Are you curious about how annuity insurance policies work? Whether you're looking to secure your financial future or simply seeking to understand your options better, you've come to the right place. Annuities can provide a steady income stream and peace of mind, making them a popular choice for many individuals planning for retirement. Join us as we explore everything you need to know about annuity insurance policies and how they might fit into your financial strategy!

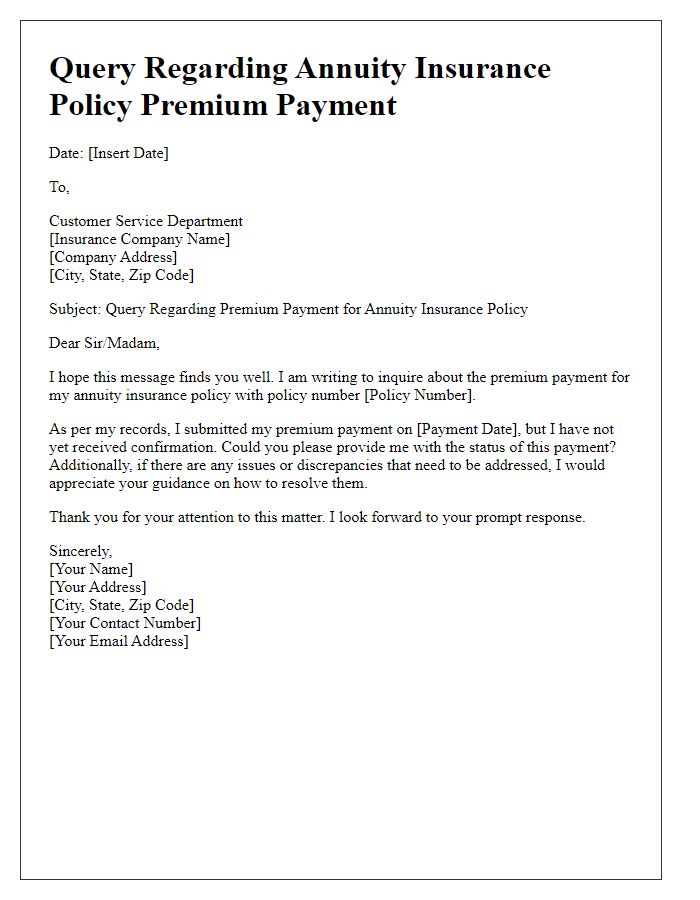

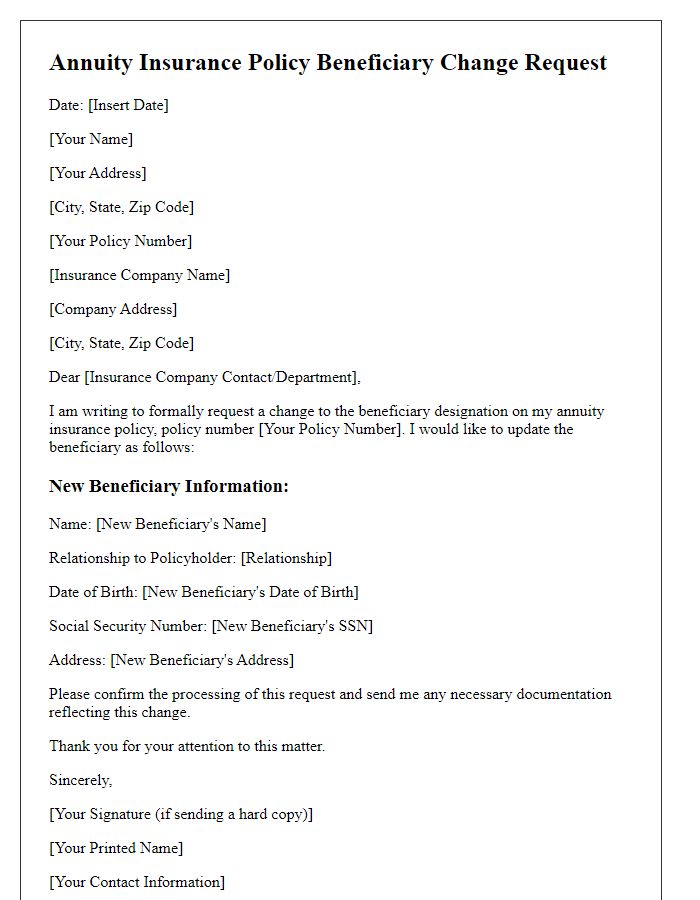

Policyholder information

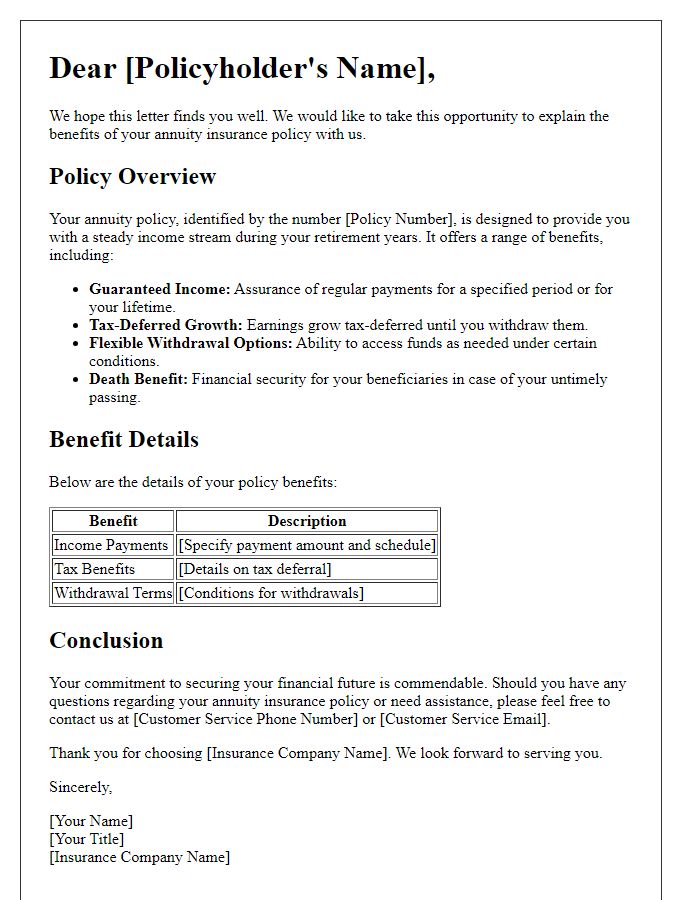

Annuity insurance policies provide individuals, like retirees or pre-retirees, with a steady stream of income, often during their retirement years. For policyholders, details such as policy number and personal identification information (like Social Security number) are crucial for managing benefits and accessing funds. Additionally, understanding the specific terms related to the annuity, including surrender charges, interest rates, and beneficiary options, can greatly impact financial planning. Regular communication with insurers, such as requests for current account values or withdrawal options, facilitates informed decisions that align with long-term financial goals.

