Hey there! Have you ever received a confusing letter from your insurance provider that left you scratching your head? You're not aloneâmany people find the details of insurance deductions rather puzzling. In this article, we aim to break down the common terminology and processes related to insurance deductions so you can navigate the details with ease. So, if you're ready to demystify your insurance statements, keep reading!

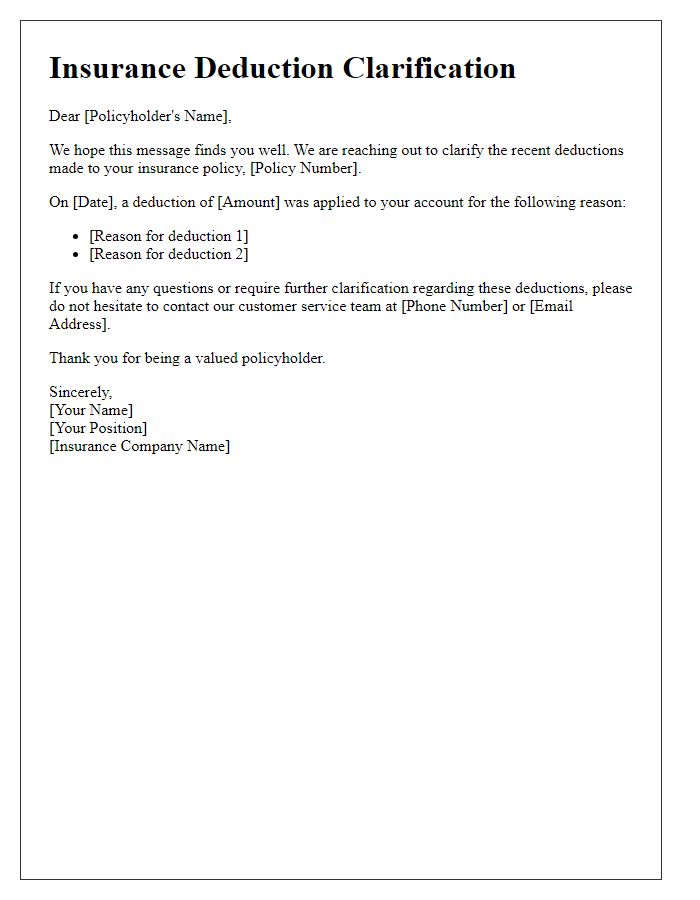

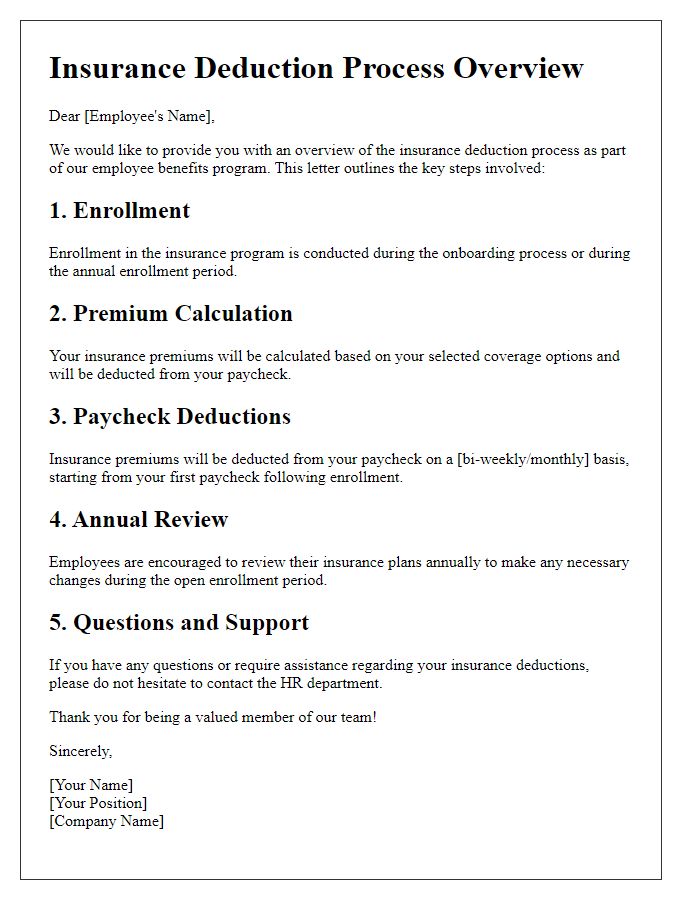

Policy Information

Insurance policies, such as homeowners or auto policies, often include specific terms detailing deductions, or deductibles, which refer to the amount paid out of pocket before insurance coverage kicks in. Common deductible amounts may range from $500 to $2,000, depending on the policy type and insurer. For example, a standard auto policy might have a collision deductible of $1,000. This means that in the event of an accident resulting in $5,000 worth of damage, the policyholder must first pay $1,000, with the insurance covering the remaining $4,000. Deductibles are crucial in determining premium costs, with higher deductibles typically leading to lower monthly payments yet increasing out-of-pocket expenses during claims. Understanding these policy specifics is essential for comprehensive financial planning and risk management.

