Are you facing the frustrating reality of an insurance non-renewal? It can be quite a shock when you receive that letter in the mail, leaving you wondering what to do next. Understanding the reasons behind this decision and how it affects you is crucial for navigating the insurance landscape. Dive into our article to find out essential steps you can take and what options are available to you!

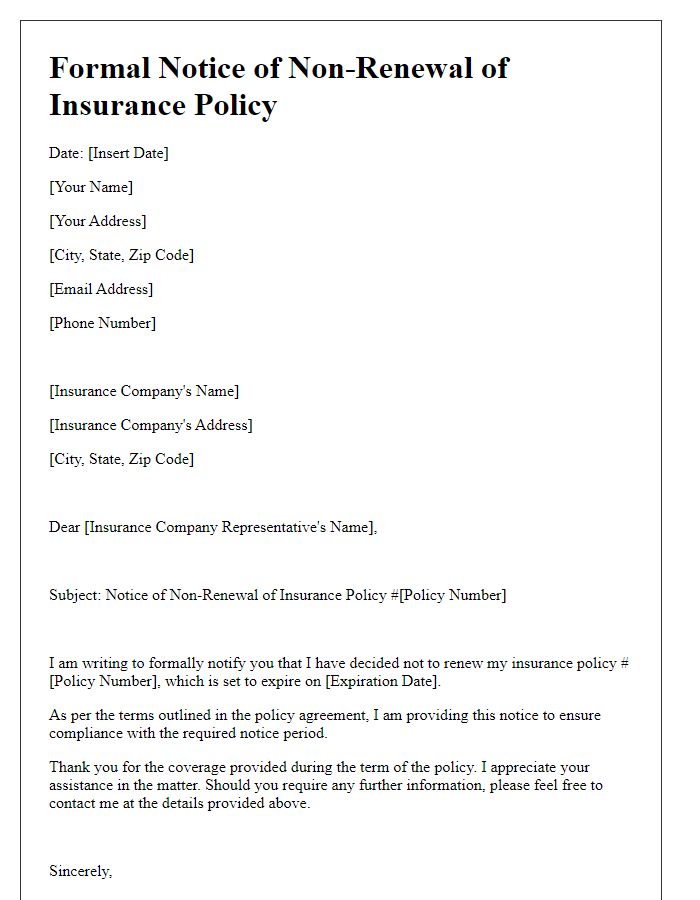

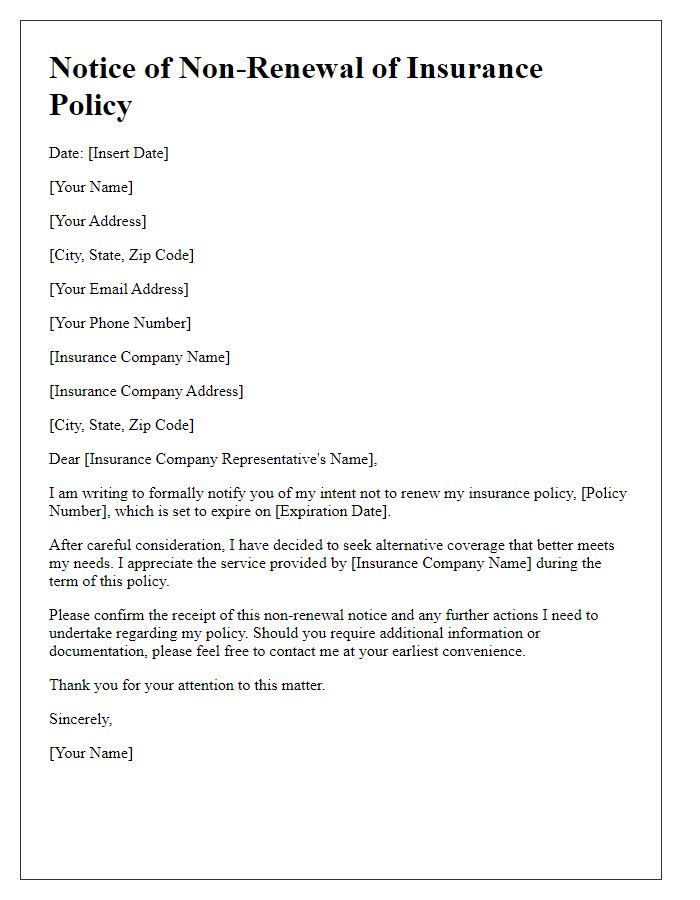

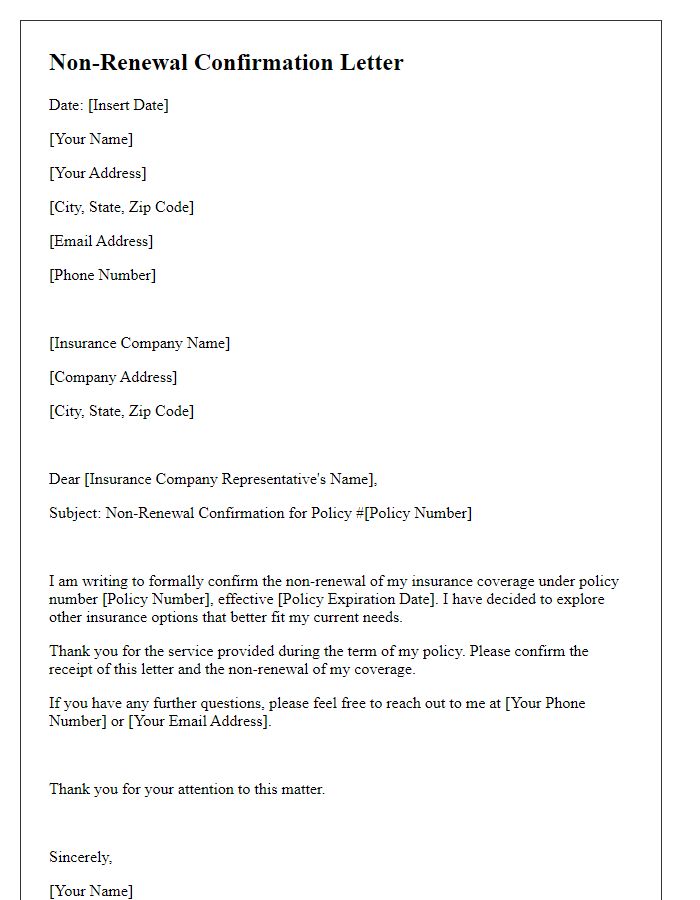

Clear Subject Line

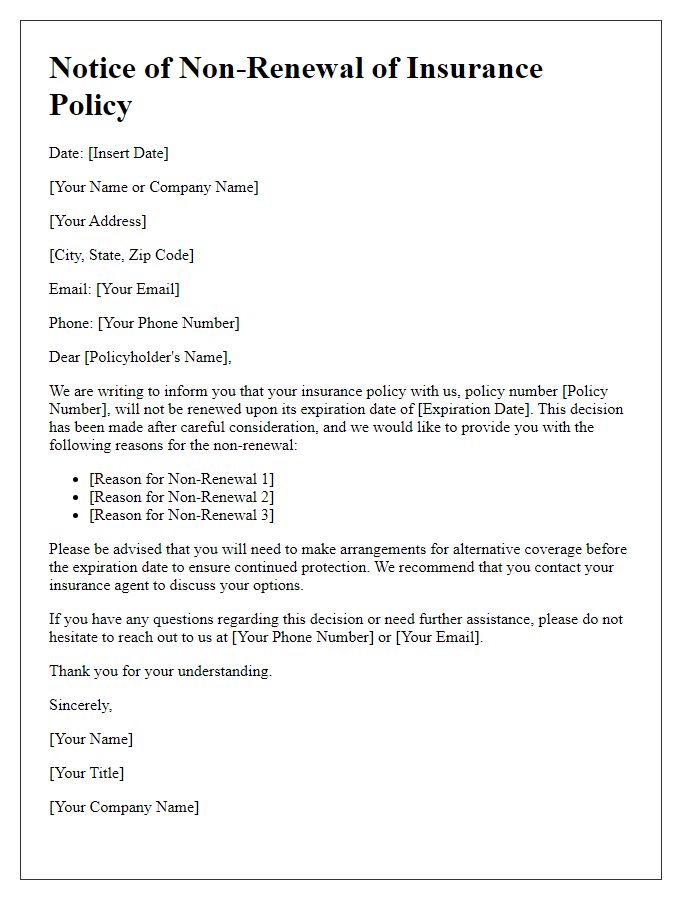

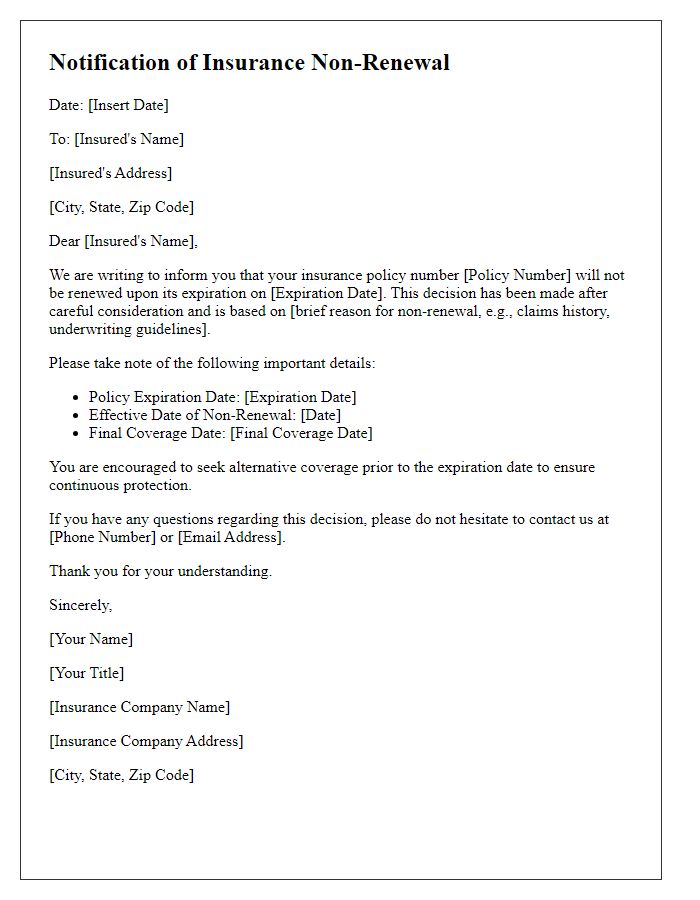

