Are you feeling overwhelmed by the various aspects of credit insurance? You're not alone! Understanding the disclosure requirements can be complex, but it doesn't have to be daunting. In this article, we'll break down everything you need to know about credit insurance disclosure, from the key terms to your rights. So, let's dive in and empower you with the knowledge to make informed decisions!

Policy Terms and Conditions

Credit insurance policies provide essential protection for businesses against potential losses stemming from customer insolvency or protracted payment delays. Understanding the specific terms and conditions of a credit insurance policy is vital. Key aspects include coverage limits, which dictate the maximum payout, typically expressed in monetary values relevant to the insured transactions, often ranging from a few thousand to millions of dollars. The policy duration, usually spanning one year with renewal options, affects the protection period. Exclusions may apply, particularly concerning specific industries or types of customers, which could limit coverage. Additionally, the premium calculation methods rely on factors such as the business's credit risk profile, which includes payment history and the economic conditions of operating regions. Accurate information submission is crucial, as discrepancies can lead to claims denial. Compliance with the notification requirements, such as informing the insurer of significant changes in customer circumstances, ensures uninterrupted coverage.

Coverage Limits and Exclusions

Credit insurance provides financial protection against debtor defaults, ensuring business continuity during unforeseen circumstances. Coverage limits vary by policy, commonly ranging from 70% to 90% of the total receivables, depending on the insurer, industry, and specific terms outlined in the agreement. Exclusions can include circumstances such as bankruptcy cases under Chapter 7 or Chapter 11, changes in ownership affecting creditworthiness, and natural disasters impacting debtors' operational capabilities. Understanding these nuances is essential for businesses seeking to safeguard their cash flow and mitigate risks associated with credit sales across various sectors.

Premium Payment Details

Credit insurance offers protection for borrowers against payment defaults. Premium payment details are vital, outlining the costs associated with coverage. Typical aspects include the premium amount, payment frequency (monthly, quarterly, annually), and payment methods (credit card, bank transfer). Clear disclosure ensures borrowers understand their financial commitment, preventing misunderstandings. Factors influencing premiums may include borrower's credit score, loan amount, and insurance company's risk assessment. Awareness of cancellation policies is essential, detailing the conditions for terminating coverage without incurring penalties. Timely premium payments maintain coverage continuity, protecting borrowers during unforeseen circumstances like job loss or medical emergencies.

Claims Process and Reporting

The claims process for credit insurance typically involves several critical steps to ensure efficient and timely resolution. Policyholders must initially gather all required documentation, such as original invoices and proof of non-payment, which is usually needed for claims related to customer defaults. Submission of a claim should be made promptly, ideally within 30 days of the event triggering the claim, to prevent any delays in processing. Insurance providers, like Allianz or AIG, often have specific claim forms available online or through customer service representatives to facilitate reporting. Once submitted, claims generally undergo a review period, which may last 10 to 30 business days, depending on the insurer's guidelines. During this time, insurers may request additional information to support the claim. It's crucial for policyholders to maintain communication with their insurer, providing updates or responding to inquiries quickly. Final decisions will be communicated through formal notification, and approved claims can lead to compensation covering a portion of the outstanding debts, which often alleviates financial strain on the business facing customer insolvency.

Contact Information and Assistance

Credit insurance policies offer vital protection against financial loss due to unpaid debts, benefiting both consumers and lenders. Consumers should be aware of key terms, such as the coverage limit, premium fees, and the specific types of debts insured (like credit cards or personal loans). It's essential to understand the insurer's contact information, typically detailed in the policy documentation, which includes a customer service number and email address for queries. Assistance can also be accessed through online resources, including FAQs and chat support, helping consumers navigate claims processes effectively. Furthermore, regulatory bodies, like state insurance departments, provide additional oversight and consumer protection regarding credit insurance practices.

