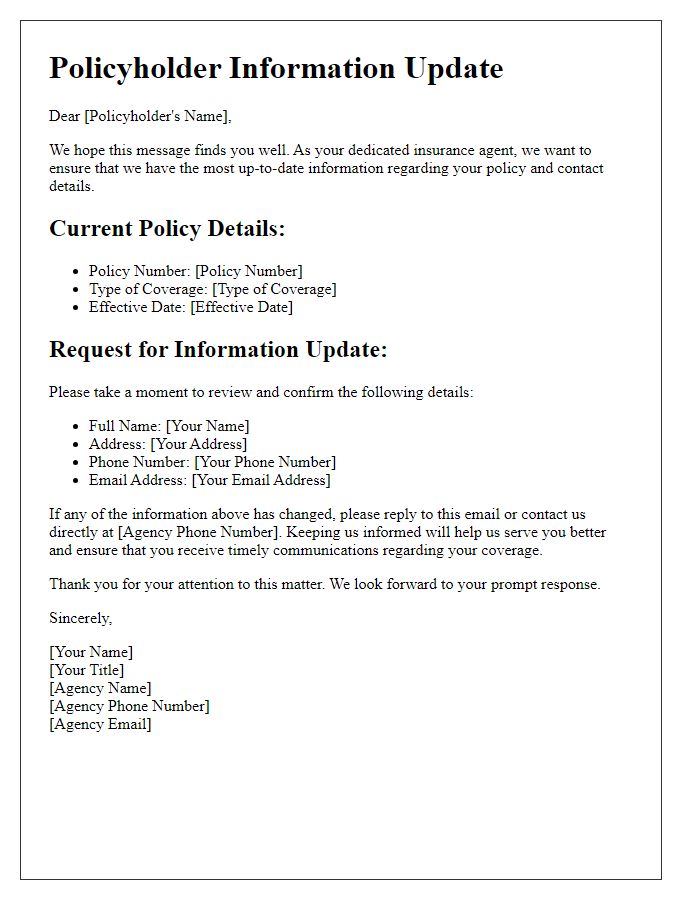

Updating Contact Information for Insurance Agent Inquiry

Personalized greeting and introduction.

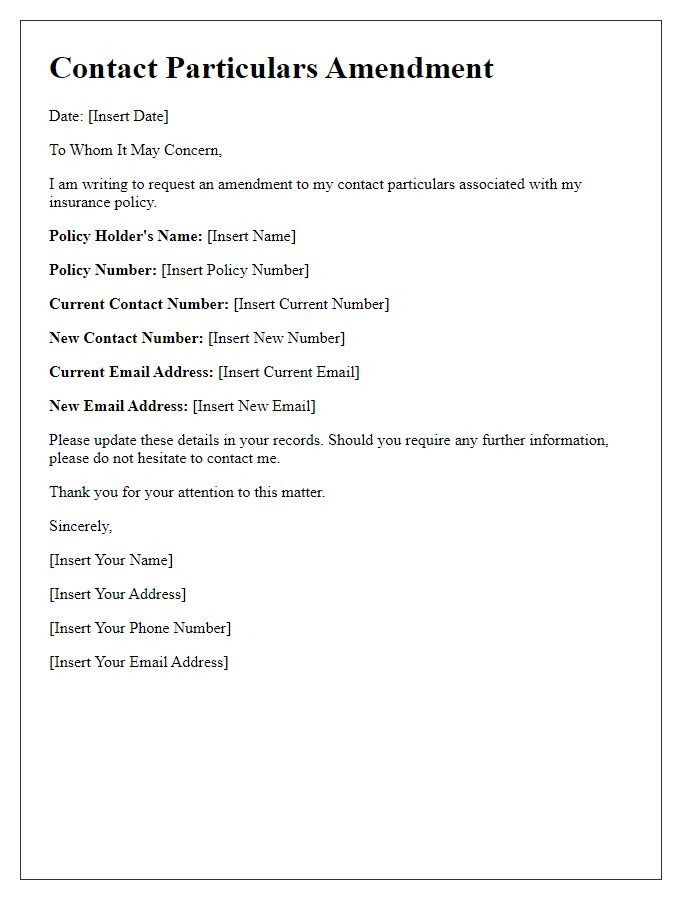

Updating your insurance agent's contact information is crucial for ensuring seamless communication regarding your policies. It is important to provide your name, policy number, and any changes to your email or phone number, which can significantly impact the efficiency of service. Clear communication can lead to faster response times for claims and inquiries. Additionally, specifying the preferred method of contact can enhance future interactions, allowing you to receive timely updates about coverage options or policy changes.

