Are you feeling overwhelmed by the insurance application process? You're not alone! Many people find navigating the world of insurance assistance programs to be a daunting task. In this article, we'll break down the essential steps and provide a helpful letter template to make your application as smooth as possibleâso you can focus on what truly matters. Read on to discover how to set yourself up for success!

Applicant's personal information.

The applicant's personal information is crucial for processing insurance assistance program applications effectively. Full name often includes both first and last names, along with middle initials for precise identification. Date of birth records can verify age, typically formatted as MM/DD/YYYY, ensuring eligibility compliance. Residential address, which includes street number, street name, city, state, and zip code, establishes the applicant's location for correspondence and service provision. Phone number, often formatted in the (XXX) XXX-XXXX style, allows for direct communication regarding application status. Email address facilitates quicker, electronic correspondence related to updates or additional requirements in the application process. Social Security number, usually represented as XXX-XX-XXXX, is critical for identity verification and must be handled with utmost confidentiality due to privacy regulations. Employment status and income information may also be required to assess eligibility for specific assistance levels, with details ranging from job title to employer name.

Clear statement of assistance request.

The insurance assistance program offers crucial support for individuals facing financial hardships due to unexpected medical expenses or property damage. Eligible applicants must provide detailed information regarding their current financial situation, including monthly income figures, outstanding debts, and specific areas of crisis, such as recent hospitalizations or natural disasters affecting property. The program, administered by organizations like the Federal Emergency Management Agency (FEMA) in the United States, often requires documentation to verify claims, including medical bills, insurance policies, and proof of income. Timely submission of an application, along with all necessary documents, can significantly expedite the review process, ensuring that assistance reaches those most in need. Applicants also benefit from understanding eligibility criteria, understanding program limits, and knowing how funding directly addresses personal circumstances.

Specific details about the insurance program.

The insurance assistance program, known as the "Health Guarantee Initiative," provides financial support to individuals and families facing unexpected medical expenses. This program, funded by the state government, aims to alleviate the burden of healthcare costs, especially for those with low to moderate incomes. Eligible participants must demonstrate financial need, meeting the income eligibility threshold, which is set at 200% of the federal poverty level, varying by family size. Coverage includes essential services such as hospitalization, outpatient services, and preventive care, ensuring access to critical medical treatment. Enrollment requires documentation, including proof of income and residency, within the designated enrollment period, which occurs annually from January to March. Program participants can receive up to $5,000 annually, assisting with deductibles, copayments, and uninsured medical expenses, thereby promoting overall community health and wellness.

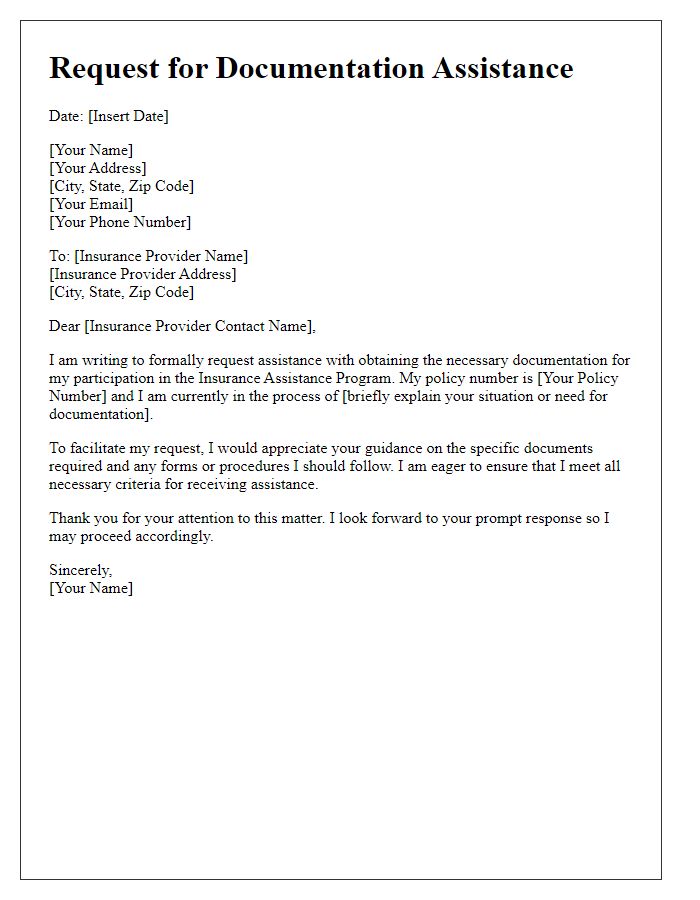

Documentation of financial need.

