Are you feeling a bit overwhelmed by the insurance coverage process? You're not alone! Many people find it challenging to navigate the intricacies of policies and guarantees. In this article, we'll simplify everything you need to know about obtaining insurance coverage guarantees, so you can make informed decisions with confidence. Join me as we dive into the essentials!

Policyholder Information

The insurance coverage guarantee serves as a critical assurance for policyholders, encompassing vital details relating to identity, protection, and terms. Policyholder information includes essential identifiers such as full name, address, and policy number. This information enables seamless communication with the insurance provider, facilitating efficient claims processing. Coverage guarantees outline specific benefits, such as life, auto, or health insurance, highlighting coverage limits, deductibles, and excluded conditions. Updates, renewals, and any pertinent changes to the policy should be communicated promptly to maintain the integrity of the coverage. Regulatory guidelines outlined by institutions such as the Insurance Regulatory and Development Authority (IRDA) ensure compliance and protection for policyholders throughout their coverage period.

Coverage Details

Insurance coverage guarantees often include essential details about policy conditions, limits, and exclusions. Standard coverage parameters typically encompass property damage, personal liability, and medical expenses. Property damage coverage may extend to specific incidents, like fire or theft, and could have maximum limits, such as $250,000 for dwelling coverage. Personal liability insurance often covers claims up to $300,000 for bodily injury or property damage to others occurring on the insured property. Additional provisions may include endorsements for specific events, such as natural disasters, applicable in regions prone to hurricanes or earthquakes. Exclusions often specify non-covered incidents like intentional acts or wear and tear, highlighting the need for careful review.

Guarantee Commitment Statement

Insurance coverage guarantees provide policyholders with reassurance regarding financial protection. These commitments typically outline the extent of coverage under various circumstances, such as accidents, natural disasters, or theft. For instance, in the event of a fire damage claim, a homeowner's insurance policy may cover repairs up to $400,000, depending on the assessed value of the property. Additionally, insurers often include specific stipulations, such as deductibles or co-pays, which define policyholder responsibilities prior to claim approval. Understanding the nuances of these guarantees is essential for consumers to ensure adequate support during unforeseen events, ultimately fostering trust in financial service providers.

Terms and Conditions

Insurance coverage guarantees offer protection for policyholders against financial loss. Terms and conditions outline the obligations and rights of both parties involved. A policy may include specific clauses detailing coverage limits, such as a maximum payout amount of $500,000 for property damage or a 90-day waiting period for claims related to accidental injuries. Exclusions, such as natural disasters or pre-existing conditions, may also be stipulated, ensuring policyholders understand the scope of their coverage. Additionally, the policy might require regular premium payments, which can vary based on factors like age, location, and risk assessment, emphasizing the importance of renewals to maintain active coverage. Always review the fine print before signing to avoid misunderstandings.

Contact Information

Insurance coverage guarantees provide crucial protection for policyholders and their assets. High-value items such as homes (average U.S. home valued at $320,000) often require specific coverage limits to ensure full replacement costs in the event of damages. Businesses engaging in commercial insurance need comprehensive liability coverage, with general liability policies commonly offering limits ranging from $1 million to $2 million. Understanding policy specifics, including deductibles (the amount paid out of pocket before coverage kicks in), is essential. Additionally, maintaining updated contact information ensures prompt communication with insurance providers, especially during claims processes. This is vital, as delays can significantly impact the resolution of claims.

