Are you considering adjusting your homeowners insurance coverage? It's crucial to ensure your policy aligns with your current needs and protects your most valuable assets. Whether you've made renovations to your home or acquired new belongings, regular assessments can save you from unexpected financial burdens in the future. Keep reading to discover the essential steps you should take to adjust your homeowners insurance coverage effectively!

Policyholder Information

Homeowners insurance coverage adjustments can be essential for homeowners seeking adequate protection for valuable assets. Considering factors such as the dwelling's replacement cost, which may fluctuate with current market conditions, and personal property limits, policyholders should meticulously review their coverage at least annually. Additionally, local property values can impact coverage needs; for example, homes in neighborhoods like Palo Alto, California, often see significant price increases, necessitating adjustments. Specific events, such as natural disasters or increasing crime rates, can also prompt homeowners to reassess their insurance. Furthermore, enhancing home security features or completing renovations can add value, showcasing the importance of regularly updating insurance to reflect changes in risk and asset value accurately.

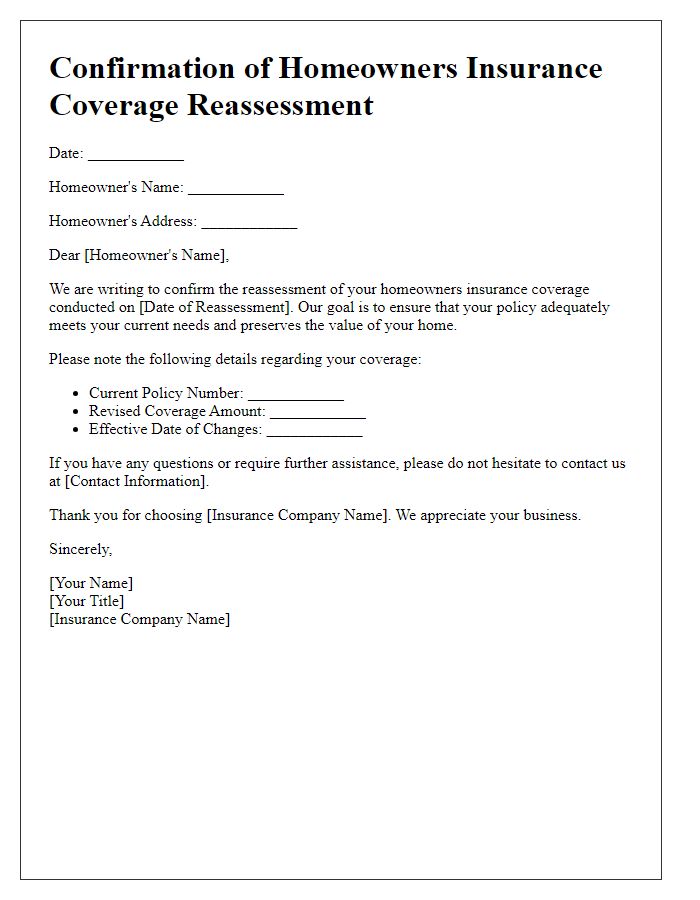

Current Coverage Details

Homeowners insurance policies provide essential protection for residential properties against various risks such as fire, theft, and natural disasters. The current coverage details typically include dwelling protection, which insures the physical structure of the home, including roofing and walls, generally up to a specified value like $300,000. Additionally, personal property coverage safeguards belongings inside the home, often covering up to 50-70% of the dwelling amount. Liability insurance protects homeowners against legal claims for bodily injury or property damage, with standard limits often starting at $100,000. Extended replacement cost coverage can account for potential increases in rebuilding costs, ensuring homeowners can fully restore their property even in fluctuating markets. Lastly, additional living expenses (ALE) coverage assists homeowners with the cost of living elsewhere while repairs are made, typically covering necessary expenses up to a certain limit like $30,000. Adjustments to these coverage amounts may be necessary based on changes in property value, personal belongings, or market conditions.