The Insurance Assistance Program application requires comprehensive documentation to validate an individual's financial need. Essential documents include recent bank statements (typically covering the last three months), pay stubs (or proof of income such as tax returns from the previous year), and any existing bills (for example, utility bills, medical expenses) to demonstrate ongoing financial obligations. Additionally, a formal letter detailing the applicant's current financial situation, including circumstances that led to hardship (like job loss, medical emergencies), is crucial. Supporting documents could also encompass proof of government assistance (if applicable), such as unemployment benefits or Supplemental Nutrition Assistance Program (SNAP) eligibility. Providing clear and accurate records ensures a higher chance of receiving the necessary support.

Closing with a request for review and contact information.

The insurance assistance program offers vital support for individuals facing financial difficulties due to unexpected medical expenses. Applicants often require detailed documentation, including personal identification, financial statements, and medical bills, to establish eligibility. The review process can take several weeks, where program officers assess each case based on guidelines set by local government or private organizations. Prospective recipients are encouraged to follow up, providing their contact information such as phone numbers and email addresses to facilitate communication. This proactive approach can expedite the application review and ensure that necessary assistance is provided promptly to those in need.

Letter Template For Insurance Assistance Program Application Samples

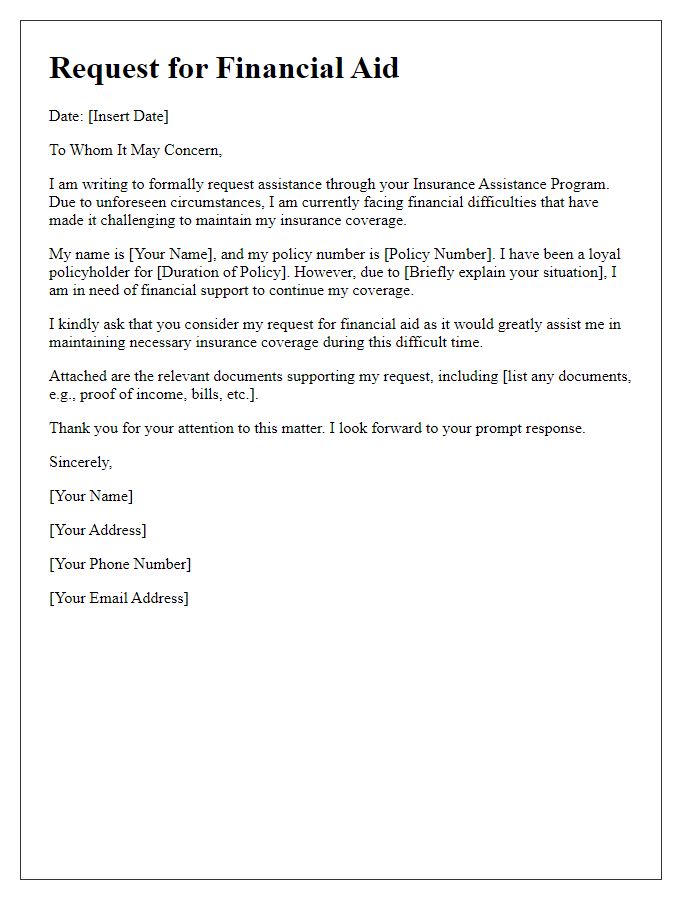

Letter template of insurance assistance program request for financial aid.