Letter Template For Insurance Coverage Guarantee Samples

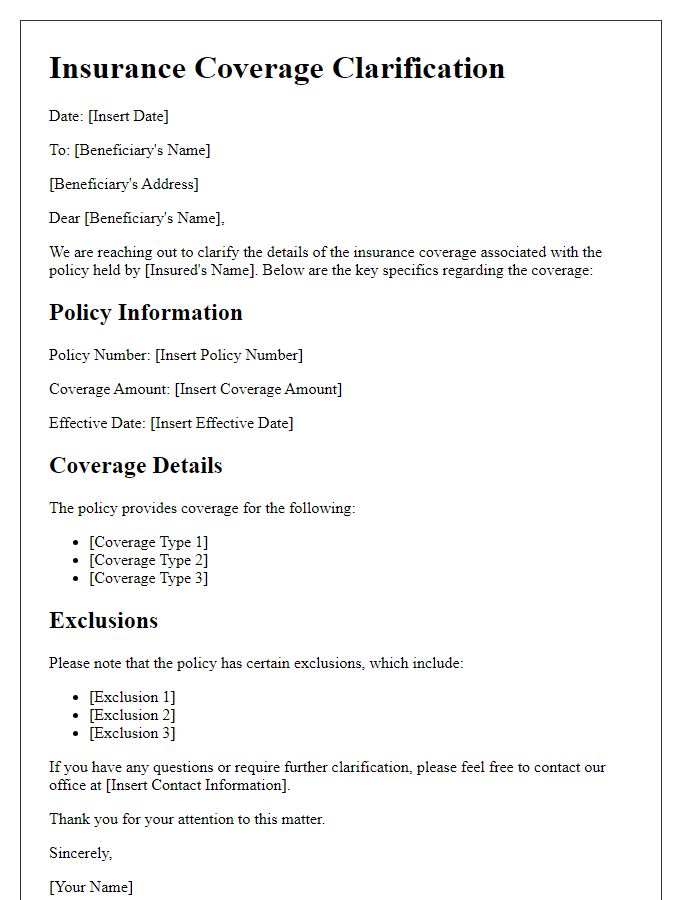

Letter template of insurance coverage verification for claims processing.

Letter template of insurance coverage notification for renewal reminders.

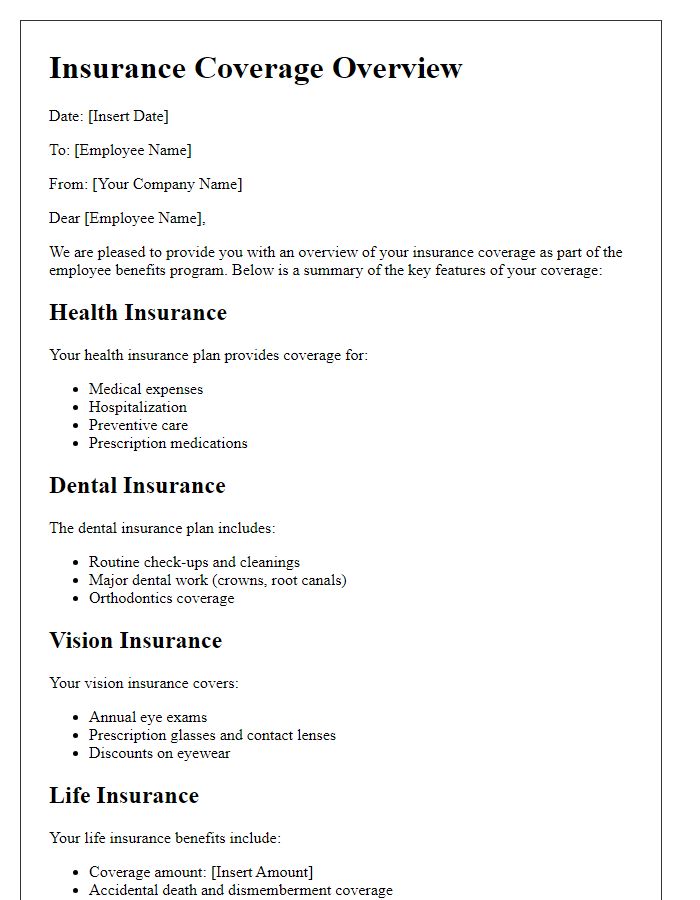

Letter template of insurance coverage explanation for dependent inclusion.

Letter template of insurance coverage endorsement for additional services.

Comments