Are you looking to transfer an insurance policy but unsure of where to start? Navigating the process can be overwhelming, but it doesn't have to be! This article will guide you through a simple letter template that makes your policy transfer request straightforward and stress-free. So, grab a cup of coffee and dive in to learn how you can smoothly handle your insurance changes!

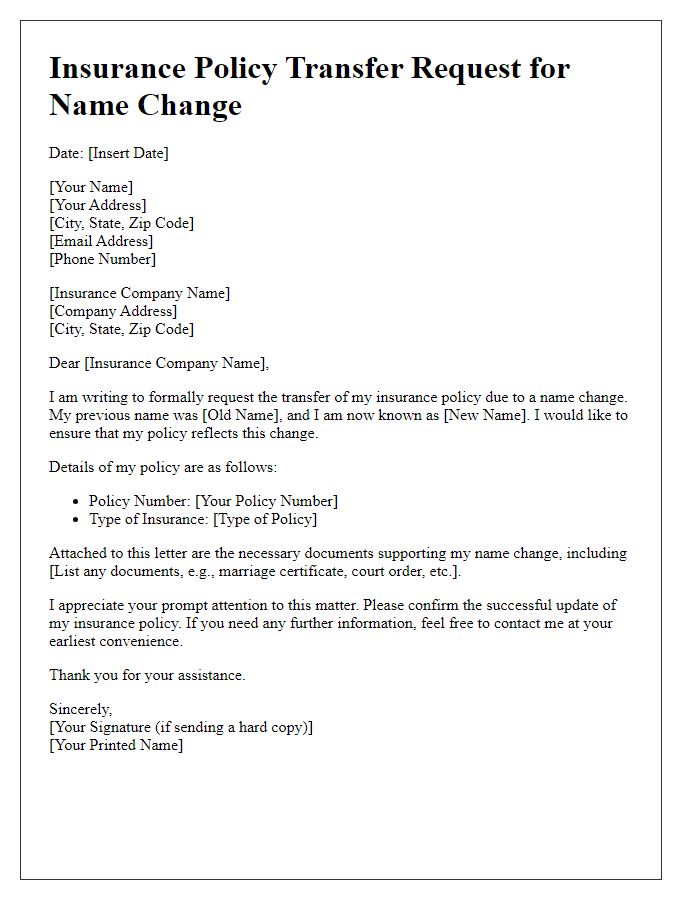

Personal Information

Transferring an insurance policy requires clear communication of personal information to ensure a seamless transition. Policyholders must verify their full name, address, contact number, email address, and policy number. The transfer request should include specific details regarding the type of insurance, such as auto insurance, home insurance, or life insurance. Additional information may include date of birth to confirm identity and any beneficiary details if applicable. It is vital to provide any relevant documentation or forms as specified by the insurance company, such as proof of identity or existing policy documents, to facilitate the policy transfer efficiently.

Policy Details

Insurance policy transfer requests require careful attention to specific details. Essential information includes the policy number assigned to the insurance contract, the full name of the policyholder, and relevant contact information. Also include the name of the insurance company, specifically its registered address for accurate correspondence. The transfer request should mention the new policyholder's information, including their full name, address, and any necessary identification details. Additionally, the effective date of the transfer should be clearly stated to ensure a smooth transition. It's crucial to provide a reason for the transfer, such as a change in ownership or beneficiary designation, to clarify the request's purpose.