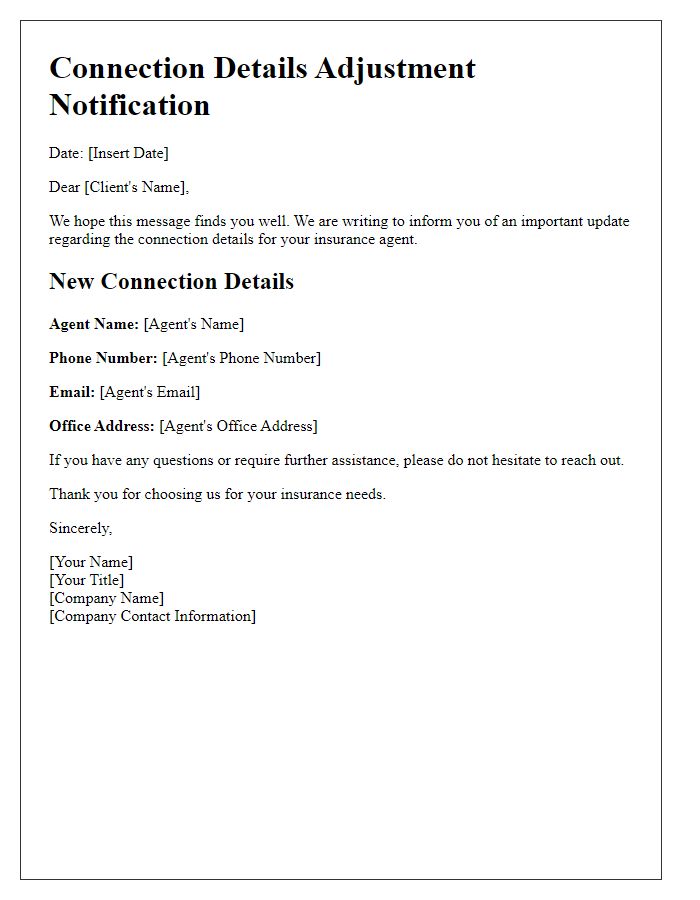

Updated contact information.

