Are you considering canceling your insurance policy but unsure how to communicate your decision? Writing a cancellation notice can seem daunting, but it's a straightforward process that ensures you're protected and aligned with your insurance provider. In this article, we'll explore a simple letter template to help you effectively convey your cancellation request. So, let's dive in and make this task easier for youâread on for all the details!

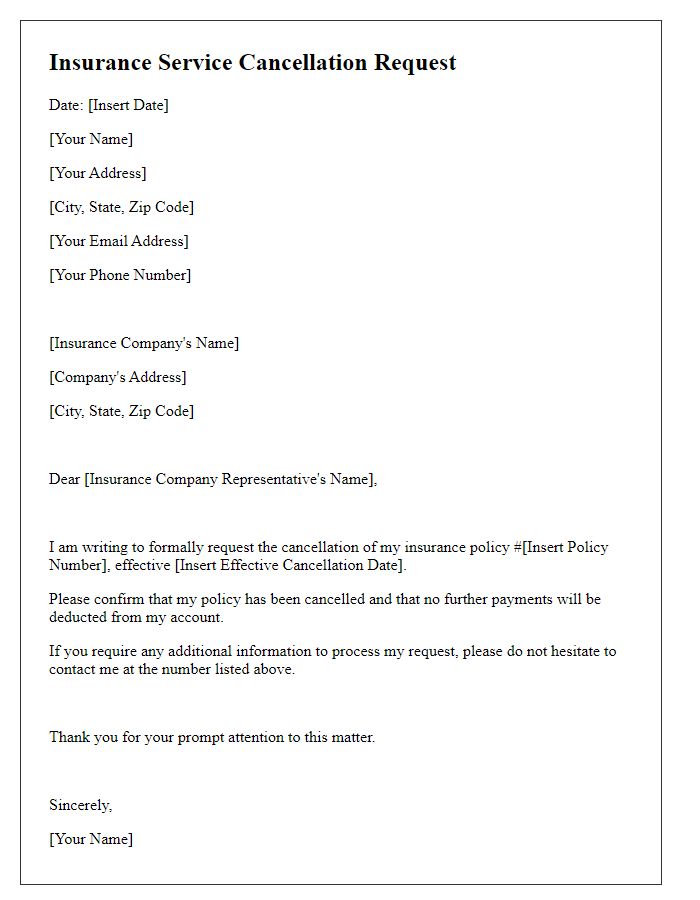

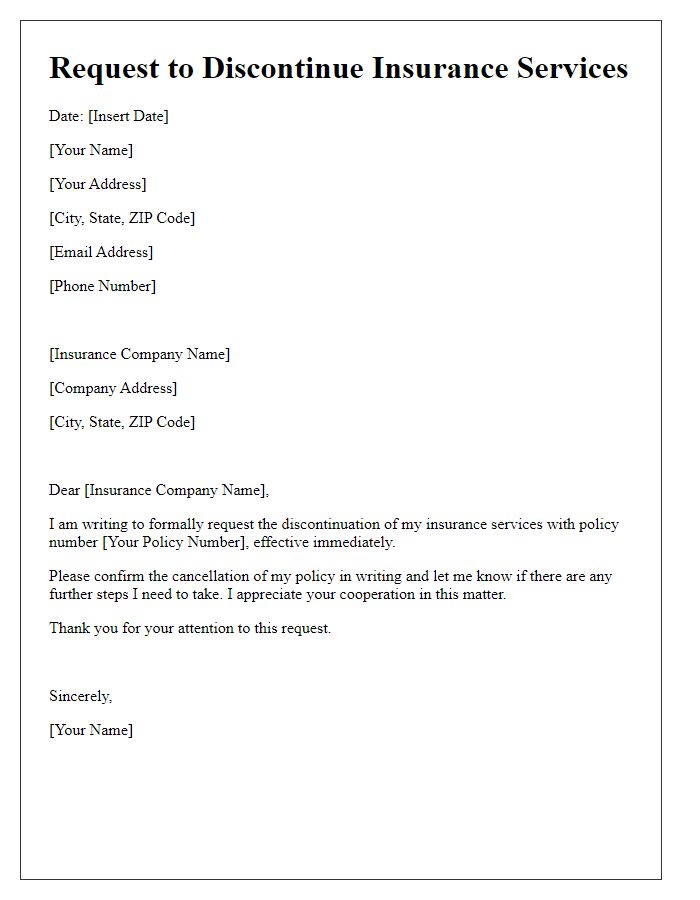

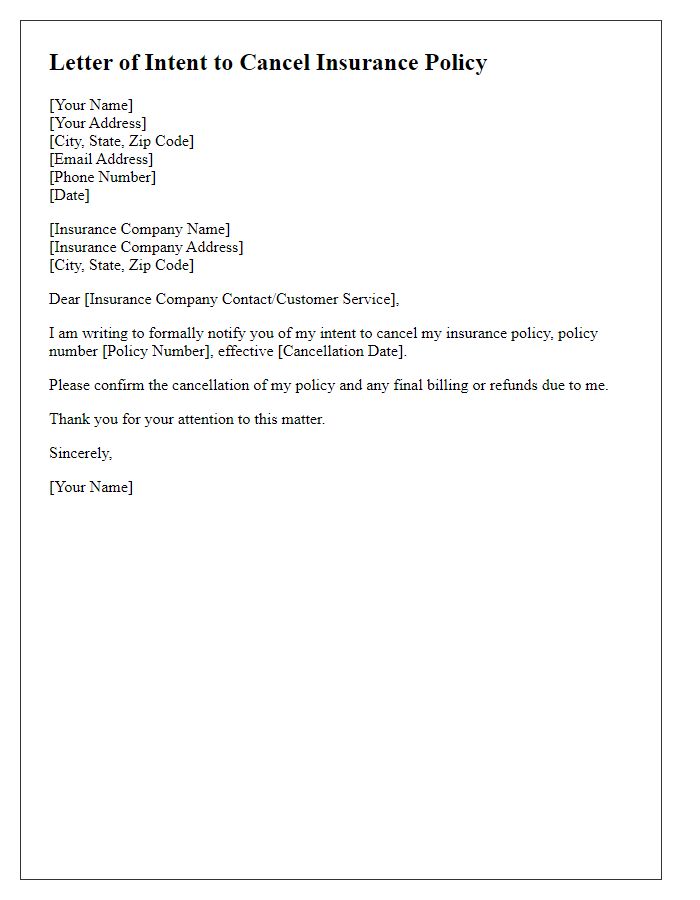

Policyholder Information

Insurance policy cancellation notices require clarity and specificity. Start by clearly identifying the policyholder information, including full name, address, and contact number. Specify the insurance company name, policy number, and effective date of cancellation. Additionally, include reasons for cancellation, if necessary, such as better rates or change in coverage needs. Provide instructions for confirming receipt of the cancellation notice, which could involve a return receipt or a confirmation email. Ensure all relevant details are accurate to prevent any miscommunication.