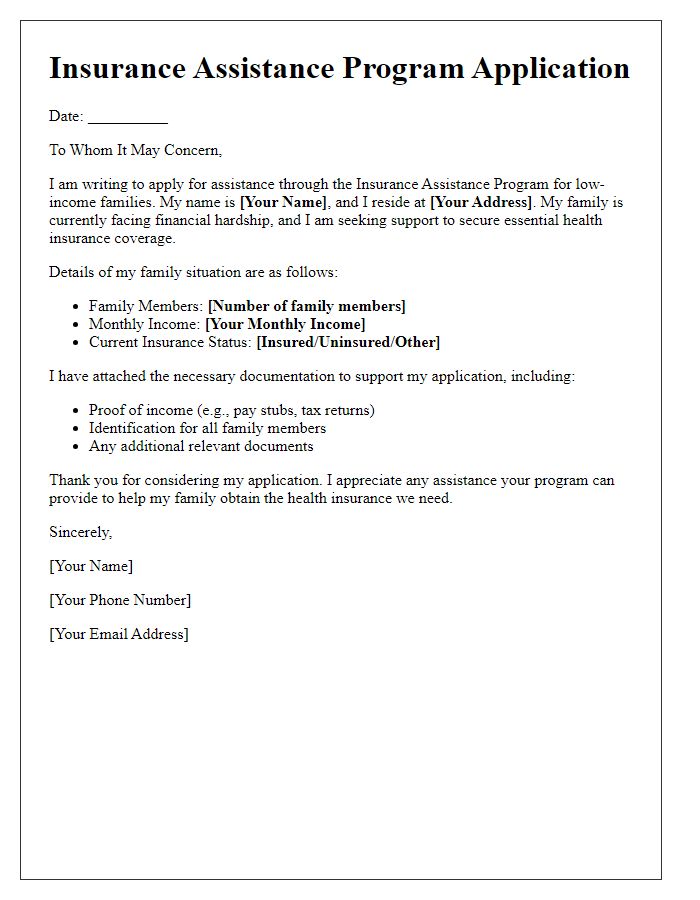

Letter template of insurance assistance program application for low-income families.

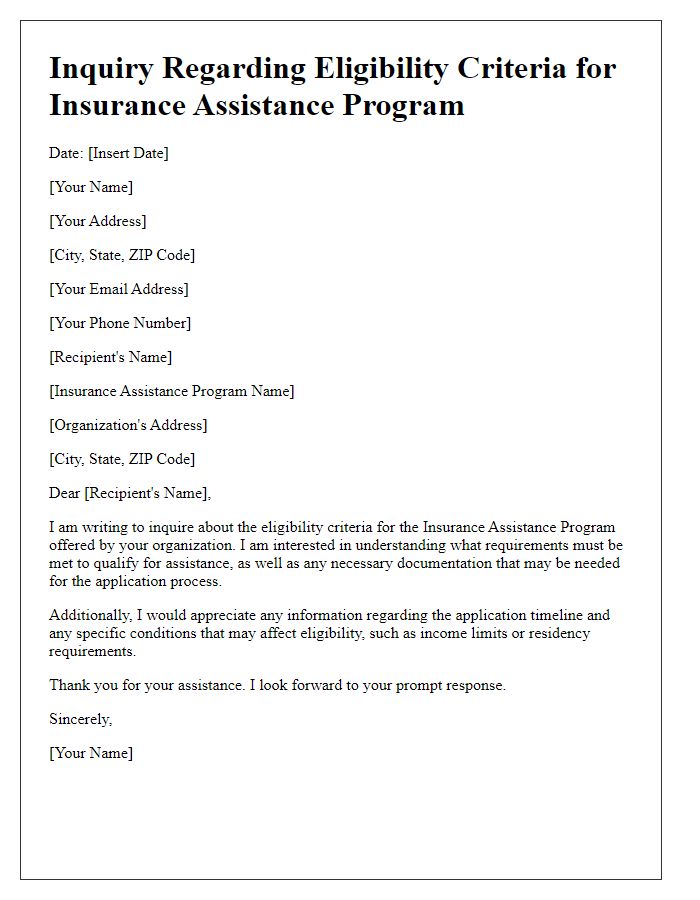

Letter template of insurance assistance program inquiry for eligibility criteria.