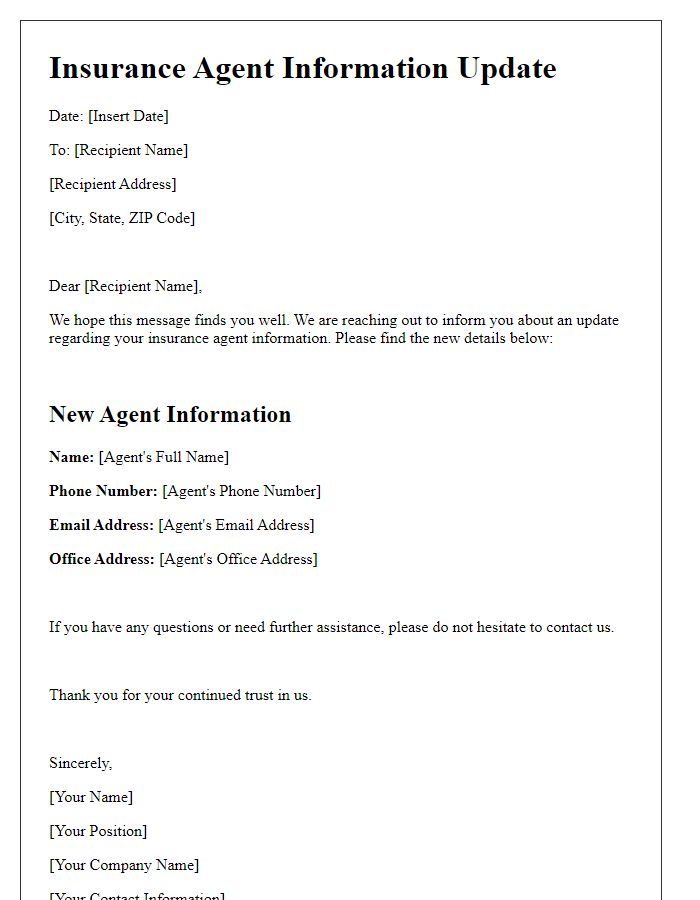

An updated contact information system is crucial for maintaining effective communication in insurance industries. Agents often rely on current phone numbers, emails, and addresses for seamless interactions with clients. For example, new email addresses such as name@example.com should reflect promptly in databases to avoid potential lapses in service. Phone updates, particularly when transitioning to mobile numbers starting with area codes like 415 or 212, ensure quick access for urgent inquiries or claims processing. Address changes, such as moving from 123 Main St, Los Angeles, CA to 456 Elm St, San Francisco, CA, need swift inclusion for correct policy documentation and timely notifications. Regular audits of this information can significantly enhance client satisfaction and operational efficiency.

