Are you grappling with the intricacies of changing your insurance payment schedule? We understand that life can throw curveballs, and sometimes your financial situation requires a little flexibility. In this article, we'll break down the steps to adjust your payment plan smoothly while ensuring you stay covered. So, if you're ready to learn how to navigate this process, let's dive in!

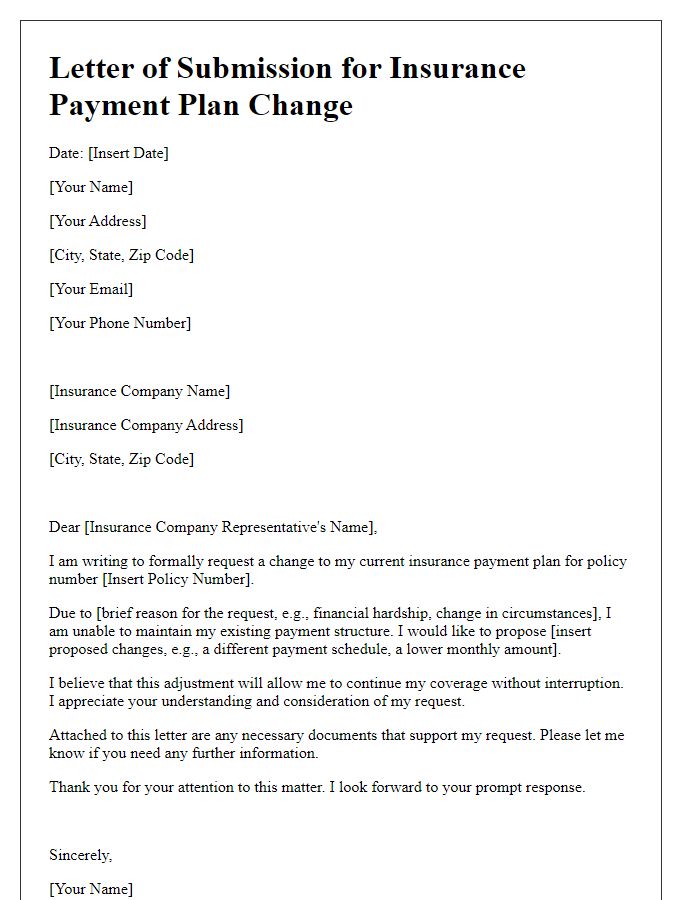

Accurate Policy Information

Insurance companies often require accurate policy information to process changes in payment schedules effectively. Policyholders must provide details such as policy numbers, effective dates, and insured personal information to ensure clarity. For example, an auto insurance policy might reference a specific coverage amount like $100,000 liability coverage under a specific policy number such as A123456789. Ensuring correct premium amounts, payment due dates, and contact information contributes to seamless processing and avoids any potential delays in adjustments. Keeping documentation organized, including previous correspondence or payment records, can expedite the review process by underwriting departments responsible for these changes.

Clear Request Details

A change in insurance payment schedules can significantly impact budgeting and financial planning. Insurance policyholders may need to adjust payment dates to align with income cycles, such as monthly salaries or quarterly earnings. In 2023, many individuals reassess financial commitments, driven by rising living costs and inflation rates exceeding 5 percent in several regions. Clear requests for adjustments should specify new preferred dates while referencing policy numbers and previous agreements. Insurers often accommodate such requests, especially when supported by valid reasons like job changes or unexpected expenses. Prompt communication and documentation can streamline the process and facilitate timely approvals.

Justification for Change

Insurance payment schedules can be adjusted based on individual financial circumstances. Changes in income, such as job loss, reduced working hours, or unexpected medical expenses, may necessitate a more manageable payment plan. For instance, a customer facing a 30% decrease in income may request adjustments to avoid policy lapses. Additionally, life events like marriage, childbirth, or retirement can influence financial obligations and necessitate realignment of payment schedules. Insurers often consider a customer's payment history, where consistent on-time payments showcase reliability, warranting potential flexibility. Meeting with a financial advisor to understand new budgets can further support the justification for changing insurance payment schedules, ultimately leading to better financial health and continued coverage.