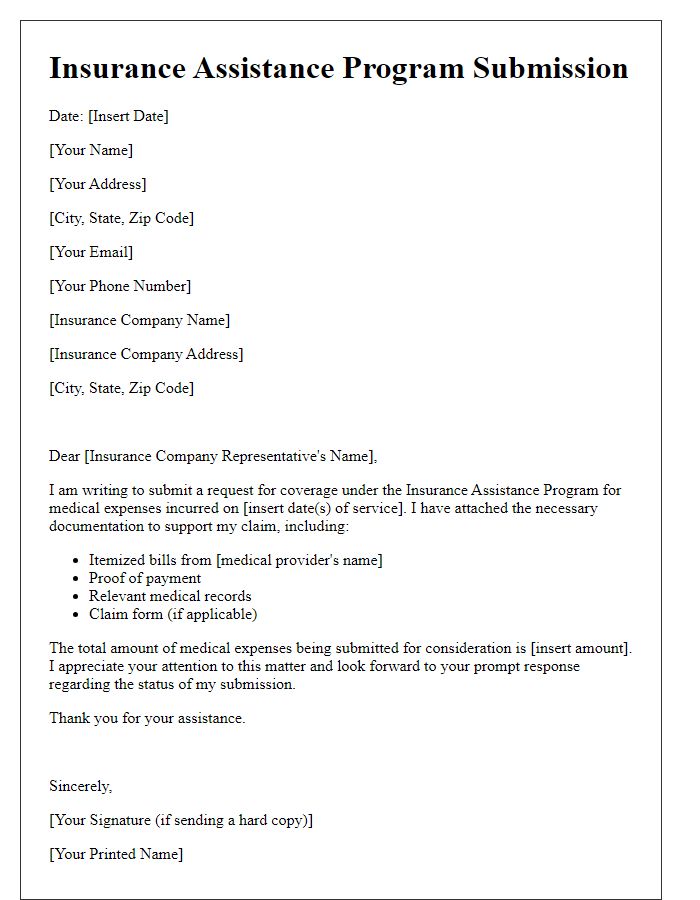

Letter template of insurance assistance program submission for medical expenses coverage.

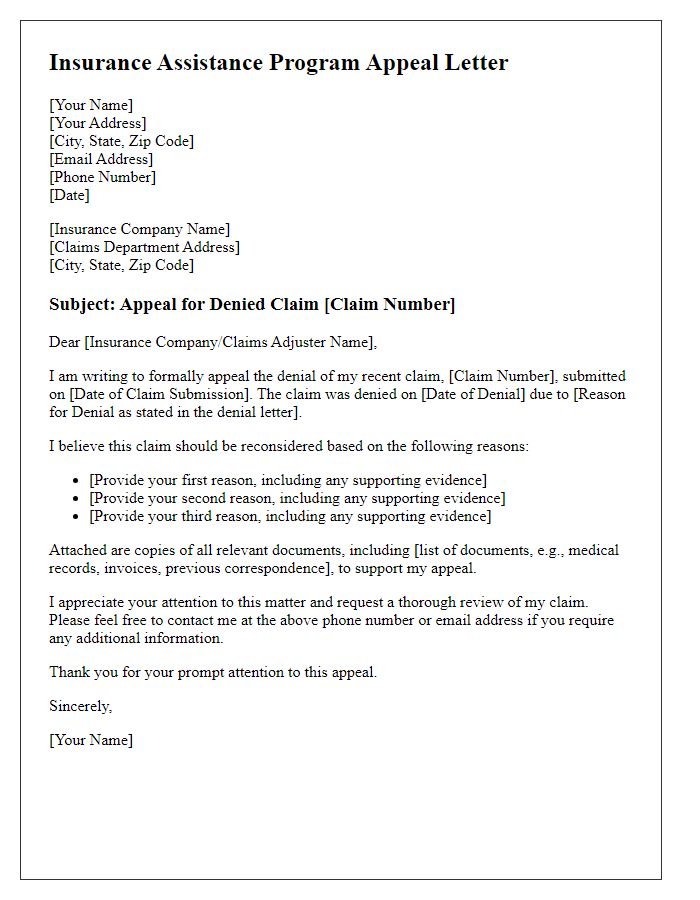

Letter template of insurance assistance program appeal for denied claims.