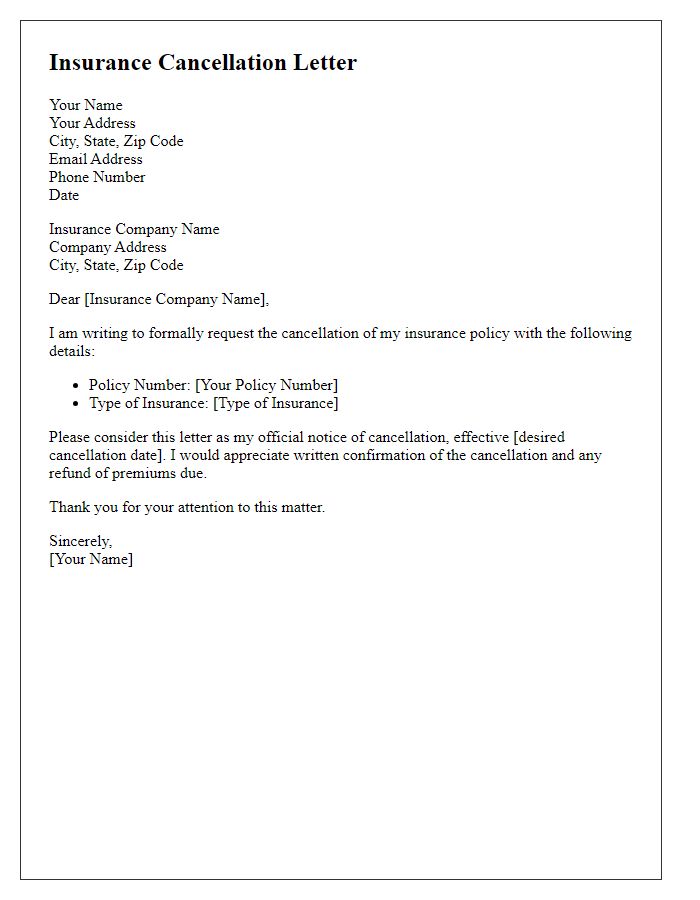

Policy Number

Insurance service cancellation notices can create confusion regarding coverage, terms (including refund policies), and timelines. For example, a cancellation could affect the insurance policy, such as a home, auto, or health coverage. Policy number (often a unique identifier consisting of alphanumeric characters like 1234-ABC) is essential for identifying the specific agreement between the policyholder and the insurance provider. Notifying the insurer within a stipulated timeframe (usually 30 days prior) is crucial for compliance. The cancellation may lead to a lapse in insurance coverage, potentially exposing the individual to risks unrelated to their contractual obligations. It is always wise to maintain a record of communications regarding cancellation to ensure proper processing and future reference.