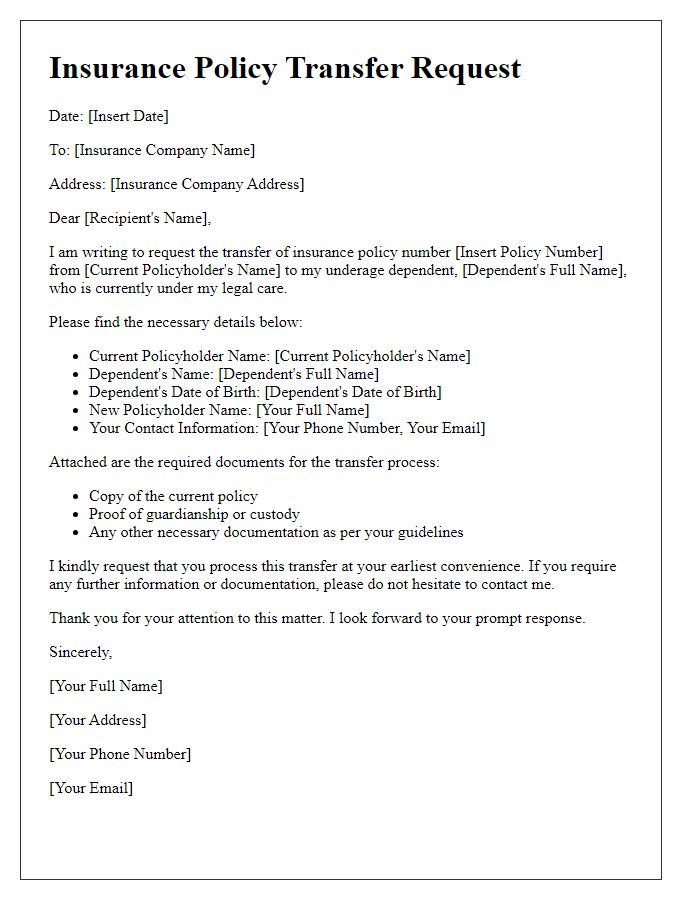

Request for Transfer

Transferring an insurance policy can simplify financial management and provide better coverage options. A policyholder may seek to transfer ownership or coverage of a specific insurance policy, such as a life insurance policy, homeowner's insurance, or auto insurance policy. Essential details include the policy number, the current policyholder's name, and the new policyholder's information. The process typically requires the completion of specific forms mandated by the insurance provider, which ensures all legal guidelines are followed. Timely submission of the transfer request is crucial, as any delays might lead to lapses in coverage or misunderstandings regarding responsibility. Necessary documentation may consist of identification documents, existing policy papers, and a consent form from the current holder, ensuring a smooth transition for all parties involved.

Reason for Request

Due to significant life changes such as relocation, marriage, or change of employment, I am requesting the transfer of my insurance policy. This transfer is essential to ensure my coverage is aligned with my current situation and provides me with the appropriate protection. The policy in question is held with XYZ Insurance Company, last updated in January 2022, and covers personal property valued at approximately $150,000. The new address will be at 1234 Elm Street, Springfield, IL, which also affects local risk assessments and premium calculations. Timely processing of this request will help me maintain continuous coverage and avoid potential gaps in insurance protection.

Contact Information

Transferring an insurance policy requires a clear and direct communication that includes essential contact information for proper processing. Important elements include the policyholder's full name, current address, and the insurance company's name. The message should specify the policy number associated with the transfer request, ensuring that it aligns with both the current and new policyholder's names if applicable. Additionally, including a contact phone number and email address facilitates any follow-up communication required by the insurance provider. Ensuring accuracy in these details helps prevent delays in the transfer process, which may vary based on the insurer's procedures and state regulations governing insurance policies.