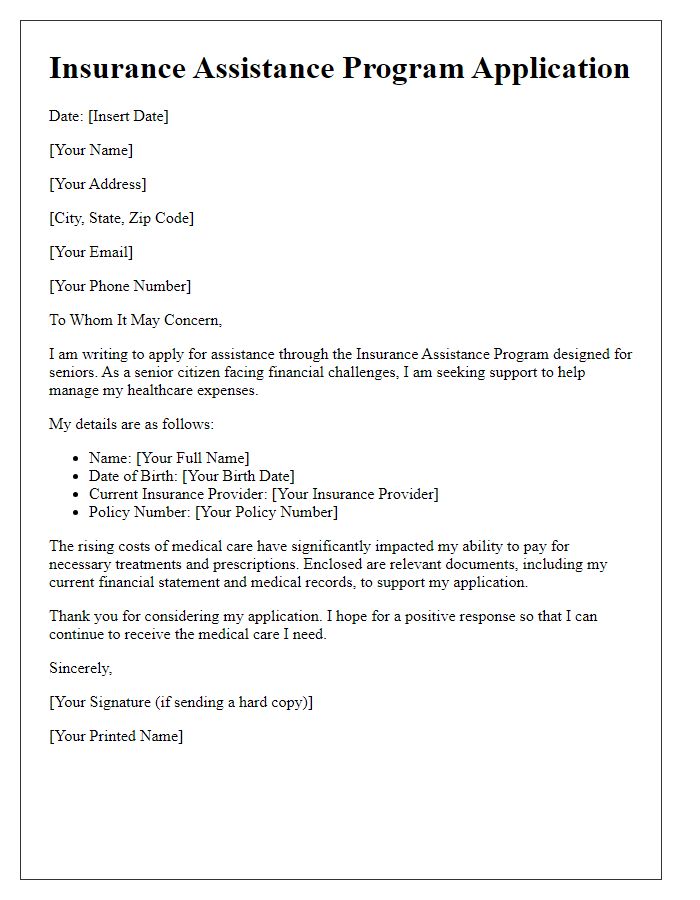

Letter template of insurance assistance program application for seniors.

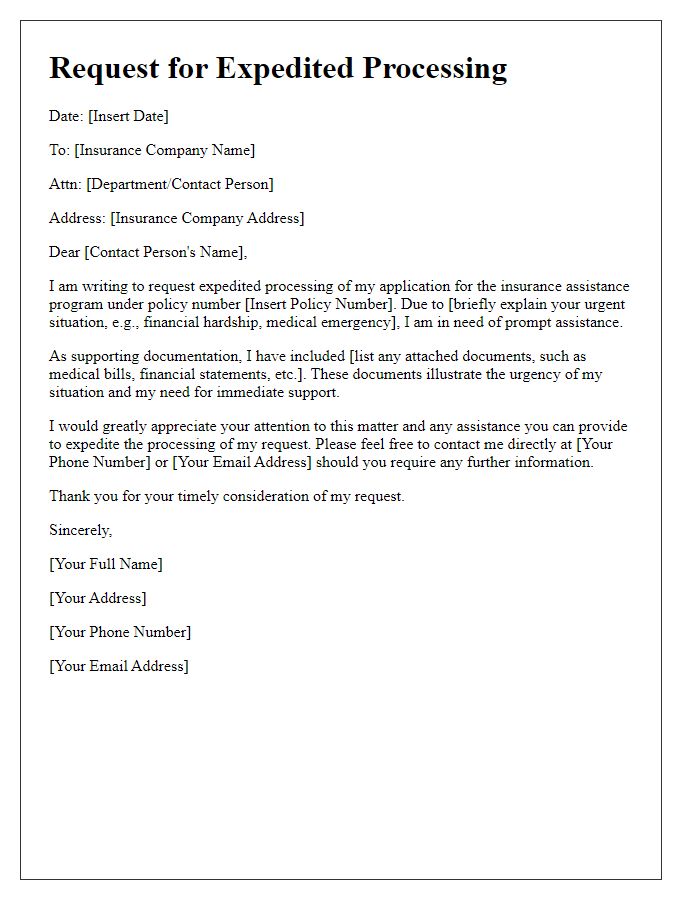

Letter template of insurance assistance program request for expedited processing.

