When life throws unexpected challenges our way, having the right insurance can make all the difference. If you've found yourself needing to initiate a property insurance claim, you might be wondering where to start and how to ensure you've covered all your bases. This article will guide you step by step through the process, making it as smooth and stress-free as possible. So, let's dive in and empower you with the knowledge to navigate your claim effectively!

Policyholder Information

The initiation of a property insurance claim requires accurate documentation of the policyholder information, which typically includes the full name of the insured individual or entity, policy number associated with the property insurance, and contact details such as physical address, phone number, and email address. Additionally, the claim form often necessitates the date of the incident or loss, as well as a detailed description of the damage incurred, including items affected by the event, estimated value of loss, and the cause of the claim, whether it be fire, theft, or natural disasters like hurricanes or floods. An organized presentation of these details facilitates prompt assessment and resolution of the insurance claim by the insurer.

Insurance Policy Details

Insurance policy details provide critical information required to initiate a property insurance claim successfully. These details include the policy number, representing the unique identifier associated with the insurance coverage. Additionally, the insured's name is essential, as it identifies the individual or entity covered under the policy. The type of coverage mentioned, such as homeowners insurance or commercial property insurance, indicates the specific protections offered. Important dates such as the policy effective date (the date coverage begins) and the expiration date (the date coverage terminates) are crucial for understanding the validity of the claim. Furthermore, the premium amount paid periodically reflects the cost of the insurance coverage. Lastly, the insurer's name and contact information facilitate direct communication regarding the claim process.

Incident Description

A severe windstorm struck Miami, Florida, on October 15, 2023, causing extensive damage to residential properties. Wind gusts reached up to 100 miles per hour, uprooting trees and damaging roofs. My property, located at 123 Ocean Drive, experienced significant roof damage, resulting in water leaks and subsequent interior damage. The storm caused shingles to tear off and exposed areas of the roof, leading to water intrusion and potential mold growth. Immediate assessment reveals damage to drywall in the living room and ceiling, with visible stains and structural concerns. Photographic evidence and repair estimates are available for review, highlighting the urgent need for property insurance claim initiation.

Damages and Losses Summary

Property insurance claims can be initiated efficiently by detailing damages and losses resulting from events such as natural disasters or accidental incidents. For example, water damage caused by a burst pipe in a residential property located in Springfield, due to freezing temperatures dropping below 32 degrees Fahrenheit, can lead to significant issues like mold growth and structural weakening. Recording specific metrics, such as the square footage affected (e.g., 300 square feet in the basement), enhances the clarity of the claim. Additionally, including receipts for damaged items like furniture and electronics, along with estimated repair costs from licensed contractors, helps substantiate the claim process. Insurance agents typically require a comprehensive summary that highlights all affected areas, ensures accurate navigation through the claims procedure, and expedites compensation.

Supporting Documentation List

When initiating a property insurance claim, a comprehensive supporting documentation list can enhance the claim process significantly. Essential documents include a completed claim form, often provided by the insurance company like State Farm or Allstate, detailing the incident's specifics. Photographic evidence (high-resolution images) showing damage to property, including dates and contexts, is crucial. An itemized inventory list of affected items with purchase receipts or proof of ownership (e.g., credit card statements from Target or Walmart) strengthens your case. Additional documentation may consist of police reports (if applicable), professional repair estimates from licensed contractors, and correspondence copies with the insurance company, highlighting communication history. For claims involving personal injury, medical records or bills from healthcare providers may be required.

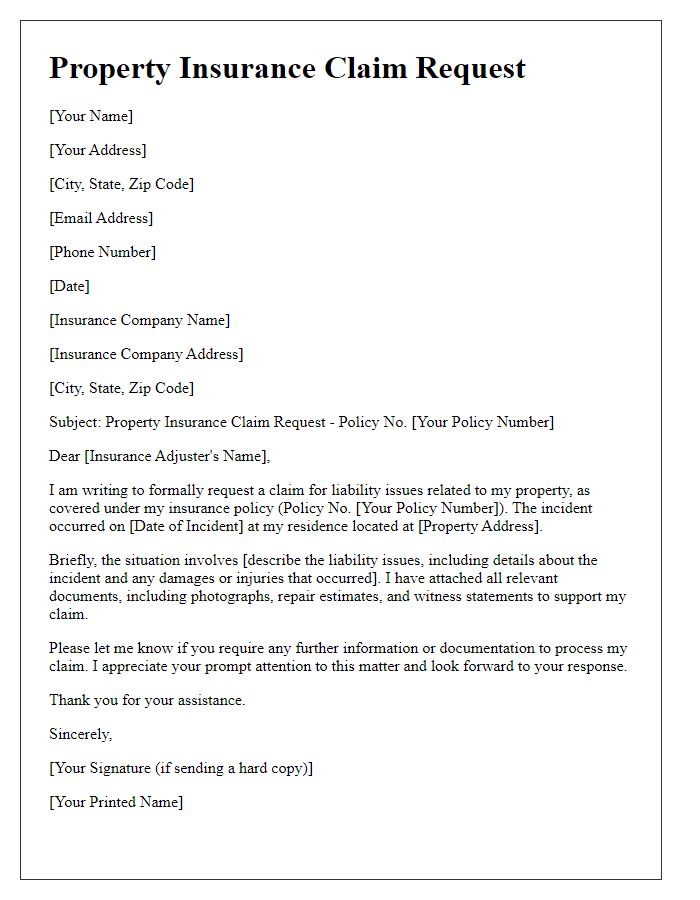

Letter Template For Property Insurance Claim Initiation Samples

Letter template of property insurance claim request for residential damage

Letter template of property insurance claim initiation for commercial property

Letter template of property insurance claim notification for storm damage

Letter template of property insurance claim initiation for personal property loss

Comments