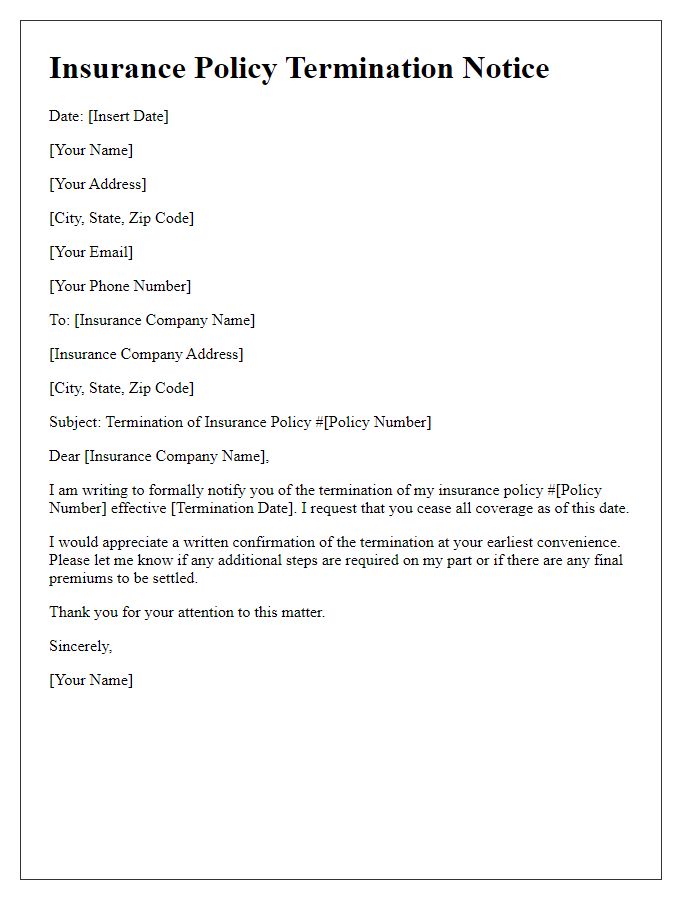

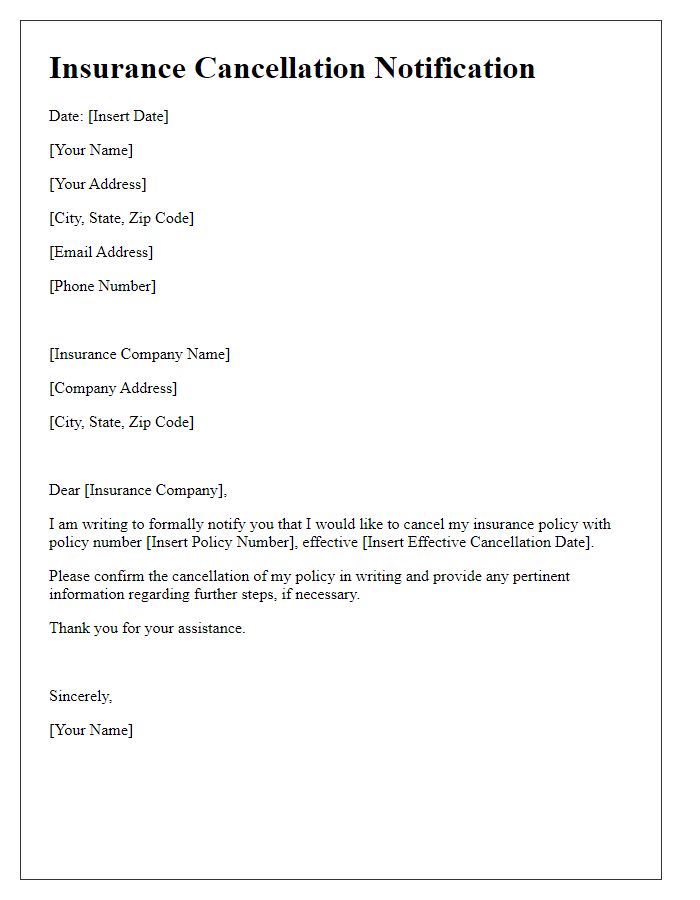

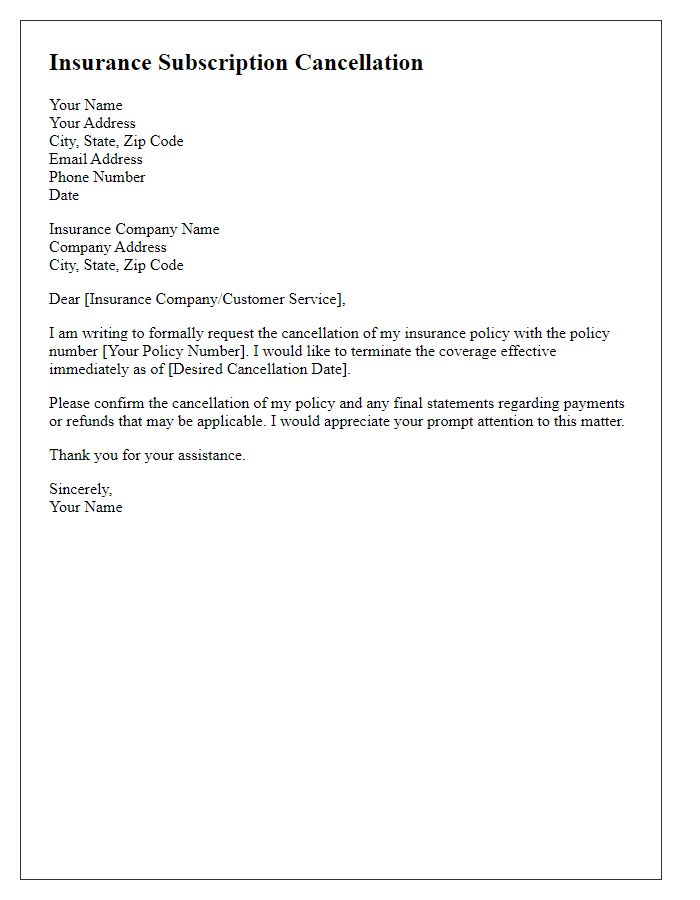

Cancellation Effective Date

Insurance service cancellation requires clear communication to ensure all parties understand the effective date of cancellation. Insurance policies may have specific cancellation terms, typically outlined in documents provided at the start of coverage. The effective date of cancellation is crucial, as it determines when coverage ceases, and any associated premiums stop. Policyholders should reference their unique policy number and include pertinent details like the insurance provider's name and contact information. Timely delivery of this notice is essential to avoid potential lapses in other necessary coverage services that may depend on the insurance being canceled. Proper documentation ensures both parties maintain a record of the cancellation process for future reference.