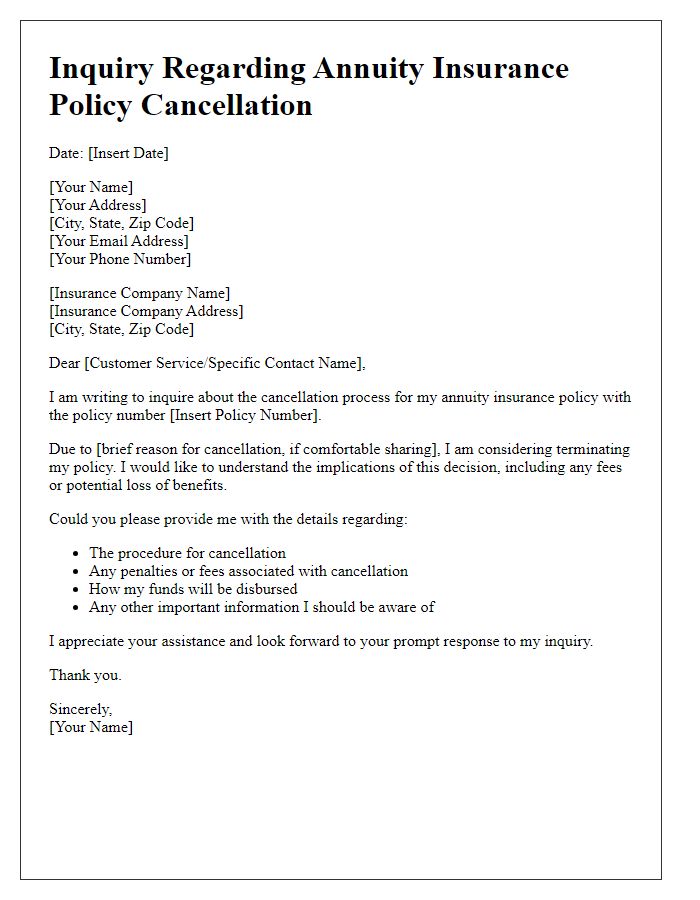

Specific policy details

Annuity insurance policies provide individuals with a reliable source of income during retirement, characterized by various types such as fixed, variable, or indexed annuities. Each policy varies significantly in terms of features like payout options, surrender charges, and tax implications. For example, a fixed annuity guarantees a certain interest rate over a specified period, while variable annuities involve investment in market-linked accounts. Policyholders may encounter terms such as "accumulation phase," typically spanning several years, and "annuitization," the process of converting the accumulated value into periodic income payments. Insurance providers often detail specific elements like minimum investment amounts, age restrictions for withdrawals, and the impact of inflation on payout amounts. Understanding these facets is crucial for making informed decisions regarding retirement planning and ensuring financial security.

Inquiry or request purpose

An annuity insurance policy serves as a financial product designed for long-term savings and investment, often used to secure a steady income during retirement. Individuals typically purchase these policies from insurance companies, such as MetLife or Prudential, to receive periodic payments after a specified period, often starting at retirement age, commonly 65. Many annuities offer tax-deferred growth, meaning that investment gains are not taxed until they are withdrawn, providing substantial benefits under IRS rules. Important details include surrender charges for early withdrawals, varying interest rates based on the type of annuity, and varying payout options, including lifetime income or fixed-period distributions. Understanding the terms and conditions of an annuity insurance policy is crucial for informed financial planning.

Contact information

Annuity insurance policies, a financial product designed to provide a steady income stream during retirement, often require critical information for effective management and inquiry. Key details include the policy number, unique identifiers for tracking and managing specific plans. Contact information for the issuing insurance company should include the customer service hotline (usually a toll-free number) and physical addresses for both claims and correspondence. Additionally, email addresses can facilitate quick communication, while secure online portals ensure efficient access to policy details. Understanding terms and conditions outlined in the policy document can greatly aid in inquiries, as well as documentation of recent transactions, changes in personal information, or updates on beneficiaries. Proper organization of these details can streamline the process of managing annuity insurance inquiries effectively.

Preferred response time and method

Inquiries regarding annuity insurance policies often require prompt attention to ensure clients receive essential information. Preferred response time typically falls within 24 to 48 hours, allowing sufficient time for comprehensive analysis and personalized feedback. Common methods of response include email, which provides a written record of communication, and phone calls for direct, interactive discussions. Clients may also prefer updates through secure online messaging platforms associated with their insurance provider, delivering convenience and security. By prioritizing clear, timely responses across these channels, insurance companies can enhance customer satisfaction and foster trust in their services.

Comments