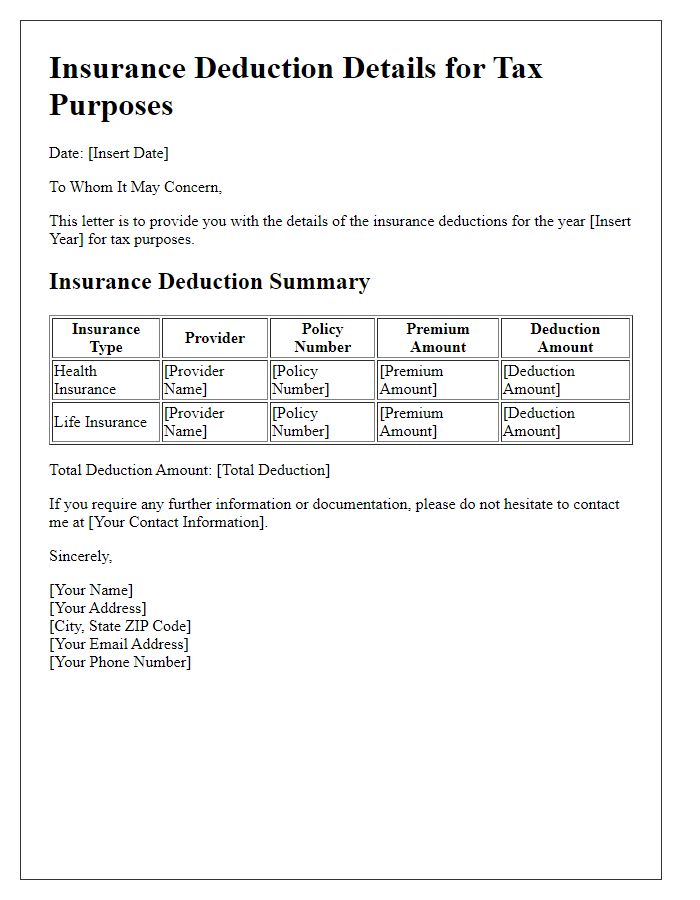

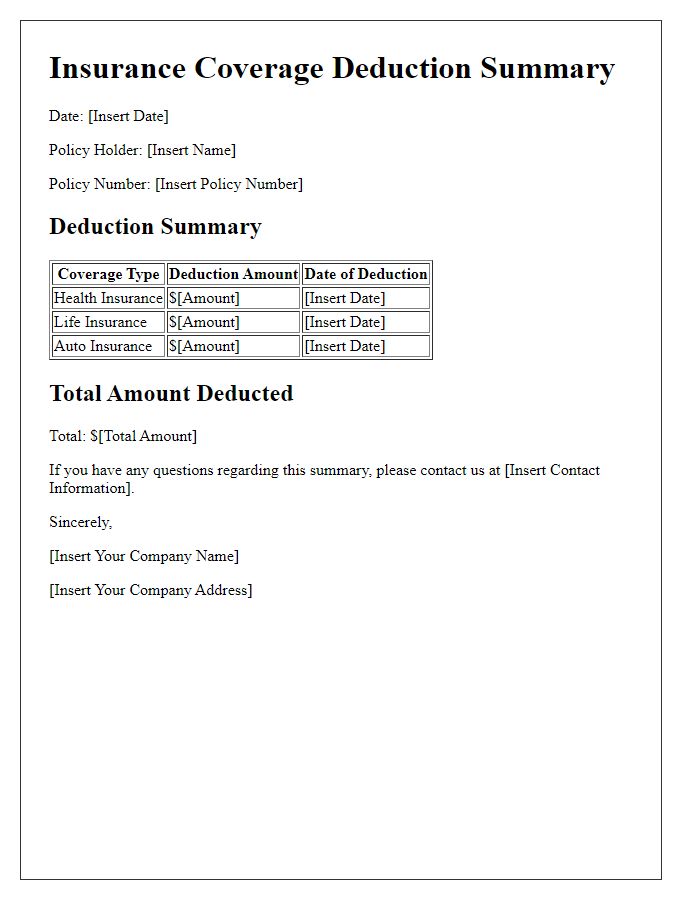

Deduction Details

Insurance deductions play a significant role in determining net income for tax purposes. For instance, taxpayers can deduct premiums paid for essential coverages like health insurance (averaging $400 to $1,200 annually) or property insurance (often ranging from $700 to $2,500 annually). In 2022, the IRS established specific rules for deducting unreimbursed medical expenses, allowing taxpayers to deduct qualifying expenses that exceed 7.5% of adjusted gross income. This deduction can notably affect individuals who experience significant medical bills not covered by insurance, leading to better financial management. Furthermore, self-employed individuals can deduct 100% of health insurance premiums directly from their taxable income, providing substantial tax savings. Understanding these specifics is vital for maximizing potential deductions and ensuring compliance with tax regulations.