Requested Adjustment Description

Homeowners insurance coverage adjustments often arise from changes in property value or modifications in personal circumstances. For instance, adding a new room (expansion) to a house located in Los Angeles (which may increase the insured value substantially due to local real estate market fluctuations) or updating the home security system with advanced features like smart locks and 24/7 monitored cameras can prompt a review of existing policy limits. Additionally, factors such as increased home replacement costs due to inflation (current rate around 7% as of 2023) necessitate adjustments in dwelling coverage to ensure adequate protection. Notable events like recent natural disasters in Florida, shaping homeowners' need for more comprehensive coverage, further underline the importance of regularly reviewing and adjusting policy terms.

Justification for Adjustment

Homeowners insurance policy adjustments often arise from changes in property value, risks, or personal circumstances. For homeowners, accurate coverage is crucial to protect assets against potential losses. Factors affecting justification for an adjustment may include local real estate market trends highlighting increased property values, revised replacement costs for structures following inflation rates above 5%, or enhancements in home safety features like advanced security systems reducing risk. Additionally, natural disasters such as hurricanes or wildfires, especially in areas like California or Florida, may necessitate reassessment of coverage limits to reflect the current risk landscape and ensure comprehensive protection. Regular evaluations of policy terms can lead to better-informed decisions about coverage levels tailored to the homeowner's specific needs.

Contact and Response Instructions

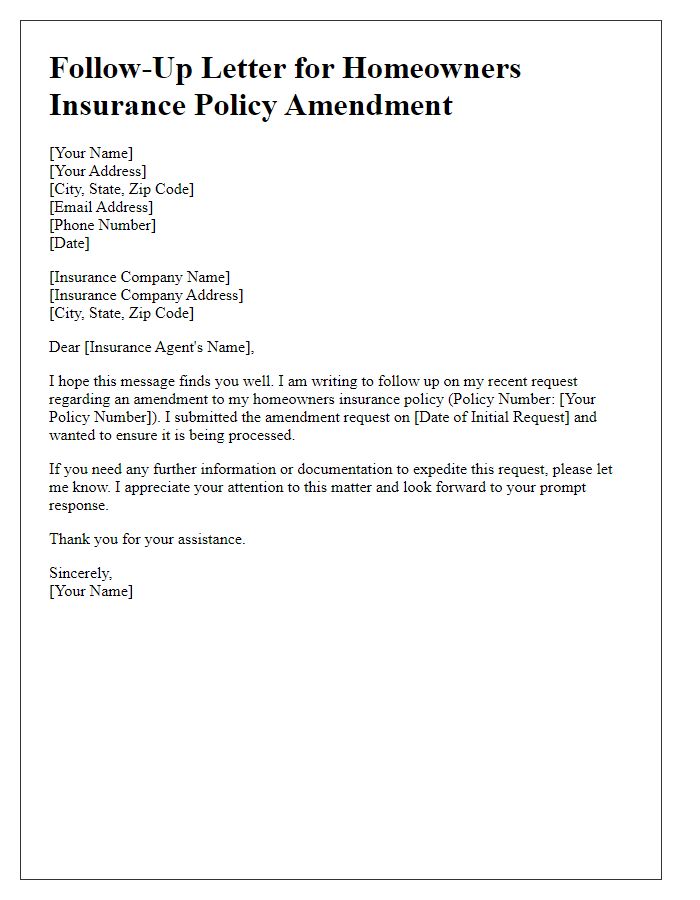

Homeowners often seek adjustments in their insurance coverage to ensure adequate protection. Contacting the insurance provider involves reaching out via customer service hotlines or email, typically found on the company's website. Homeowners must prepare specific information, including policy numbers, property details, and recent appraisal values. Timely responses from the insurer are crucial; they generally outline required documentation or additional information needed for processing requests. Homeowners should anticipate a potential review period lasting from a few days to several weeks, depending on the complexity of adjustments desired. Understanding the implications of changes in coverage, such as premiums and deductibles, is also essential for informed decision-making.

Letter Template For Homeowners Insurance Coverage Adjustment Samples

Letter template of request for homeowners insurance coverage modification

Letter template of notification for changes in homeowners insurance requirements

Letter template of proposal for additional coverage in homeowners insurance

Letter template of recommendation for revising homeowners insurance coverage

Letter template of demand for comprehensive homeowners insurance evaluation

Letter template of suggestion for increasing homeowners insurance coverage

Comments