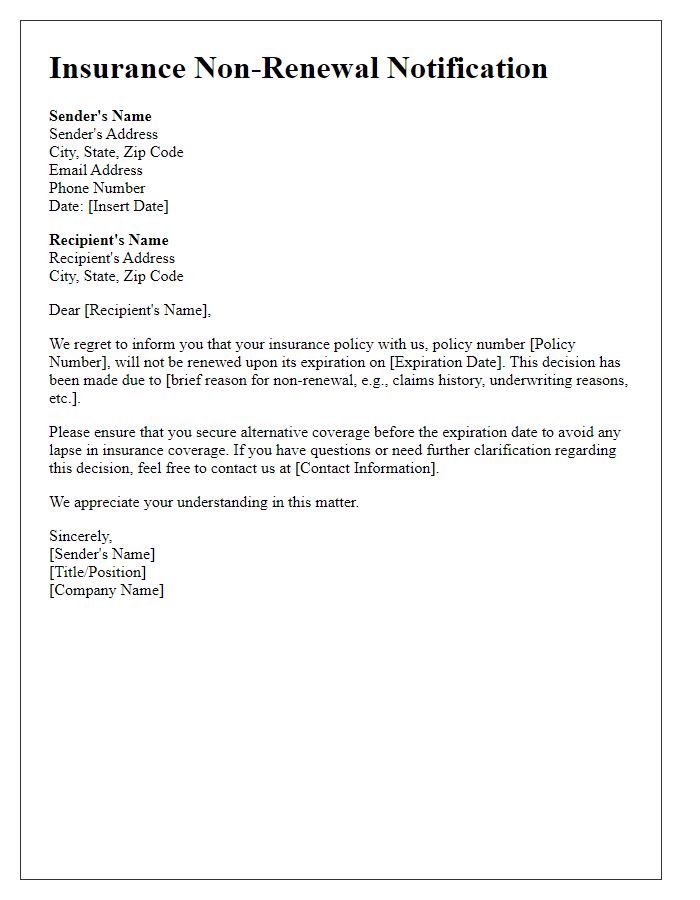

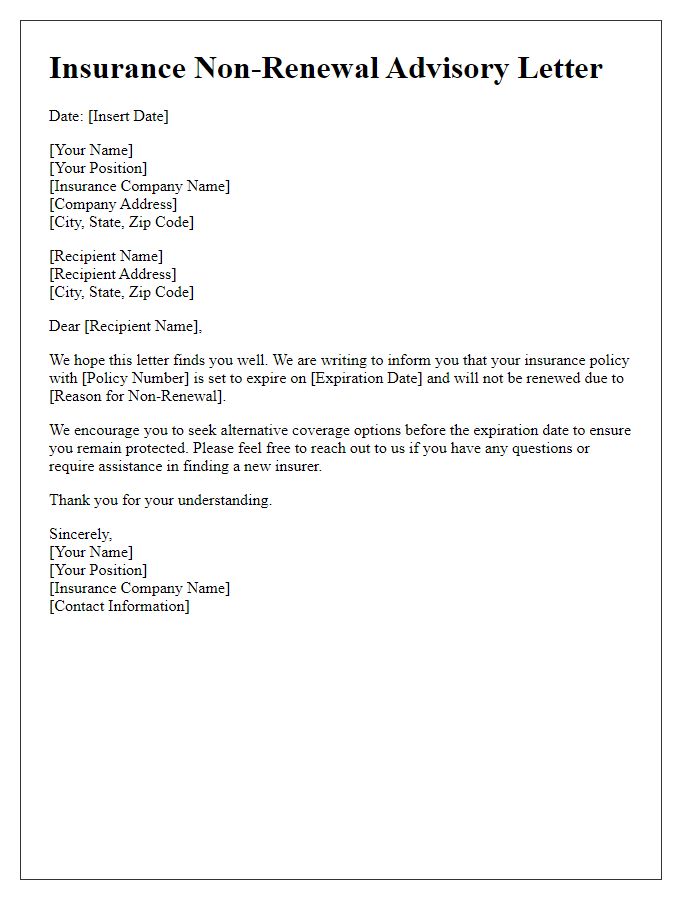

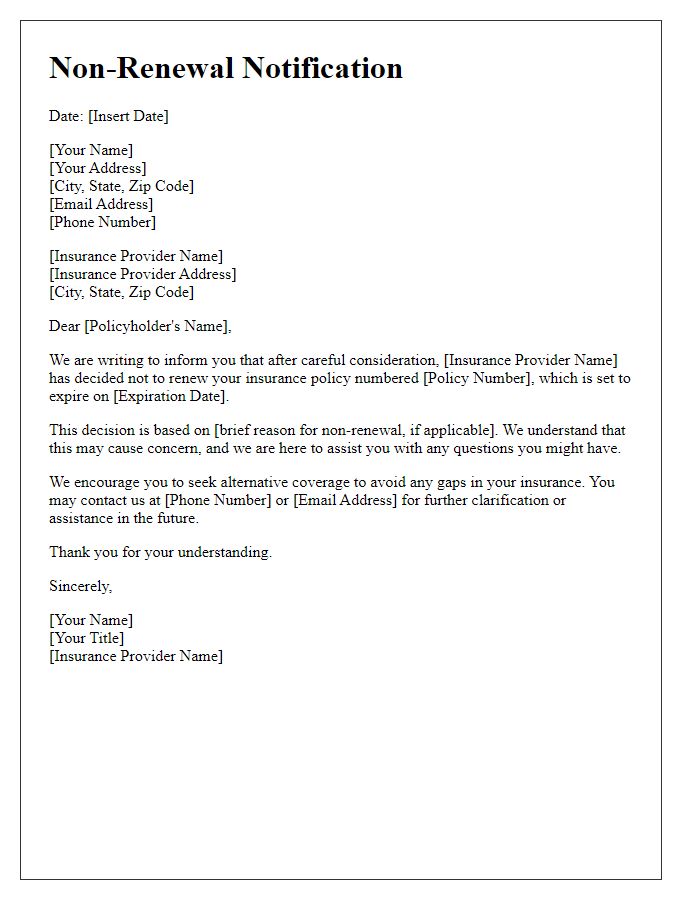

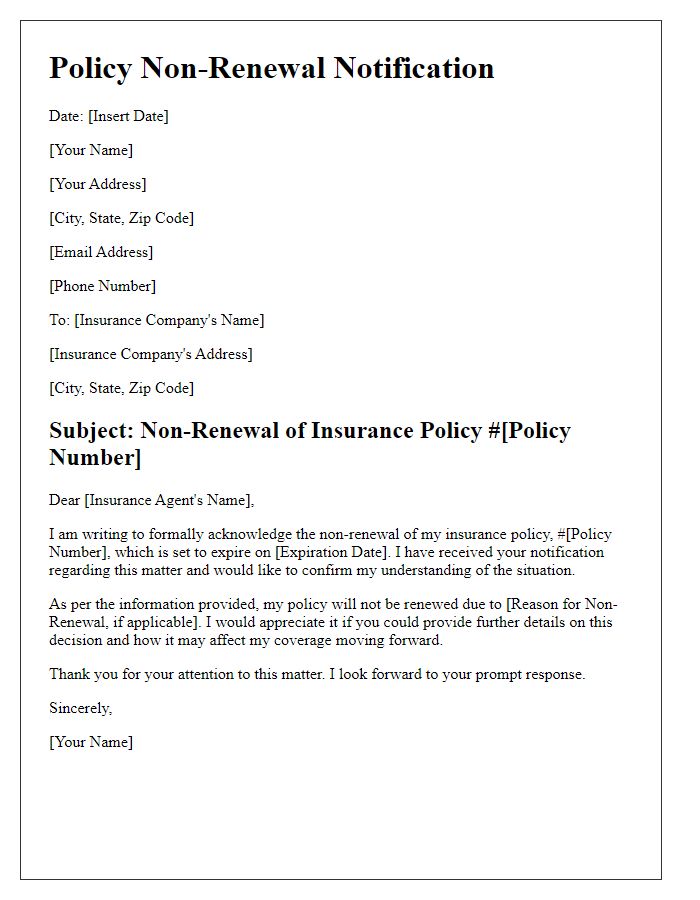

Insurance non-renewal notifications can cause confusion and concern among policyholders. Insurers often send these notices via mail or email, clearly stating the non-renewal decision. The date of notification bears importance, usually occurring 30 to 60 days before policy expiration. The notification includes policy details, such as coverage types, policy number, and effective dates. Insurers may provide reasons for non-renewal, including claims history, changes in risk, or failure to meet underwriting criteria. Policyholders should be aware of their options post-notification, like seeking alternate coverage in the same state or discussing potential reinstatement if circumstances change. Careful reading of the notification can help guide policyholders in navigating these transitions.