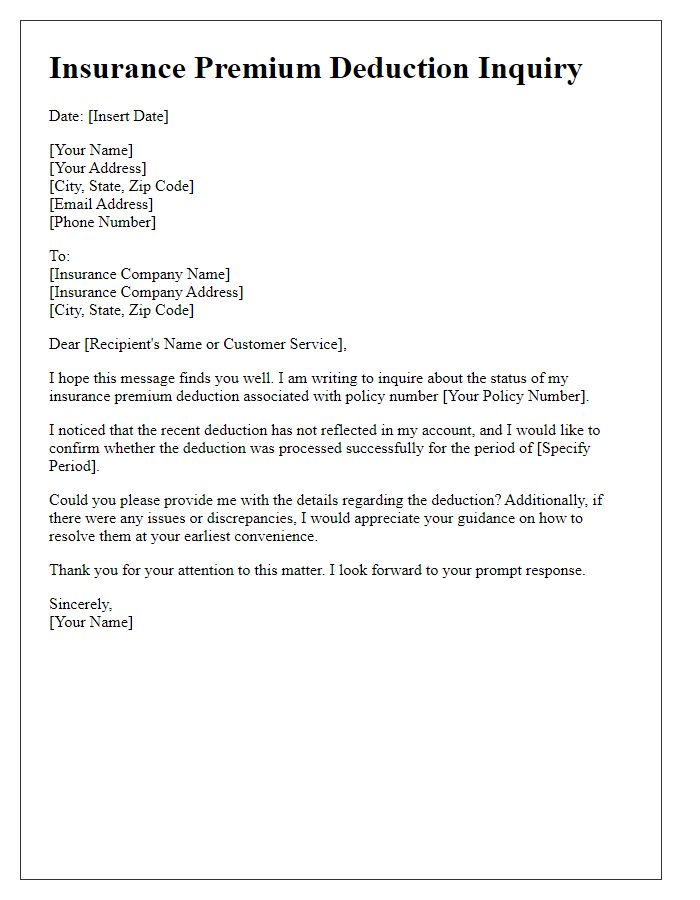

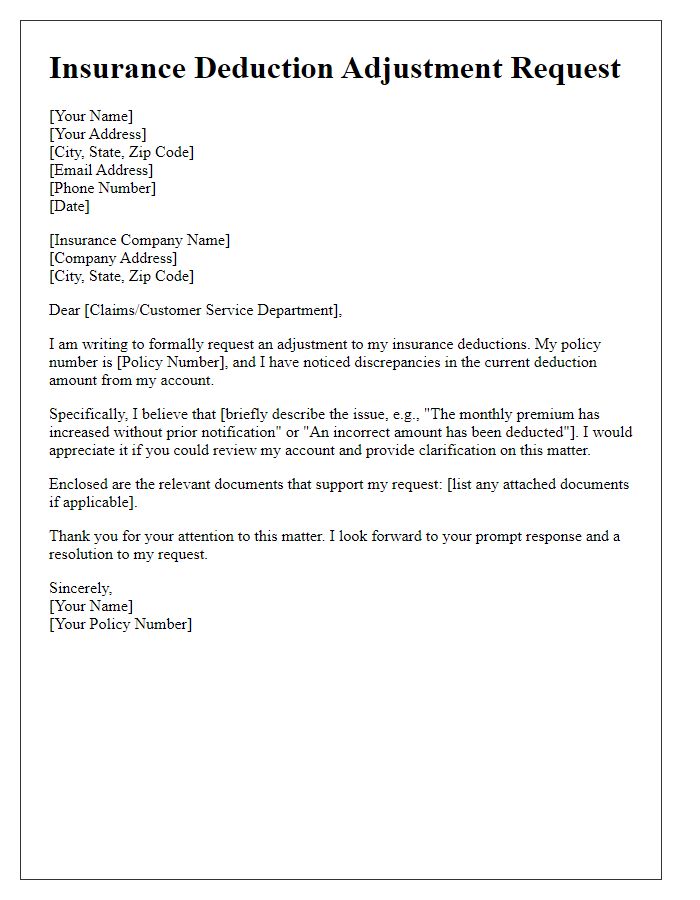

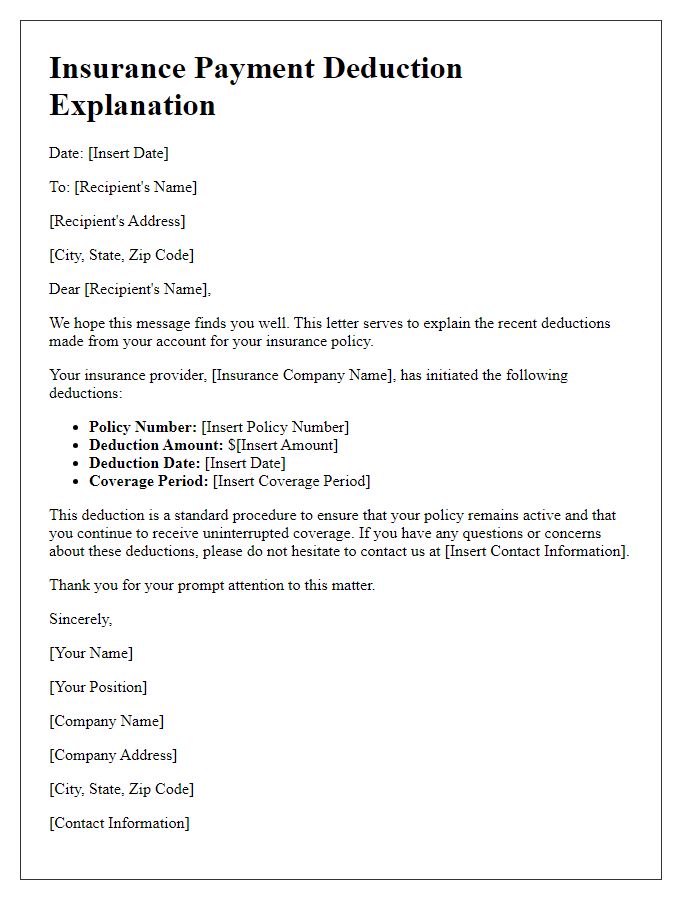

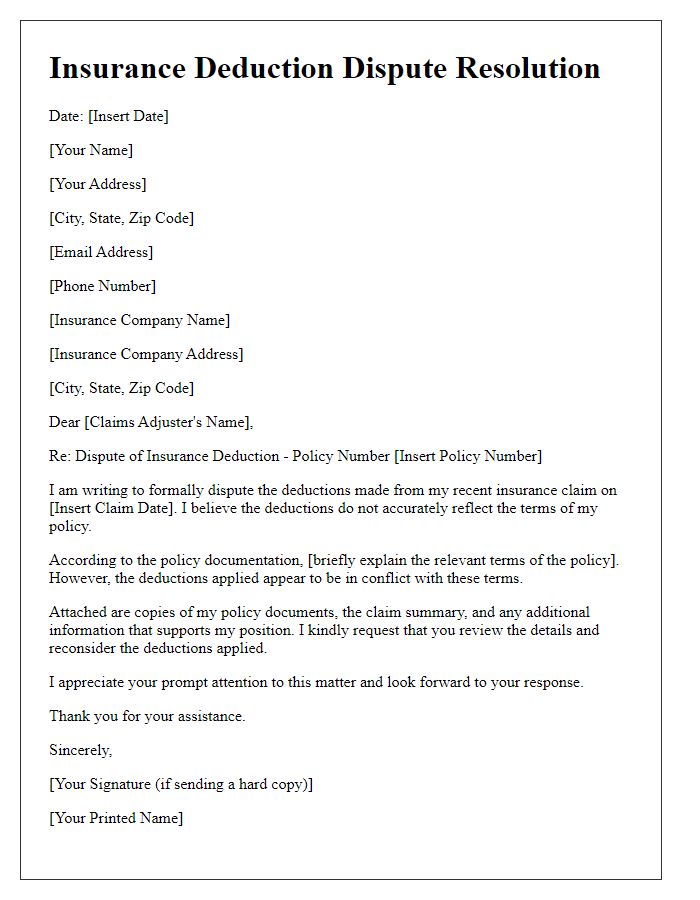

Rationale for Deduction

Insurance deductions can significantly impact policyholders, especially regarding premium adjustments. When assessing claims and determining payment amounts, insurers often consider factors such as policy limits, coverage types, and various deductibles. Premiums usually reflect risk assessments based on historical data and market trends, influencing monthly or annual payments significantly. For instance, comprehensive auto insurance policies commonly include deductibles ranging from $250 to $1,000, determining out-of-pocket expenses during claims. Additionally, factors like location, property value, and demographic information can affect the overall insurance rates in specific areas such as California, which faces unique risks