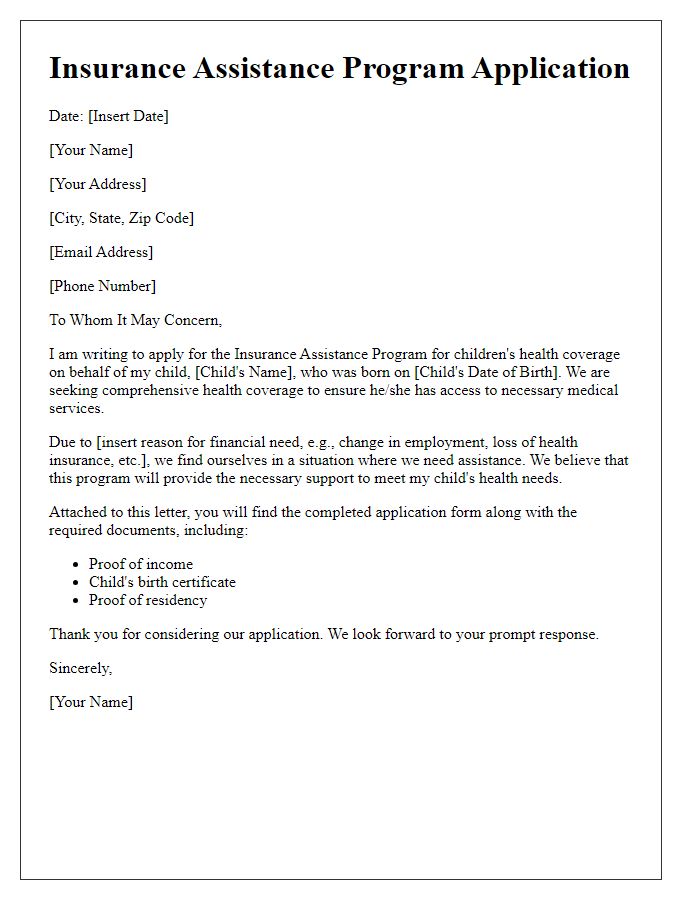

Letter template of insurance assistance program application for children’s health coverage.

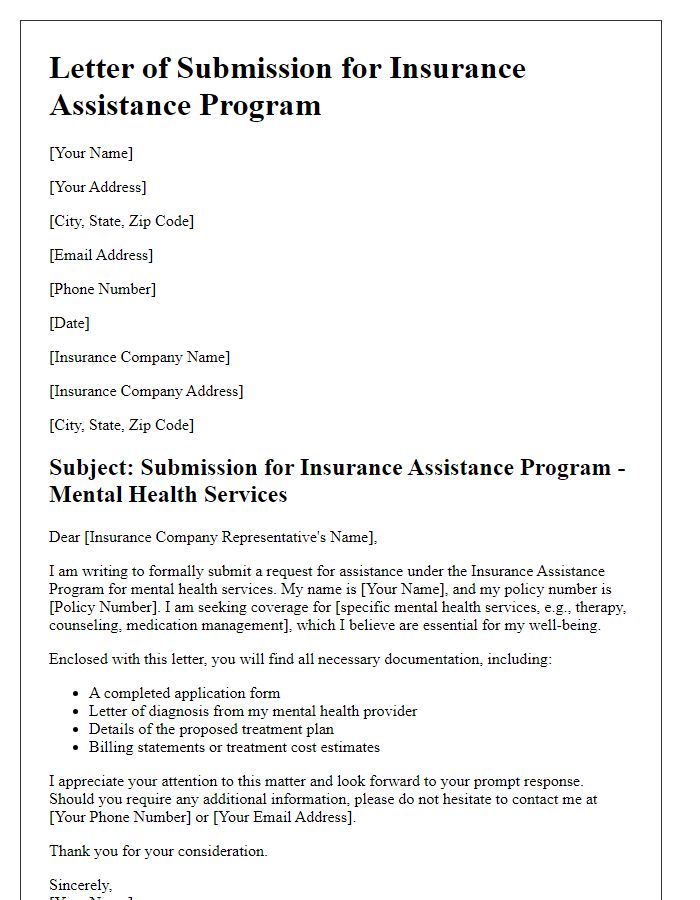

Letter template of insurance assistance program submission for mental health services.

Comments