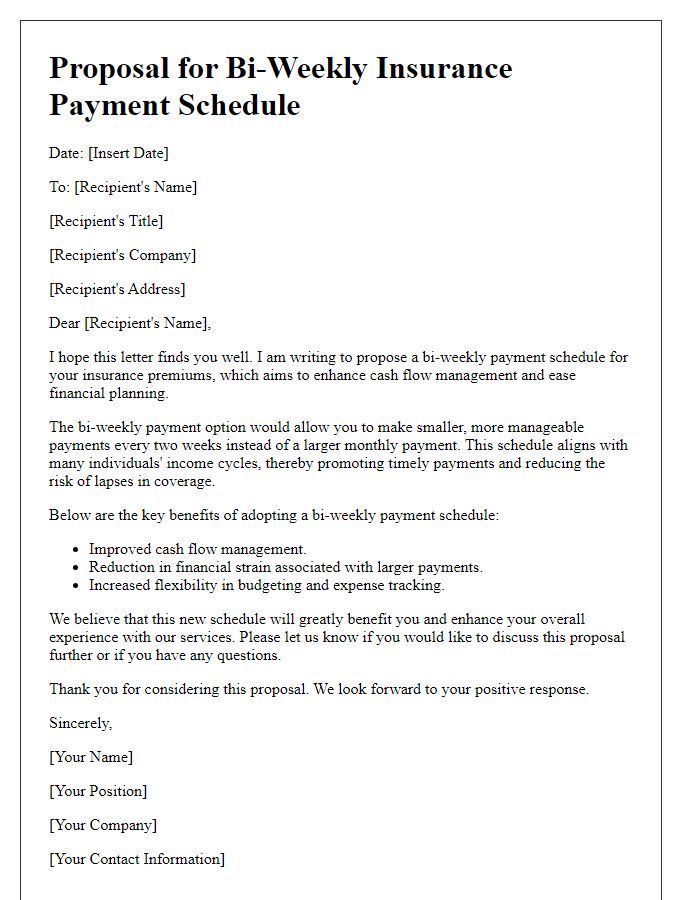

Preferred Payment Schedule

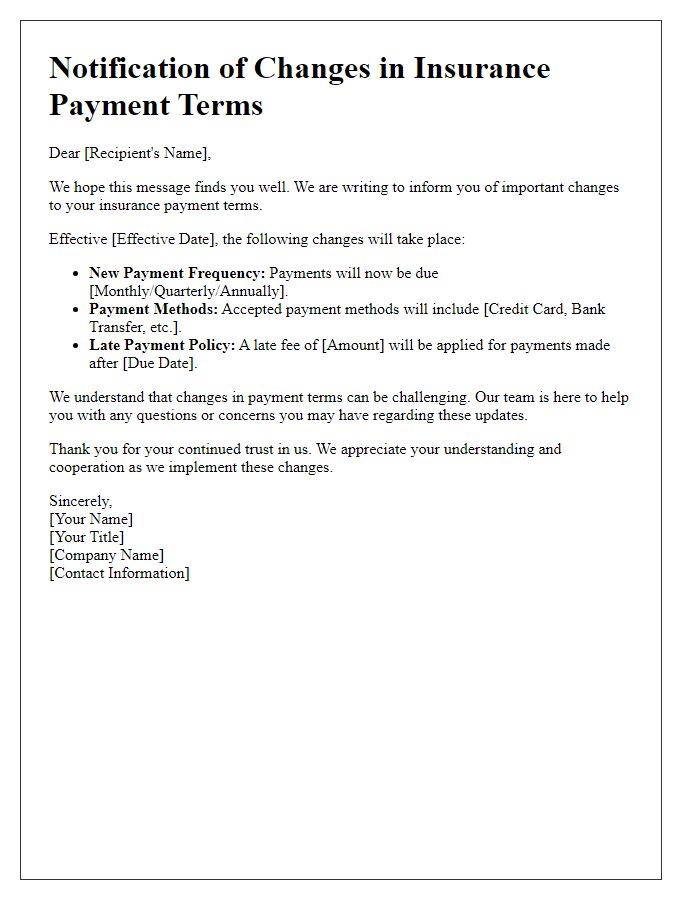

Changing the preferred payment schedule for an insurance policy can impact cash flow management significantly. Policyholders may opt for monthly, quarterly, semi-annual, or annual payment schedules, depending on financial needs and budget capabilities. For instance, selecting a monthly payment schedule allows for smaller payments spread over the year, making it easier for households to manage premiums. Conversely, a semi-annual or annual payment plan often provides discounts, potentially saving policyholders money on total premiums. It's essential for individuals to review their insurance documents, paying attention to terms and conditions regarding payment flexibility, penalties for missed payments, and any adjustments in coverage during the change. Customers should also communicate with their insurance provider promptly to ensure timely processing and confirmation of the revised schedule.

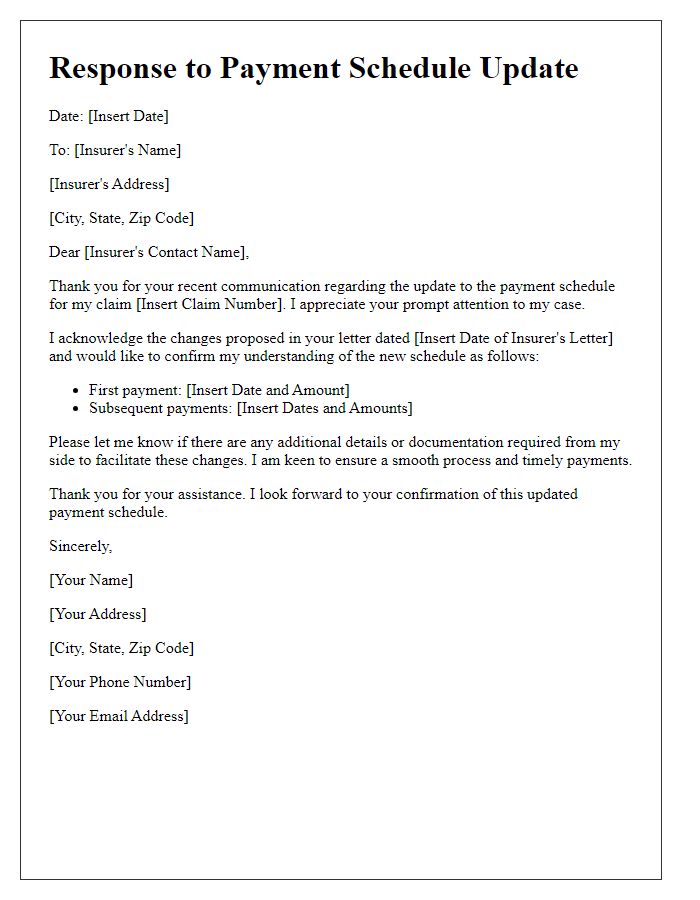

Contact Information for Follow-up

Updating an insurance payment schedule can significantly impact personal financial management. In particular, policyholders may require immediate access to their updated billing details, including new due dates and amounts. Contact information, such as a dedicated customer service hotline (typically 1-800-555-0199 for many insurance companies), is crucial for follow-up inquiries and clarifications. Additionally, email support options provide a convenient alternative, allowing for a written record of communications. Some policies may also include a client portal, enabling users to directly view their schedules and payment history, ensuring transparency and ease of access in managing their policies. Maintaining clear communication channels with the insurance provider ensures that all adjustments to payment schedules are understood and executed smoothly.

Letter Template For Insurance Payment Schedule Change Samples

Letter template of inquiry regarding insurance payment deadline modifications

Comments