like wildfires. Understanding the rationale behind these deductions helps policyholders make informed decisions about coverage and potential financial repercussions.

Contact Information

Contact information is crucial for effective communication in the insurance industry. Clear details such as name, phone number, email address, and physical address enable policyholders and insurance providers to correspond efficiently. Accurate contact information ensures timely updates regarding deductions, claims processing, and policy renewals. In the context of deductions, specific guidelines often apply, influencing how insurance premiums are calculated based on factors like location, type of coverage, and individual circumstances. Proper documentation of contact details can expedite inquiries related to coverage modifications or billing discrepancies, highlighting the importance of maintaining current information to avoid potential issues with policy management.

Assurance and Support

Insurance deductions can impact financial planning significantly. For instance, a standard home insurance policy might deduct a certain percentage, like 1% or 2%, from the total claim amount due to policy terms. Understanding these deductions ensures homeowners, especially in regions prone to natural disasters such as Florida or California, can prepare for potential financial shortfalls. Eventualities like fire, water damage, or theft can result in claims where upfront deductibles can range from $500 to $2,500. Additionally, policyholders should be aware of specific clauses related to act of God incidents, influencing the final settlement considerably. Consulting with insurance professionals or representatives at companies like State Farm or Allstate can provide clarity on policy terms and support options available for mitigation and recovery efforts.

Comments