Hello! We all know that keeping up with our insurance policies can sometimes slip our minds amidst our busy lives. That's why a timely renewal reminder can be a lifesaver, ensuring you're continuously covered and protected. In this article, we'll explore a friendly and effective letter template that you can use to remind clients about their upcoming insurance policy renewals. So, let's dive in and help you craft the perfect reminder!

Personalization

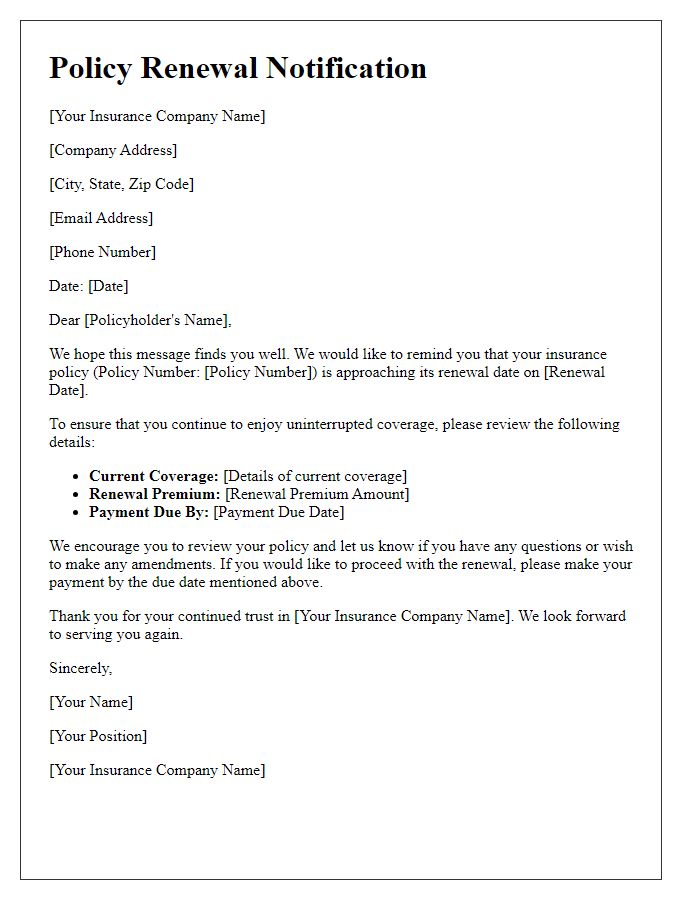

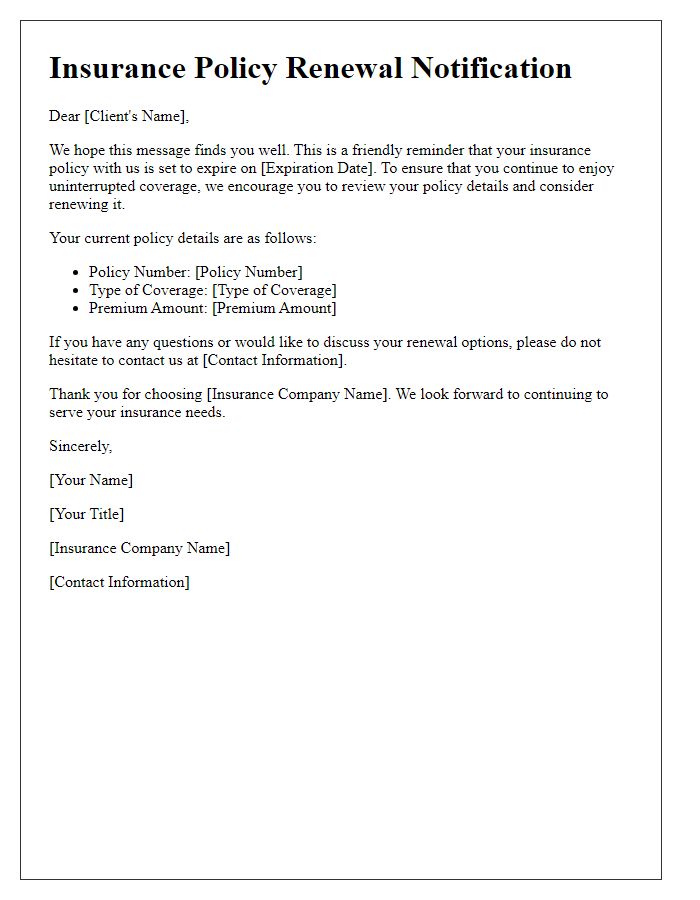

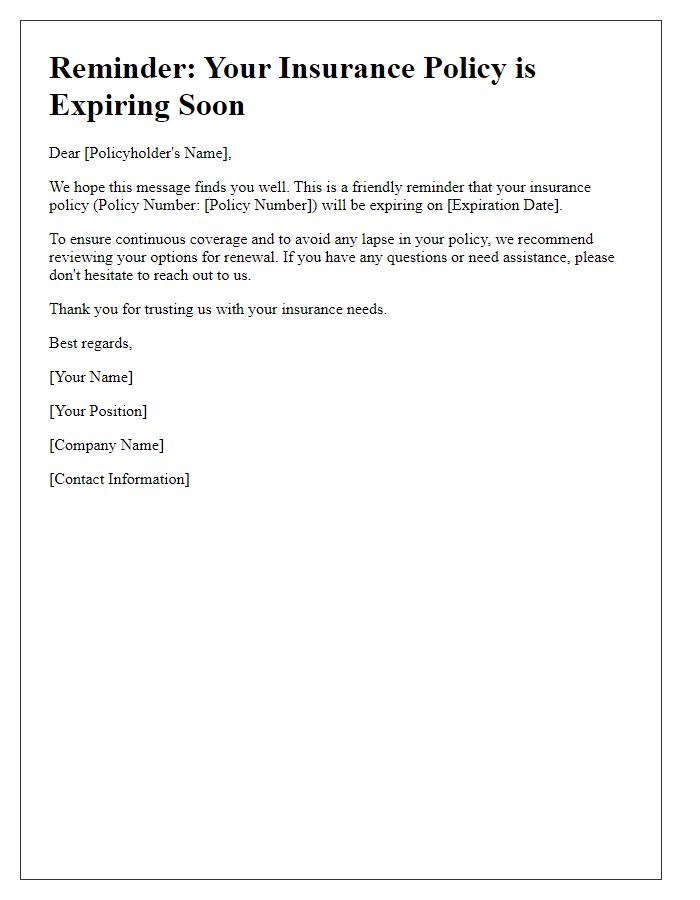

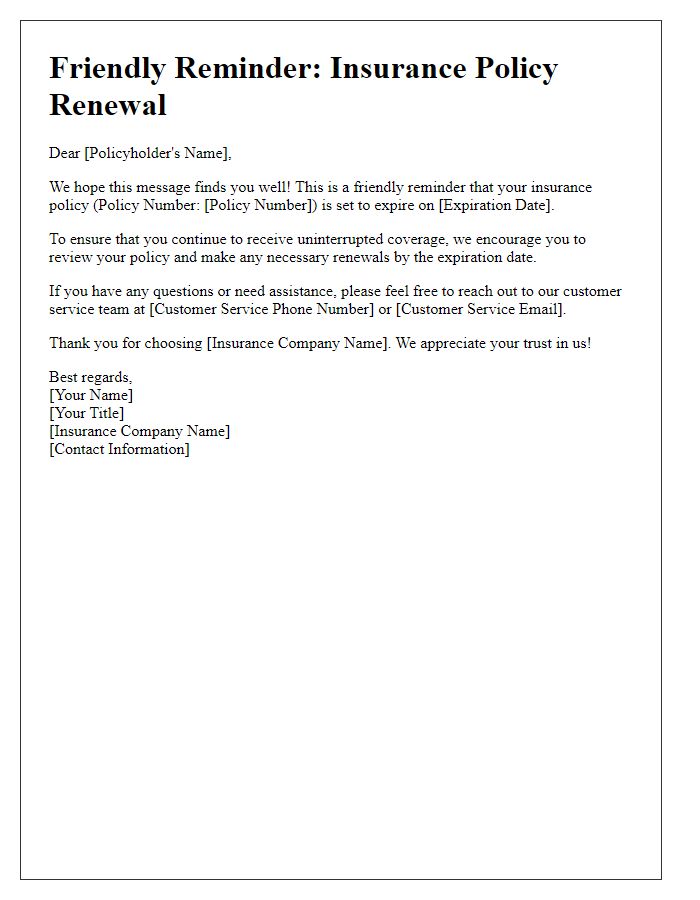

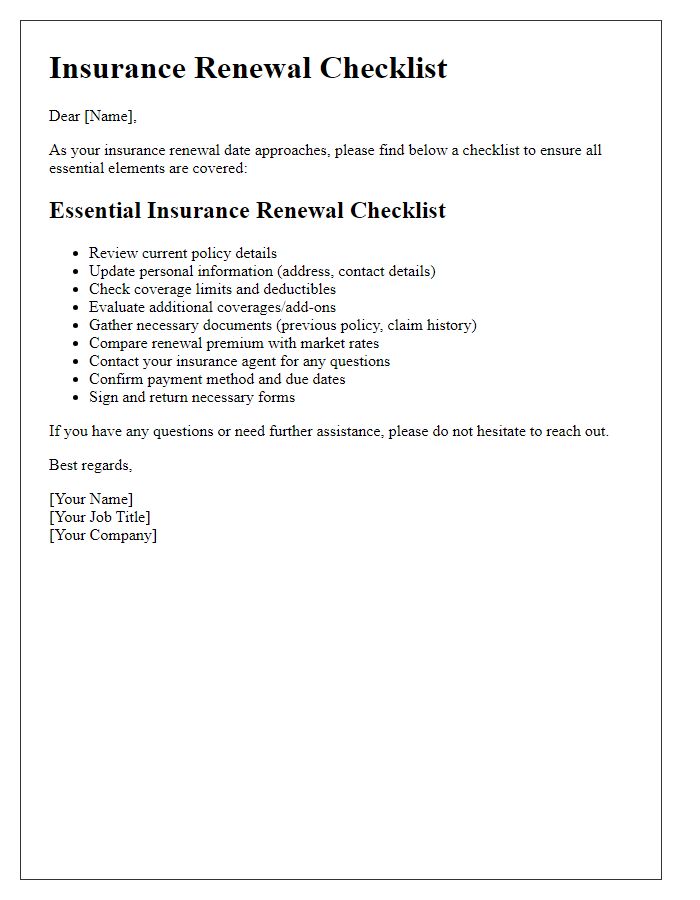

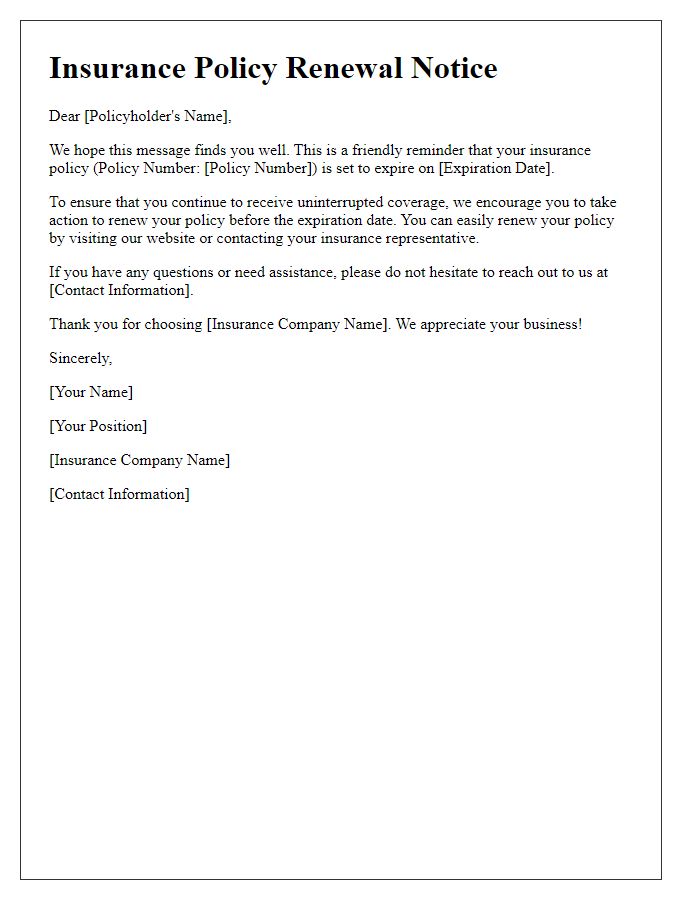

Insurance policy renewal reminders play a crucial role in ensuring policyholders maintain their coverage. Policy details such as the policy number, coverage type, and renewal date must be highlighted for easy reference. Personalization elements should include the insured's full name, encouraging a direct connection. Clear instructions about payment options (such as online payment through the insurer's website or via check) enhance convenience. Additionally, a summary of premium changes, if