Letter Template For Insurance Policy Transfer Request Samples

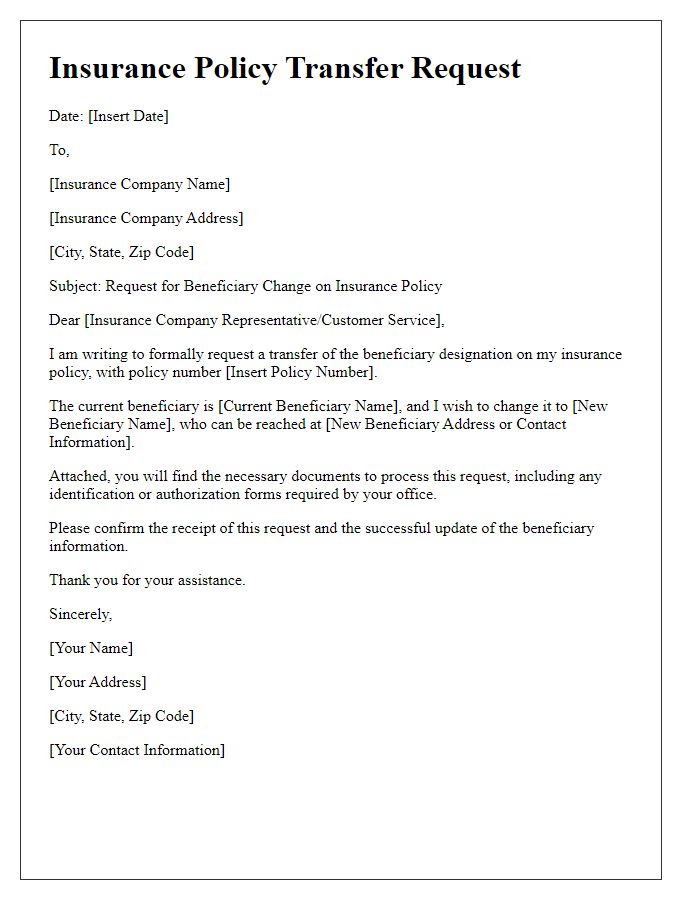

Letter template of insurance policy transfer request for beneficiary change

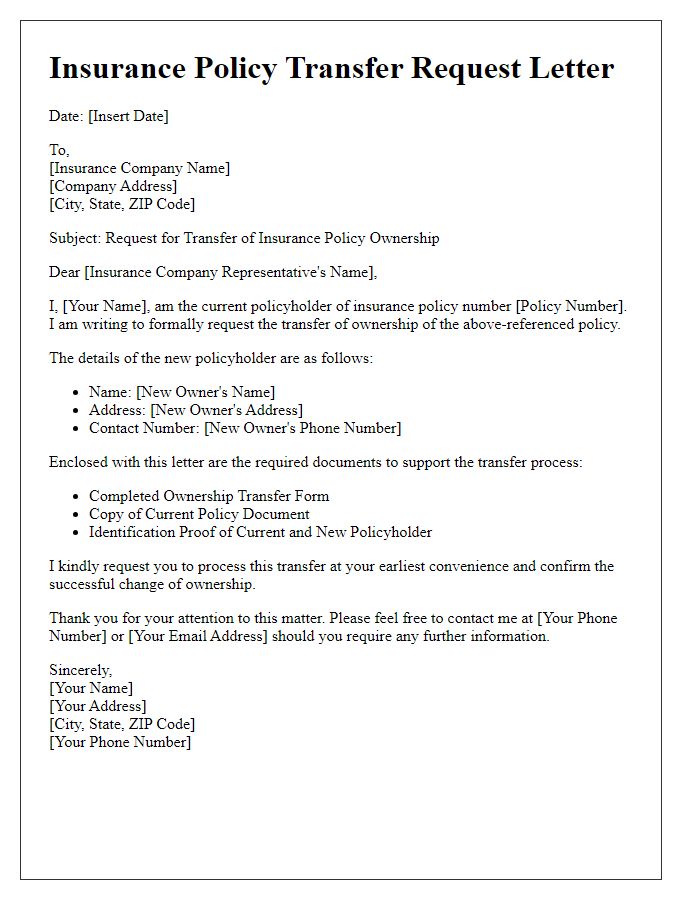

Letter template of insurance policy transfer request for ownership transfer

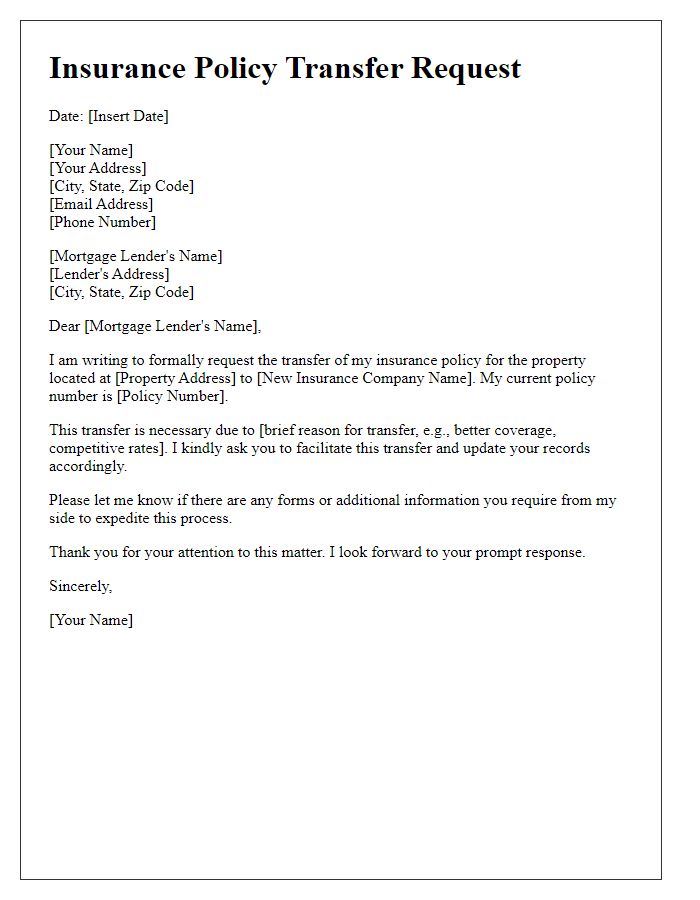

Letter template of insurance policy transfer request for mortgage lender

