When it comes to handling an insurance audit, crafting the perfect response letter can be pivotal to depicting your business's professionalism and preparedness. It's essential that your letter clearly addresses all the auditor's inquiries while maintaining a friendly tone that invites further conversation. By demonstrating transparency and a willingness to collaborate, you can foster a positive relationship with your insurance providers. Ready to dive into the key elements of an effective audit response letter? Let's explore this topic further!

Policy Number and Claim Reference

An insurance audit response should encompass key elements, including a detailed mention of the specific policy number (often a unique identifier for the insurance agreement, such as 123456789) and the corresponding claim reference (which can be a specific incident identifier, like CLM-098765432). This information is crucial for the insurance company's review and processing of claims. Including these identifiers ensures that all correspondence is streamlined and adequately tracked within the company's systems, facilitating an efficient audit process. Providing context about the claim (such as the date of incident and type of coverage) can further assist in clarifying any disputes or questions that arise during the review.

Detailed Explanation of Incident

During the significant incident on June 15, 2023, at the manufacturing facility located in Houston, Texas, an unexpected machinery malfunction occurred. The primary equipment affected was the hydraulic press, crucial for metal fabrication processes. This hydraulic press, which operates with a pressure capacity of 200 tons, experienced a sudden release of pressure, leading to an unintended operation that caused damage to surrounding equipment valued at approximately $75,000. Additionally, the incident resulted in a temporary halt in production, impacting the facility's output by an estimated 2,000 units over a two-week period. The incident was reported to the local safety authority, triggering an investigation that documented compliance with safety regulations and proper maintenance checks conducted within the previous six months. A detailed incident report was compiled, outlining the timeline of events, response actions taken, and remedial measures implemented to prevent recurrence.

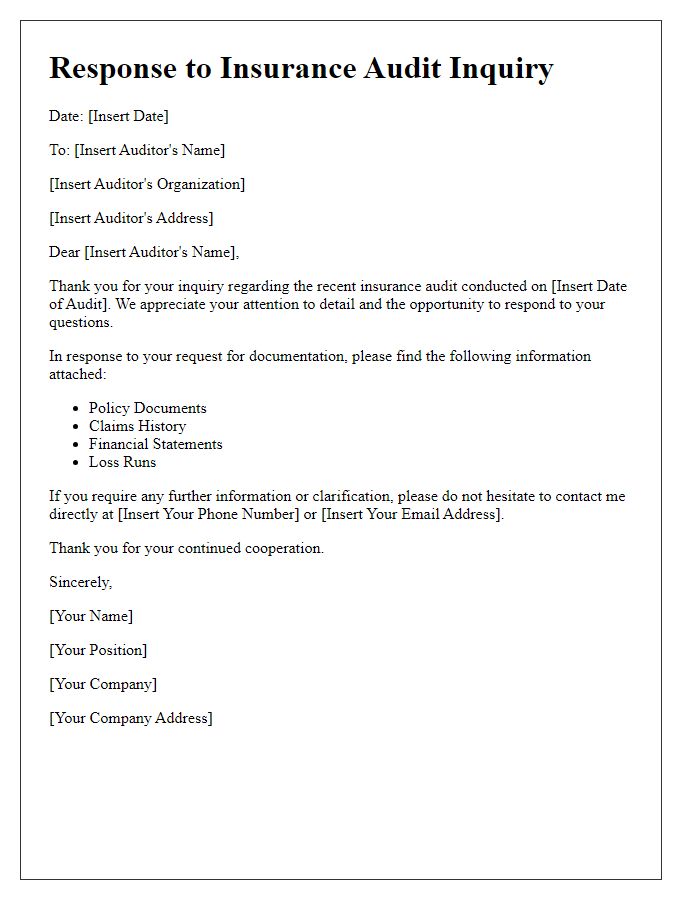

Supporting Documentation and Evidence

During an insurance audit, comprehensive documentation serves as critical evidence to substantiate claims and accurately reflect the company's financial activities. Essential records include financial statements (such as profit and loss statements), billing records, policy documents (detailing coverage and limits), and loss run reports (summarizing claims history). Additional supporting materials consist of correspondence with insurance providers and any relevant spreadsheets (detailing calculations or financial analyses). These documents should be organized chronologically, ensuring easy access for auditors, typically from the last three fiscal years. Maintaining this thorough documentation not only ensures compliance with regulatory standards but also provides transparency and safeguards against potential disputes.