Policy Details

Insurance non-renewal notifications inform policyholders about the decision not to renew their insurance coverage. Important details include policy number (unique identifier for the insurance contract), effective date (the date coverage begins or ends), and premium amount (the cost the policyholder pays for coverage). Also, the reason for non-renewal (such as claims history, changes in risk assessment, or business practices) plays a crucial role in transparency. Communication about alternative coverage options or steps for obtaining new insurance may enhance the customer experience. Clear timelines for when the policyholder must seek new coverage can prevent lapses in coverage.

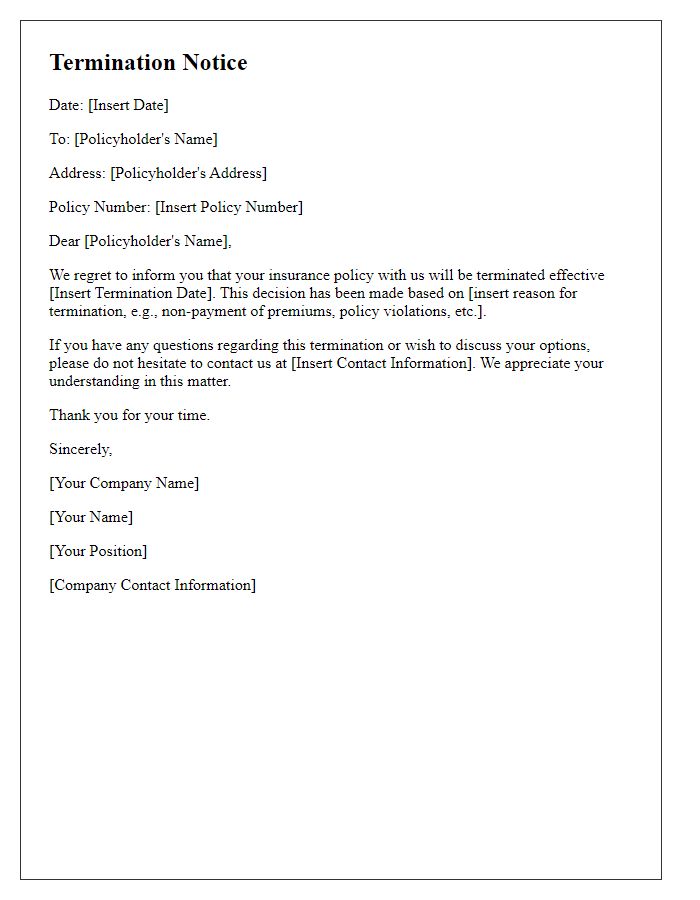

Reason for Non-Renewal

Insurance policy non-renewal notifications often stem from various factors, impacting policyholders significantly. Common reasons include increased claim frequency, high-risk profile assessments, or changes in underwriting guidelines. For instance, a homeowner's insurance policy may not be renewed if there are multiple claims associated with severe weather events, such as hurricanes or floods, within the last five years. Similarly, a significant rise in liability claims could lead to auto insurance non-renewal, especially for policies covering high-risk drivers. Additionally, insurers may revise their eligibility criteria based on market fluctuations, such as economic downturns or legislative changes, ultimately affecting policy renewals for several customers across multiple states.

Effective Date

Insurance non-renewal notifications often indicate the end of coverage for a specific policy. For example, if an auto insurance policy is set to expire on December 31, 2023, a notification might be sent out approximately 30 days prior, alerting the policyholder of the impending cessation of coverage. Important details such as the policy number, premium amounts paid, and reasons for non-renewal (such as increased claims or changes in underwriting guidelines) should also be mentioned. This ensures the policyholder has adequate time to secure alternative coverage and understand the implications of lost protection.

Contact Information

Insurance non-renewal notifications must be clear and direct. Insurers typically include essential contact information, such as the policyholder's name, address, and relevant policy number. The insurance provider's name, address, and customer service phone number should also be prominently displayed. Providing an email address for further inquiries can enhance communication. Including a deadline for questions ensures timely resolution. This clarity allows policyholders to easily understand the situation and seek alternative insurance options well before expiration dates. Excellent communication can help maintain a positive relationship even in the face of non-renewal.

Comments