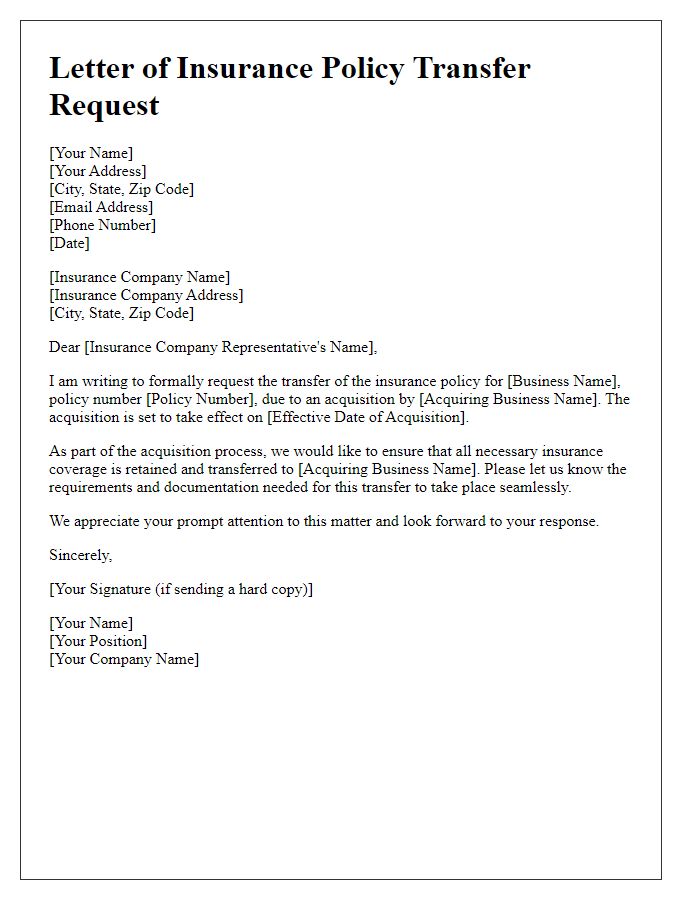

Letter template of insurance policy transfer request for business acquisition

Letter template of insurance policy transfer request for divorce settlement

Letter template of insurance policy transfer request for estate planning

Letter template of insurance policy transfer request for trust fund establishment

Comments