Hey there! We all lead busy lives, and sometimes important things can slip our minds, like our insurance policies. If you've received a warning about a lapse in your insurance coverage, it's crucial to address it promptly to avoid any gaps in protection. Let's dive deeper into what this means and how you can easily rectify the situationâread on to learn more!

Policyholder's personal information

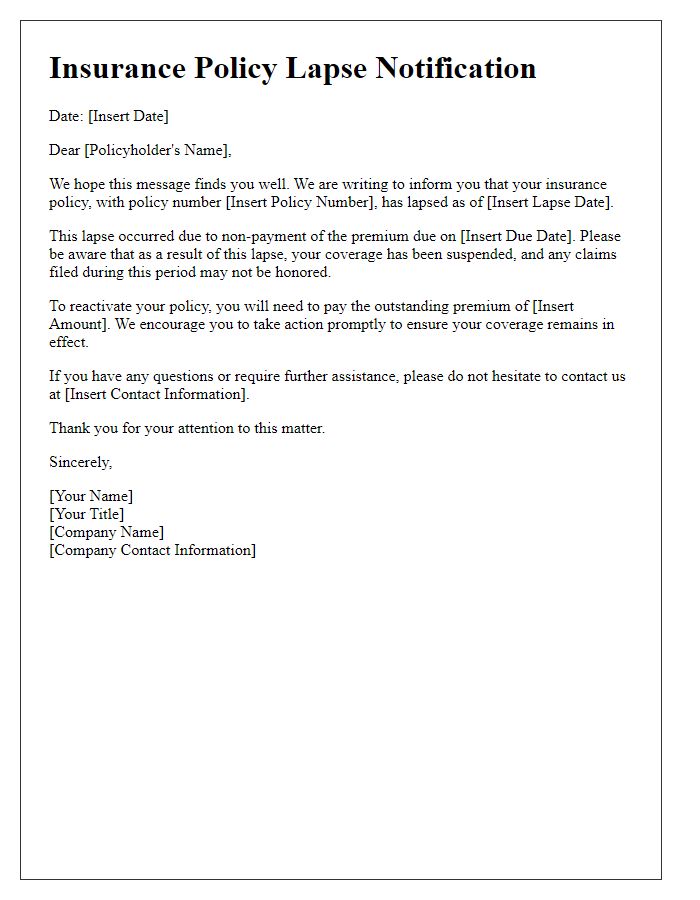

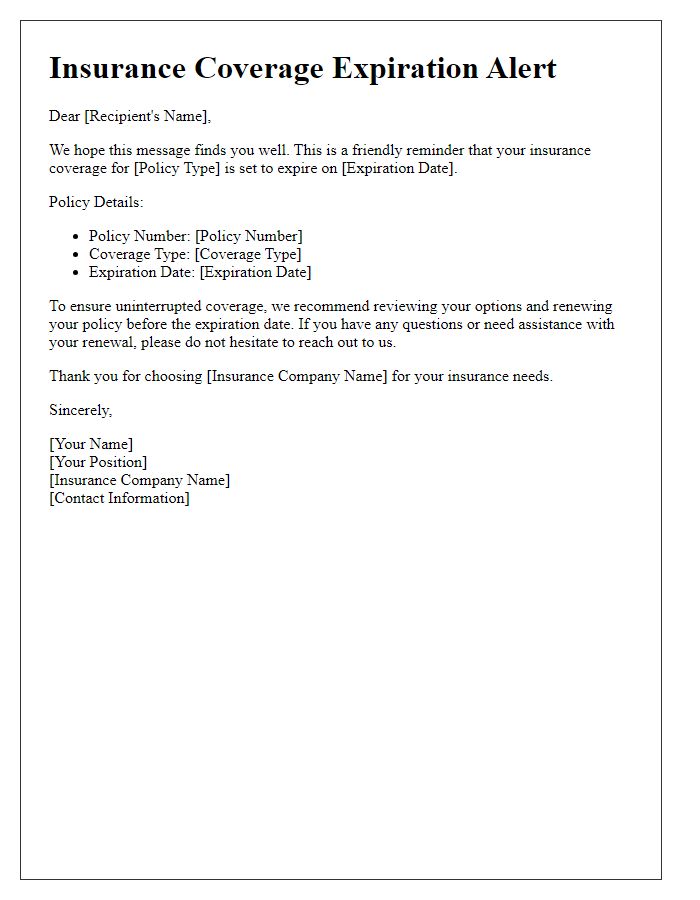

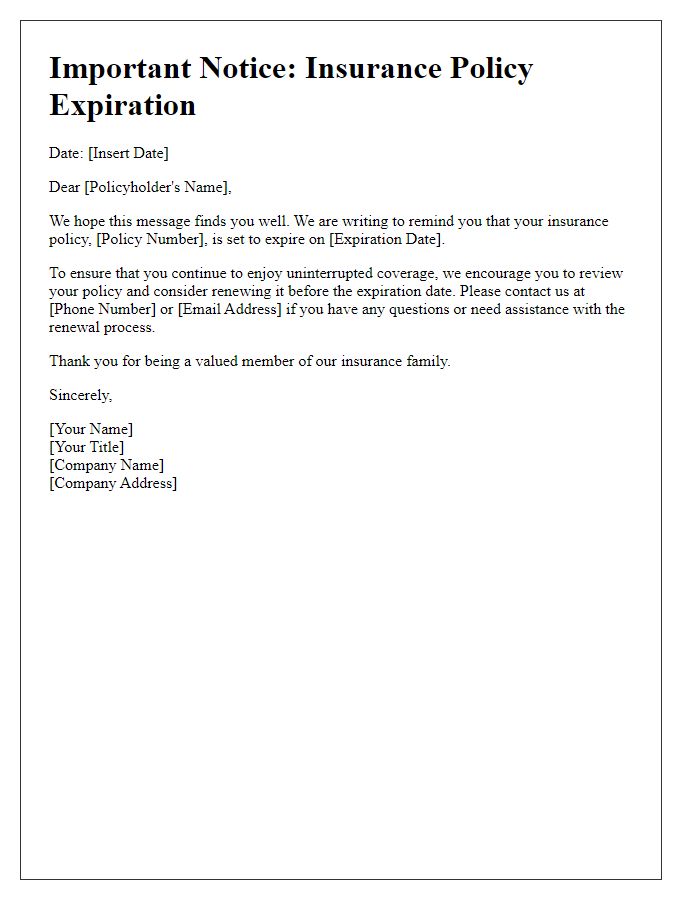

An insurance policy lapse can occur when a policyholder fails to make premium payments on time, resulting in coverage interruption. Common policy types affected include auto insurance, homeowner's insurance, and health insurance. The grace period for most insurers ranges from 10 to 30 days, depending on state regulations, allowing policyholders an opportunity to rectify missed payments. During this time, communication from the insurance provider is critical to inform the policyholder of the lapse and the consequences, such as loss of coverage, increased future premiums, or difficulty in obtaining insurance in the future. It's essential for policyholders to keep their contact information, including phone numbers and email addresses, updated to receive timely notifications. Additionally, insurers often provide options to reinstate policies; however, fees may apply, and the coverage will typically restart after a new payment is made.

Policy details and identification number

Insurance policy lapses can occur when premium payments are not made on time, potentially leading to loss of coverage. Important details include policy identification numbers, which help track specific accounts. Insurance policies, especially life or health coverage, often contain significant protections for individuals and families, so understanding policy terms and renewal dates is crucial. Companies typically provide notice periods, sometimes 30 days before the lapse occurs, allowing policyholders the opportunity to rectify missed payments or explore reinstatement options. Maintenance of accurate records and timely communication with the insurance provider can prevent disruption in coverage.