Letter Template For Credit Insurance Disclosure Samples

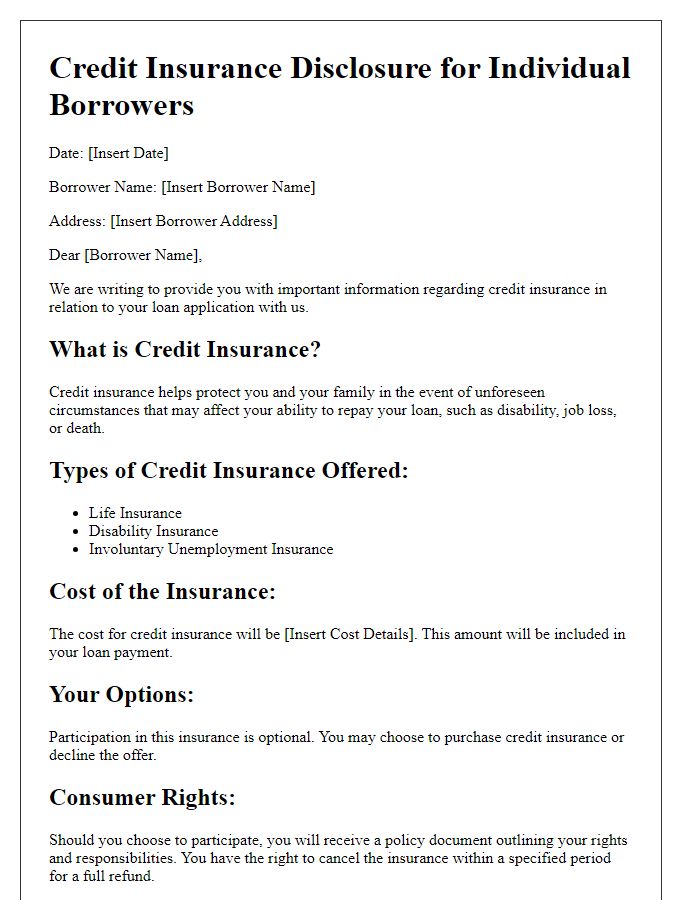

Letter template of credit insurance disclosure for individual borrowers.

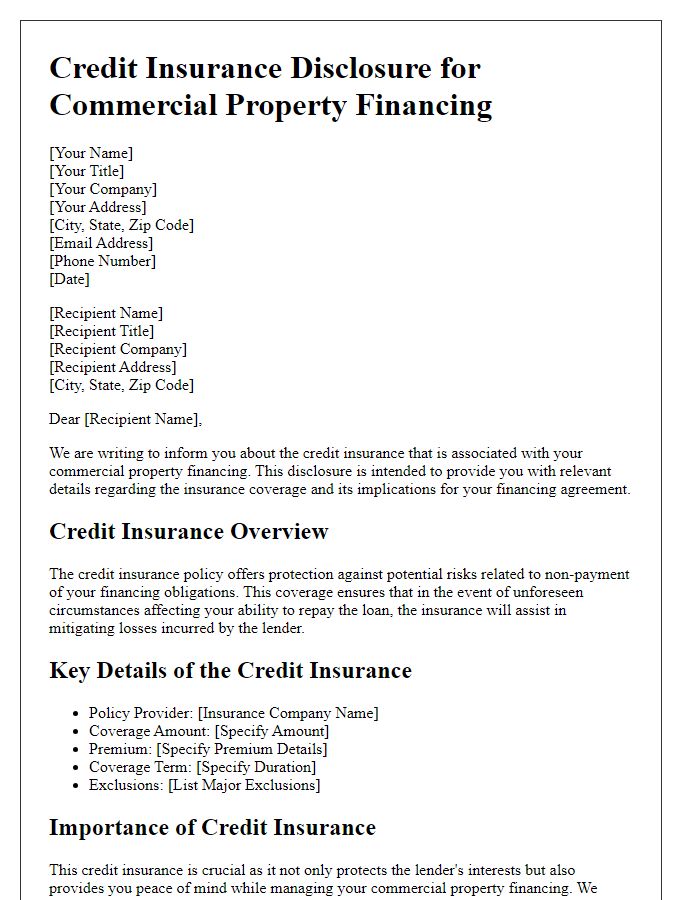

Letter template of credit insurance disclosure for commercial property financing.

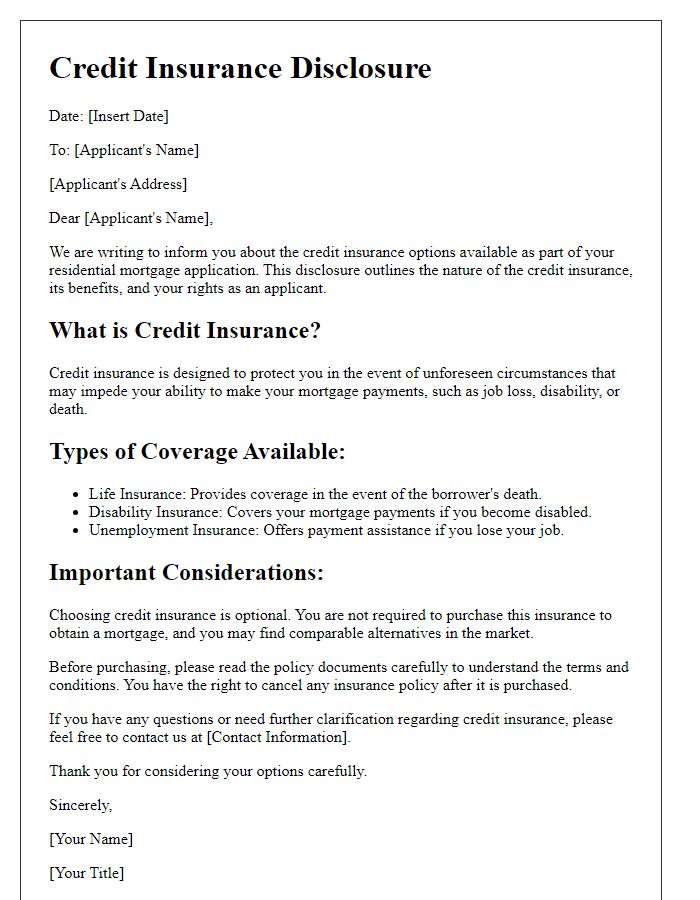

Letter template of credit insurance disclosure for residential mortgage applicants.

Letter template of credit insurance disclosure for personal loan seekers.

Letter template of credit insurance disclosure for business line of credit.

Comments