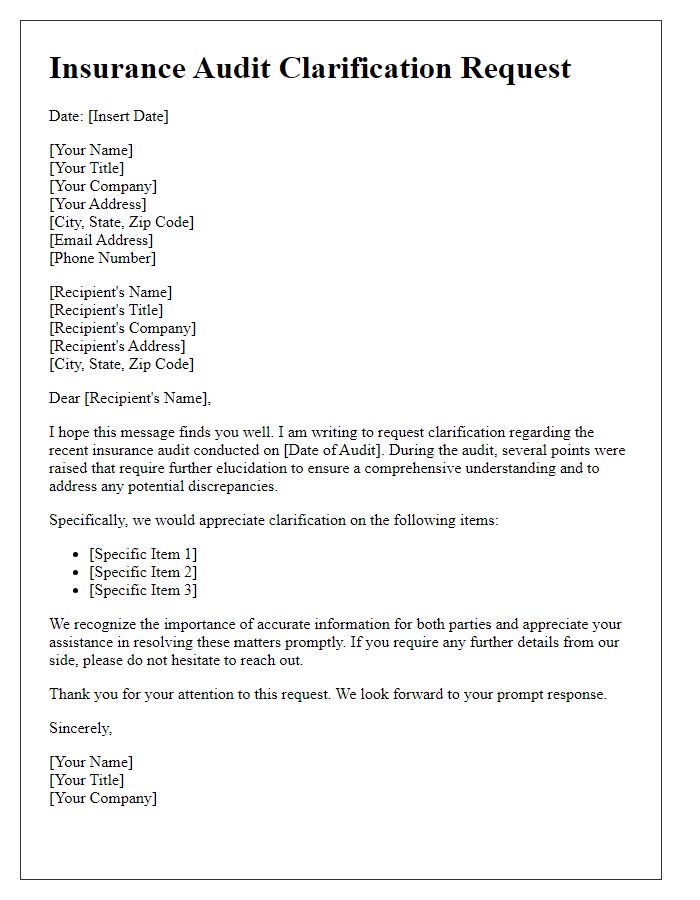

Contact Information for Further Inquiries

Contact information for further inquiries regarding insurance audit responses can include important details such as the primary contact's name, their role within the organization (e.g., Audit Coordinator), direct phone number, and official email address. This information ensures that auditors can easily reach out for clarifications or additional documentation. Specific hours of availability (e.g., Monday to Friday, 9 AM to 5 PM EST) can enhance communication efficiency. Including the organization's address is also beneficial, as it adds credibility and allows for correspondence via physical mail if necessary. Clear and concise contact information can facilitate a smoother audit process.

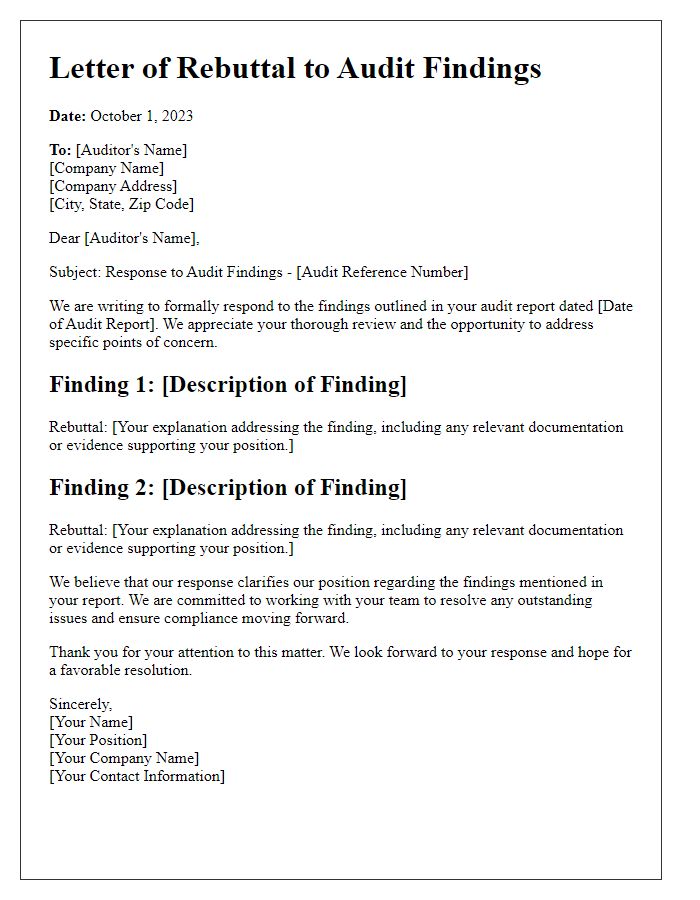

Deadline for Response and Compliance

Insurance audits frequently require timely responses to ensure compliance with policy regulations and contractual obligations. Specific deadlines for submissions, often set by the auditing organization or insurance provider, are crucial for maintaining policy effectiveness. Non-compliance can result in repercussions, such as revoked coverage or financial penalties. Auditees should pay close attention to documentation requests concerning financial records, claims history, and operational procedures, ensuring all information is accurate and submitted by the given date. Failing to adhere to these timelines can not only jeopardize ongoing insurance contracts but may also influence future premium rates and coverage options.

Comments