Lapse risk and consequences

Insurance policy lapses can lead to significant consequences for policyholders, including loss of coverage and financial liability. Policies may lapse after missed premium payments, typically within a grace period of 30 days. Once lapsed, individuals may face difficulties in reapplying, increased premiums, or denial of future claims. In life insurance, for instance, this can result in a loss of accumulated cash value. Health insurance lapses may leave individuals uninsured during critical health events, leading to exorbitant medical bills. Maintaining timely premium payments is crucial to ensure continued protection and coverage from unforeseen events.

Payment options and deadlines

Insurance policy lapses can occur due to missed premium payments, potentially leaving policyholders without coverage. Common payment methods include online transactions, direct bank transfers, and checks, with typical deadlines ranging from 30 to 90 days after the due date depending on the insurer. If policyholders miss the deadline, grace periods of up to 30 days can sometimes apply, allowing reinstatement without penalties. However, failure to make timely payments may result in higher premiums or the need for a new policy application. It is crucial for policyholders to review their policy terms and understand these critical dates and options to maintain their insurance coverage.

Contact information for customer support

Insurance policy lapses can lead to coverage gaps, affecting protection against unforeseen events such as accidents or natural disasters. For prompt assistance, customers are encouraged to reach out to customer support at 1-800-555-0199, where representatives are available from 8 AM to 8 PM EST, Monday through Friday. Email inquiries can be sent to support@insurancecompany.com, with a typical response time of 24 hours. Maintaining up-to-date contact information ensures seamless communication regarding policy renewals, payment schedules, and claims processing. Regular alerts via text messages and emails remind clients of upcoming deadlines, providing an additional layer of support in managing their insurance needs.

Comments