applicable, can prepare policyholders for potential adjustments. Offering customer service contact information (including phone number and email) reassures clients of support during the renewal process. Providing a specific call-to-action, such as "renew your policy by March 30 for uninterrupted coverage," promotes timely responses and ensures compliance.

Policy Details Summary

Insurance policy renewal reminders are crucial for maintaining uninterrupted coverage and ensuring policyholders stay informed. A typical policy includes details such as the policyholder's name, coverage type (like auto, health, or home insurance), and the policy number, which serves as a unique identifier for easy reference. Renewal dates, typically occurring annually, require attention, usually set 30 days prior to expiration to avoid lapse in coverage. Premium amounts, which reflect the cost of the policy, change annually based on claims history, risk assessment, and market conditions. Additionally, any changes in terms and conditions, including new exclusions or updated coverage limits, must be clearly communicated to ensure the policyholder understands their current protections and obligations.

Renewal Deadline and Instructions

Policyholders receive important notifications regarding their insurance policies. Renewal deadlines often occur annually, typically 30 days prior to the policy expiration date, such as December 31 for a calendar year policy. Instructions for the renewal process may include reviewing updated terms, confirming personal information, and updating coverage options. Additionally, premium payment methods, like online payment portals or automatic deductions, often enable a seamless transition from one policy term to the next. Missing the renewal deadline could result in coverage lapses, leading to potential financial exposure in the event of a claim.

Contact Information

Insurance policy renewal reminders enhance customer engagement and ensure timely coverage continuity. A comprehensive reminder includes essential details such as the policyholder's name, policy number (e.g., 123456789), and the expiration date (e.g., December 31, 2023). Clear contact information should be provided, including the insurance company's name (e.g., Acme Insurance Co.), customer service hotline (e.g., 1-800-555-0199), and email address (support@acmeinsurance.com). This streamlined communication process aids in avoiding lapses in coverage and facilitates seamless renewal transactions, thereby safeguarding customers' interests.

Benefits of Renewal

Insurance policy renewal offers numerous benefits to policyholders seeking continued protection and peace of mind. Renewing policies, such as auto or home insurance, ensures uninterrupted coverage against unforeseen events, including accidents, natural disasters, or thefts. Maintaining coverage provides continued access to essential services, such as roadside assistance or emergency repairs, which can save considerable expenses. Moreover, renewals allow policyholders to review and adjust their coverage limits and deductibles to reflect changes in circumstances, such as increased property value or new vehicles. Additionally, many insurance companies offer loyalty discounts or premium reductions for long-term customers, making renewal financially advantageous. Ensuring timely renewal can also prevent lapses in coverage, which can lead to higher premiums or denial of claims during crucial moments. Overall, renewing an insurance policy reinforces financial security and safeguards valuable assets against potential risks.

Comments