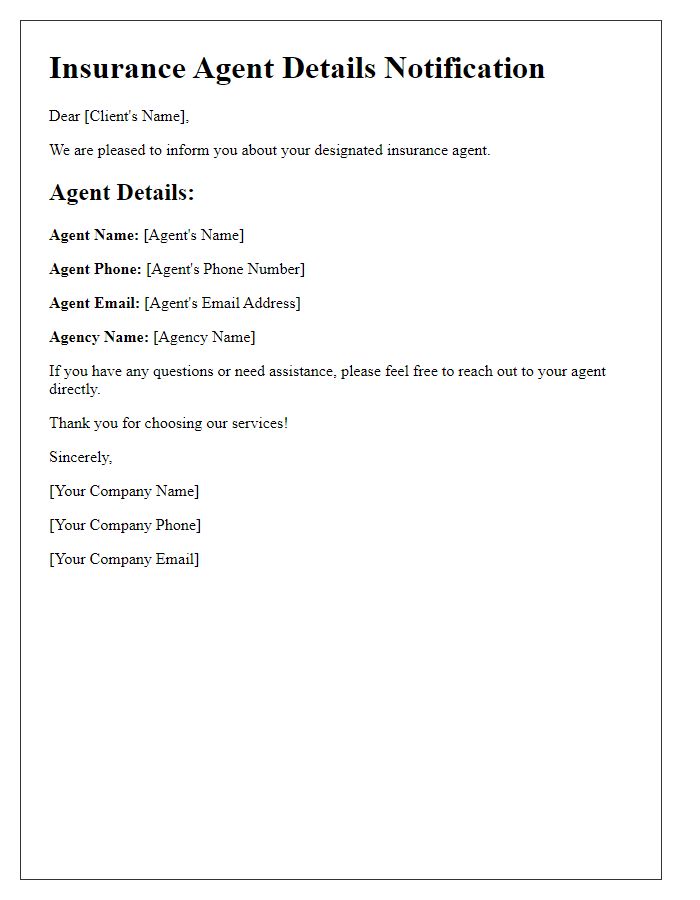

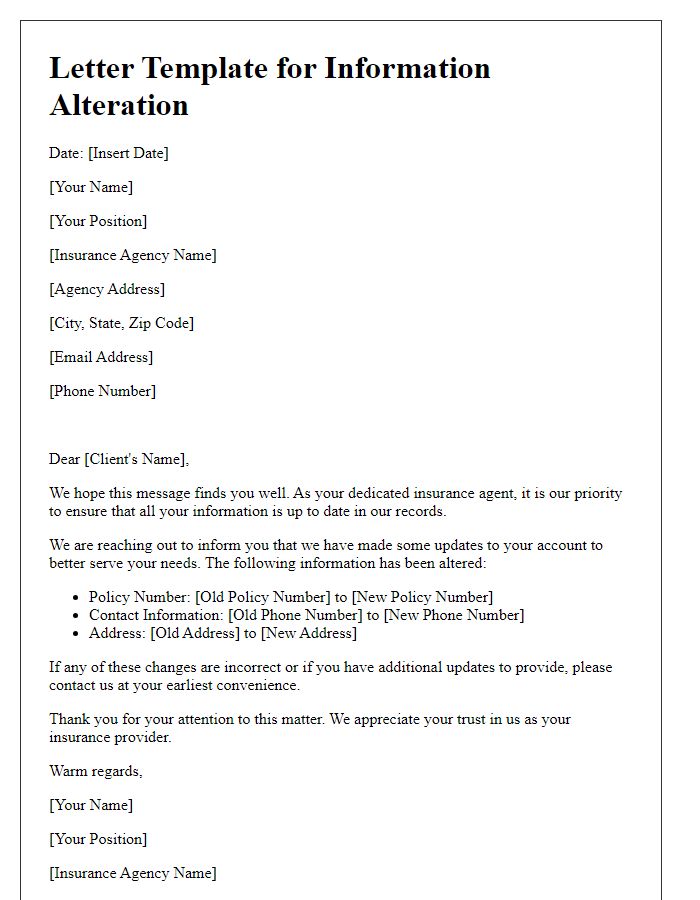

Brief explanation of changes or updates.

In recent months, the insurance industry's landscape has rapidly evolved, necessitating updates to agent contact information for improved client communication. Agents, such as those associated with major providers like Allstate and State Farm, have expanded their service areas and adopted new technology platforms (including CRM systems) to enhance customer interaction. As a result, agency contact numbers may have changed, along with email addresses and office locations, reflecting shifts in administrative structures or service enhancements. Ensuring clients have the most accurate information fosters trust and enables timely assistance regarding policies and claims, ultimately benefiting both agents and clients alike.

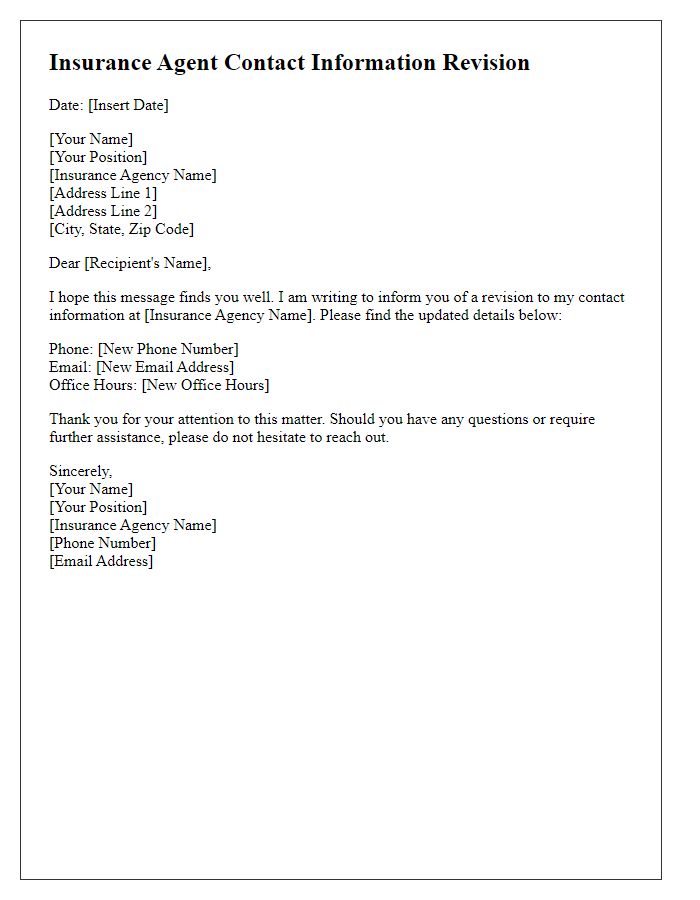

Call to action or next steps.

An insurance agent contact update is crucial for ensuring continued communication regarding policy details and claims. Clients should contact their insurance agent promptly if they experience number changes in phone or email addresses, or if there are other important updates. It is essential to verify that personal information remains current in the company system to facilitate seamless interactions. Clients can easily reach out via office phone numbers or through secure online portals during business hours to report the updates. Additionally, schedule an appointment, either in-person or virtually, to discuss any changes in coverage requirements or to review existing policies, ensuring comprehensive support tailored to individual needs.

Comments