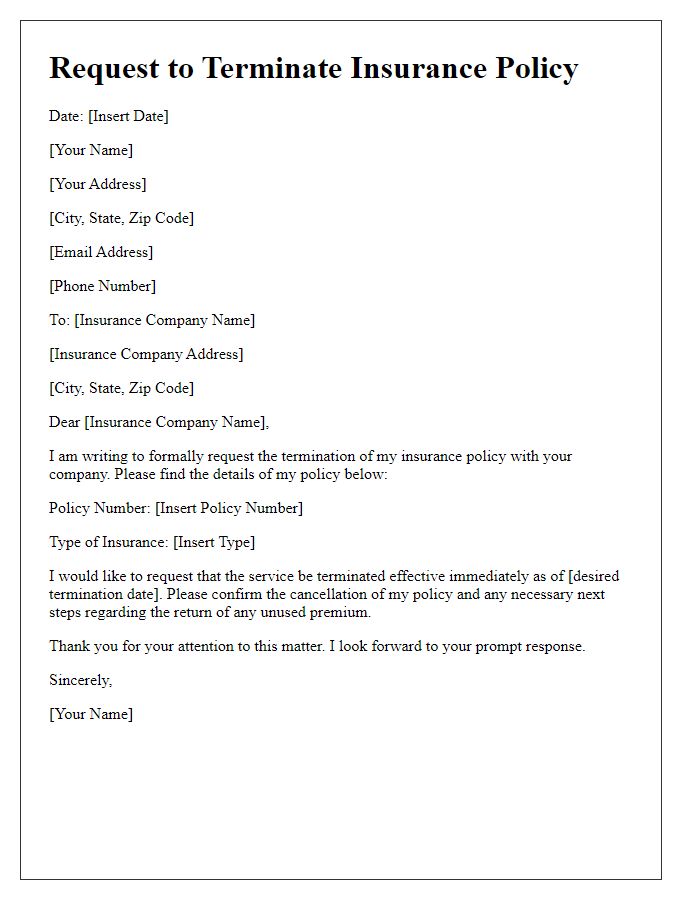

Reason for Cancellation

Insurance policy cancellations can occur for various reasons, such as changes in financial circumstances or dissatisfaction with service. Common reasons include non-payment of premiums, a move to a different state, or finding more favorable coverage options. It's essential to notify the insurance provider, which typically includes specifying the policy number, the effective cancellation date, and a request for confirmation of the cancellation. Providing details about the cancellation can also help in resolving any outstanding claims and ensuring that no further payments are deducted. Timely communication can prevent potential lapses in coverage or unnecessary financial charges.

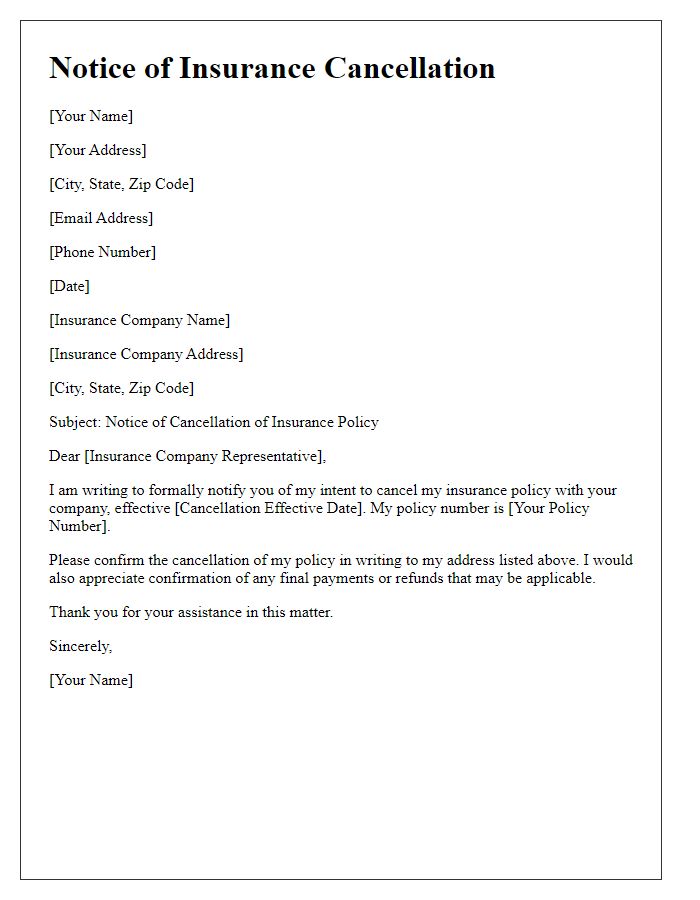

Contact Information

Insurance service cancellation can lead to significant implications for policyholders. Policyholders must ensure they provide accurate contact information, including full names, policy numbers, and addresses. Today, many insurance providers process cancellations electronically, emphasizing the importance of submitting requests through secure online portals or verified mailing addresses. Cancellation requests typically require a minimum notice period, often thirty days, to avoid lapsing coverage. Understanding each provider's specific cancellation policy is crucial to prevent unintended consequences, such as lapses in coverage that could expose policyholders to financial risks during the transition. Proper documentation should be retained for records to ensure clarity and avoid disputes with insurance companies.

Comments